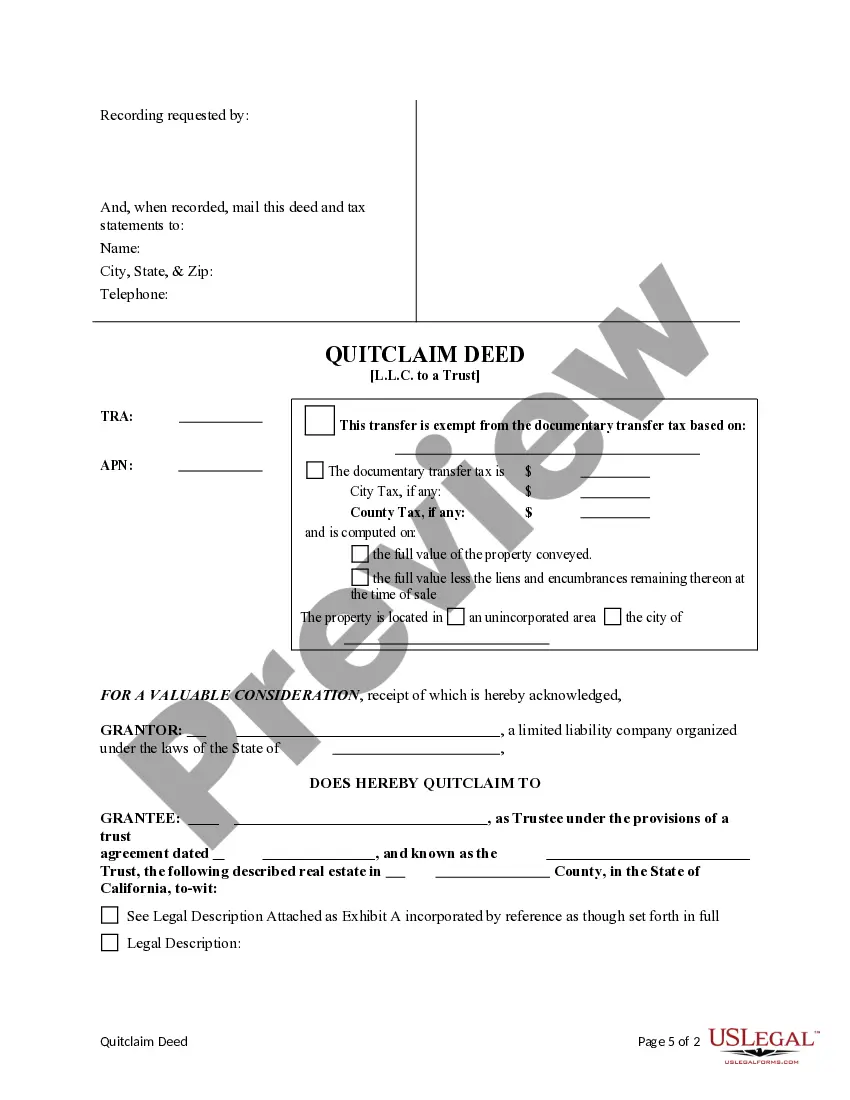

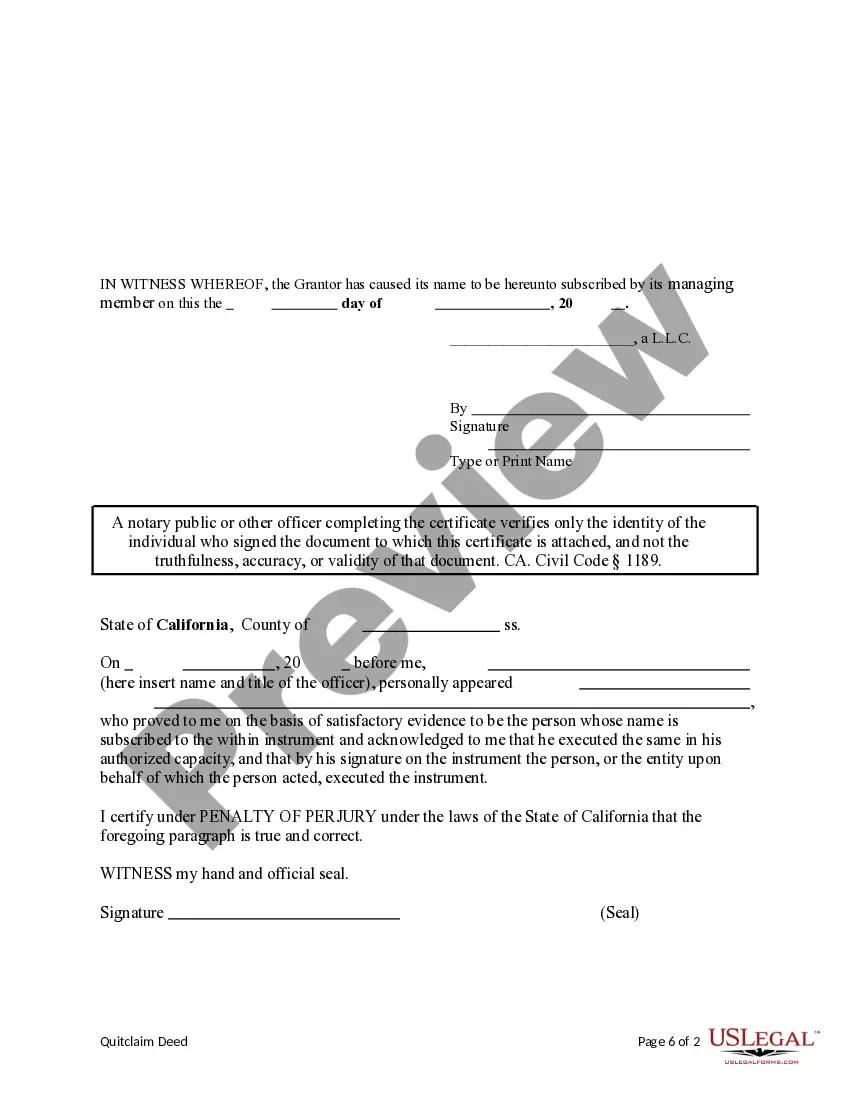

This form is a Quitclaim Deed where the Grantor is an LLC and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

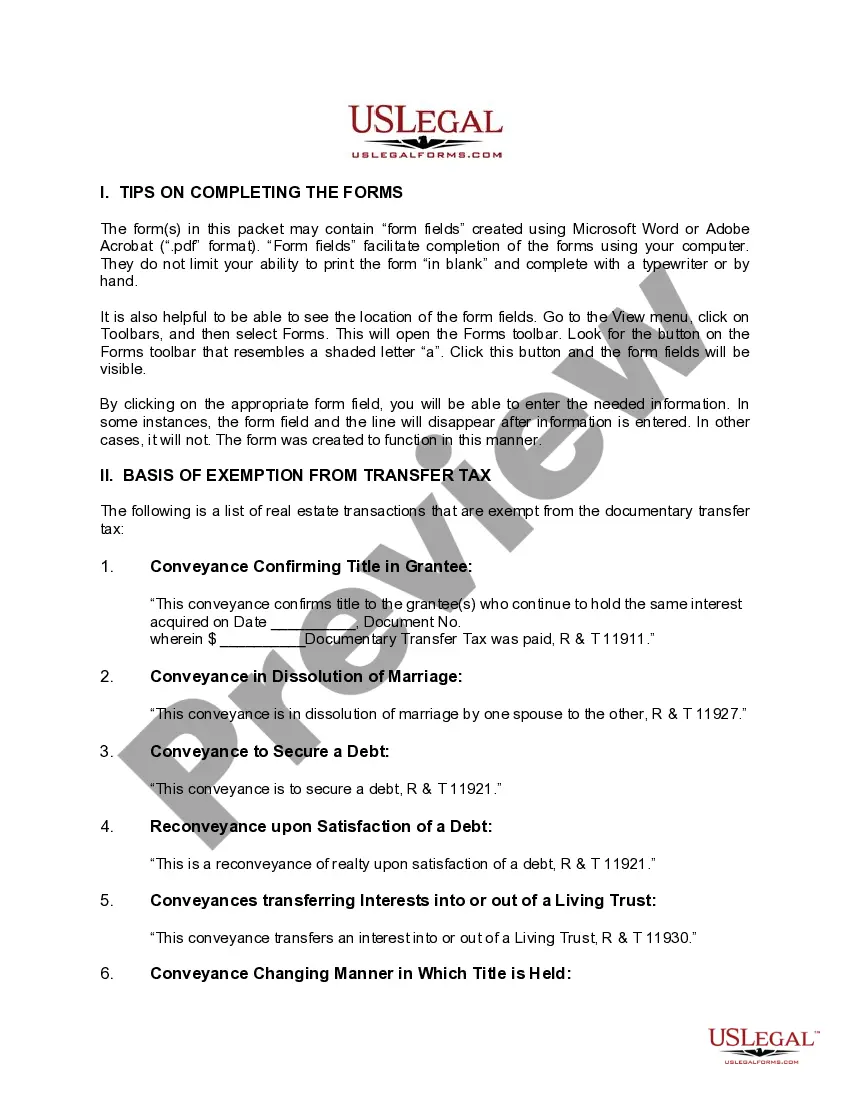

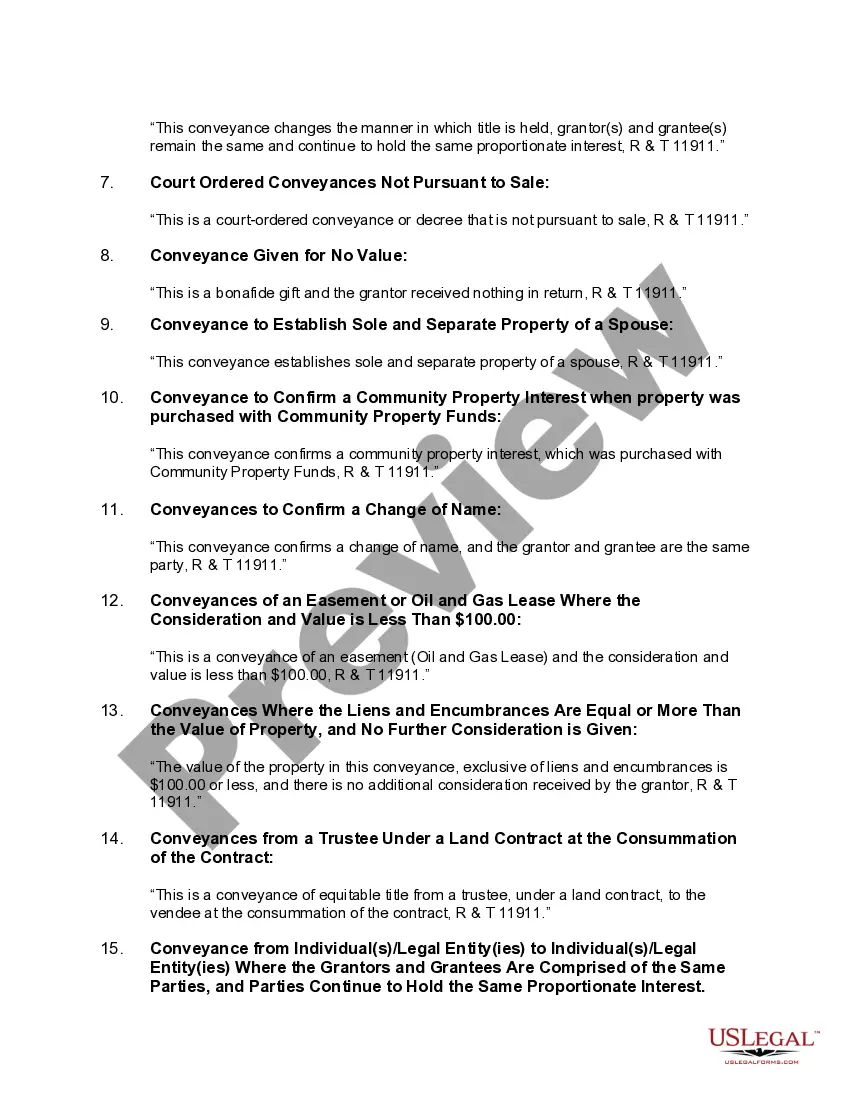

A Santa Clara California Quitclaim Deed from a Limited Liability Company to a Trust is a legal document that allows for the transfer of property ownership rights from an LLC to a trust. This type of deed is commonly used in Santa Clara County, California, for estate planning purposes or to facilitate the efficient transfer of property assets. When a Limited Liability Company (LLC) decides to transfer their interest in a property to a trust, they can utilize a Quitclaim Deed, which conveys all rights, title, and interest that the LLC holds in the property. This deed acts as evidence of the transfer and helps ensure clear ownership of the property by the trust. This type of transaction is often employed when the owners of an LLC wish to protect their assets or streamline the transfer of property to heirs. By transferring the property to a trust, the LLC owners can ensure that the property is managed according to their wishes and potentially minimize