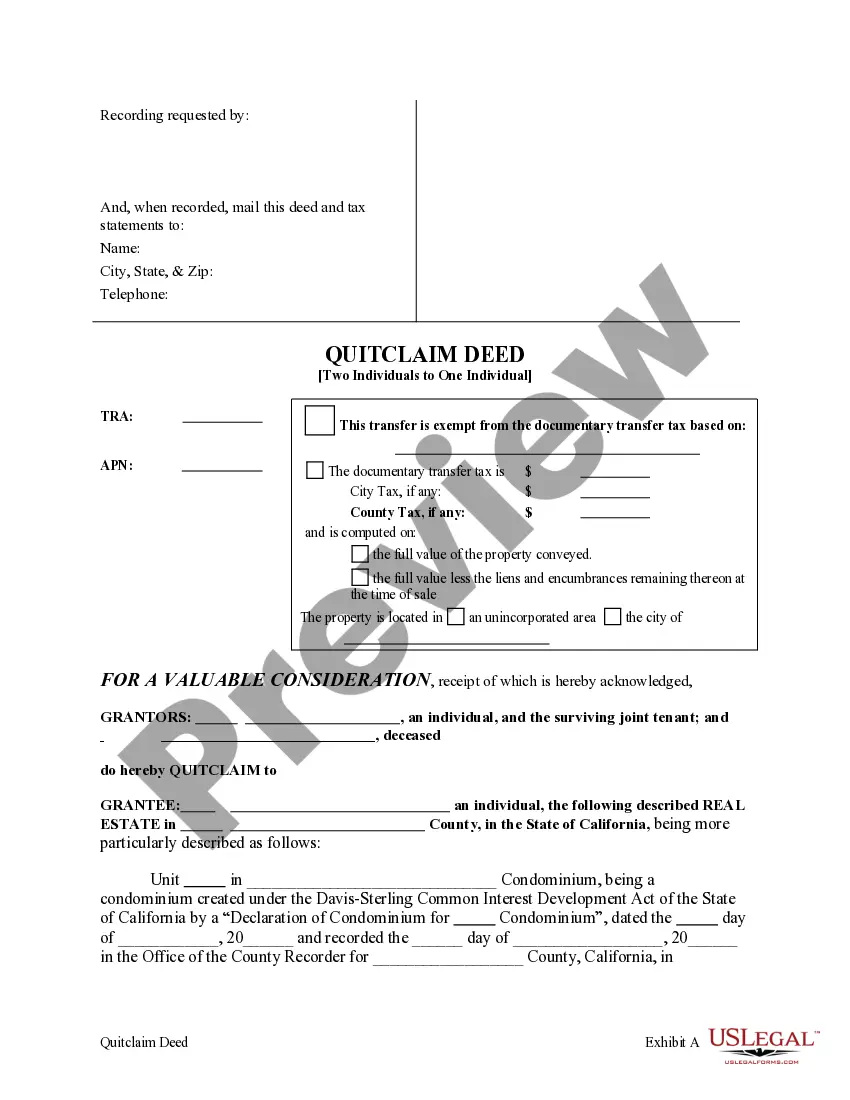

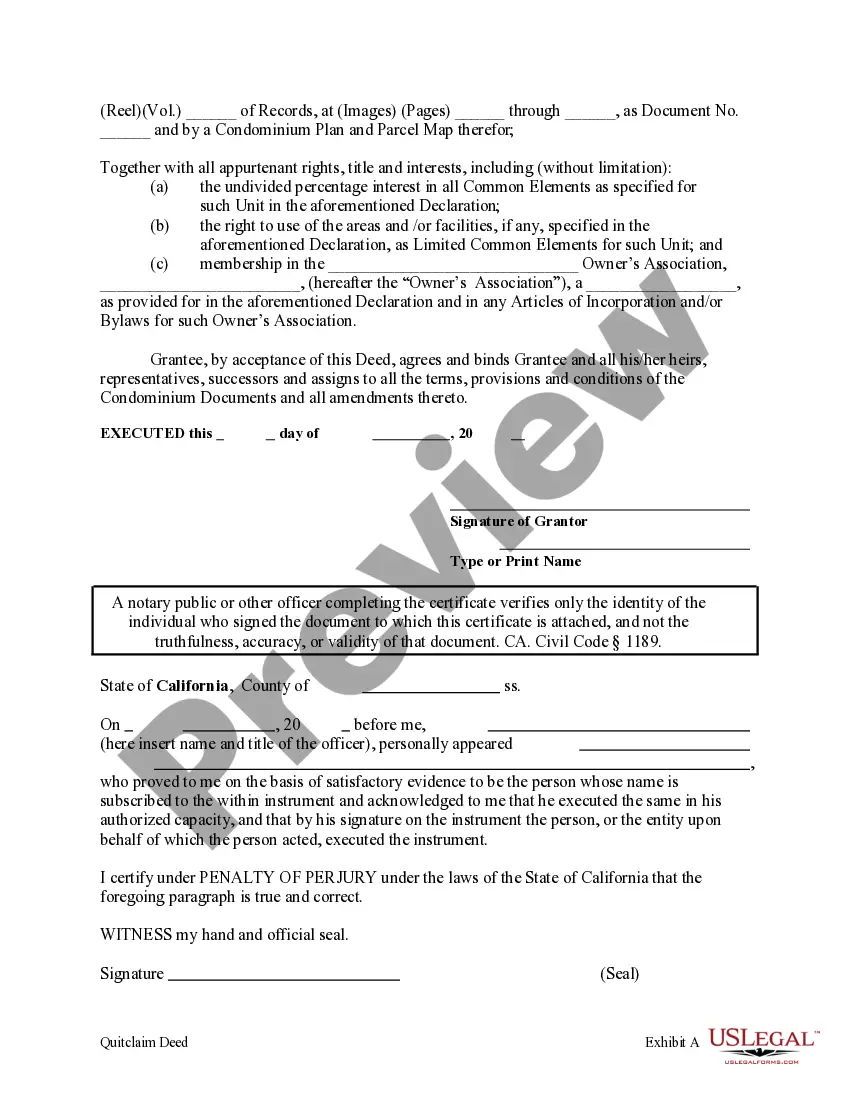

This form is a Quitclaim Deed where the Grantors are two Individuals, one deceased and one the surviving joint tenant, and the Individual Grantee. Grantors convey and quitclaim the described property to Grantee. This deed complies with all state statutory laws.

A Daly City California Quitclaim Deed is a legal document used to transfer ownership of a condominium property from two individuals, one of whom is deceased, to another individual. This type of deed is commonly used when transferring property between family members, business partners, or in cases of inheritance. The Quitclaim Deed is a legally binding document that allows the current owners to convey their interest in the property to the new owner, known as the grantee. It essentially "quits" or relinquishes any claim or interest they have in the property, hence the name "Quitclaim." However, it's important to note that a Quitclaim Deed does not guarantee clear title or guarantee that the granters actually own the property being transferred. In Daly City, California, there may be different variations or specific types of Quitclaim Deeds that pertain to condominiums: 1. Daly City California Special Warranty Quitclaim Deed: This type of Quitclaim Deed differs from a general Quitclaim Deed as it includes a limited warranty. It means that the granters are guaranteeing that they have not encumbered the property during their ownership period, but they make no warranties about any encumbrances that existed before they acquired it. 2. Daly City California Life Estate Quitclaim Deed: This type of Quitclaim Deed may be used when one individual grants ownership rights over the property to another individual (granter to grantee). However, the granter retains the right to live in or use the property until their death. Upon the granter's death, full ownership rights of the property transfer to the grantee. It is important to consult with a real estate attorney or a title company to determine the specific type of Quitclaim Deed needed for the transfer of ownership