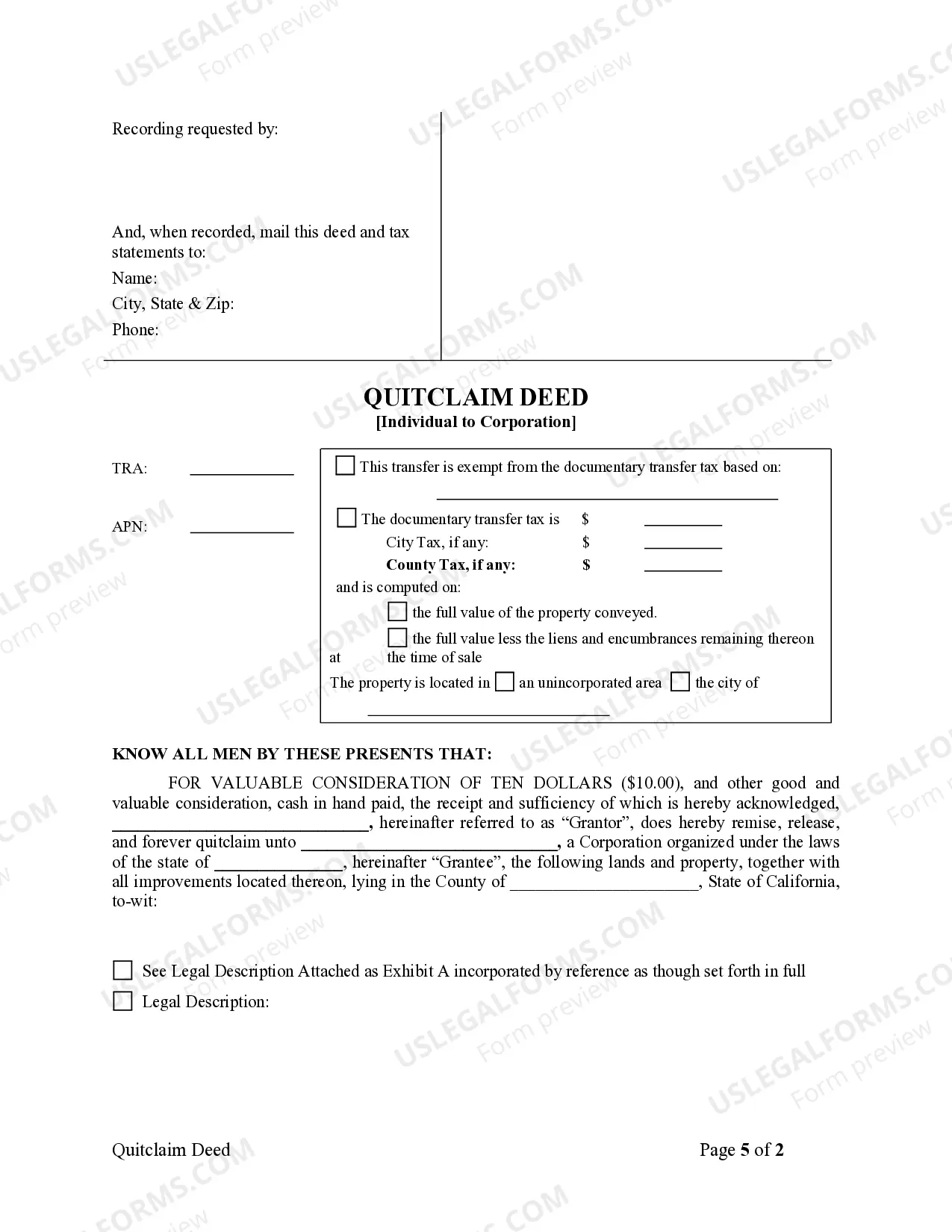

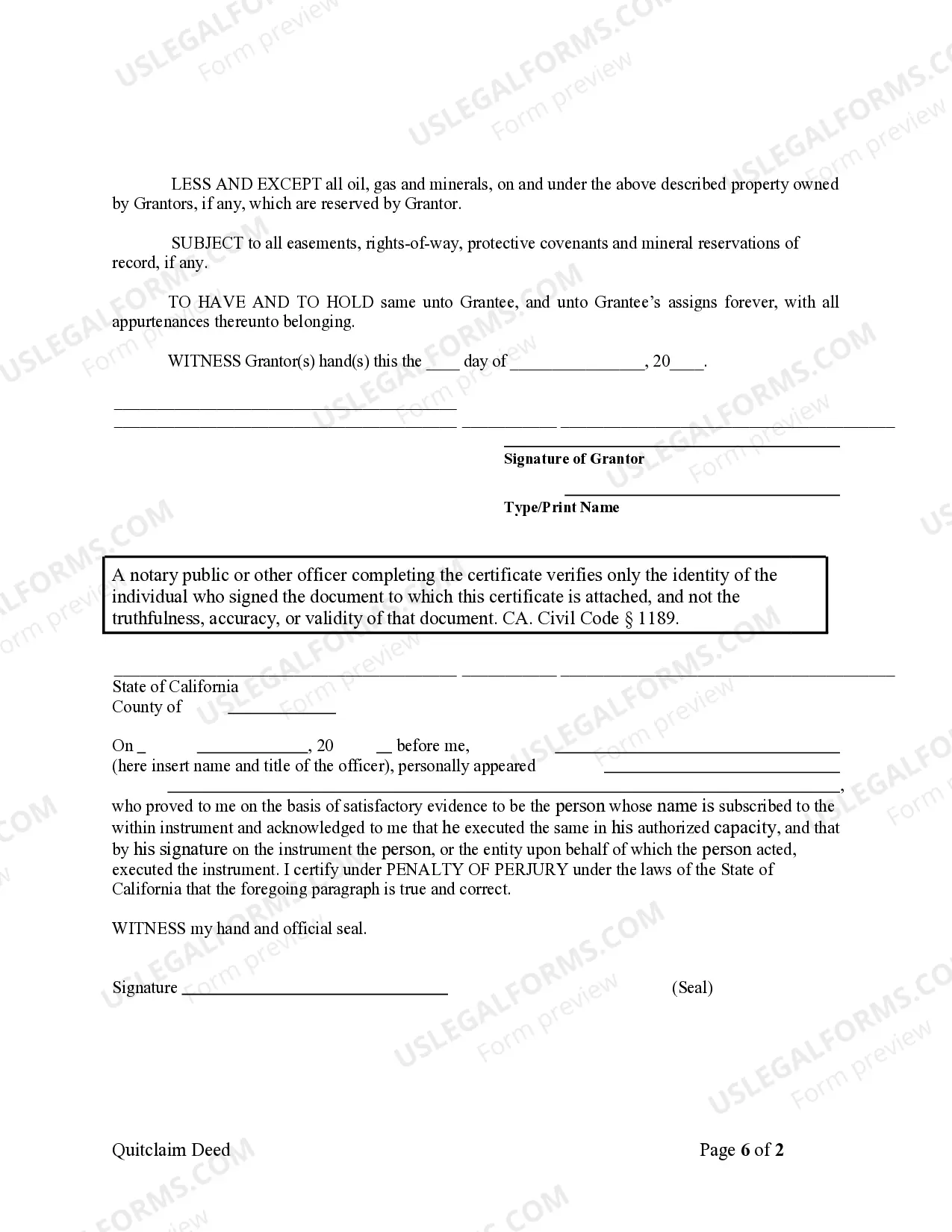

This Quitclaim Deed From an Individual To a Corporation form is a Quitclaim Deed where the grantor is an individual and the grantee is a corporation. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

A quitclaim deed is a legal document used to transfer ownership of a property from one party to another. In the context of Riverside, California, a quitclaim deed can be executed when an individual wishes to transfer their property to a corporation. This transfer can occur for various reasons, such as a change in business structure or the desire to protect personal assets. The Riverside California Quitclaim Deed from Individual to Corporation enables the transfer of property rights from an individual property owner to a corporate entity, ensuring that the corporation becomes the legal owner of the property. This type of deed is commonly used when an individual wants to establish a business entity or transfer property ownership to an existing corporation based in Riverside, California. By executing this quitclaim deed, the individual (granter) relinquishes all rights, interests, and claims on the property, effectively transferring them to the corporation (grantee). The corporation becomes responsible for any existing liabilities or encumbrances associated with the property. It is important to note that there may be different variations or specific types of Riverside California Quitclaim Deed from Individual to Corporation based on certain circumstances or requirements. Some possible variations include: 1. General Riverside California Quitclaim Deed from Individual to Corporation: This is the standard form used for the transfer of property ownership from an individual to a corporation in Riverside. It outlines the legal rights and responsibilities of both parties involved. 2. Riverside California Quitclaim Deed with Consideration: This type of quitclaim deed may be used when the corporation pays a certain amount of money or provides other valuable consideration to the individual in exchange for the property transfer. Consideration can include cash, stocks, services, or any other benefit agreed upon between the parties. 