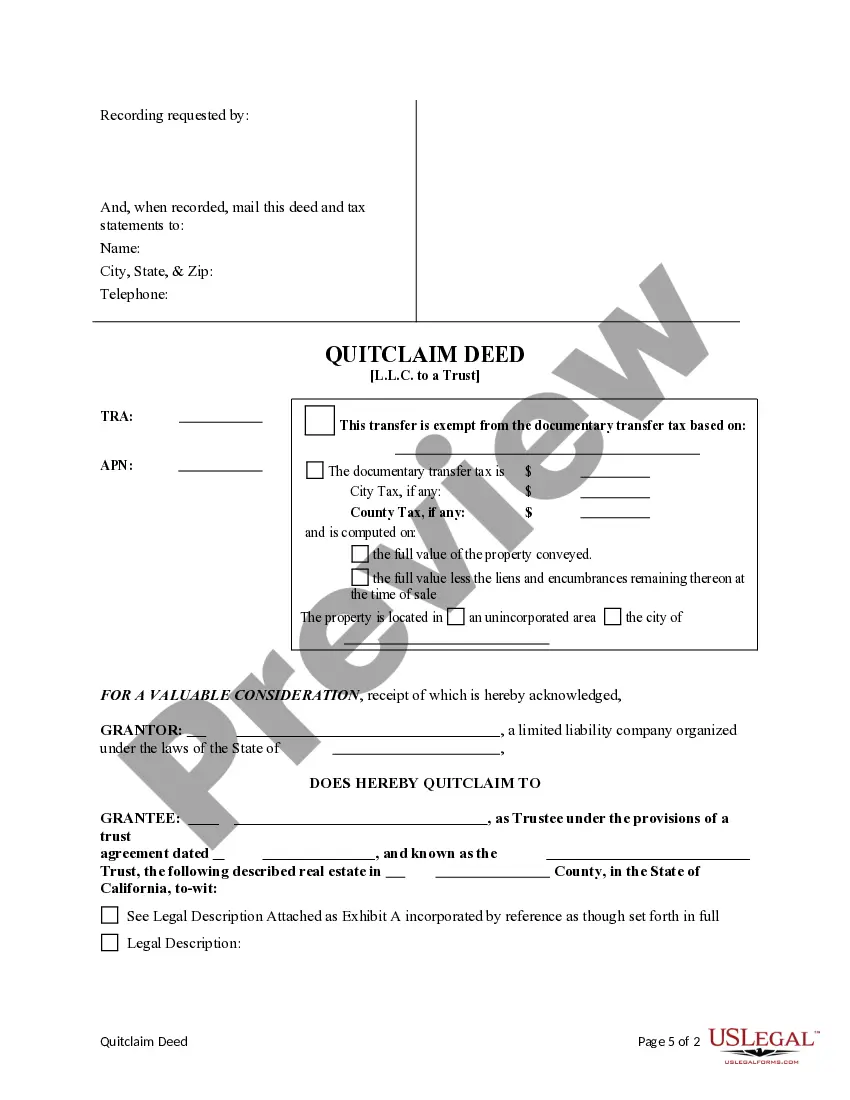

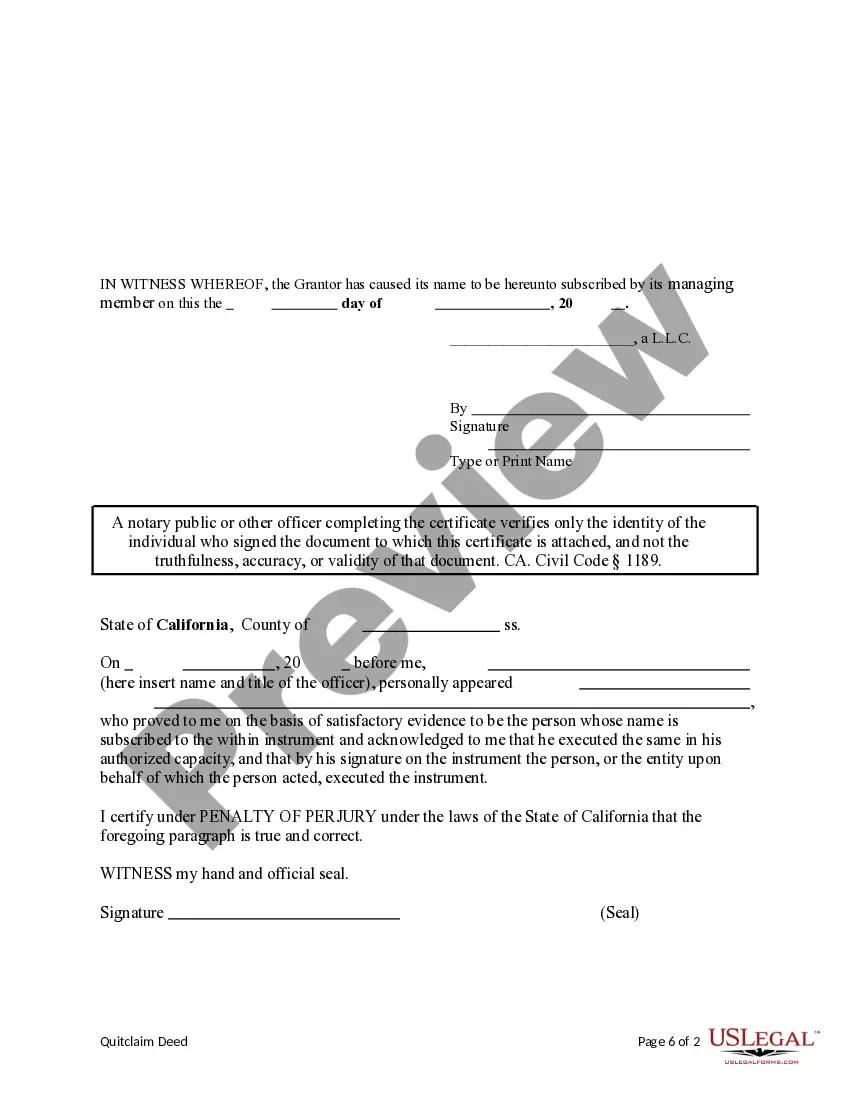

This form is a Quitclaim Deed where the Grantor is an LLC and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Elk Grove California Quitclaim Deed: Transferring Ownership from a Limited Liability Company to a Trust A quitclaim deed is a legal document used to transfer interest or rights in a property from one party to another. In the context of Elk Grove, California, this description specifically focuses on quitclaim deeds from a Limited Liability Company (LLC) to a Trust. When an LLC wishes to transfer ownership of a property to a trust entity, they can utilize an Elk Grove California Quitclaim Deed to successfully complete the transaction. This type of transfer can occur for various reasons, such as estate planning, asset protection, or restructuring ownership. Keywords: Elk Grove California, quitclaim deed, limited liability company, transfer of ownership, trust entity, property transfer, estate planning, asset protection, restructuring ownership. There could be different types of Elk Grove California Quitclaim Deeds from a Limited Liability Company to a Trust, depending on specific circumstances and the intentions of the parties involved. Some variations may include: 1. Inter vivos trust quitclaim deed: This type of quitclaim deed is commonly used for transferring ownership from an LLC to a revocable living trust. The purpose of such a transfer is often associated with estate planning, allowing for the seamless transition of property ownership and asset management. 2. Irrevocable trust quitclaim deed: In cases where asset protection is of utmost importance, an LLC might transfer ownership of the property to an irrevocable trust through a quitclaim deed. This type of transfer can provide significant protection against potential liabilities and creditor claims. 3. Special needs trust quitclaim deed: If the intention is to establish a trust specifically designed to meet the needs of individuals with disabilities or special needs, an LLC may use a quitclaim deed to transfer ownership to a special needs trust. This type of transfer could be part of a comprehensive plan to ensure the well-being and financial security of the individual. 4. Charitable trust quitclaim deed: An LLC may choose to donate a property to a charitable trust using a quitclaim deed. This type of transfer allows the LLC to contribute to a cause or organization they support while also potentially receiving certain tax benefits. In summary, an Elk Grove California Quitclaim Deed from a Limited Liability Company to a Trust involves the transfer of property ownership from an LLC to a trust entity for various purposes like estate planning, asset protection, or charitable donations. Different types of quitclaim deeds include inter vivos trust quitclaim deed, irrevocable trust quitclaim deed, special needs trust quitclaim deed, and charitable trust quitclaim deed. These transfers play a crucial role in facilitating effective property ownership transitions while adhering to legal requirements.