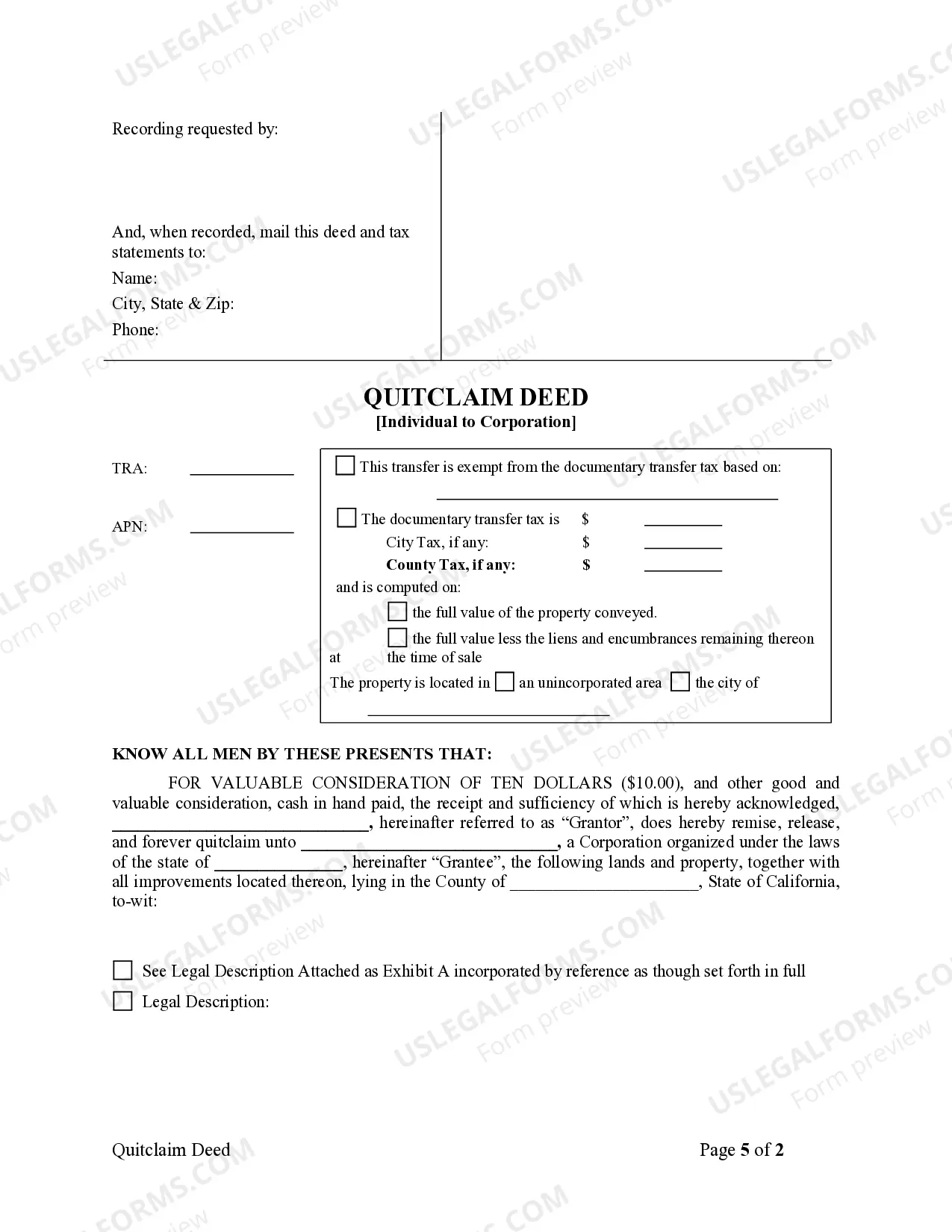

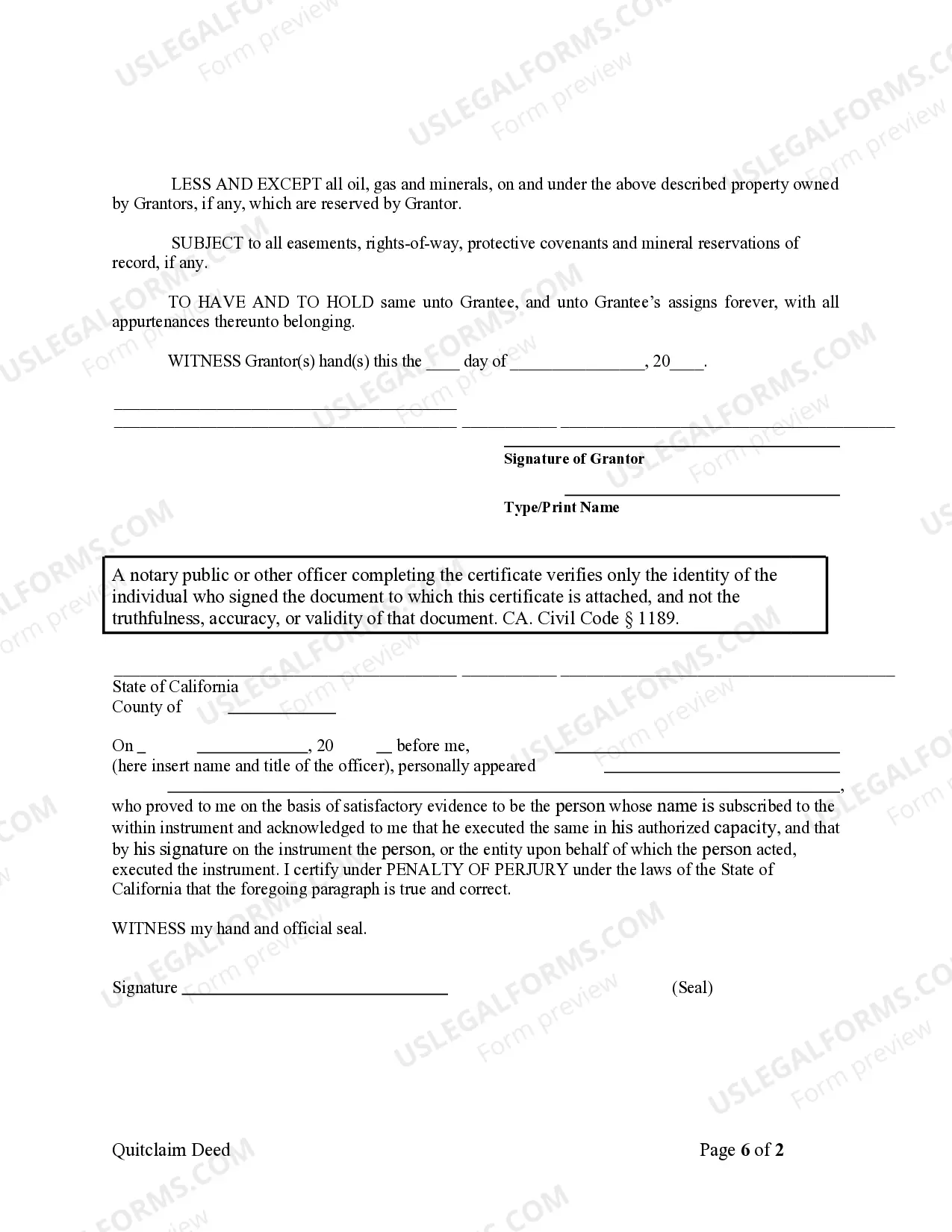

This Quitclaim Deed From an Individual To a Corporation form is a Quitclaim Deed where the grantor is an individual and the grantee is a corporation. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

A Salinas California quitclaim deed from an individual to a corporation is a legal document that transfers ownership of property from an individual to a corporation without providing any guarantee of ownership or clear title. It is commonly used when the transfer of property is within a family, for tax purposes, or in other non-traditional real estate transactions. This type of deed is specific to Salinas, California, and is recognized by the local jurisdiction. The primary purpose of a quitclaim deed is to transfer the individual's interest or claim to the property to the corporation. It does not guarantee that the property is free of liens or encumbrances, nor does it verify the quality of title held by the individual transferring it. It simply transfers whatever rights or interest the individual holds to the corporation. There are two main types of Salinas California quitclaim deeds from an individual to a corporation: 1. General Quitclaim Deed: This is the most common type of quitclaim deed used in Salinas, California. It transfers the property from the individual to the corporation without indicating any warranties or guarantees regarding the ownership or title of the property. This type of deed is typically used in non-commercial transactions, such as transferring property within a family or for tax planning purposes. 2. Special Purpose Quitclaim Deed: This type of quitclaim deed is used in specific cases where there are additional terms or conditions agreed upon by both the individual and the corporation. It may outline certain restrictions, limitations, or obligations imposed on the corporation after the transfer of ownership. This type of deed is often used when there are unique circumstances or considerations involved in the property transfer. It is crucial for both the individual transferring the property and the corporation receiving it to consult with legal professionals, such as real estate