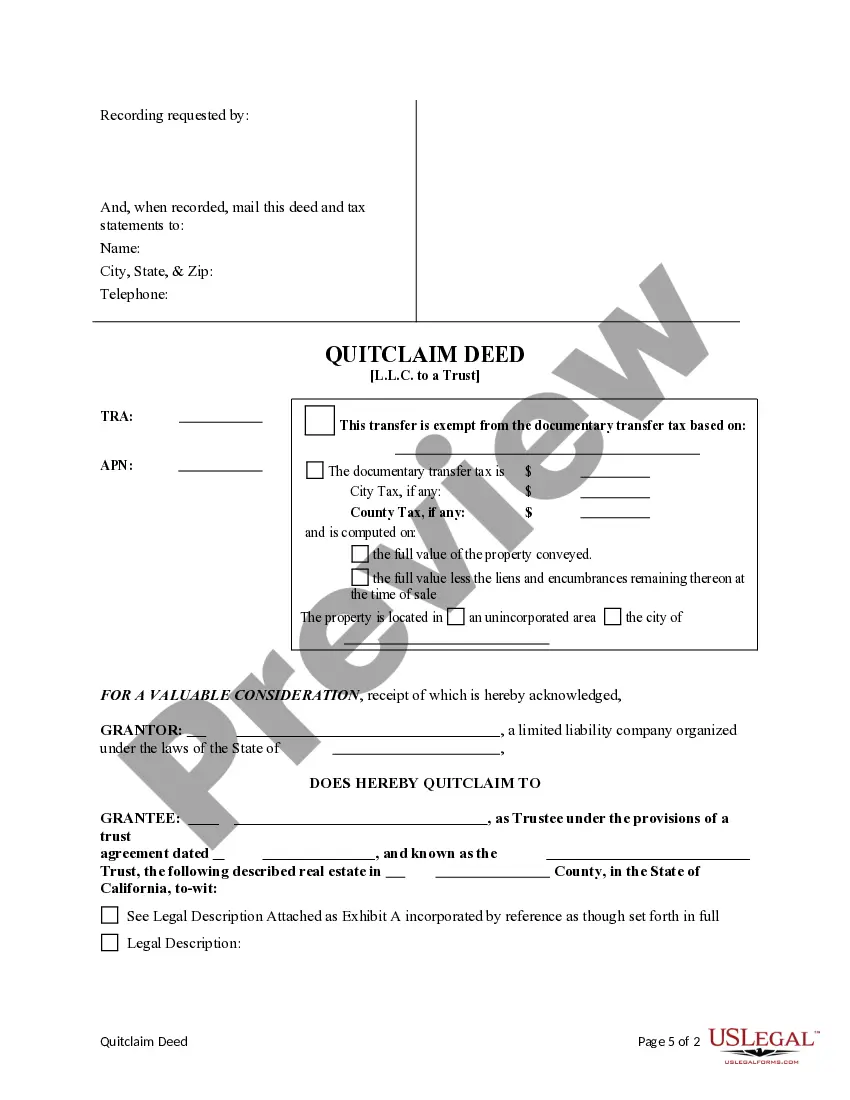

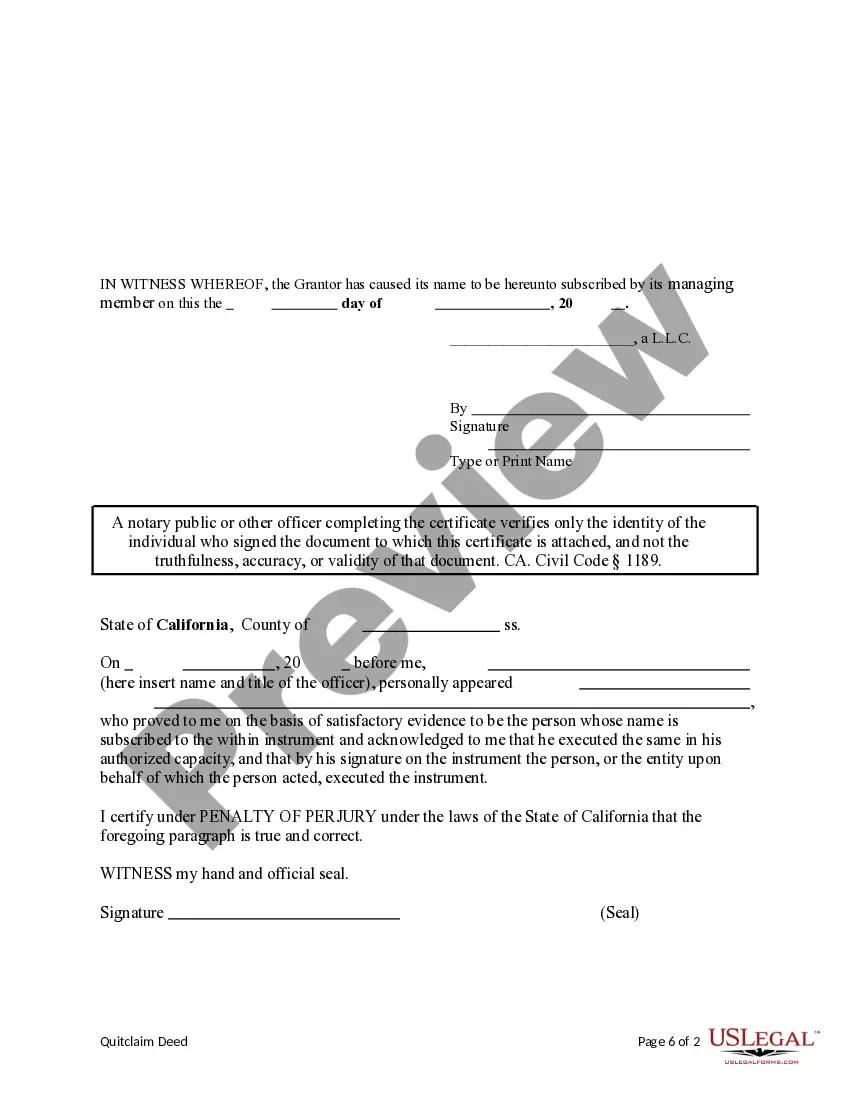

This form is a Quitclaim Deed where the Grantor is an LLC and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Orange California Quitclaim Deed from a Limited Liability Company to a Trust: A Comprehensive Overview In Orange County, California, a Quitclaim Deed is a legal document used to transfer the ownership rights to a property from one party, a Limited Liability Company (LLC), to another, a Trust. This type of deed facilitates the smooth transfer of real estate assets without implying any warranties or guarantees regarding the property's title. A quitclaim deed is commonly employed when individuals wish to transfer real estate property between related entities for estate planning, succession, or tax purposes. The LLC, acting as the granter, transfers its interest in the property to the trust, acting as the grantee, with the intention of conveying all ownership rights. Key Legal Terms and Process: 1. Quitclaim Deed: A legal instrument used in Orange County, California, to transfer property rights between parties, without any warranties or guarantees. 2. Limited Liability Company (LLC): A business structure that offers limited liability protection to its members while maintaining a relatively flexible management structure. 3. Trust: A legal arrangement where one party (trust or) transfers ownership of assets to another party (trustee) for the benefit of a third party (beneficiary). 4. Granter: The LLC relinquishing ownership rights to the property. 5. Grantee: The trust receiving ownership rights to the property. 6. Granting Clause: The section of the deed specifying the granter's intention to convey the property to the grantee. 7. Legal Description: A detailed and accurate depiction of the property's boundaries, usually derived from official surveys or property records. 8. Consideration: The value exchanged between parties during the transfer, often represented by a nominal amount like $10 to satisfy the requirement of a valid contract. It is worth noting that there are no different types of Orange California Quitclaim Deed from an LLC to a Trust based on the type of trust. The process and legal requirements remain the same irrespective of whether the trust is revocable, irrevocable, living, testamentary, or any other kind. However, it is crucial to consult with an attorney or legal professional to ensure compliance with specific regulations and tailor the deed to suit the parties' unique circumstances. In conclusion, an Orange California Quitclaim Deed from a Limited Liability Company to a Trust enables the transfer of ownership rights of a property from the LLC to the trust. This legal process facilitates estate planning goals, asset protection, and seamless transfer of real estate assets within related entities. By understanding the involved terms and following the legal procedures, individuals can