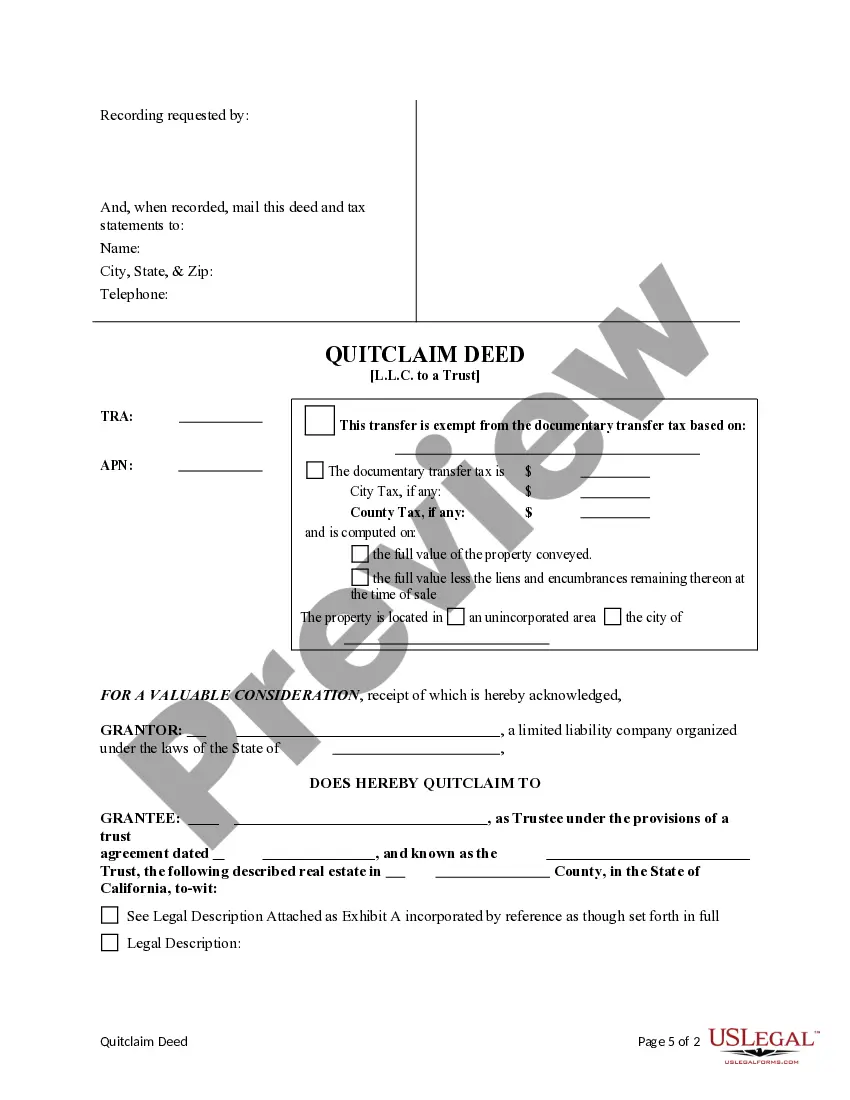

This form is a Quitclaim Deed where the Grantor is an LLC and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

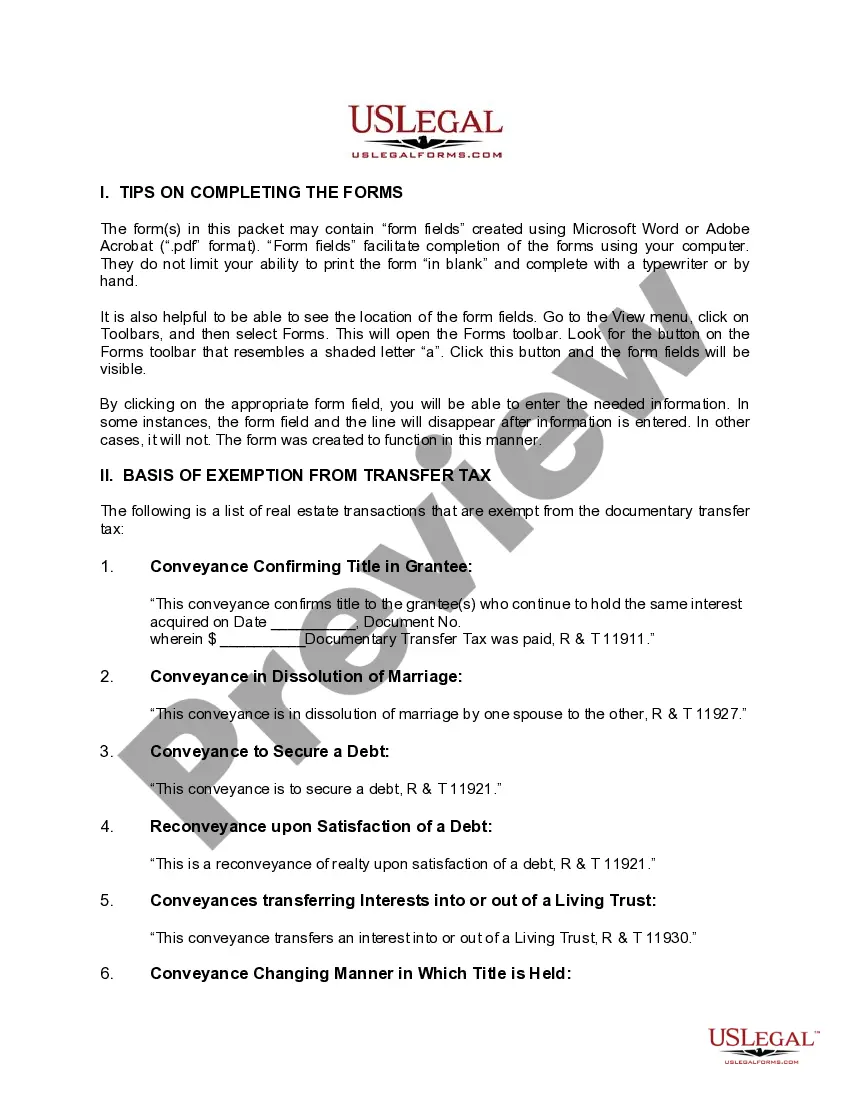

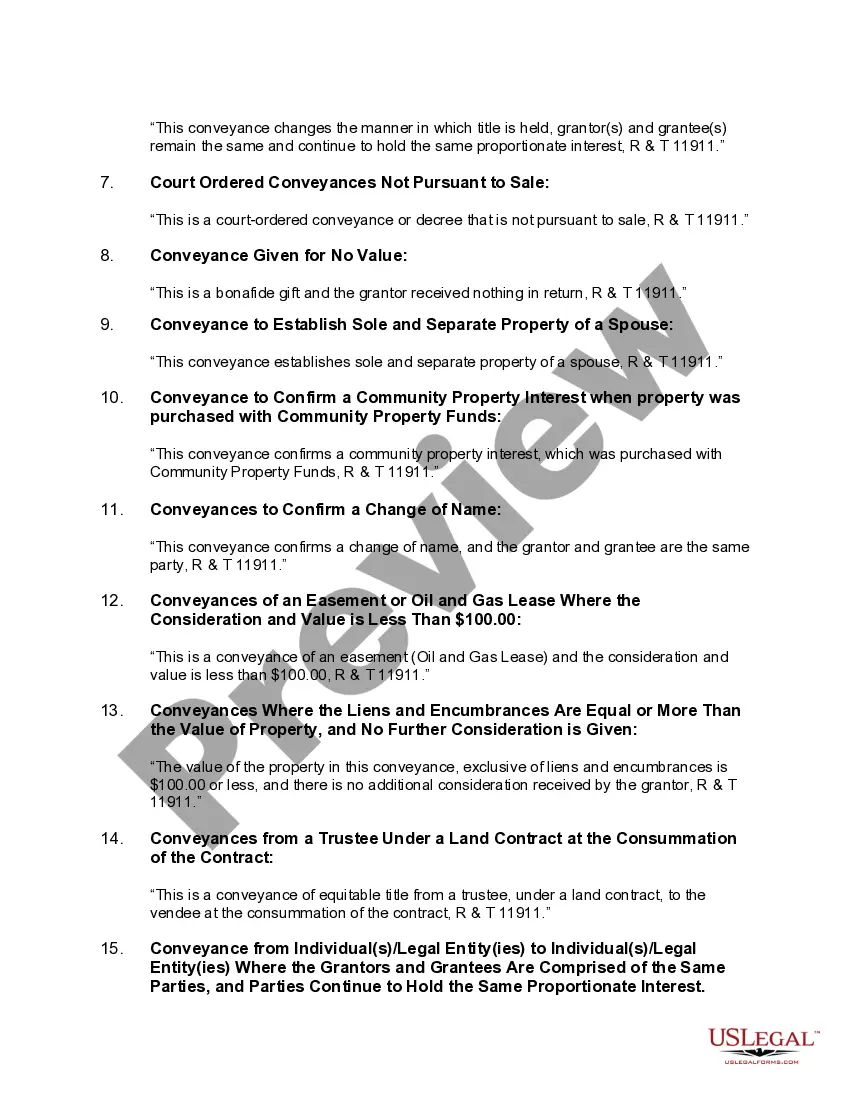

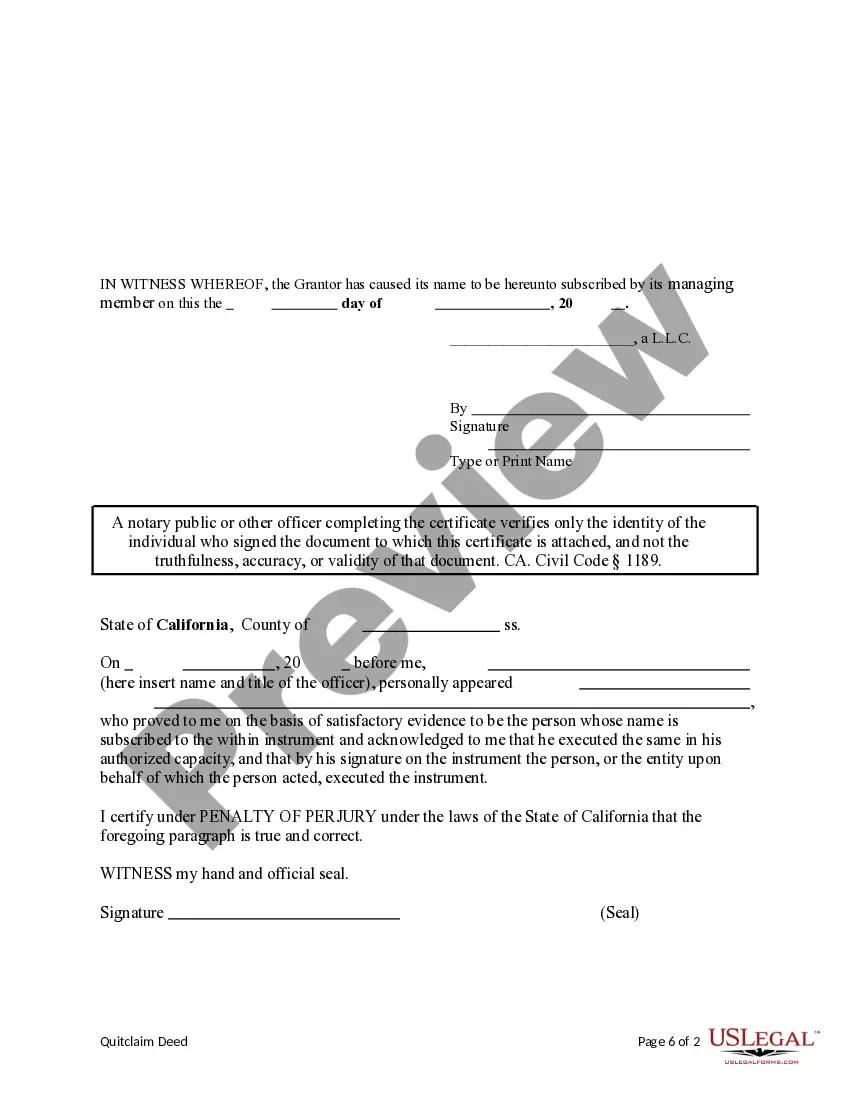

A Santa Maria California Quitclaim Deed from a Limited Liability Company to a Trust is a legal document that allows a limited liability company (LLC) to transfer the ownership of a property to a trust. This deed is commonly used when an LLC member wishes to convey their interest in the property held by the LLC to a trust, often for estate planning purposes or to streamline the ownership structure. The quitclaim deed serves as a legal instrument for the LLC to transfer its rights, title, and interest in the property to the trust. Unlike a warranty deed, a quitclaim deed does not offer any guarantees or warranties concerning the property's title. The LLC, as the granter, is simply relinquishing any claim it might have on the property, transferring it to the trust, which becomes the grantee. By transferring the property to a trust, LLC members can ensure a more seamless transfer of ownership upon their passing or if they wish to establish specific beneficiary rights. Additionally, a trust may provide certain tax advantages or asset protection benefits that an LLC alone cannot provide. It is advisable to consult with a qualified attorney or financial advisor to understand the potential implications and benefits of this transfer. While there may not be specific types of Santa Maria California Quitclaim Deeds from an LLC to a Trust, the terms of