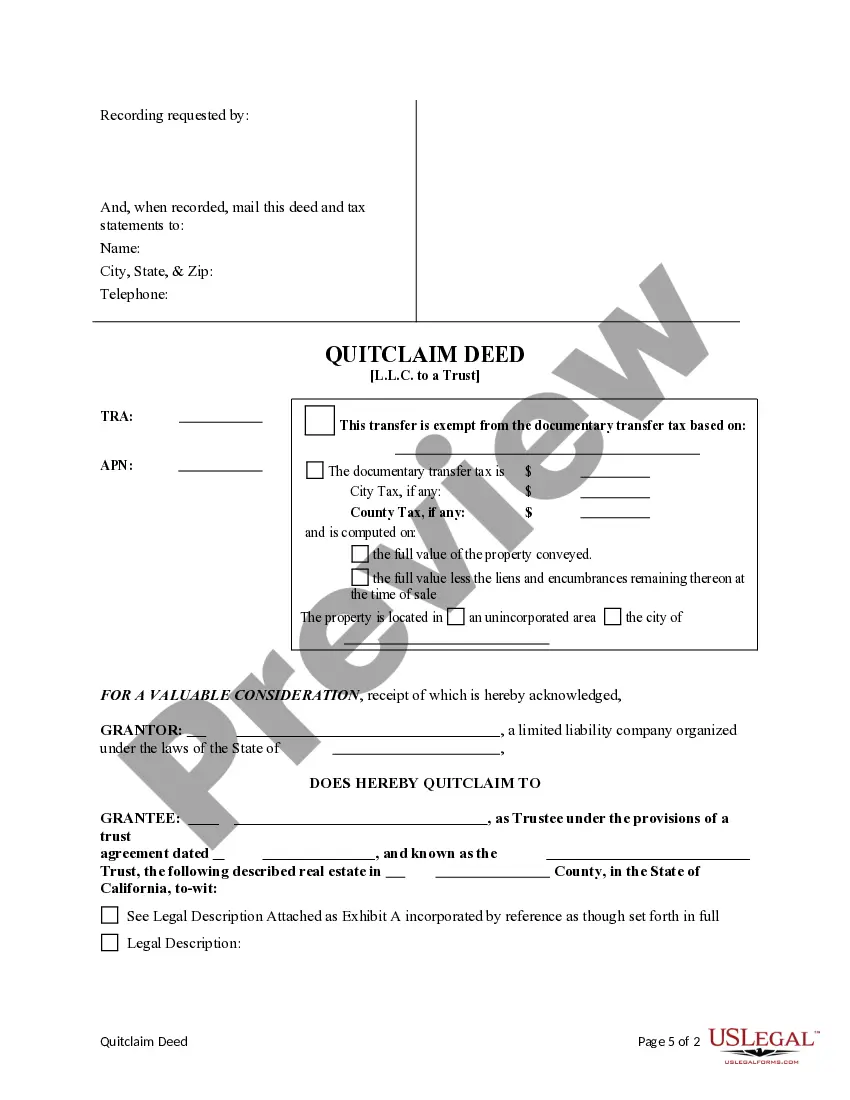

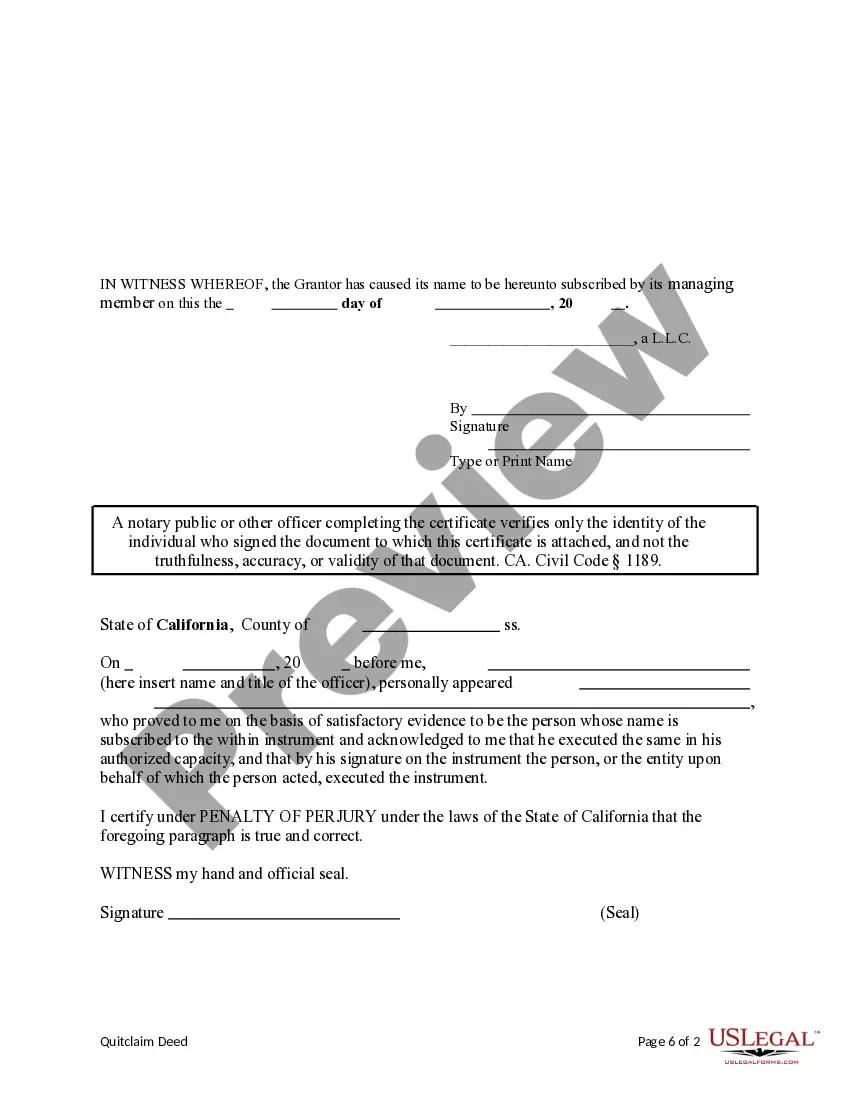

This form is a Quitclaim Deed where the Grantor is an LLC and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

A Downey California Quitclaim Deed from a Limited Liability Company to a Trust is a legal document used for transferring ownership of real estate property from an LLC to a trust without any warranties or guarantees. This type of deed is commonly utilized in situations where a limited liability company wishes to transfer real estate assets to a trust it controls, or to protect assets from liability by transitioning them to a trust structure. In Downey, California, there are two specific types of Quitclaim Deeds related to transfers from an LLC to a trust: 1. Downey California Single-Member LLC to Trust Quitclaim Deed: This type of Quitclaim Deed is used when a single-member LLC in Downey, California, wants to transfer real estate property it holds to a trust. The LLC, acting as the granter, relinquishes all its rights, title, and interest in the property to the trust. This transfer ensures that the trust becomes the legal owner of the property and can exercise control and decision-making rights over it. 2. Downey California Multi-Member LLC to Trust Quitclaim Deed: When a multi-member limited liability company in Downey, California, intends to transfer a real estate property it owns to a trust, this type of Quitclaim Deed is utilized. Similar to the single-member situation, the LLC conveys all its rights, title, and interest in the property to the trust. However, since a multi-member LLC involves multiple individuals or entities, the Quitclaim Deed must be executed and acknowledged by all the LLC members involved. The Downey California Quitclaim Deed from an LLC to a Trust ensures a straightforward and relatively simple transfer of ownership, without any guarantees regarding title or potential prior claims on the property. It is important to note that while this type of deed facilitates the transfer, the individuals or entities involved should seek legal advice to ensure compliance with relevant