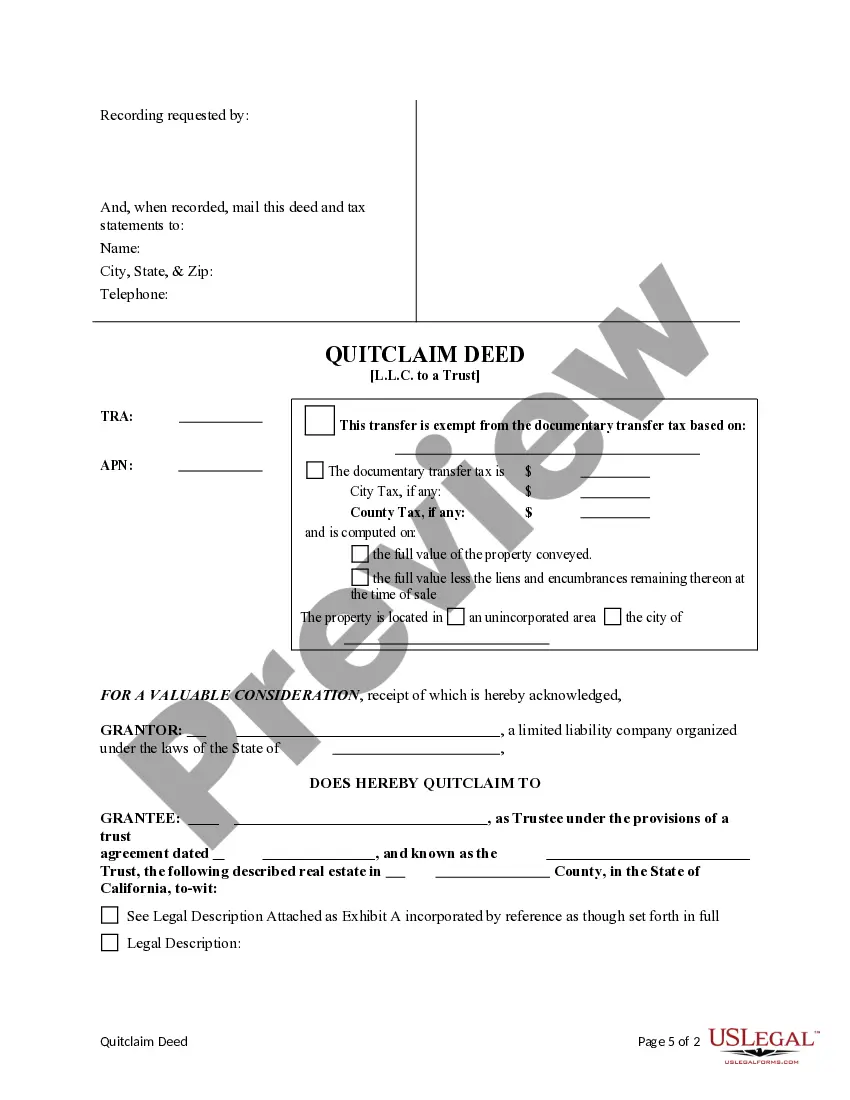

This form is a Quitclaim Deed where the Grantor is an LLC and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

A Pomona California quitclaim deed from a limited liability company (LLC) to a trust involves the transfer of real property ownership rights from an LLC to a trust, using a specific legal document known as a quitclaim deed. This type of transfer is commonly used in estate planning and asset protection strategies. A quitclaim deed is a legal instrument used to convey any interest, if any, that the granter (in this case, the LLC) has in the property to the grantee (the trust). It does not necessarily guarantee that the LLC possesses any valid or clear title to the property. Instead, it transfers whatever rights the LLC may hold, making the grantee the legal owner of the property. The quitclaim deed is often used when the transfer is between related parties or to cure any title defects. In the context of Pomona, California, there might be a few different types of quitclaim deeds involving the transfer of property ownership from an LLC to a trust, such as: 1. Pomona California Quitclaim Deed from an LLC to a Revocable Living Trust: This type of transfer involves an LLC transferring ownership of a property to a revocable living trust. A revocable living trust is a type of trust agreement that allows the trust or (the individual establishing the trust) to retain control over the trust assets during their lifetime, with the ability to modify or revoke the trust at any time. 2. Pomona California Quitclaim Deed from an LLC to an Irrevocable Trust: In this case, the LLC transfers property ownership to an irrevocable trust. Unlike a revocable living trust, an irrevocable trust cannot be modified or revoked without the consent of the beneficiaries. This type of trust offers more asset protection benefits and potential tax advantages. 3. Pomona California Quitclaim Deed from an LLC to a Special Needs Trust: This type of transfer involves an LLC transferring ownership to a special needs trust. A special needs trust is created to provide for the needs of an individual with disabilities while protecting their eligibility for government benefits such as Medicaid and Supplemental Security Income (SSI). When considering any type of quitclaim deed, it is crucial to consult with an attorney or legal professional experienced in real estate and estate planning laws in Pomona, California. They can provide guidance on the specific requirements, tax implications, and potential legal risks associated with the transfer, ensuring a smooth and legally valid transaction.