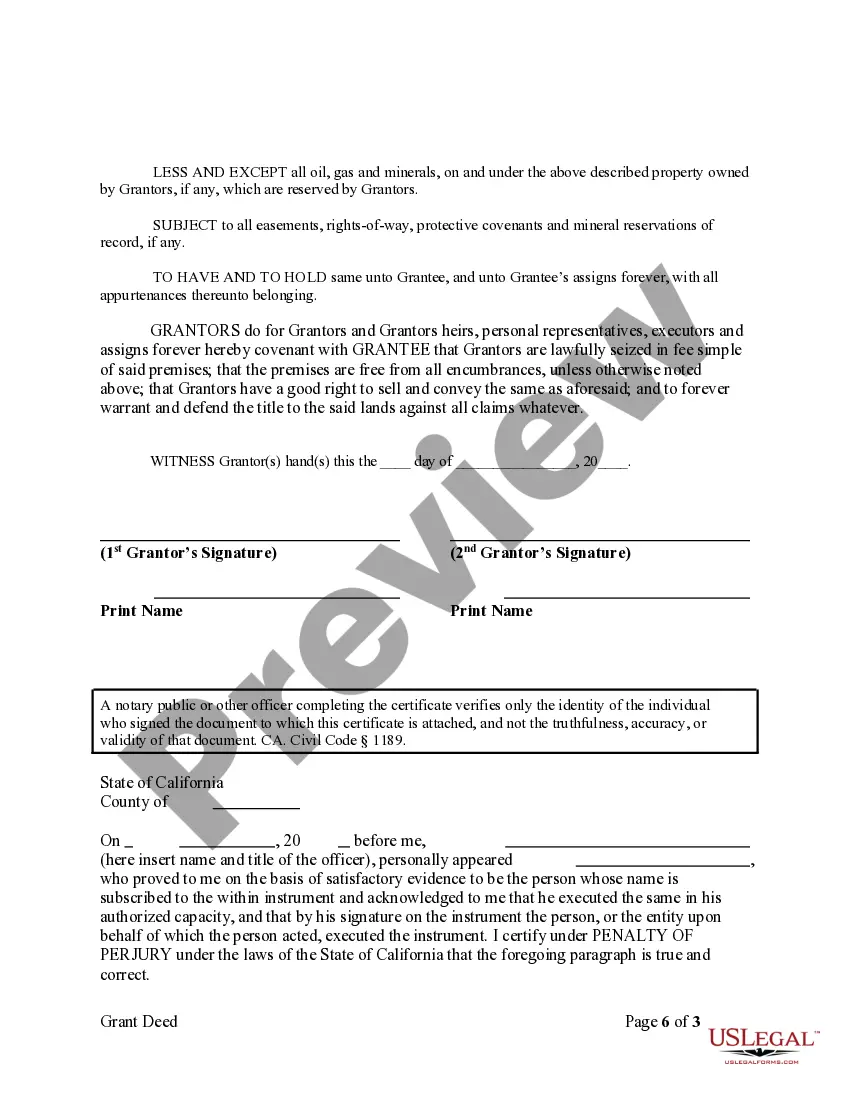

This Warranty Deed from two Individuals to Corporation form is a Warranty Deed where the Grantors are two individuals and the Grantee is a corporation. Grantors convey and warrant the described property to Grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

