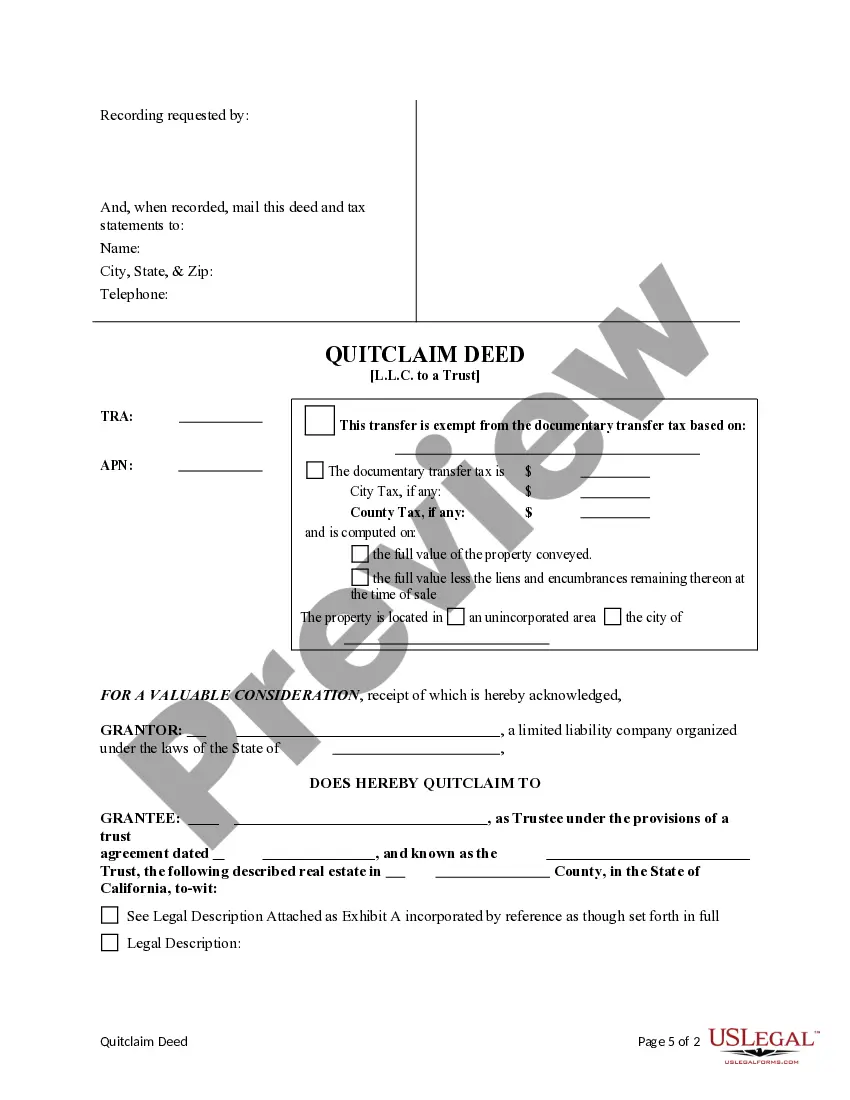

This form is a Quitclaim Deed where the Grantor is an LLC and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Los Angeles California Quitclaim Deed from a Limited Liability Company (LLC) to a Trust is a legal document that transfers ownership of a property from an LLC to a trust. This type of deed is commonly used in real estate transactions to streamline the transfer process and protect the interests of both parties involved. A quitclaim deed is a legal instrument used to transfer real property rights. It releases the LLC's interest or claim to the property without making any guarantees or warranties regarding the property's title. In other words, the LLC transfers its ownership interest to the trust without offering any guarantee against any potential defects in the property's title or any claims from third parties. By transferring property through a quitclaim deed, the LLC is transferring any rights it holds in the property to the trust. The trust then becomes the new owner, receiving all the rights and responsibilities associated with owning the property. Some variations of this type of quitclaim deed in Los Angeles, California, may include: 1. Los Angeles California Quitclaim Deed from an LLC to a Revocable Living Trust: This type of deed is commonly used when an LLC wants to transfer property to a revocable living trust, which is a trust that can be modified or revoked during the granter's (trust creator's) lifetime. This deed allows for seamless transfer of ownership and may be used for estate planning purposes. 2. Los Angeles California Quitclaim Deed from an LLC to an Irrevocable Trust: An irrevocable trust is a trust that cannot be altered, modified, or revoked without the beneficiary's permission or a court order. This type of quitclaim deed is employed when an LLC wants to transfer property to an irrevocable trust for asset protection, tax planning, or charitable giving purposes. 3. Los Angeles California Quitclaim Deed from an LLC to a Special Needs Trust: Special Needs Trusts are created to benefit individuals with disabilities without jeopardizing their eligibility for government assistance programs. This type of quitclaim deed is used when the LLC wants to transfer property to a trust dedicated to providing for the needs of individuals with special needs. It is essential to consult with a knowledgeable real estate attorney or legal professional when dealing with any type of quitclaim deed to ensure all legal requirements are properly met and that the transfer of property is executed accurately.