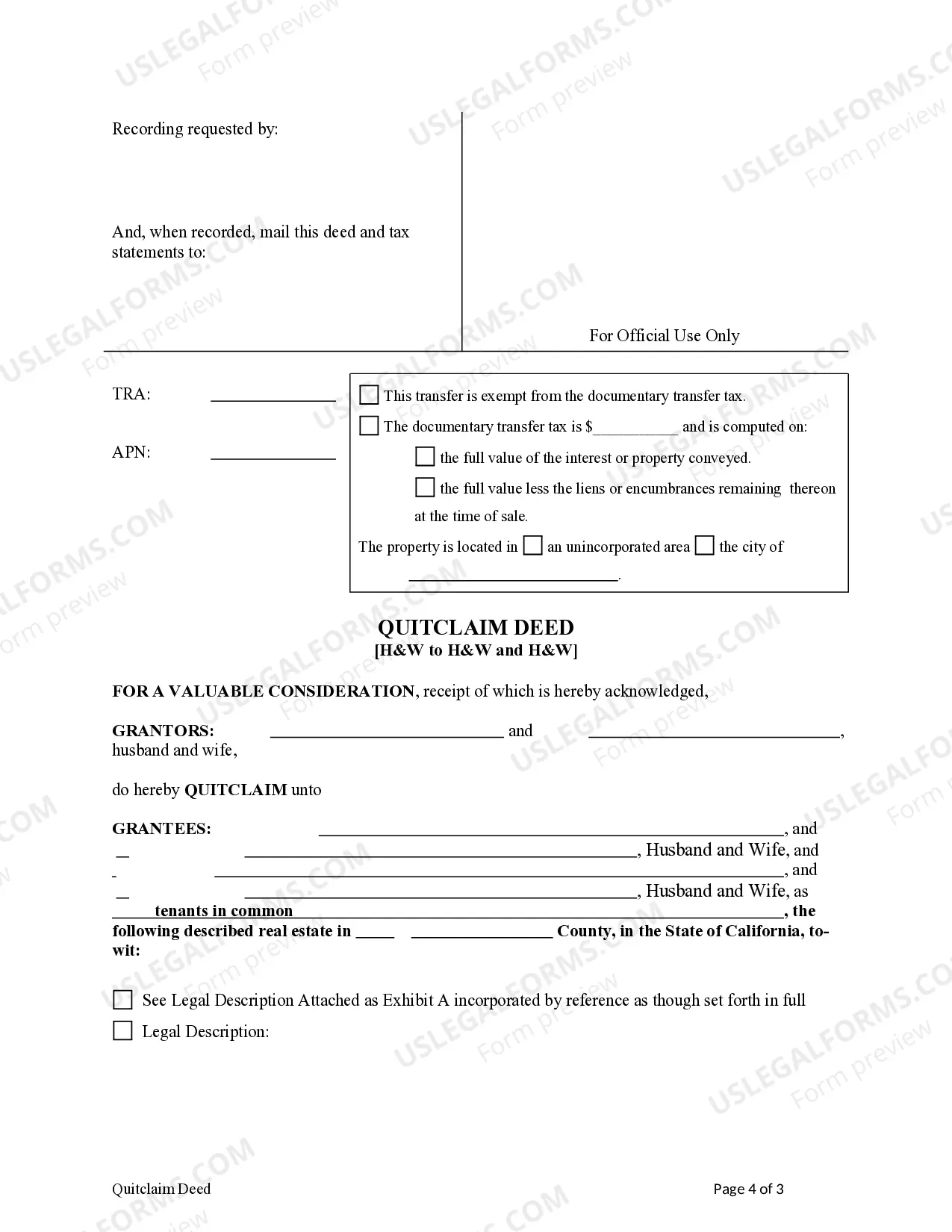

This form is a Quitclaim Deed where the Grantors are Husband and Wife and the Grantees are two married couples. This deed complies with all state statutory laws.

A Quitclaim Deed is a legal document used to transfer ownership interest in a property from one party to another. In the case of Husband and Wife to Husband and Wife and Husband and Wife (Two Couples) in El Cajon, California, there are various types of Quitclaim Deeds that may apply. 1. Traditional Quitclaim Deed: This type of Quitclaim Deed is used when one married couple (Husband and Wife) wants to transfer their interest in a property to another married couple (Husband and Wife and Husband and Wife). 2. Joint Tenancy Quitclaim Deed: This form of Quitclaim Deed is commonly used when the two couples want to hold the property as joint tenants, where each couple has an equal interest in the property. This means that if one party passes away, their interest in the property automatically transfers to the surviving party/parties. 3. Tenants in Common Quitclaim Deed: This type of Quitclaim Deed is used when the two couples want to hold the property as tenants in common, allowing them to have unequal ownership shares. Each couple can specify their ownership percentage, and if one party passes away, their share of the property would not automatically transfer to the other party/parties. 4. Community Property Quitclaim Deed: In California, a community property state, this Quitclaim Deed is applicable when both couples want to establish community property ownership. This means that both couples will have equal ownership rights to the property, and in case of a divorce, the property would be divided equally. When creating an El Cajon California Quitclaim Deed from Husband and Wife to Husband and Wife and Husband and Wife (Two Couples), it is crucial to include pertinent information such as the complete legal names of all parties involved, the legal description of the property being transferred, and a clear statement of the intent to transfer ownership. It's also essential to ensure the document complies with the legal requirements of El Cajon, California. Consulting with a qualified real estate attorney or title company can help ensure accuracy and adherence to the specific requirements.