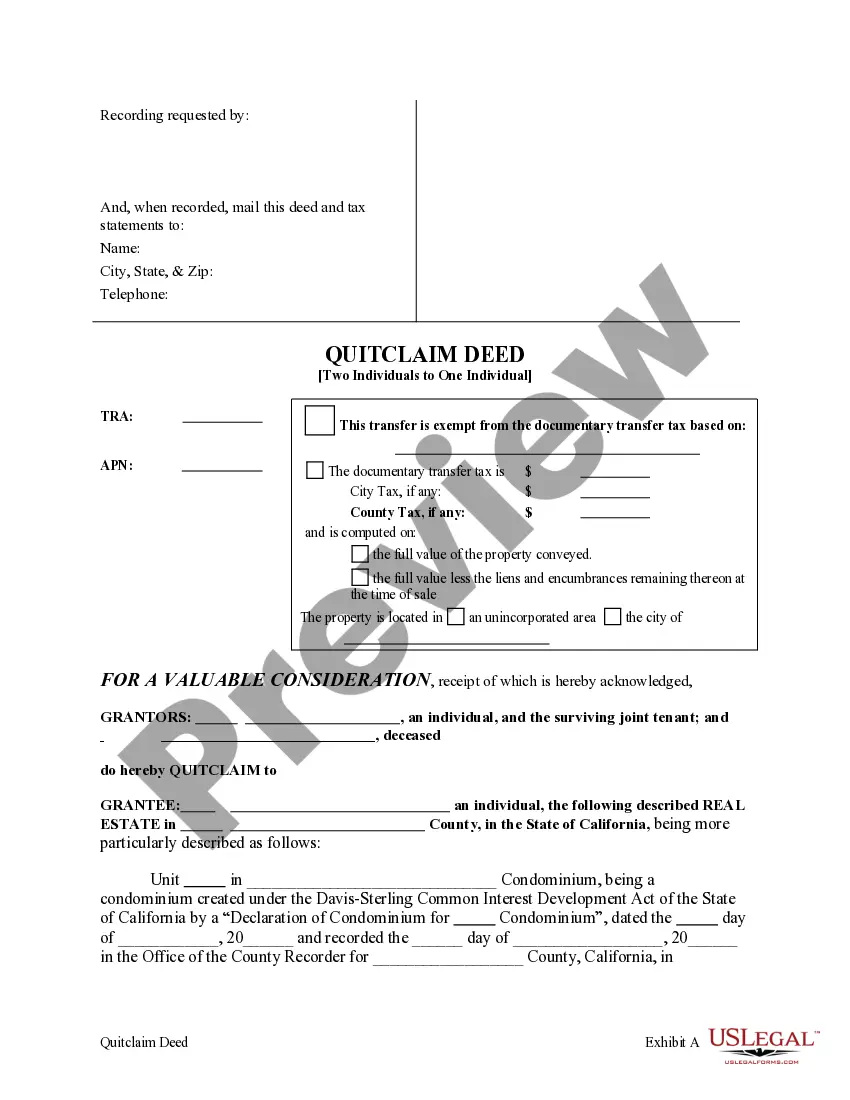

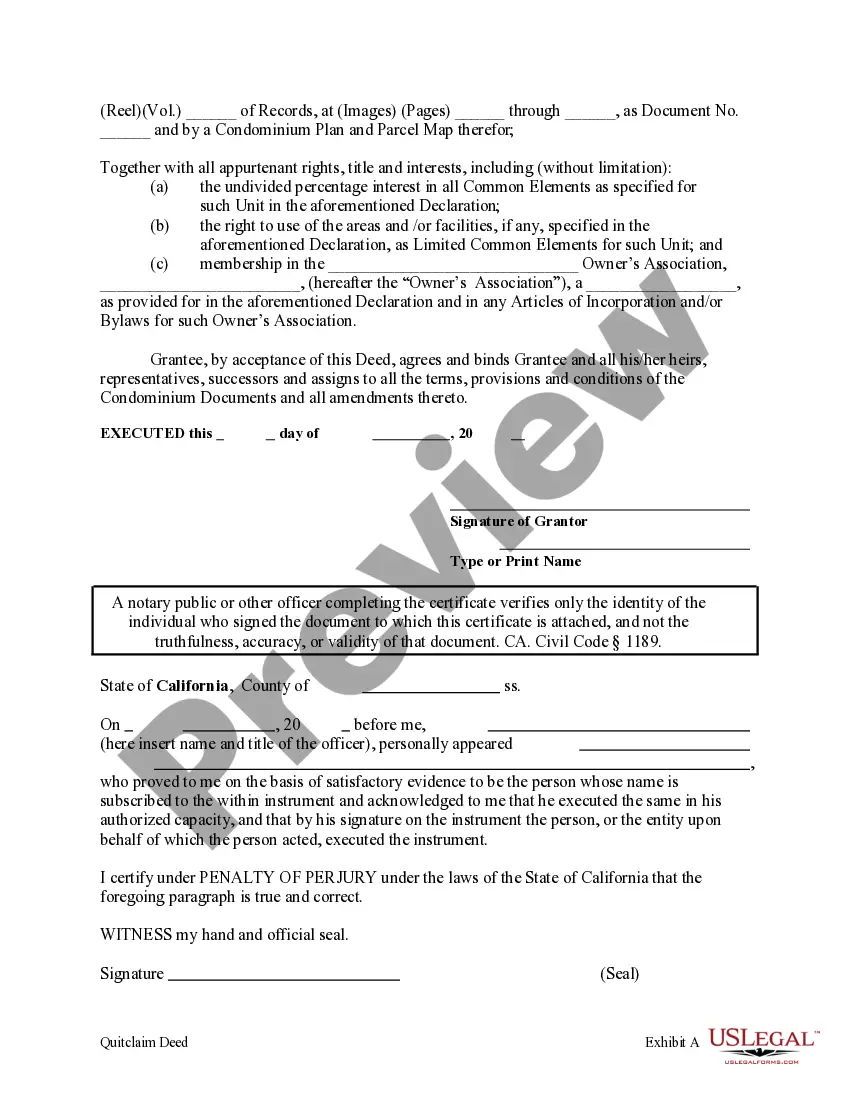

This form is a Quitclaim Deed where the Grantors are two Individuals, one deceased and one the surviving joint tenant, and the Individual Grantee. Grantors convey and quitclaim the described property to Grantee. This deed complies with all state statutory laws.

A San Diego California Quitclaim Deed is a legal document used to transfer ownership of a condominium property from two individuals, one of whom is deceased, to another individual. This type of deed is commonly used when the parties involved want to transfer their interests in the property without guaranteeing the title's validity or ownership rights. The Quitclaim Deed is often used in situations where there are uncertainties regarding the property's title or when family members or friends want to transfer ownership among themselves. By utilizing this deed, the transferring parties are not providing any warranties or guarantees about the property's title. It simply means that they are transferring whatever interests or claims they may have in the property to the recipient. In San Diego, California, there are different variations or types of Quitclaim Deeds specifically designed for condominium properties. Some of these include: 1. Standard San Diego California Quitclaim Deed for Condominium: This is the most common type of Quitclaim Deed used for transferring ownership of a condominium. It involves the transfer of the deceased individual's interest, as well as the interest of the other individual, to the new owner. 2. San Diego California Joint Tenancy Quitclaim Deed for Condominium: In cases where the two individuals held the condominium property as joint tenants with the right of survivorship, this type of Quitclaim Deed is used. It allows the surviving joint tenant to transfer their interest, including that of the deceased joint tenant, to the new owner. 3. San Diego California Tenants in Common Quitclaim Deed for Condominium: If the two individuals owned the condominium as tenants in common, this type of Quitclaim Deed would be applicable. It permits the transferring of their respective shares, including the deceased individual's share, to the new owner. It's essential to consult with a real estate attorney or a professional familiar with San Diego's laws and regulations to ensure the correct type of Quitclaim Deed is used for the specific circumstances. Additionally, conducting a title search and obtaining title insurance is recommended to protect the new owner's interests and ensure a smooth transfer of the property.