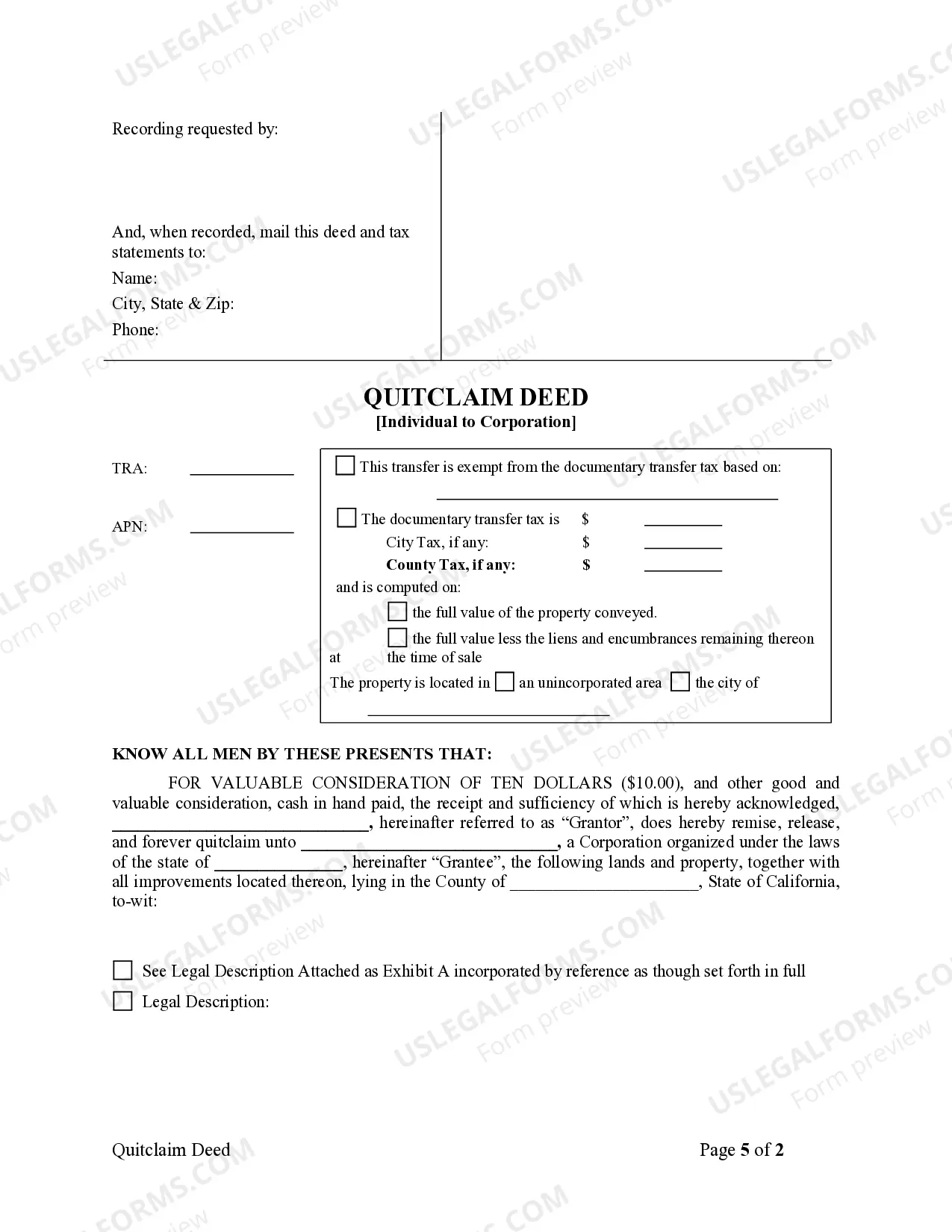

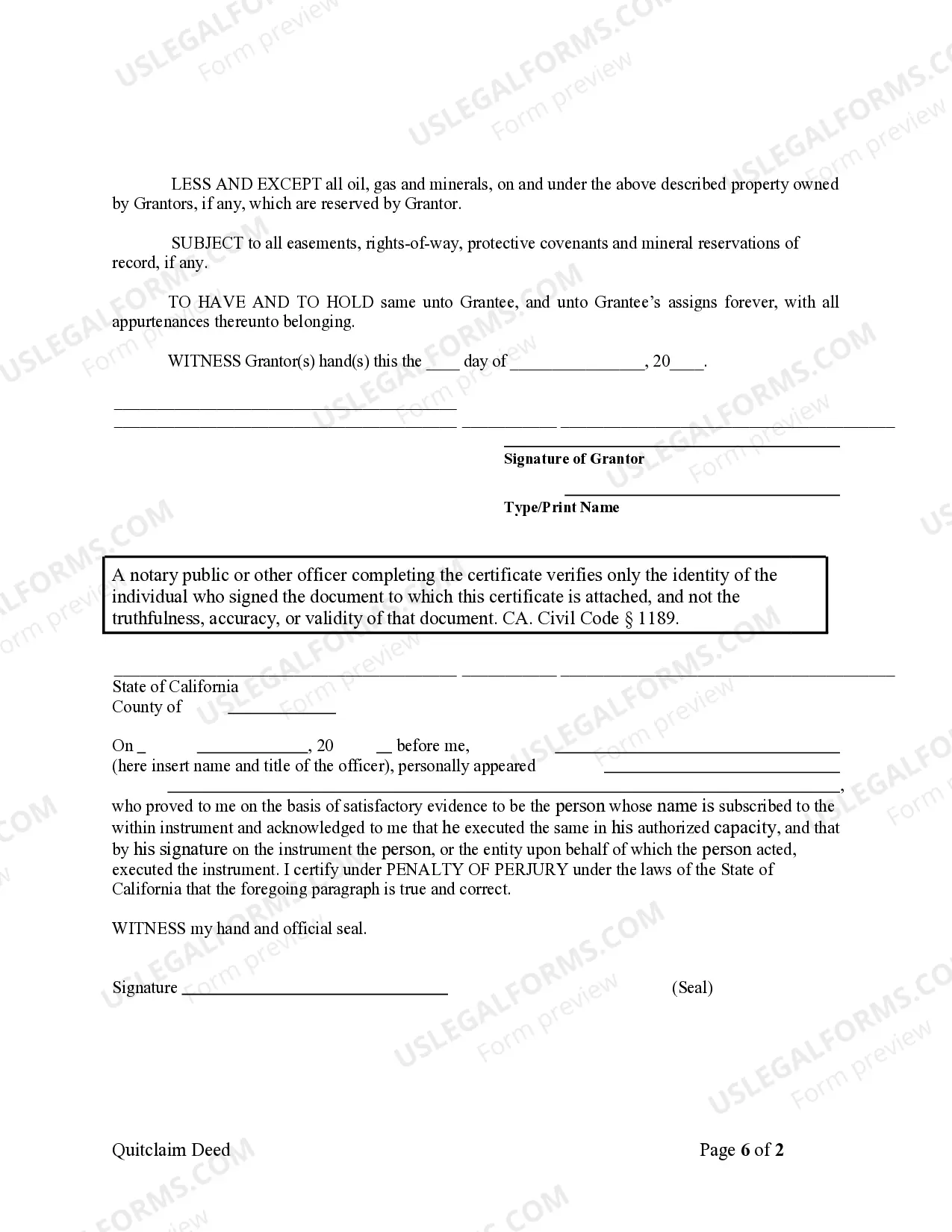

This Quitclaim Deed From an Individual To a Corporation form is a Quitclaim Deed where the grantor is an individual and the grantee is a corporation. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

A San Jose California Quitclaim Deed from Individual to Corporation is a legal document that allows an individual property owner to transfer ownership rights of a property to a corporation through a quitclaim transaction. This type of deed is commonly used when an individual wants to transfer their personal property to a corporation, typically for business purposes. Keywords: San Jose California, quitclaim deed, individual, corporation, legal document, transfer ownership, property, quitclaim transaction, personal property, business purposes. There are several types of San Jose California Quitclaim Deed from Individual to Corporation that serve specific purposes: 1. Regular Quitclaim Deed: This is the standard form of quitclaim deed used to transfer ownership rights from an individual to a corporation. It includes all necessary legal provisions and details the transfer of ownership. 2. Limited Liability Company (LLC) Quitclaim Deed: This type of deed is specifically used when an individual wants to transfer ownership rights to an LLC, which is a type of business entity that combines the limited liability protection of a corporation with the pass-through taxation of a partnership or sole proprietorship. 3. Non-Profit Corporation Quitclaim Deed: This type of deed is used when an individual wishes to transfer ownership rights to a non-profit corporation. Non-profit corporations are organizations that are formed for charitable, educational, religious, or scientific purposes and are exempt from certain taxes. 4. C Corporation Quitclaim Deed: This type of deed is used when an individual wants to transfer ownership rights to a C corporation. C corporations are a traditional type of business entity that offers limited liability protection to its shareholders but is subject to double taxation. Each type of quitclaim deed mentioned above serves a specific purpose and carries its own set of legal implications and requirements. It is crucial for both the individual and