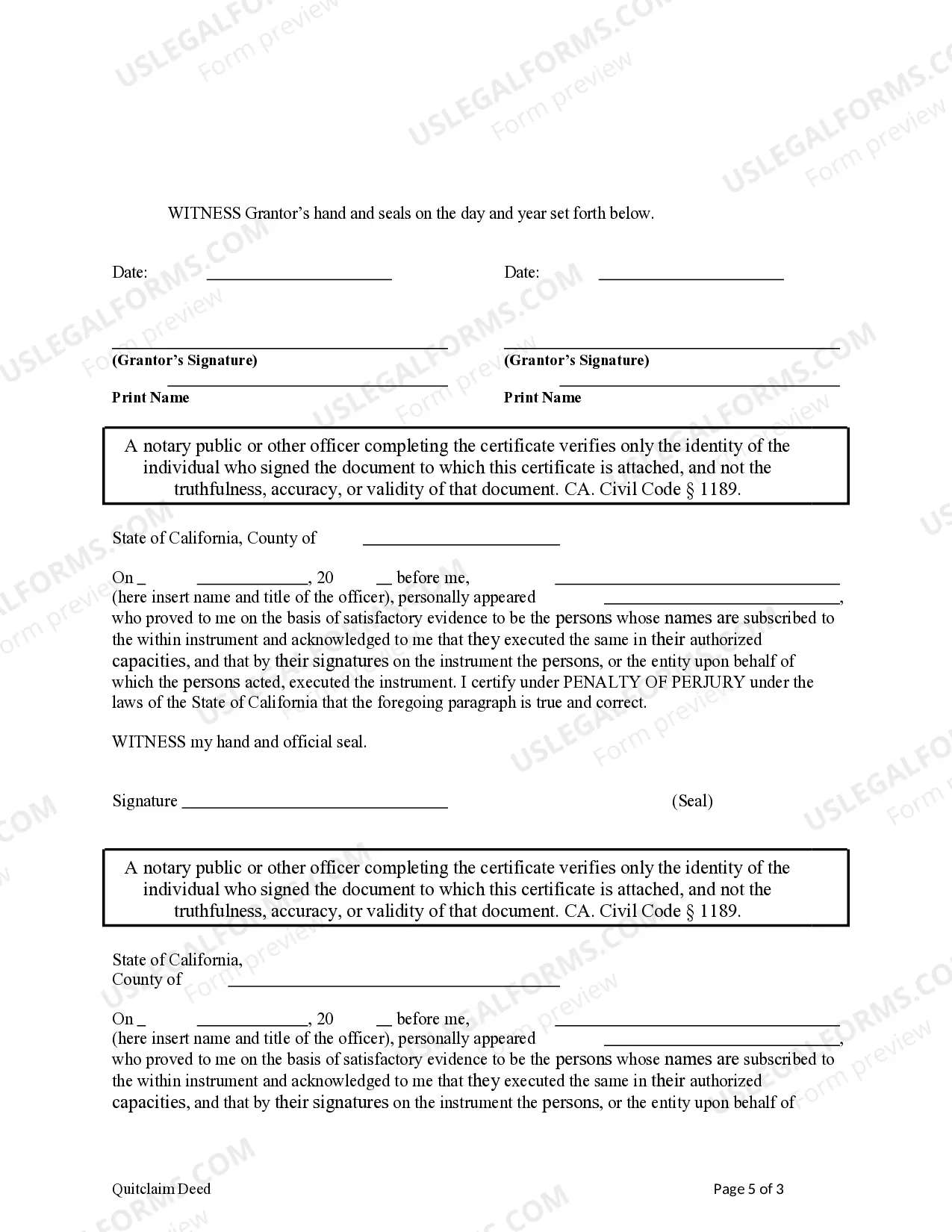

This form is a Quitclaim Deed where the Grantors are Husband and Wife and the Grantees are two married couples. This deed complies with all state statutory laws.

