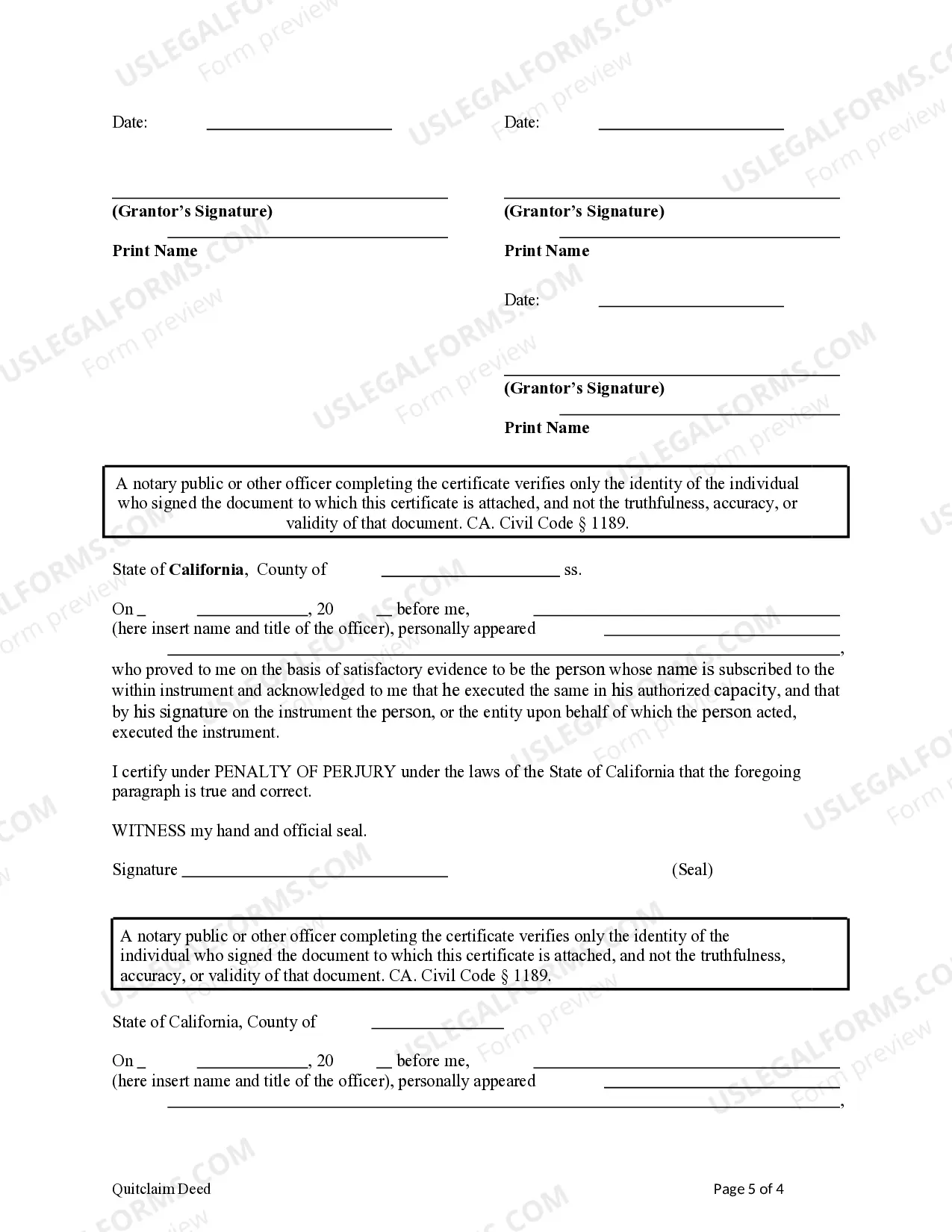

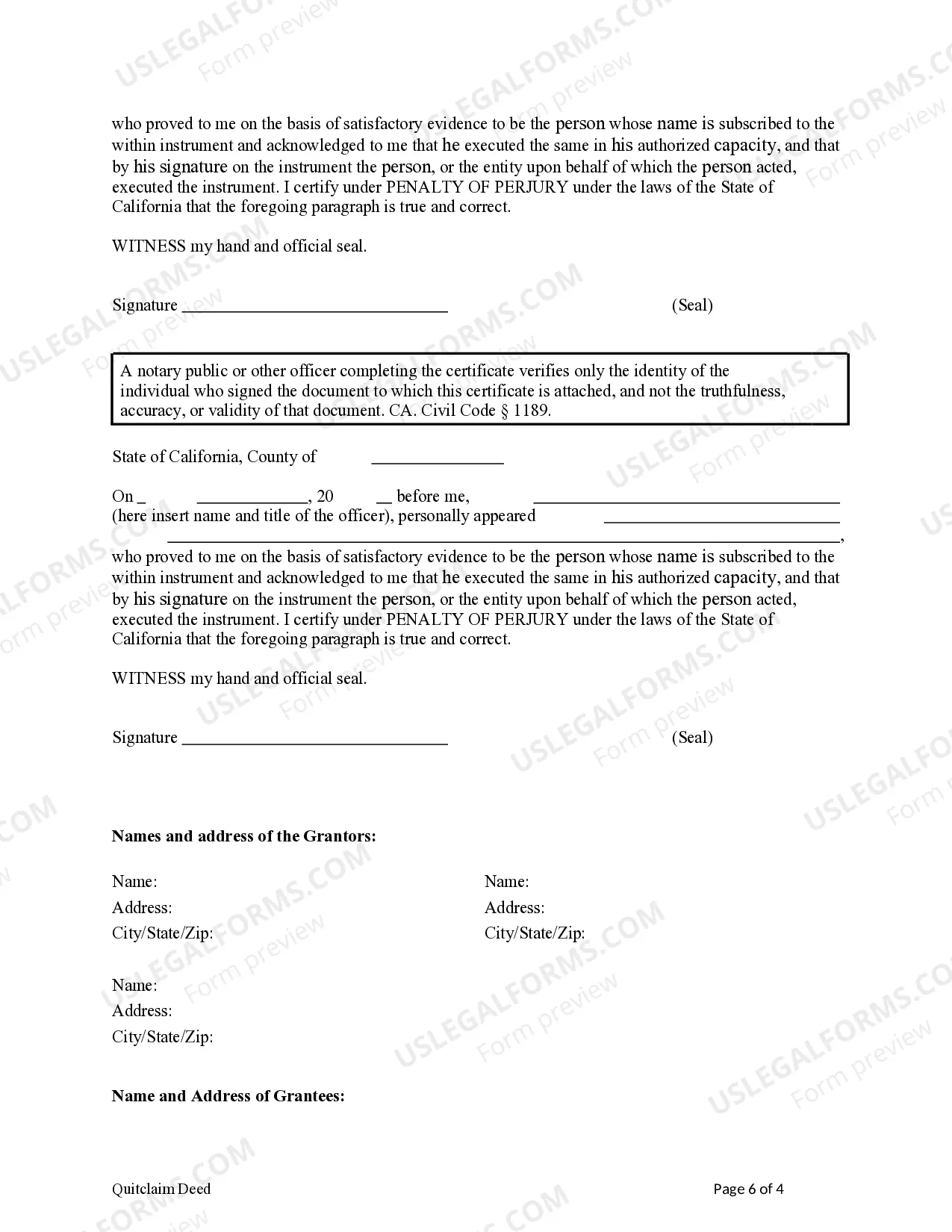

This form is a Quitclaim Deed where the Grantors are Husband, Wife and an Individual and the Grantees are Husband and Wife. Grantors convey and quitclaim the described property to Grantees. This deed complies with all state statutory laws.

A quitclaim deed is a legal document used in real estate to transfer ownership of a property from one party to another. In the case of Anaheim, California, a quitclaim deed from a husband, wife, and an individual to a husband and wife signifies a transfer of property ownership among these parties. The Anaheim California Quitclaim Deed from Husband, Wife, and an Individual to Husband and Wife is a specific type of legal document used in Anaheim, California. This deed allows the transfer of property ownership from a husband, wife, and an individual to another husband and wife without any warranty or guarantee of title. Some different types of Anaheim California Quitclaim Deeds from Husband, Wife, and an Individual to Husband and Wife may include the following: 1. Standard Quitclaim Deed: This is the most common type of quitclaim deed, used to transfer property ownership without any warranties or guarantees. 2. Inter-spousal Quitclaim Deed: This type of quitclaim deed is used when a property is being transferred solely between spouses, with no third-party involvement. 3. Joint Tenant Quitclaim Deed: If the parties involved in the quitclaim deed wish to hold the property as joint tenants, they can use this type of deed to transfer ownership. 4. Community Property Quitclaim Deed: In situations where the property being transferred is considered community property, this type of quitclaim deed highlights the spousal interest in the property. 5. Tenants-in-Common Quitclaim Deed: When multiple individuals hold an undivided interest in the property, this type of quitclaim deed allows for the transfer of respective shares. It is important to consult with a real estate attorney or legal professional to determine the appropriate type of quitclaim deed for your specific situation in Anaheim, California. Additionally, conducting