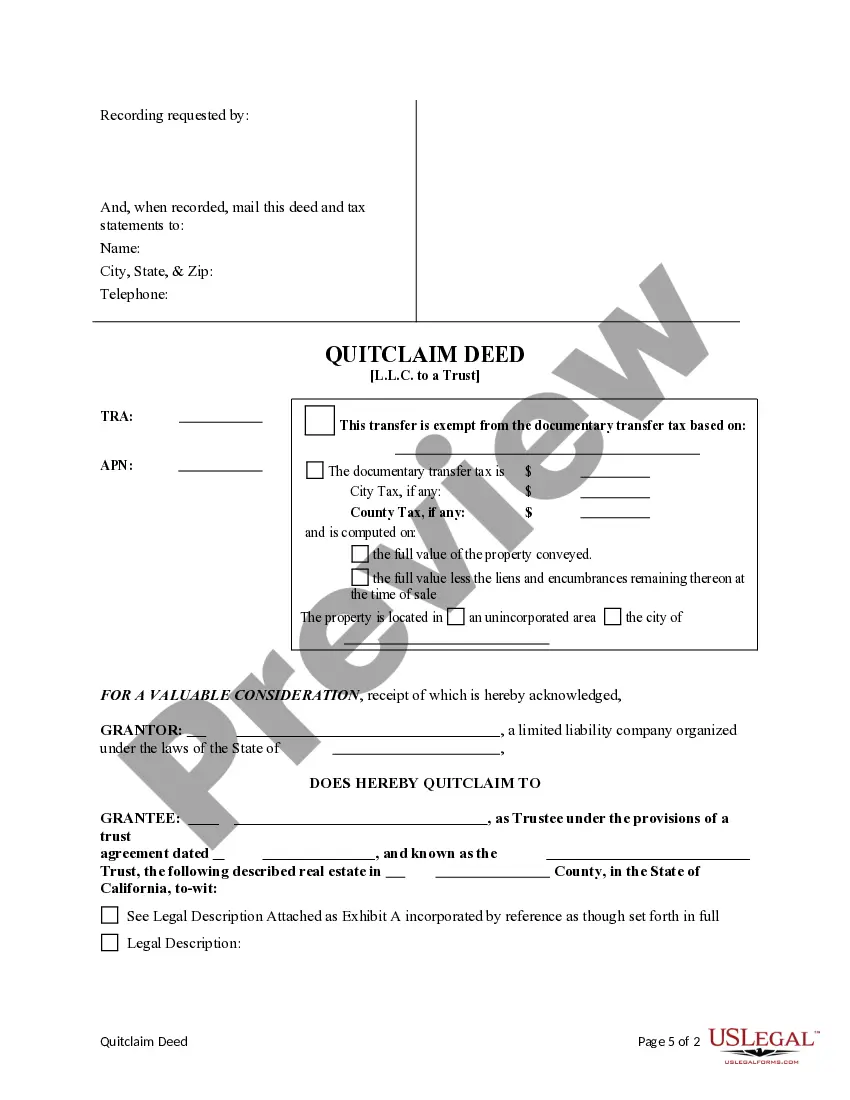

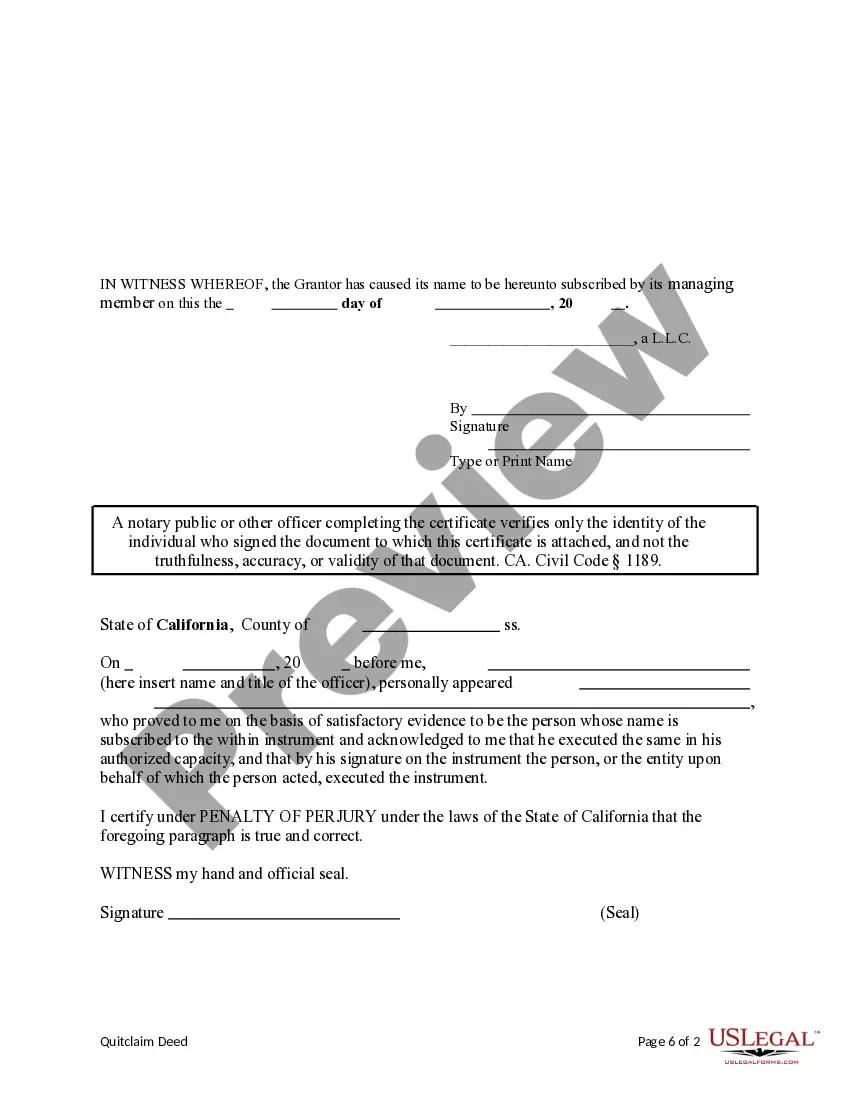

This form is a Quitclaim Deed where the Grantor is an LLC and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

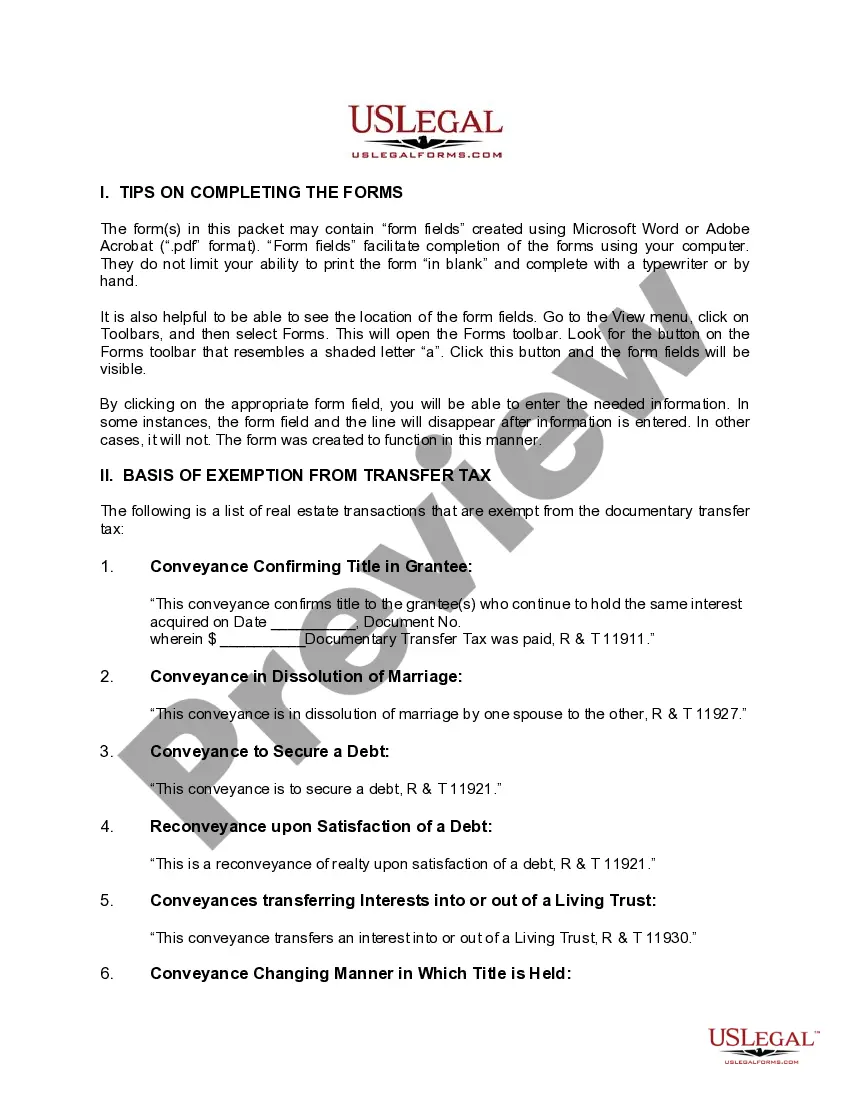

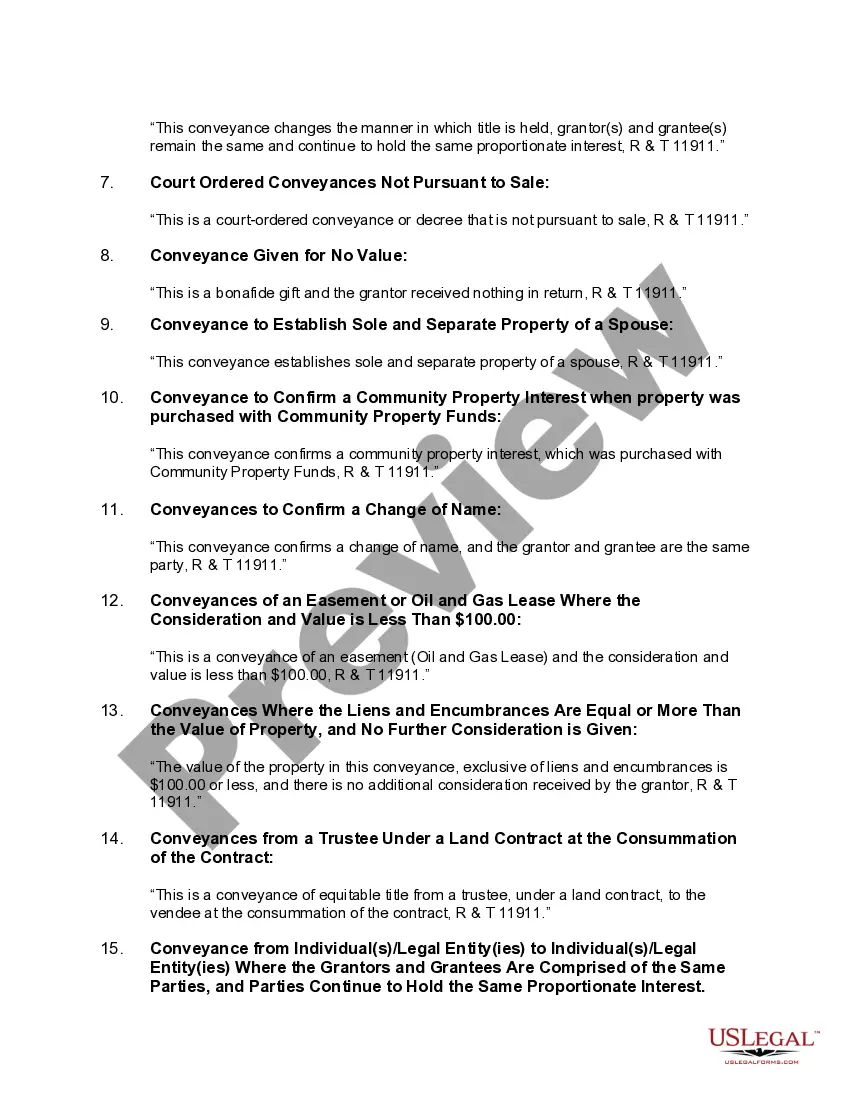

A quitclaim deed is a legal document used to transfer property ownership from one party to another, with the granter making no warranties or guarantees about the property's title. In Inglewood, California, a quitclaim deed from a Limited Liability Company (LLC) to a Trust involves the transfer of ownership of a property, held by the LLC, to a trust entity. This type of transfer often occurs when an LLC wants to protect or restructure its assets or when an individual wants to establish a trust for estate planning purposes. The Inglewood California Quitclaim Deed from an LLC to a Trust is commonly used in various scenarios, including but not limited to: 1. Asset Protection: When an LLC wants to separate its ownership from specific properties, transferring those properties to a trust can help shield them from legal claims or creditors. By removing the property from the LLC's ownership, it becomes an asset of the trust, reducing the risk to the LLC and its members. 