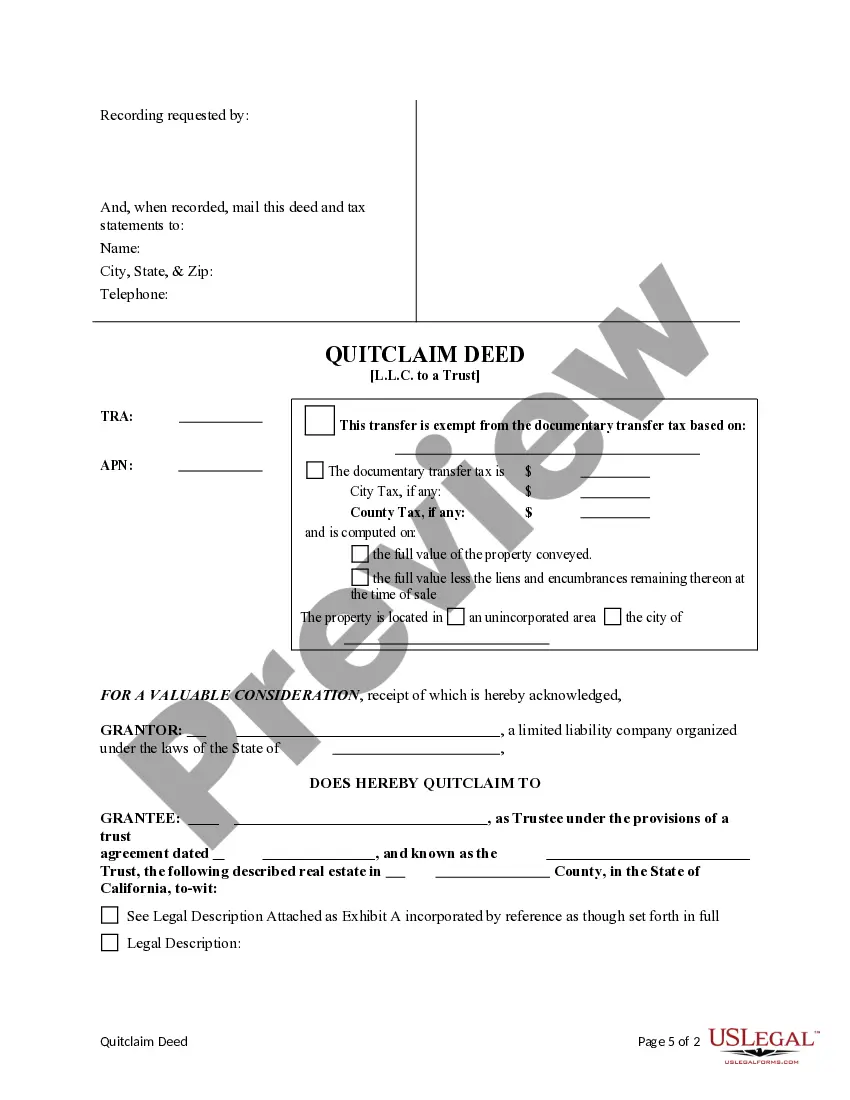

This form is a Quitclaim Deed where the Grantor is an LLC and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Escondido California Quitclaim Deed from a Limited Liability Company to a Trust is a legal document used to transfer ownership of a property from an LLC (Limited Liability Company) to a trust. It essentially releases any claims or interest in the property and transfers it to a trust entity. This type of deed can be used in various scenarios, such as estate planning, transferring real estate investments, or asset protection. The Escondido California Quitclaim Deed from an LLC to a Trust follows specific guidelines and requirements set by the state of California. It is essential to understand the different variations of this deed to ensure compliance and accuracy. Here are some types of Escondido California Quitclaim Deeds from an LLC to a Trust: 1. Escondido California Revocable Living Trust Quitclaim Deed: This type of deed is commonly used in estate planning, allowing individuals to transfer ownership of their property to a revocable living trust while retaining control and benefits during their lifetime. The granter (LLC) conveys the property to the trust, which becomes the new owner. 2. Escondido California Irrevocable Trust Quitclaim Deed: An irrevocable trust deed transfers property ownership from an LLC to an irrevocable trust, which cannot be altered or revoked without the consent of the beneficiaries. This type of deed provides asset protection and may be used for tax planning purposes. 3. Escondido California Special Needs Trust Quitclaim Deed: Special needs trust deeds are specifically designed to protect the assets of individuals with disabilities or special needs while enabling them to qualify for government benefits. An LLC would transfer property ownership to the trust, which is managed for the beneficiary's well-being and financial security. 4. Escondido California Land Trust Quitclaim Deed: A land trust deed allows an LLC to transfer ownership of a property to a land trust. This type of trust maintains the confidentiality of the beneficiary's identity while providing the benefits and protections associated with trust ownership. When preparing an Escondido California Quitclaim Deed from an LLC to a Trust, it is crucial to consult with a knowledgeable attorney or legal professional familiar with California real estate laws. The deed should include detailed property descriptions, granter and trustee information, notary acknowledgments, and comply with all applicable legal requirements. This document is a key instrument in transferring property to a trust, ensuring clarity, and protecting the interests of all parties involved.