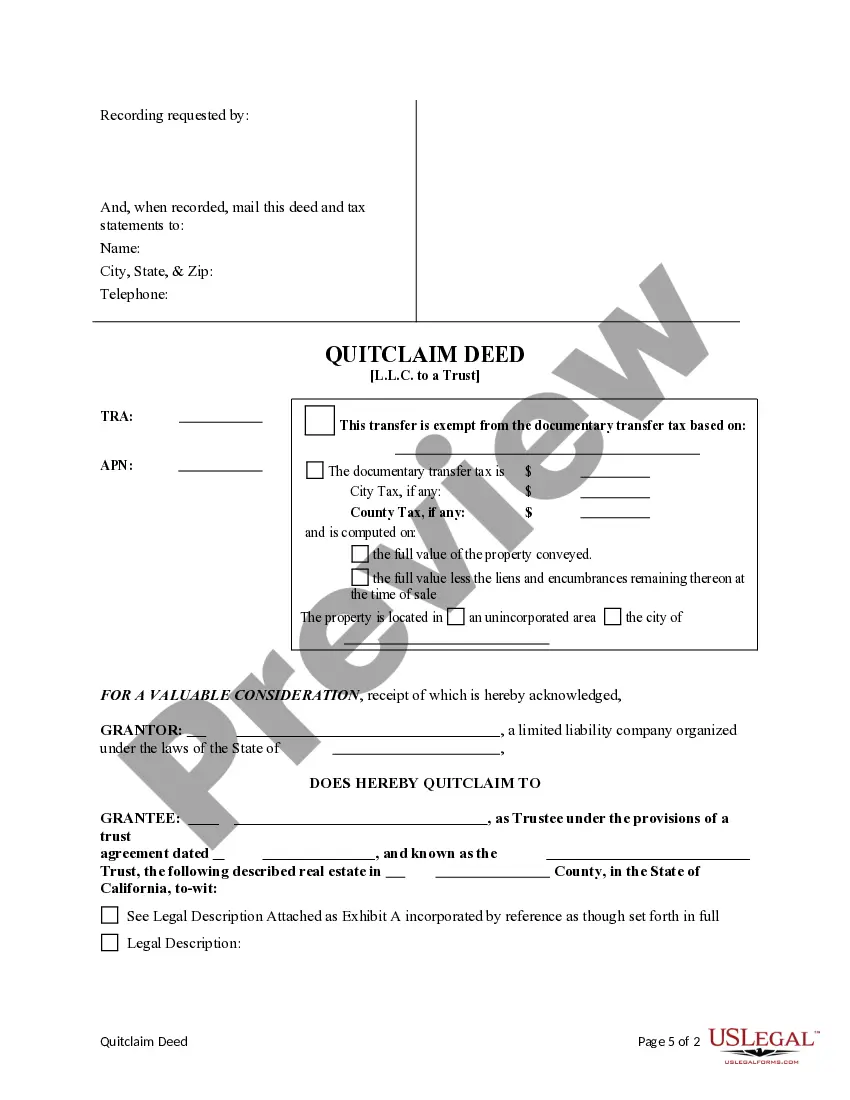

This form is a Quitclaim Deed where the Grantor is an LLC and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

A Jurupa Valley California Quitclaim Deed from a Limited Liability Company (LLC) to a Trust is a legal document that transfers the ownership of a property held by an LLC to a trust entity. This type of transfer is commonly used in estate planning or asset protection strategies. A quitclaim deed, also known as a non-warranty deed, is a document used to transfer the interest or claim that the LLC has in a property without making any warranties or guarantees about the property's condition or title. It's important to note that a quitclaim deed only transfers whatever interest or claim the LLC holds, and does not guarantee the absence of liens, encumbrances, or defects. The transfer of property from an LLC to a trust through a quitclaim deed allows for potential benefits such as asset protection, tax planning, and the ability to dictate the distribution of the property upon the trust holder's death. The trust becomes the legal owner of the property, and the LLC ceases to have any ownership rights. There can be variations of Jurupa Valley California Quitclaim Deeds from an LLC to a Trust, including: 1. Trustee-to-Trustee Transfer: In some cases, the LLC may act as the trustee of the trust itself. In this scenario, the LLC transfers the property to a separate legal entity acting as the trust. 2. Single-Member LLC to Irrevocable Trust: If the LLC is a single-member LLC, the property can be transferred to an irrevocable trust. This provides additional benefits, such as potential Medicaid planning and protection against creditors. 3. Multi-Member LLC to Revocable Living Trust: If the LLC has multiple members, the property can be transferred to a revocable living trust. This type of trust allows for flexibility as the trust can be amended or revoked during the trust owner's lifetime. 4. LLC to Land Trust: The LLC may transfer the property to a land trust, which is a type of living trust specifically designed to hold real estate. This can provide anonymity to the property owner as the trust's name is used in public records. The specific type of quitclaim deed used will depend on the goals and circumstances of the LLC and the trust involved. It is important to consult with legal professionals, such as real estate attorneys or estate planners, to properly execute and ensure the effectiveness of the transfer.A Jurupa Valley California Quitclaim Deed from a Limited Liability Company (LLC) to a Trust is a legal document that transfers the ownership of a property held by an LLC to a trust entity. This type of transfer is commonly used in estate planning or asset protection strategies. A quitclaim deed, also known as a non-warranty deed, is a document used to transfer the interest or claim that the LLC has in a property without making any warranties or guarantees about the property's condition or title. It's important to note that a quitclaim deed only transfers whatever interest or claim the LLC holds, and does not guarantee the absence of liens, encumbrances, or defects. The transfer of property from an LLC to a trust through a quitclaim deed allows for potential benefits such as asset protection, tax planning, and the ability to dictate the distribution of the property upon the trust holder's death. The trust becomes the legal owner of the property, and the LLC ceases to have any ownership rights. There can be variations of Jurupa Valley California Quitclaim Deeds from an LLC to a Trust, including: 1. Trustee-to-Trustee Transfer: In some cases, the LLC may act as the trustee of the trust itself. In this scenario, the LLC transfers the property to a separate legal entity acting as the trust. 2. Single-Member LLC to Irrevocable Trust: If the LLC is a single-member LLC, the property can be transferred to an irrevocable trust. This provides additional benefits, such as potential Medicaid planning and protection against creditors. 3. Multi-Member LLC to Revocable Living Trust: If the LLC has multiple members, the property can be transferred to a revocable living trust. This type of trust allows for flexibility as the trust can be amended or revoked during the trust owner's lifetime. 4. LLC to Land Trust: The LLC may transfer the property to a land trust, which is a type of living trust specifically designed to hold real estate. This can provide anonymity to the property owner as the trust's name is used in public records. The specific type of quitclaim deed used will depend on the goals and circumstances of the LLC and the trust involved. It is important to consult with legal professionals, such as real estate attorneys or estate planners, to properly execute and ensure the effectiveness of the transfer.