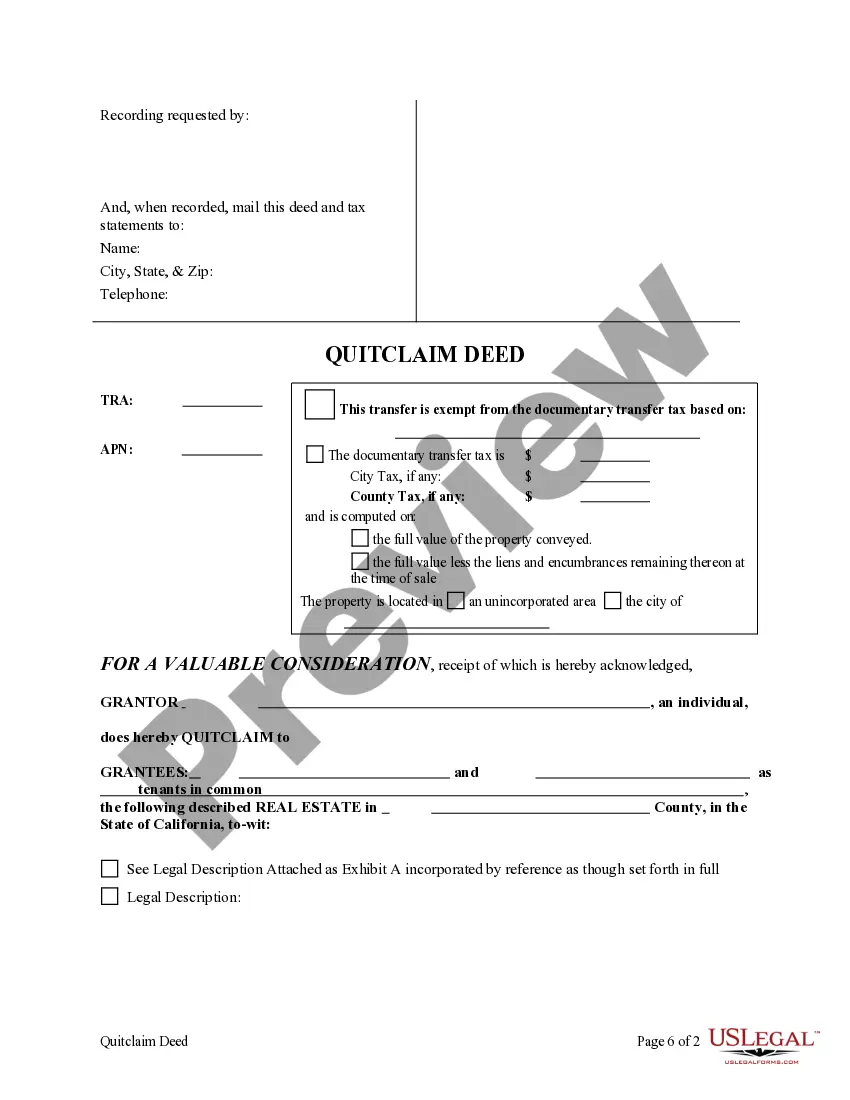

This form is a Quitclaim Deed where the Grantor is an individual and the Grantees are two individuals. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

San Jose California Quitclaim Deed from an Individual to Two Individuals

Description

How to fill out California Quitclaim Deed From An Individual To Two Individuals?

If you have previously utilized our service, Log In to your account and store the San Jose California Quitclaim Deed from an Individual to Two Individuals on your device by clicking the Download button. Ensure that your subscription is active. If it isn’t, renew it according to your payment plan.

If this is your initial experience with our service, follow these straightforward steps to obtain your file.

You have continuous access to every document you have purchased: you can find it in your profile within the My documents menu whenever you need to use it again. Utilize the US Legal Forms service to quickly discover and save any template for your personal or business needs!

- Ensure you’ve found an appropriate document. Browse the description and use the Preview function, if available, to verify if it suits your requirements. If it doesn’t fulfill your needs, utilize the Search tab above to locate the correct one.

- Purchase the template. Click the Buy Now button and select a monthly or yearly subscription plan.

- Establish an account and make a payment. Use your credit card information or the PayPal option to finalize the purchase.

- Acquire your San Jose California Quitclaim Deed from an Individual to Two Individuals. Choose the file format for your document and save it to your device.

- Complete your sample. Print it out or use professional online editors to fill it out and sign it digitally.

Form popularity

FAQ

Calculating real property transfer tax is straightforward. Currently, most counties charge $1.10 per $1000 value of transferred real property in California. For example, on real property valued at $20,000, the county documentary tax would be $22.00.