3. Riverside California Quitclaim Deed with Restrictive Covenants: In some cases, the individual may impose certain conditions or restrictions on the use or future sale of the property by the corporation. These restrictions could include limitations on development, zoning requirements, or other specific terms that the corporation must adhere to. 4. Riverside California Quitclaim Deed due to Merger or Acquisition: If an individual's property is being transferred to a corporation as a result of a merger or acquisition, a specific quitclaim deed may be used. This deed ensures the smooth transition and transfer of ownership without any legal disputes. When executing a Riverside California Quitclaim Deed from Individual to Corporation, it is essential to consult with a real estate attorney or a qualified professional to ensure compliance with local laws and regulations. The deed must be properly prepared, signed, notarized, and recorded with the Riverside County Recorder's Office to facilitate the legal transfer of property ownership from the individual to the corporation.A quitclaim deed is a legal document used to transfer ownership of a property from one party to another. In the context of Riverside, California, a quitclaim deed can be executed when an individual wishes to transfer their property to a corporation. This transfer can occur for various reasons, such as a change in business structure or the desire to protect personal assets. The Riverside California Quitclaim Deed from Individual to Corporation enables the transfer of property rights from an individual property owner to a corporate entity, ensuring that the corporation becomes the legal owner of the property. This type of deed is commonly used when an individual wants to establish a business entity or transfer property ownership to an existing corporation based in Riverside, California. By executing this quitclaim deed, the individual (granter) relinquishes all rights, interests, and claims on the