future taxation or probate complications. Different types of Santa Clara California Quitclaim Deeds from a Limited Liability Company to a Trust include: 1. Individual-to-Revocable Living Trust: This type of quitclaim deed is used when a single individual, who is a member or owner of the LLC, transfers the property ownership to their own revocable living trust. This allows the individual to retain control during their lifetime and ensure smooth asset distribution upon their death. 2. Multiple Owners-to-Revocable Living Trust: When an LLC has multiple owners, each owner may decide to transfer their respective ownership interests in the property to a common revocable living trust. This type of transfer can be useful for managing and distributing shared assets according to the trust's provisions. 3. LLC-to-Irrevocable Trust: In certain cases, LLC owners may choose to transfer the property to an irrevocable trust for estate planning or asset protection purposes. An irrevocable trust cannot be altered or revoked without the permission of the beneficiaries, making it a suitable option for long-term asset management and wealth preservation. It is important to consult with legal professionals such as attorneys or real estate experts in Santa Clara County, California, to ensure compliance with the local regulations and to customize the quitclaim deed based on specific circumstances.A Santa Clara California Quitclaim Deed from a Limited Liability Company to a Trust is a legal document that allows for the transfer of property ownership rights from an LLC to a trust. This type of deed is commonly used in Santa Clara County, California, for estate planning purposes or to facilitate the efficient transfer of property assets. When a Limited Liability Company (LLC) decides to transfer their interest in a property to a trust, they can utilize a Quitclaim Deed, which conveys all rights, title, and interest that the LLC holds in the property. This deed acts as evidence of the transfer and helps ensure clear ownership of the property by the trust. This type of transaction is often employed when the owners of an LLC wish to protect their assets or streamline the transfer of property to heirs. By transferring the property to a trust, the LLC owners can ensure that the property is managed according to their wishes and potentially minimize future taxation or probate complications. Different types of Santa Clara California Quitclaim Deeds from a Limited Liability Company to a Trust include: 1. Individual-to-Revocable Living Trust: This type of quitclaim deed is used when a single individual, who is a member or owner of the LLC, transfers the property ownership to their own revocable living trust. This allows the individual to retain control during their lifetime and ensure smooth asset distribution upon their death. 2. Multiple Owners-to-Revocable Living Trust: When an LLC has multiple owners, each owner may decide to transfer their respective ownership interests in the property to a common revocable living trust. This type of transfer can be useful for managing and distributing shared assets according to the trust's provisions. 3. LLC-to-Irrevocable Trust: In certain cases, LLC owners may choose to transfer the property to an irrevocable trust for estate planning or asset protection purposes. An irrevocable trust cannot be altered or revoked without the permission of the beneficiaries, making it a suitable option for long-term asset management and wealth preservation. It is important to consult with legal professionals such as attorneys or real estate experts in Santa Clara County, California, to ensure compliance with the local regulations and to customize the quitclaim deed based on specific circumstances.