a thorough title search beforehand is crucial to identify any potential liens, encumbrances, or claims that may affect the property's ownership or transfer.A quitclaim deed is a legal document used in real estate to transfer ownership of a property from one party to another. In the case of Anaheim, California, a quitclaim deed from a husband, wife, and an individual to a husband and wife signifies a transfer of property ownership among these parties. The Anaheim California Quitclaim Deed from Husband, Wife, and an Individual to Husband and Wife is a specific type of legal document used in Anaheim, California. This deed allows the transfer of property ownership from a husband, wife, and an individual to another husband and wife without any warranty or guarantee of title. Some different types of Anaheim California Quitclaim Deeds from Husband, Wife, and an Individual to Husband and Wife may include the following: 1. Standard Quitclaim Deed: This is the most common type of quitclaim deed, used to transfer property ownership without any warranties or guarantees. 2. Inter-spousal Quitclaim Deed: This type of quitclaim deed is used when a property is being transferred solely between spouses, with no third-party involvement. 3. Joint Tenant Quitclaim Deed: If the parties involved in the quitclaim deed wish to hold the property as joint tenants, they can use this type of deed to transfer ownership. 4. Community Property Quitclaim Deed: In situations where the property being transferred is considered community property, this type of quitclaim deed highlights the spousal interest in the property. 5. Tenants-in-Common Quitclaim Deed: When multiple individuals hold an undivided interest in the property, this type of quitclaim deed allows for the transfer of respective shares. It is important to consult with a real estate attorney or legal professional to determine the appropriate type of quitclaim deed for your specific situation in Anaheim, California. Additionally, conducting a thorough title search beforehand is crucial to identify any potential liens, encumbrances, or claims that may affect the property's ownership or transfer.