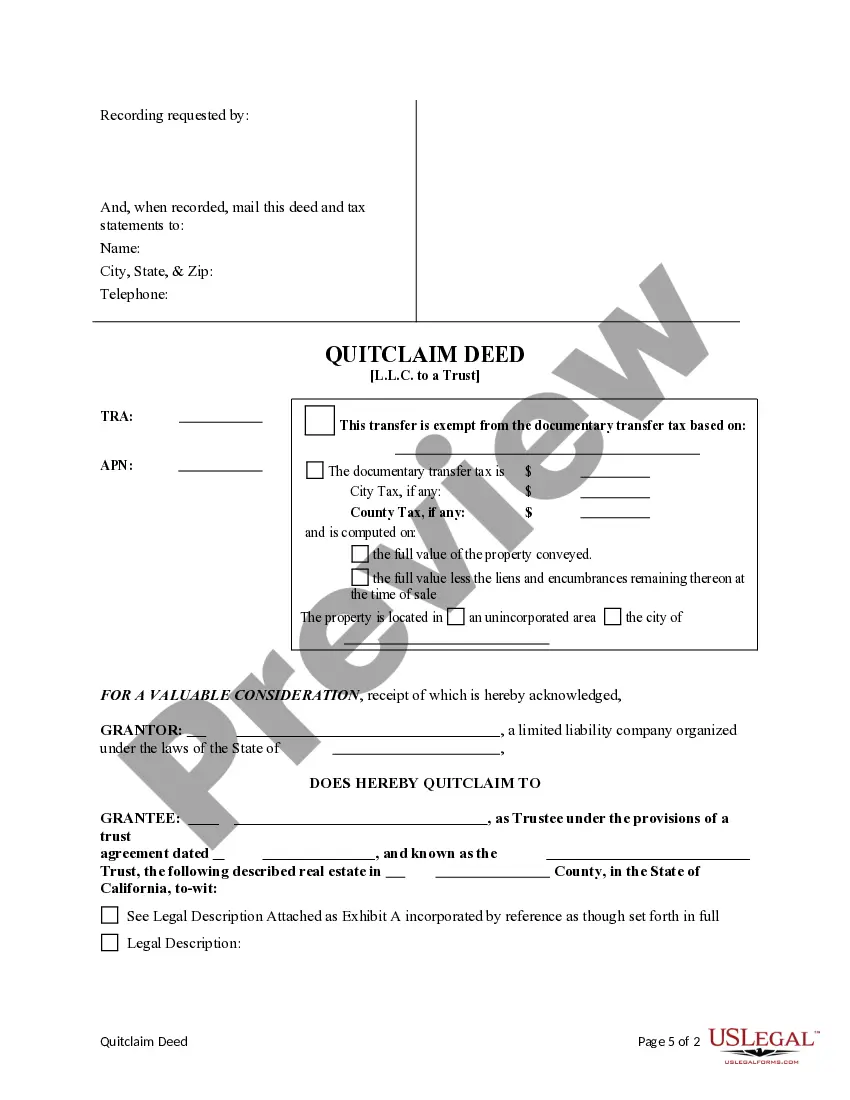

This form is a Quitclaim Deed where the Grantor is an LLC and the Grantee is a Trust. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

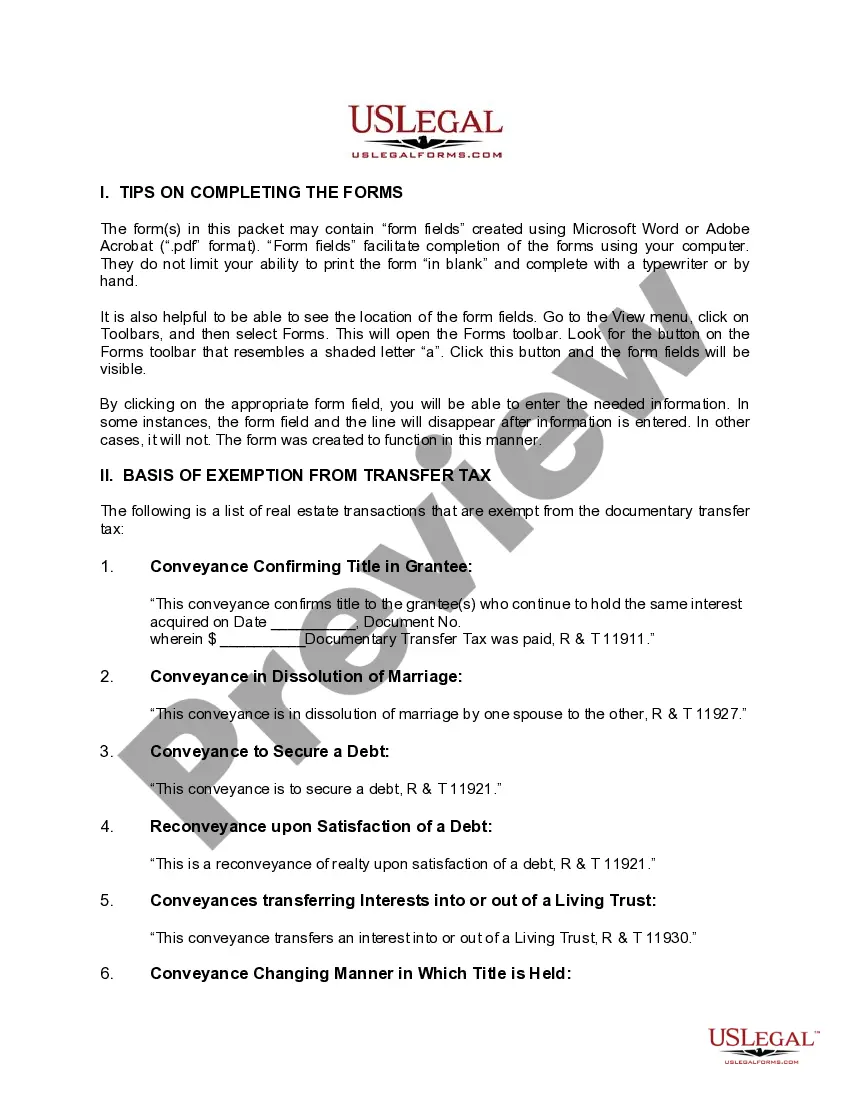

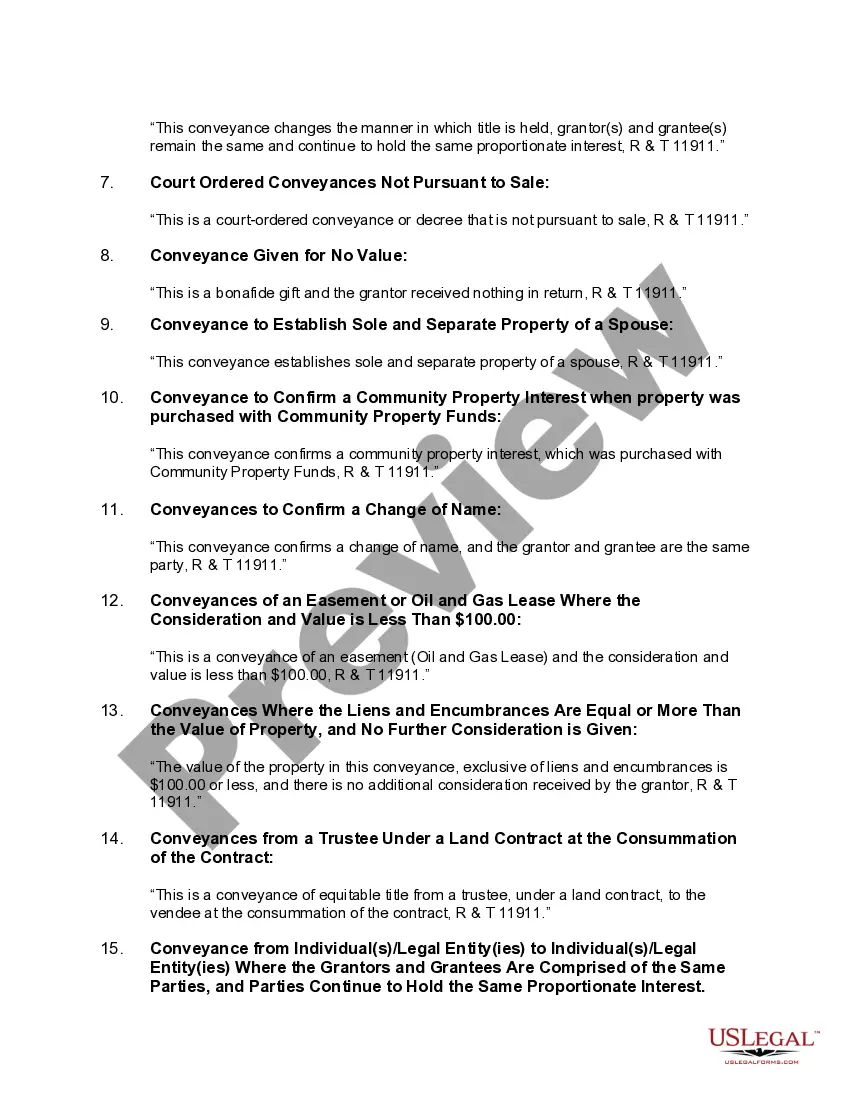

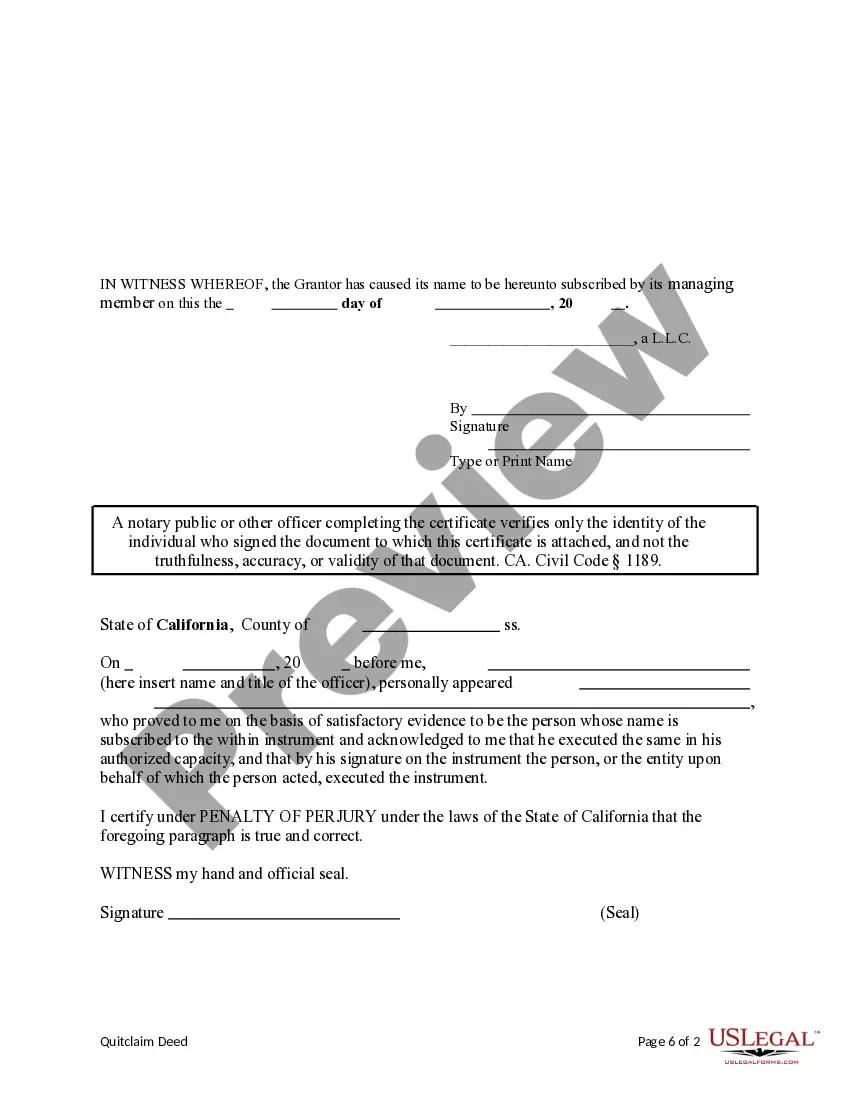

A West Covina California Quitclaim Deed from a Limited Liability Company to a Trust is a legal document typically used to transfer property ownership from an LLC (Limited Liability Company) to a trust. This type of transfer is commonly done as part of estate planning or to manage assets efficiently. A quitclaim deed is a conveyance document that transfers the interest or claim a granter (in this case, the LLC) has in the property to the grantee (the trust). It is important to note that a quitclaim deed does not guarantee or provide any warranties regarding the property's title. There are different types of West Covina California Quitclaim Deeds from a Limited Liability Company to a Trust, including: 1. Standard West Covina California Quitclaim Deed from LLC to Trust: This is the most common type of quitclaim deed used for transferring property interests from an LLC to a trust. It is a straightforward process that requires the granter to execute the deed and properly record it with the relevant county recorder's office. 2. West Covina California Quitclaim Deed with Consideration: This type of quitclaim deed from an LLC to a trust involves taking some form of consideration. The consideration can be monetary or non-monetary, such as assuming a mortgage or providing another property in exchange. Including consideration helps establish the transaction's value and may have important tax implications. 