attorneys, to ensure all necessary legal requirements are met, and to fully understand the implications and risks associated with the transfer.A Salinas California quitclaim deed from an individual to a corporation is a legal document that transfers ownership of property from an individual to a corporation without providing any guarantee of ownership or clear title. It is commonly used when the transfer of property is within a family, for tax purposes, or in other non-traditional real estate transactions. This type of deed is specific to Salinas, California, and is recognized by the local jurisdiction. The primary purpose of a quitclaim deed is to transfer the individual's interest or claim to the property to the corporation. It does not guarantee that the property is free of liens or encumbrances, nor does it verify the quality of title held by the individual transferring it. It simply transfers whatever rights or interest the individual holds to the corporation. There are two main types of Salinas California quitclaim deeds from an individual to a corporation: 1. General Quitclaim Deed: This is the most common type of quitclaim deed used in Salinas, California. It transfers the property from the individual to the corporation without indicating any warranties or guarantees regarding the ownership or title of the property. This type of deed is typically used in non-commercial transactions, such as transferring property within a family or for tax planning purposes. 2. Special Purpose Quitclaim Deed: This type of quitclaim deed is used in specific cases where there are additional terms or conditions agreed upon by both the individual and the corporation. It may outline certain restrictions, limitations, or obligations imposed on the corporation after the transfer of ownership. This type of deed is often used when there are unique circumstances or considerations involved in the property transfer. It is crucial for both the individual transferring the property and the corporation receiving it to consult with legal professionals, such as real estate attorneys, to ensure all necessary legal requirements are met, and to fully understand the implications and risks associated with the transfer.