?Adding someone to a deed? means transferring ownership to that person. The transfer of ownership can occur during life (with a regular quitclaim deed, for example) or at death (using a lady bird deed, transfer-on-death-deed, or life estate deed).

The easiest way to grant your spouse title to your home is via a quitclaim deed (Californians generally use an interspousal grant deed). With a quitclaim deed, you can name your spouse as the property's joint owner. The quitclaim deed must include the property's description, including its boundary lines.

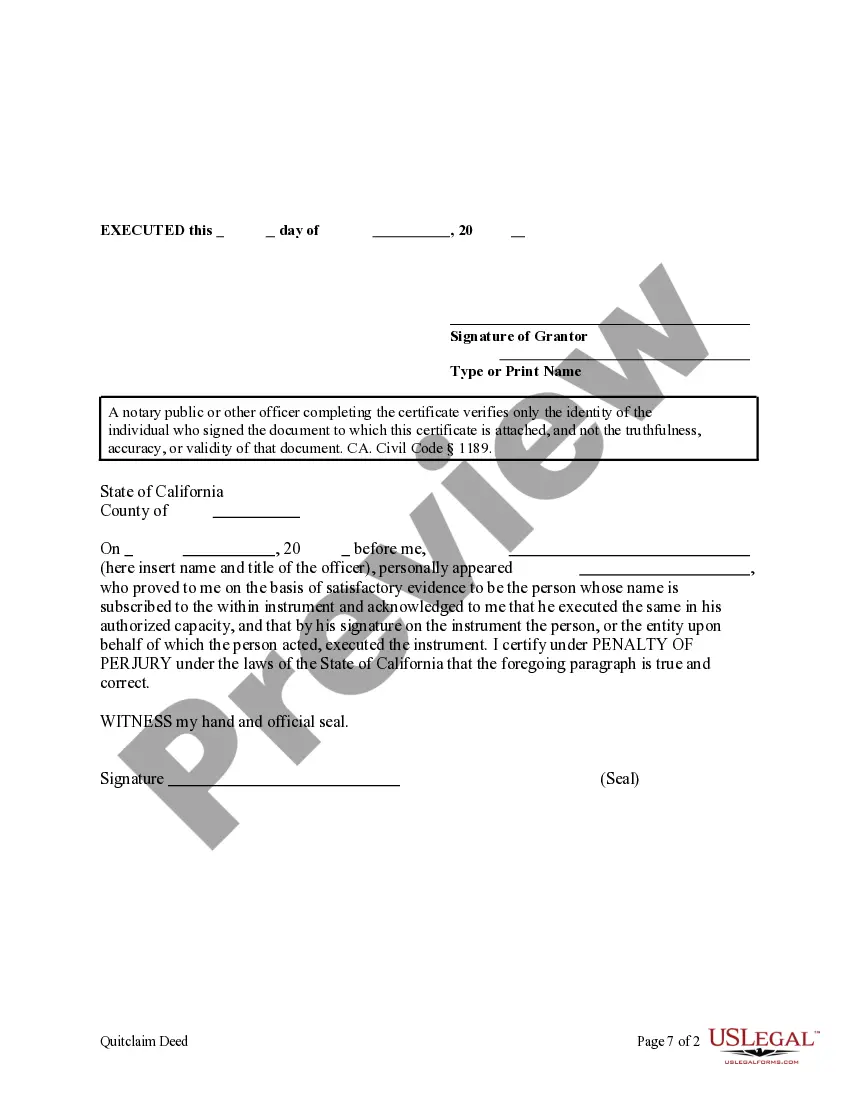

By completing a quit claim deed, the owner quits his interest in the home. Obtain a quit claim deed.Fill in the names.Copy the legal description from the current deed.Fill in the tax assessor's parcel number space located near the top of the deed.Insert special clauses.

Adding a name to the deeds Equity transfer is not just about removing a name from the deeds. It also includes adding a name. For example, parents may want to add their children to the deeds of the family home. When someone marries their partner, they may want to add them to the deeds of the property they already owned.

You can arrange to legally transfer the deed to your house to your children before you die. To do so, you sign a deed transfer and record it with the county recorder's office. There are a few types of deeds that accomplish this in California, including a quitclaim deed, grant deed and transfer on death deed.

As a homeowner, you are permitted to give your property to your children at any time, even if you live in it.

How to transfer property ownership Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

California mainly uses two types of deeds: the ?grant deed? and the ?quitclaim deed.? Most other deeds you will see, such as the common ?interspousal transfer deed,? are versions of grant or quitclaim deeds customized for specific circumstances.