3. West Covina California Quitclaim Deed for Tax Planning: A quitclaim deed from an LLC to a trust can be used as part of tax planning strategies. By transferring property ownership, the LLC can potentially reduce tax liability or protect assets from certain tax implications. It is advised to consult with a tax professional or attorney specialized in tax planning for specific advice. In order to execute a West Covina California Quitclaim Deed from a Limited Liability Company to a Trust, the following steps typically need to be taken: 1. Preparation: The granter (LLC) should prepare the quitclaim deed, ensuring accuracy, completeness, and adherence to legal requirements. It is recommended to seek legal assistance or use a reputable deed preparation service to ensure compliance. 2. Execution and Notarization: The granter must sign the quitclaim deed in the presence of a notary public, who will notarize the document to verify its authenticity. 3. Recording: The completed and notarized quitclaim deed should be filed with the county recorder's office in the relevant jurisdiction. This step is vital to establish a public record of the ownership transfer. 4. Tax Considerations: Depending on the specifics of the property and the transaction, there may be tax implications. Consulting with a tax professional will help navigate through potential tax obligations or benefits. Completing a West Covina California Quitclaim Deed from a Limited Liability Company to a Trust requires careful attention to legal details and procedures. It is highly recommended consulting with an attorney specializing in real estate law to ensure compliance with all applicable regulations and to guarantee a smooth transfer of property ownership.A West Covina California Quitclaim Deed from a Limited Liability Company to a Trust is a legal document typically used to transfer property ownership from an LLC (Limited Liability Company) to a trust. This type of transfer is commonly done as part of estate planning or to manage assets efficiently. A quitclaim deed is a conveyance document that transfers the interest or claim a granter (in this case, the LLC) has in the property to the grantee (the trust). It is important to note that a quitclaim deed does not guarantee or provide any warranties regarding the property's title. There are different types of West Covina California Quitclaim Deeds from a Limited Liability Company to a Trust, including: 1. Standard West Covina California Quitclaim Deed from LLC to Trust: This is the most common type of quitclaim deed used for transferring property interests from an LLC to a trust. It is a straightforward process that requires the granter to execute the deed and properly record it with the relevant county recorder's office. 2. West Covina California Quitclaim Deed with Consideration: This type of quitclaim deed from an LLC to a trust involves taking some form of consideration. The consideration can be monetary or non-monetary, such as assuming a mortgage or providing another property in exchange. Including consideration helps establish the transaction's value and may have important tax implications. 