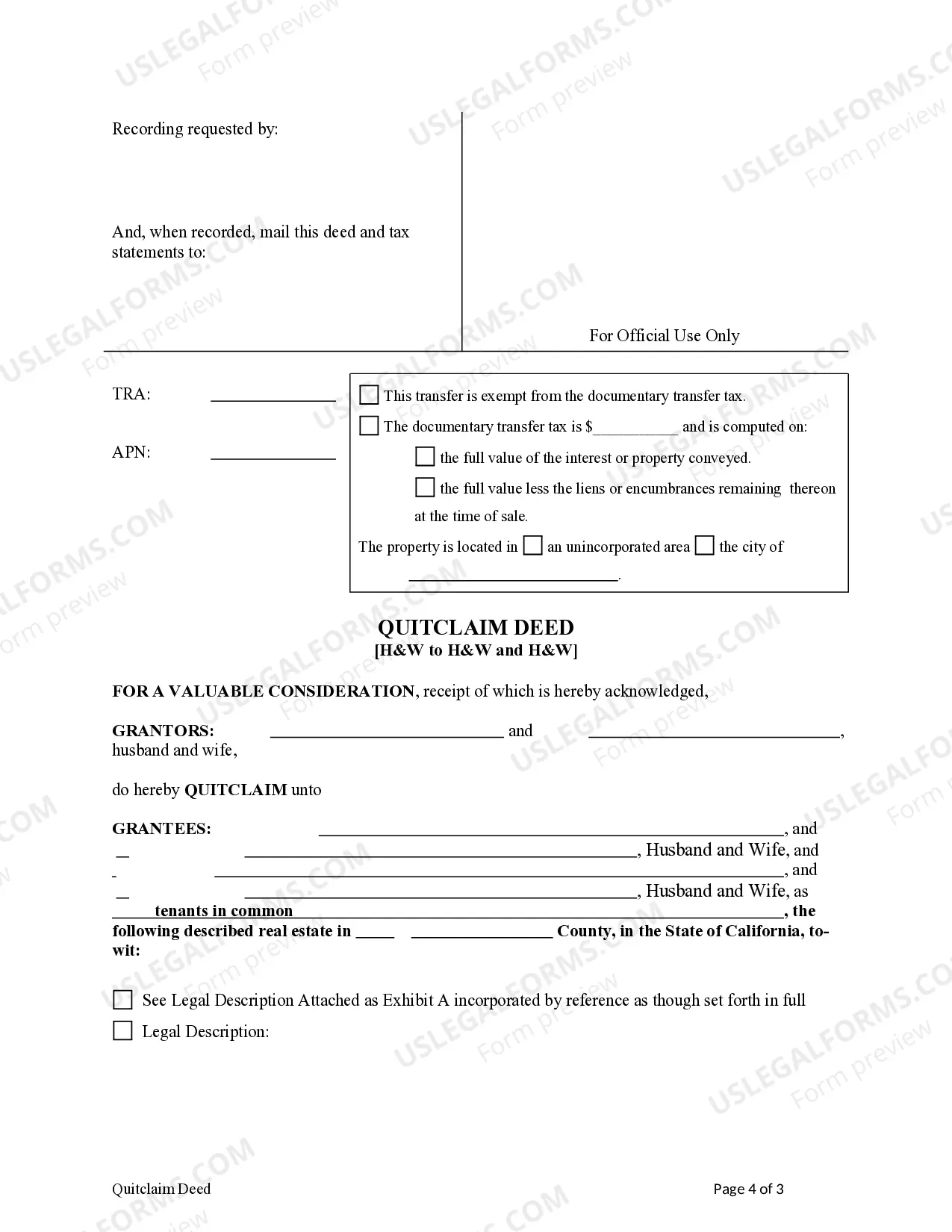

In Antioch, California, a Quitclaim Deed from Husband and Wife to Husband and Wife and Husband and Wife (Two Couples) refers to a legal document that enables the transfer of property ownership from one married couple to another married couple. This type of deed is commonly used in cases where both couples wish to have joint ownership of the property, providing equal rights and interests. The Antioch California Quitclaim Deed from Husband and Wife to Husband and Wife and Husband and Wife (Two Couples) offers a straightforward transfer process without any warranty or guarantee of the property's title. It signifies that the granter(s), being the husband and wife of the transferring couple, are releasing all their current and future claims to the property to the grantee(s), the husband and wife of the receiving couple. It is important to note that this type of deed does not provide any assurance against potential liens, encumbrances, or other claims that may exist on the property. Different variations of Antioch California Quitclaim Deed from Husband and Wife to Husband and Wife and Husband and Wife (Two Couples) may include: 1. Joint Tenancy Quitclaim Deed: This type of quitclaim deed establishes equal ownership with rights of survivorship. In the event of the death of one spouse, the surviving spouse automatically inherits the deceased spouse's share of the property without the need for probate. 2. Tenancy in Common Quitclaim Deed: With this version of the quitclaim deed, each party has distinct ownership interests. In case of death, the deceased spouse's share of the property will be transferred according to their will or state intestacy laws. 3. Community Property with Right of Survivorship Quitclaim Deed: This type of deed is specific to married couples in community property states, like California. It grants joint ownership and the right of survivorship to the parties involved. Upon the death of one spouse, the surviving spouse becomes the sole owner without undergoing probate. Whether utilizing a Joint Tenancy, Tenancy in Common, or Community Property with Right of Survivorship structure, it is essential to consult with a qualified attorney or real estate professional to ensure compliance with local laws, understand the potential tax implications, and guarantee a smooth and legally binding transfer of ownership.In Antioch, California, a Quitclaim Deed from Husband and Wife to Husband and Wife and Husband and Wife (Two Couples) refers to a legal document that enables the transfer of property ownership from one married couple to another married couple. This type of deed is commonly used in cases where both couples wish to have joint ownership of the property, providing equal rights and interests. The Antioch California Quitclaim Deed from Husband and Wife to Husband and Wife and Husband and Wife (Two Couples) offers a straightforward transfer process without any warranty or guarantee of the property's title. It signifies that the granter(s), being the husband and wife of the transferring couple, are releasing all their current and future claims to the property to the grantee(s), the husband and wife of the receiving couple. It is important to note that this type of deed does not provide any assurance against potential liens, encumbrances, or other claims that may exist on the property. Different variations of Antioch California Quitclaim Deed from Husband and Wife to Husband and Wife and Husband and Wife (Two Couples) may include: 1. Joint Tenancy Quitclaim Deed: This type of quitclaim deed establishes equal ownership with rights of survivorship. In the event of the death of one spouse, the surviving spouse automatically inherits the deceased spouse's share of the property without the need for probate. 2. Tenancy in Common Quitclaim Deed: With this version of the quitclaim deed, each party has distinct ownership interests. In case of death, the deceased spouse's share of the property will be transferred according to their will or state intestacy laws. 3. Community Property with Right of Survivorship Quitclaim Deed: This type of deed is specific to married couples in community property states, like California. It grants joint ownership and the right of survivorship to the parties involved. Upon the death of one spouse, the surviving spouse becomes the sole owner without undergoing probate. Whether utilizing a Joint Tenancy, Tenancy in Common, or Community Property with Right of Survivorship structure, it is essential to consult with a qualified attorney or real estate professional to ensure compliance with local laws, understand the potential tax implications, and guarantee a smooth and legally binding transfer of ownership.