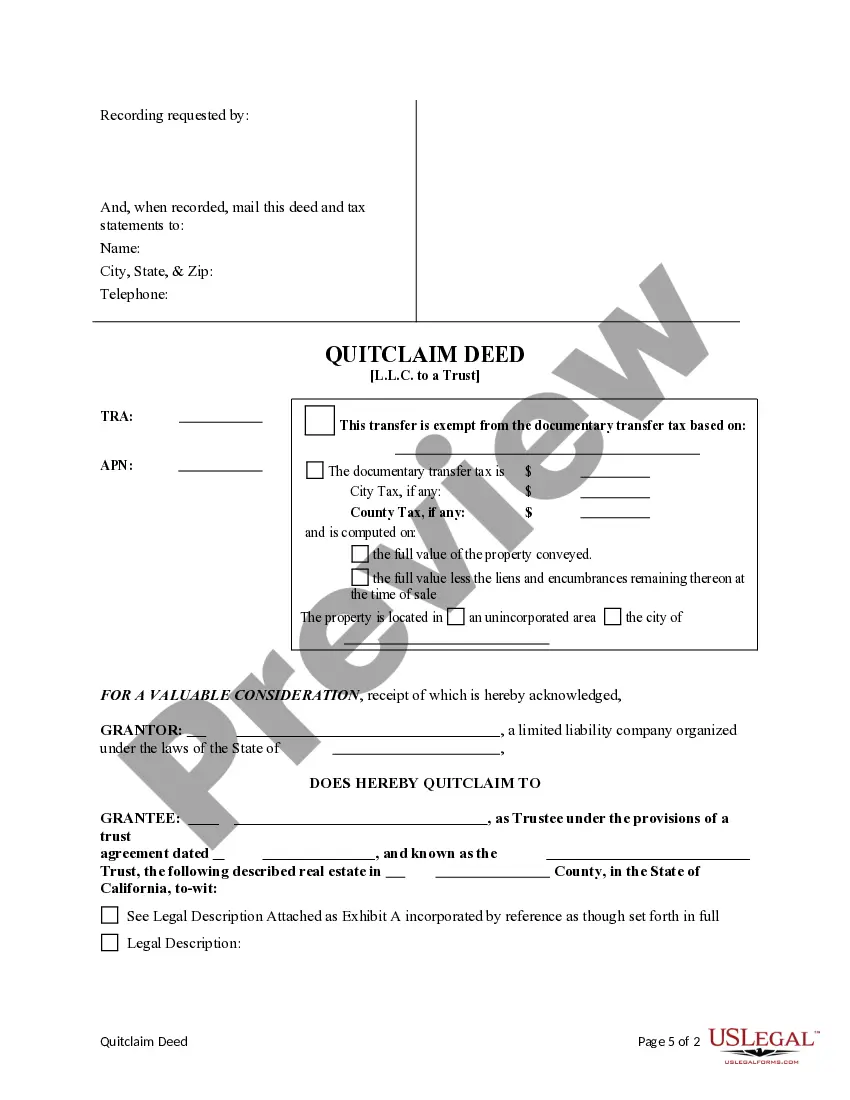

This form is a Quitclaim Deed where the Grantor is an LLC and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Sacramento California Quitclaim Deed from a Limited Liability Company to a Trust

Description

How to fill out California Quitclaim Deed From A Limited Liability Company To A Trust?

Utilize the US Legal Forms and gain immediate access to any form template you require.

Our advantageous platform, featuring a vast array of templates, eases the process of locating and obtaining almost any document sample you desire.

You can export, fill out, and sign the Sacramento California Quitclaim Deed from a Limited Liability Company to a Trust in just a few minutes instead of spending countless hours online searching for a suitable template.

Employing our collection is an excellent method to enhance the security of your document submission.

Locate the template you need. Ensure it is the document you intended to find: verify its title and description, and utilize the Preview feature when available. If not, use the Search bar to find the desired template.

Initiate the saving process. Click Buy Now and select the pricing option you prefer. Then, register for an account and complete your purchase using a credit card or PayPal.

- Our knowledgeable attorneys consistently review all documents to ensure that the templates are applicable for a specific state and comply with the latest laws and regulations.

- How can you acquire the Sacramento California Quitclaim Deed from a Limited Liability Company to a Trust.

- If you possess a subscription, simply Log In to your account. The Download button will be activated for all samples you review.

- Additionally, you can access all previously saved files in the My documents section.

- If you have not yet created an account, follow the steps outlined below.

Form popularity

FAQ

Absolutely, you can do a quit claim deed yourself, including the specific case of a Sacramento California Quitclaim Deed from a Limited Liability Company to a Trust. However, make sure to follow the correct procedures to ensure validity. If you have any doubts, UsLegalForms offers resources and templates to simplify the process, ensuring you get it right the first time. This way, you can feel confident in your property transfer.

You can prepare a deed yourself, including a Sacramento California Quitclaim Deed from a Limited Liability Company to a Trust. This process involves understanding the necessary legal elements of the deed and ensuring accuracy. While many people choose to fill out the forms independently, working with UsLegalForms can offer you essential guidance. They provide access to proper templates and instructions, making the task easier.

Yes, you can fill out a quitclaim deed yourself, particularly for a Sacramento California Quitclaim Deed from a Limited Liability Company to a Trust. However, it's important to ensure that you complete the form correctly to avoid potential legal issues. While it is manageable for many, using a platform like UsLegalForms can guide you through the required steps and provide the necessary templates. This extra support can help you complete the deed confidently.