3. West Covina California Quitclaim Deed for Tax Planning: A quitclaim deed from an LLC to a trust can be used as part of tax planning strategies. By transferring property ownership, the LLC can potentially reduce tax liability or protect assets from certain tax implications. It is advised to consult with a tax professional or attorney specialized in tax planning for specific advice. In order to execute a West Covina California Quitclaim Deed from a Limited Liability Company to a Trust, the following steps typically need to be taken: 1. Preparation: The granter (LLC) should prepare the quitclaim deed, ensuring accuracy, completeness, and adherence to legal requirements. It is recommended to seek legal assistance or use a reputable deed preparation service to ensure compliance. 2. Execution and Notarization: The granter must sign the quitclaim deed in the presence of a notary public, who will notarize the document to verify its authenticity. 3. Recording: The completed and notarized quitclaim deed should be filed with the county recorder's office in the relevant jurisdiction. This step is vital to establish a public record of the ownership transfer. 4. Tax Considerations: Depending on the specifics of the property and the transaction, there may be tax implications. Consulting with a tax professional will help navigate through potential tax obligations or benefits. Completing a West Covina California Quitclaim Deed from a Limited Liability Company to a Trust requires careful attention to legal details and procedures. It is highly recommended consulting with an attorney specializing in real estate law to ensure compliance with all applicable regulations and to guarantee a smooth transfer of property ownership.