in your particular situation. They can guide you through the process, ensure all legal requirements are met, and help protect your interests during the property transfer.A Daly City California Quitclaim Deed is a legal document used to transfer ownership of a condominium property from two individuals, one of whom is deceased, to another individual. This type of deed is commonly used when transferring property between family members, business partners, or in cases of inheritance. The Quitclaim Deed is a legally binding document that allows the current owners to convey their interest in the property to the new owner, known as the grantee. It essentially "quits" or relinquishes any claim or interest they have in the property, hence the name "Quitclaim." However, it's important to note that a Quitclaim Deed does not guarantee clear title or guarantee that the granters actually own the property being transferred. In Daly City, California, there may be different variations or specific types of Quitclaim Deeds that pertain to condominiums: 1. Daly City California Special Warranty Quitclaim Deed: This type of Quitclaim Deed differs from a general Quitclaim Deed as it includes a limited warranty. It means that the granters are guaranteeing that they have not encumbered the property during their ownership period, but they make no warranties about any encumbrances that existed before they acquired it. 2. Daly City California Life Estate Quitclaim Deed: This type of Quitclaim Deed may be used when one individual grants ownership rights over the property to another individual (granter to grantee). However, the granter retains the right to live in or use the property until their death. Upon the granter's death, full ownership rights of the property transfer to the grantee. It is important to consult with a real estate attorney or a title company to determine the specific type of Quitclaim Deed needed for the transfer of ownership in your particular situation. They can guide you through the process, ensure all legal requirements are met, and help protect your interests during the property transfer.