the deed can vary depending on the specific circumstances. Some key variations or considerations to be aware of while preparing such a document may include: 1. Single-member LLC to Trust: If the LLC is solely owned by a single member, the quitclaim deed should reflect the transfer of the entire interest held by the LLC to the trust. 2. Multi-member LLC to Trust: In the case of an LLC with multiple members, each member's percentage interest must be allocated and documented in the quitclaim deed, indicating the specific proportion being transferred to the trust. 3. Trustee Information: The quitclaim deed should include the full legal name of the trustee(s) administering the trust, ensuring proper identification and authorization for the property transfer. 4. Trust Name and Date: The quitclaim deed should clearly state the name of the trust and its effective date, as established by the trust agreement. 5. Notarization and Recording: It is essential to acknowledge the signatures of the LLC's authorized representative and the trustee(s) before a notary public. Following notarization, the quitclaim deed should be recorded with the Santa Maria County Recorder's Office to provide public notice of the transfer. In conclusion, a Santa Maria California Quitclaim Deed from a Limited Liability Company to a Trust allows for the smooth transition of property ownership from an LLC to a trust. This legal document should be accurately prepared, considering specific details and requirements, such as whether the LLC is single or multi-member and providing the necessary trustee and trust information. As with any legal matter, it is always recommended consulting with professionals well-versed in real estate and trust law to ensure compliance and address any individual considerations.A Santa Maria California Quitclaim Deed from a Limited Liability Company to a Trust is a legal document that allows a limited liability company (LLC) to transfer the ownership of a property to a trust. This deed is commonly used when an LLC member wishes to convey their interest in the property held by the LLC to a trust, often for estate planning purposes or to streamline the ownership structure. The quitclaim deed serves as a legal instrument for the LLC to transfer its rights, title, and interest in the property to the trust. Unlike a warranty deed, a quitclaim deed does not offer any guarantees or warranties concerning the property's title. The LLC, as the granter, is simply relinquishing any claim it might have on the property, transferring it to the trust, which becomes the grantee. By transferring the property to a trust, LLC members can ensure a more seamless transfer of ownership upon their passing or if they wish to establish specific beneficiary rights. Additionally, a trust may provide certain tax advantages or asset protection benefits that an LLC alone cannot provide. It is advisable to consult with a qualified attorney or financial advisor to understand the potential implications and benefits of this transfer. While there may not be specific types of Santa Maria California Quitclaim Deeds from an LLC to a Trust, the terms of the deed can vary depending on the specific circumstances. Some key variations or considerations to be aware of while preparing such a document may include: 1. Single-member LLC to Trust: If the LLC is solely owned by a single member, the quitclaim deed should reflect the transfer of the entire interest held by the LLC to the trust. 2. Multi-member LLC to Trust: In the case of an LLC with multiple members, each member's percentage interest must be allocated and documented in the quitclaim deed, indicating the specific proportion being transferred to the trust. 3. Trustee Information: The quitclaim deed should include the full legal name of the trustee(s) administering the trust, ensuring proper identification and authorization for the property transfer. 4. Trust Name and Date: The quitclaim deed should clearly state the name of the trust and its effective date, as established by the trust agreement. 5. Notarization and Recording: It is essential to acknowledge the signatures of the LLC's authorized representative and the trustee(s) before a notary public. Following notarization, the quitclaim deed should be recorded with the Santa Maria County Recorder's Office to provide public notice of the transfer. In conclusion, a Santa Maria California Quitclaim Deed from a Limited Liability Company to a Trust allows for the smooth transition of property ownership from an LLC to a trust. This legal document should be accurately prepared, considering specific details and requirements, such as whether the LLC is single or multi-member and providing the necessary trustee and trust information. As with any legal matter, it is always recommended consulting with professionals well-versed in real estate and trust law to ensure compliance and address any individual considerations.