2. Estate Planning: Individuals often use quitclaim deeds to move real estate assets into a trust, as part of their estate planning strategy. By transferring ownership to a trust, the property can be managed or distributed according to predetermined instructions, minimizing probate procedures and potential family conflicts. 3. Succession Planning: A quitclaim deed from an LLC to a trust can aid in maintaining ownership continuity through generations. By transferring properties to a trust, future generations can have a clear path for managing and benefiting from the assets without the need for complicated or lengthy legal processes. 4. Tax Planning: In some cases, transferring property ownership from an LLC to a trust can have tax benefits. This transfer could potentially impact property tax assessments, capital gains tax, or estate tax liabilities. Consulting with a tax professional is crucial to fully understand the tax implications before proceeding with such transfers. It's important to note that while the term "Inglewood California Quitclaim Deed from a Limited Liability Company to a Trust" generally covers the transfer of property ownership from an LLC to a trust, there might be additional variations of this type of deed that carry different names. These variations could include the addition of specific trust types, such as a revocable living trust, irrevocable trust, or family trust, depending on the preferences and objectives of the parties involved. To ensure a smooth and legally compliant transfer, it's highly recommended consulting with an experienced real estate attorney or legal professional who can guide the process and ensure all necessary documentation is properly prepared and filed.A quitclaim deed is a legal document used to transfer property ownership from one party to another, with the granter making no warranties or guarantees about the property's title. In Inglewood, California, a quitclaim deed from a Limited Liability Company (LLC) to a Trust involves the transfer of ownership of a property, held by the LLC, to a trust entity. This type of transfer often occurs when an LLC wants to protect or restructure its assets or when an individual wants to establish a trust for estate planning purposes. The Inglewood California Quitclaim Deed from an LLC to a Trust is commonly used in various scenarios, including but not limited to: 1. Asset Protection: When an LLC wants to separate its ownership from specific properties, transferring those properties to a trust can help shield them from legal claims or creditors. By removing the property from the LLC's ownership, it becomes an asset of the trust, reducing the risk to the LLC and its members. 2. Estate Planning: Individuals often use quitclaim deeds to move real estate assets into a trust, as part of their estate planning strategy. By transferring ownership to a trust, the property can be managed or distributed according to predetermined instructions, minimizing probate procedures and potential family conflicts. 3. Succession Planning: A quitclaim deed from an LLC to a trust can aid in maintaining ownership continuity through generations. By transferring properties to a trust, future generations can have a clear path for managing and benefiting from the assets without the need for complicated or lengthy legal processes. 4. Tax Planning: In some cases, transferring property ownership from an LLC to a trust can have tax benefits. This transfer could potentially impact property tax assessments, capital gains tax, or estate tax liabilities. Consulting with a tax professional is crucial to fully understand the tax implications before proceeding with such transfers. It's important to note that while the term "Inglewood California Quitclaim Deed from a Limited Liability Company to a Trust" generally covers the transfer of property ownership from an LLC to a trust, there might be additional variations of this type of deed that carry different names. These variations could include the addition of specific trust types, such as a revocable living trust, irrevocable trust, or family trust, depending on the preferences and objectives of the parties involved. To ensure a smooth and legally compliant transfer, it's highly recommended consulting with an experienced real estate attorney or legal professional who can guide the process and ensure all necessary documentation is properly prepared and filed.