property, effectively transferring them to the corporation (grantee). The corporation becomes responsible for any existing liabilities or encumbrances associated with the property. It is important to note that there may be different variations or specific types of Riverside California Quitclaim Deed from Individual to Corporation based on certain circumstances or requirements. Some possible variations include: 1. General Riverside California Quitclaim Deed from Individual to Corporation: This is the standard form used for the transfer of property ownership from an individual to a corporation in Riverside. It outlines the legal rights and responsibilities of both parties involved. 2. Riverside California Quitclaim Deed with Consideration: This type of quitclaim deed may be used when the corporation pays a certain amount of money or provides other valuable consideration to the individual in exchange for the property transfer. Consideration can include cash, stocks, services, or any other benefit agreed upon between the parties. 3. Riverside California Quitclaim Deed with Restrictive Covenants: In some cases, the individual may impose certain conditions or restrictions on the use or future sale of the property by the corporation. These restrictions could include limitations on development, zoning requirements, or other specific terms that the corporation must adhere to. 4. Riverside California Quitclaim Deed due to Merger or Acquisition: If an individual's property is being transferred to a corporation as a result of a merger or acquisition, a specific quitclaim deed may be used. This deed ensures the smooth transition and transfer of ownership without any legal disputes. When executing a Riverside California Quitclaim Deed from Individual to Corporation, it is essential to consult with a real estate attorney or a qualified professional to ensure compliance with local laws and regulations. The deed must be properly prepared, signed, notarized, and recorded with the Riverside County Recorder's Office to facilitate the legal transfer of property ownership from the individual to the corporation.