the corporation to consult with legal professionals who specialize in real estate law to ensure the proper completion and recording of the deed.A San Jose California Quitclaim Deed from Individual to Corporation is a legal document that allows an individual property owner to transfer ownership rights of a property to a corporation through a quitclaim transaction. This type of deed is commonly used when an individual wants to transfer their personal property to a corporation, typically for business purposes. Keywords: San Jose California, quitclaim deed, individual, corporation, legal document, transfer ownership, property, quitclaim transaction, personal property, business purposes. There are several types of San Jose California Quitclaim Deed from Individual to Corporation that serve specific purposes: 1. Regular Quitclaim Deed: This is the standard form of quitclaim deed used to transfer ownership rights from an individual to a corporation. It includes all necessary legal provisions and details the transfer of ownership. 2. Limited Liability Company (LLC) Quitclaim Deed: This type of deed is specifically used when an individual wants to transfer ownership rights to an LLC, which is a type of business entity that combines the limited liability protection of a corporation with the pass-through taxation of a partnership or sole proprietorship. 3. Non-Profit Corporation Quitclaim Deed: This type of deed is used when an individual wishes to transfer ownership rights to a non-profit corporation. Non-profit corporations are organizations that are formed for charitable, educational, religious, or scientific purposes and are exempt from certain taxes. 4. C Corporation Quitclaim Deed: This type of deed is used when an individual wants to transfer ownership rights to a C corporation. C corporations are a traditional type of business entity that offers limited liability protection to its shareholders but is subject to double taxation. Each type of quitclaim deed mentioned above serves a specific purpose and carries its own set of legal implications and requirements. It is crucial for both the individual and the corporation to consult with legal professionals who specialize in real estate law to ensure the proper completion and recording of the deed.