In a typical Sacramento California Quitclaim Deed from a Limited Liability Company to a Trust, the owner of the property, known as the grantor, initiates the quitclaim deed. The grantor voluntarily transfers their interest in the property to the recipient, or grantee, which in this case is a trust. This process can simplify property transfer, especially in cases involving an LLC. If you need help, consider using UsLegalForms to streamline the process.

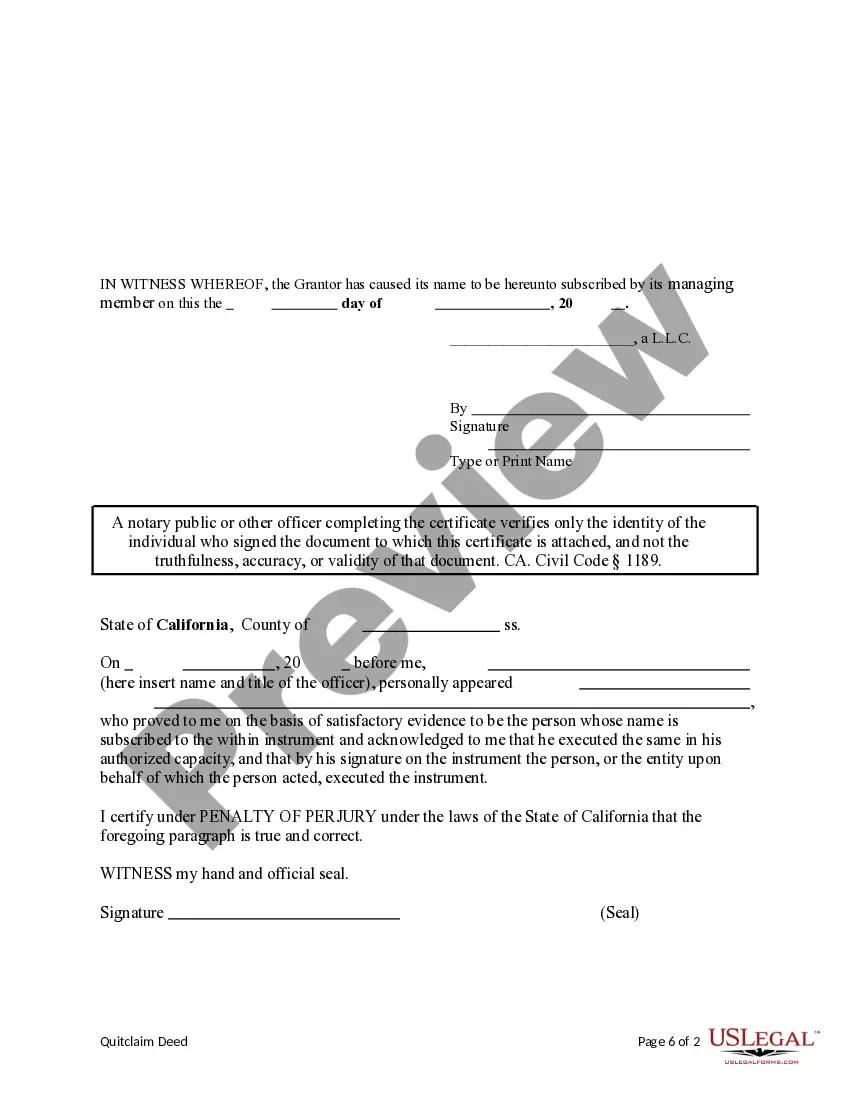

To put your property in a trust in California, you must complete a Quitclaim Deed. The Sacramento California Quitclaim Deed from a Limited Liability Company to a Trust allows you to transfer ownership efficiently. First, prepare the deed, ensuring you include accurate property details and trust information. Then, have the document signed and notarized, and finally, file it with the county recorder's office. This process protects your assets and simplifies management and distribution in the future.

Yes, you can transfer property from a trust to an individual using a quit claim deed. The trustee must sign the document to execute the transfer properly. Utilizing a Sacramento California Quitclaim Deed from a Limited Liability Company to a Trust makes this process straightforward and legally binding. Always consult with a legal expert to ensure compliance with all regulations.

A quitclaim deed cannot be used to clear a mortgage or to transfer property that is part of an ongoing divorce settlement. Further, it may not be appropriate for transferring property with existing liens without specific legal considerations. If you find yourself in complex ownership situations, consider exploring options through a Sacramento California Quitclaim Deed from a Limited Liability Company to a Trust for better clarity.

Yes, a quit claim deed can effectively transfer property out of a trust. The trustee or another authorized individual can sign the deed to convey ownership. When utilizing a Sacramento California Quitclaim Deed from a Limited Liability Company to a Trust, make certain that the current property interests are accurately represented. Legal assistance may help facilitate a smooth transfer.

To transfer a deed to a trust in California, you must complete a quit claim deed and have it signed by the property owner. The next step involves filing the quit claim deed with the local county recorder's office. Utilizing a Sacramento California Quitclaim Deed from a Limited Liability Company to a Trust simplifies this process. Ensure you adhere to local laws for proper execution and recording.

Yes, a quit claim deed can transfer property from a trust. This legal document allows the trustee to convey property rights to another party. In the case of a Sacramento California Quitclaim Deed from a Limited Liability Company to a Trust, it is essential to ensure that the documentation accurately reflects the authority of the trustee. Always consider consulting a legal professional for specific guidance.