execute this transfer effectively while seeking professional guidance tailored to their specific needs.Orange California Quitclaim Deed from a Limited Liability Company to a Trust: A Comprehensive Overview In Orange County, California, a Quitclaim Deed is a legal document used to transfer the ownership rights to a property from one party, a Limited Liability Company (LLC), to another, a Trust. This type of deed facilitates the smooth transfer of real estate assets without implying any warranties or guarantees regarding the property's title. A quitclaim deed is commonly employed when individuals wish to transfer real estate property between related entities for estate planning, succession, or tax purposes. The LLC, acting as the granter, transfers its interest in the property to the trust, acting as the grantee, with the intention of conveying all ownership rights. Key Legal Terms and Process: 1. Quitclaim Deed: A legal instrument used in Orange County, California, to transfer property rights between parties, without any warranties or guarantees. 2. Limited Liability Company (LLC): A business structure that offers limited liability protection to its members while maintaining a relatively flexible management structure. 3. Trust: A legal arrangement where one party (trust or) transfers ownership of assets to another party (trustee) for the benefit of a third party (beneficiary). 4. Granter: The LLC relinquishing ownership rights to the property. 5. Grantee: The trust receiving ownership rights to the property. 6. Granting Clause: The section of the deed specifying the granter's intention to convey the property to the grantee. 7. Legal Description: A detailed and accurate depiction of the property's boundaries, usually derived from official surveys or property records. 8. Consideration: The value exchanged between parties during the transfer, often represented by a nominal amount like $10 to satisfy the requirement of a valid contract. It is worth noting that there are no different types of Orange California Quitclaim Deed from an LLC to a Trust based on the type of trust. The process and legal requirements remain the same irrespective of whether the trust is revocable, irrevocable, living, testamentary, or any other kind. However, it is crucial to consult with an attorney or legal professional to ensure compliance with specific regulations and tailor the deed to suit the parties' unique circumstances. In conclusion, an Orange California Quitclaim Deed from a Limited Liability Company to a Trust enables the transfer of ownership rights of a property from the LLC to the trust. This legal process facilitates estate planning goals, asset protection, and seamless transfer of real estate assets within related entities. By understanding the involved terms and following the legal procedures, individuals can execute this transfer effectively while seeking professional guidance tailored to their specific needs.