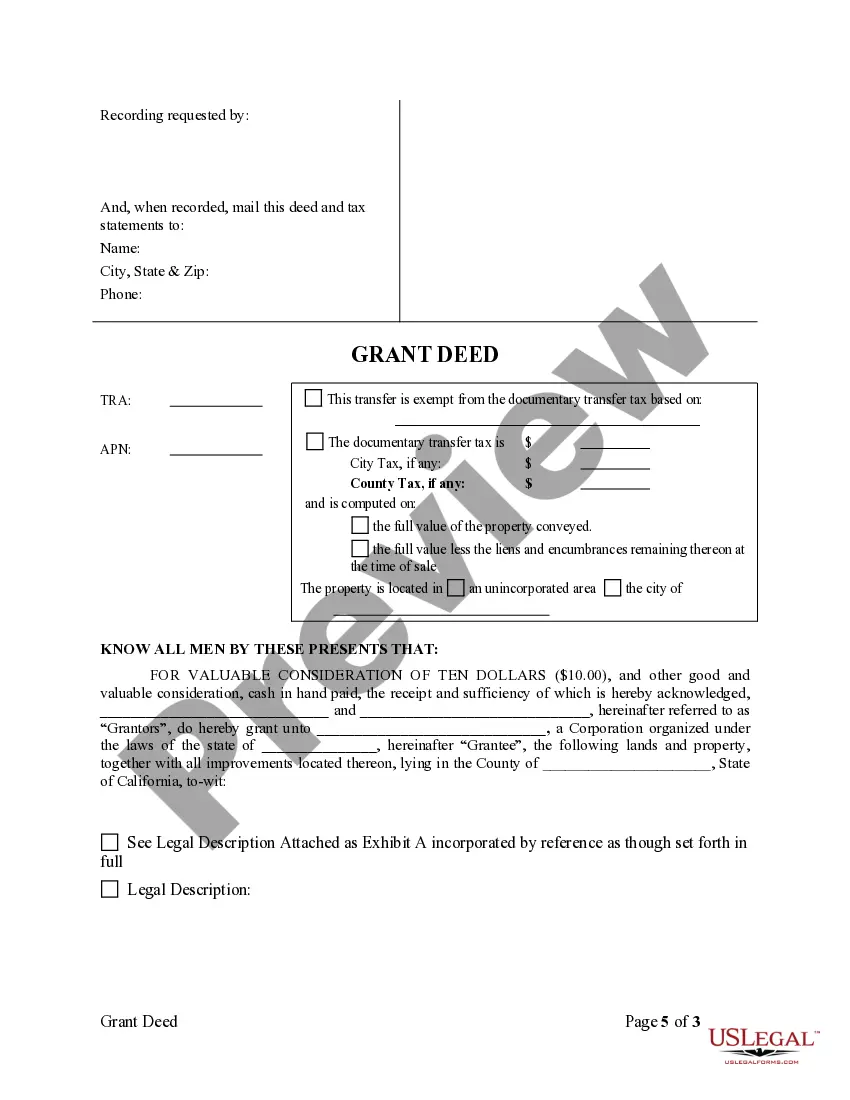

A San Bernardino California Grant Deed from Two Individuals to a Corporation is a legal document that signifies the transfer of real property ownership from two individuals to a corporation in San Bernardino County, California. This grant deed is an important legal instrument that facilitates the smooth and lawful transfer of the property's title. The San Bernardino California Grant Deed from Two Individuals to a Corporation outlines the terms and conditions of the transfer and includes key information such as the names and addresses of the granters (individuals transferring the property) and the grantee (the corporation receiving the property). It also specifies the legal description of the property, referring to its precise boundaries and location, as well as the Assessor's Parcel Number (APN) for identification purposes. Furthermore, this grant deed typically includes information about any encumbrances or liens on the property, such as mortgages or easements, that may affect the property's ownership. By disclosing such encumbrances, the granter ensures that the grantee is aware of any existing legal obligations or restrictions on the property before completing the transfer. In San Bernardino County, there may be variations of the San Bernardino California Grant Deed from Two Individuals to a Corporation. Some different types could include: 1. General Grant Deed: This is the most common type of grant deed, establishing a property transfer with a general warranty of title. It assures the grantee that the granter holds clear and marketable title to the property, free from any undisclosed encumbrances. 2. Special Grant Deed: This type of grant deed is similar to the general grant deed but specifically excludes any warranty of title. The granter conveys their interest in the property to the grantee but does not guarantee against any potential title issues. 3. Quitclaim Grant Deed: A quitclaim grant deed is often used when the granter does not want to make any claims regarding the property's title. It transfers whatever interest the granter has in the property to the grantee, without any warranties or guarantees. It is important to consult with legal professionals or relevant authorities to ensure compliance with local laws, regulations, and requirements when executing a San Bernardino California Grant Deed from Two Individuals to a Corporation. Different circumstances and specific property details may also warrant the use of specialized versions of this deed.