state laws, tax implications, and any specific requirements based on their unique circumstances.A Downey California Quitclaim Deed from a Limited Liability Company to a Trust is a legal document used for transferring ownership of real estate property from an LLC to a trust without any warranties or guarantees. This type of deed is commonly utilized in situations where a limited liability company wishes to transfer real estate assets to a trust it controls, or to protect assets from liability by transitioning them to a trust structure. In Downey, California, there are two specific types of Quitclaim Deeds related to transfers from an LLC to a trust: 1. Downey California Single-Member LLC to Trust Quitclaim Deed: This type of Quitclaim Deed is used when a single-member LLC in Downey, California, wants to transfer real estate property it holds to a trust. The LLC, acting as the granter, relinquishes all its rights, title, and interest in the property to the trust. This transfer ensures that the trust becomes the legal owner of the property and can exercise control and decision-making rights over it. 2. Downey California Multi-Member LLC to Trust Quitclaim Deed: When a multi-member limited liability company in Downey, California, intends to transfer a real estate property it owns to a trust, this type of Quitclaim Deed is utilized. Similar to the single-member situation, the LLC conveys all its rights, title, and interest in the property to the trust. However, since a multi-member LLC involves multiple individuals or entities, the Quitclaim Deed must be executed and acknowledged by all the LLC members involved. The Downey California Quitclaim Deed from an LLC to a Trust ensures a straightforward and relatively simple transfer of ownership, without any guarantees regarding title or potential prior claims on the property. It is important to note that while this type of deed facilitates the transfer, the individuals or entities involved should seek legal advice to ensure compliance with relevant state laws, tax implications, and any specific requirements based on their unique circumstances.