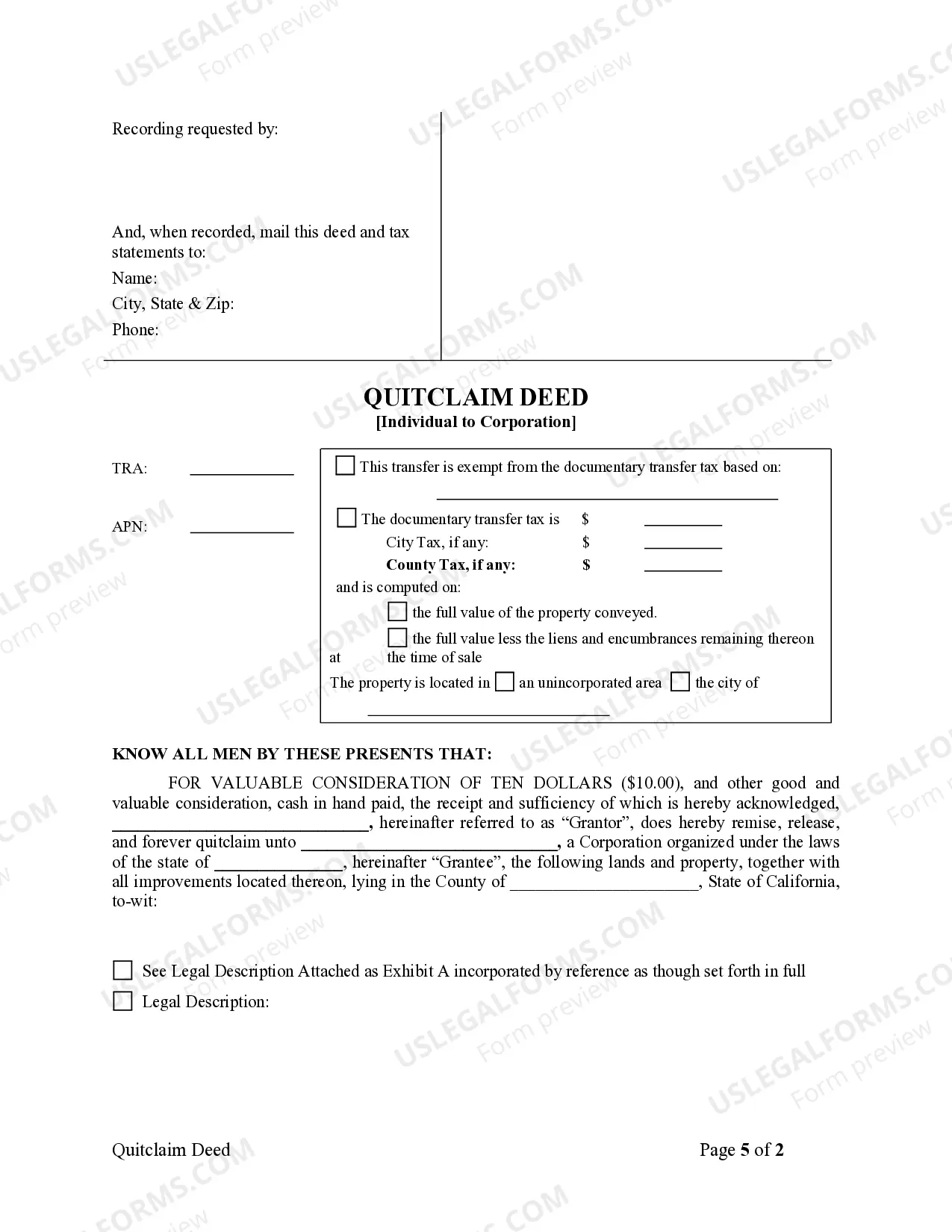

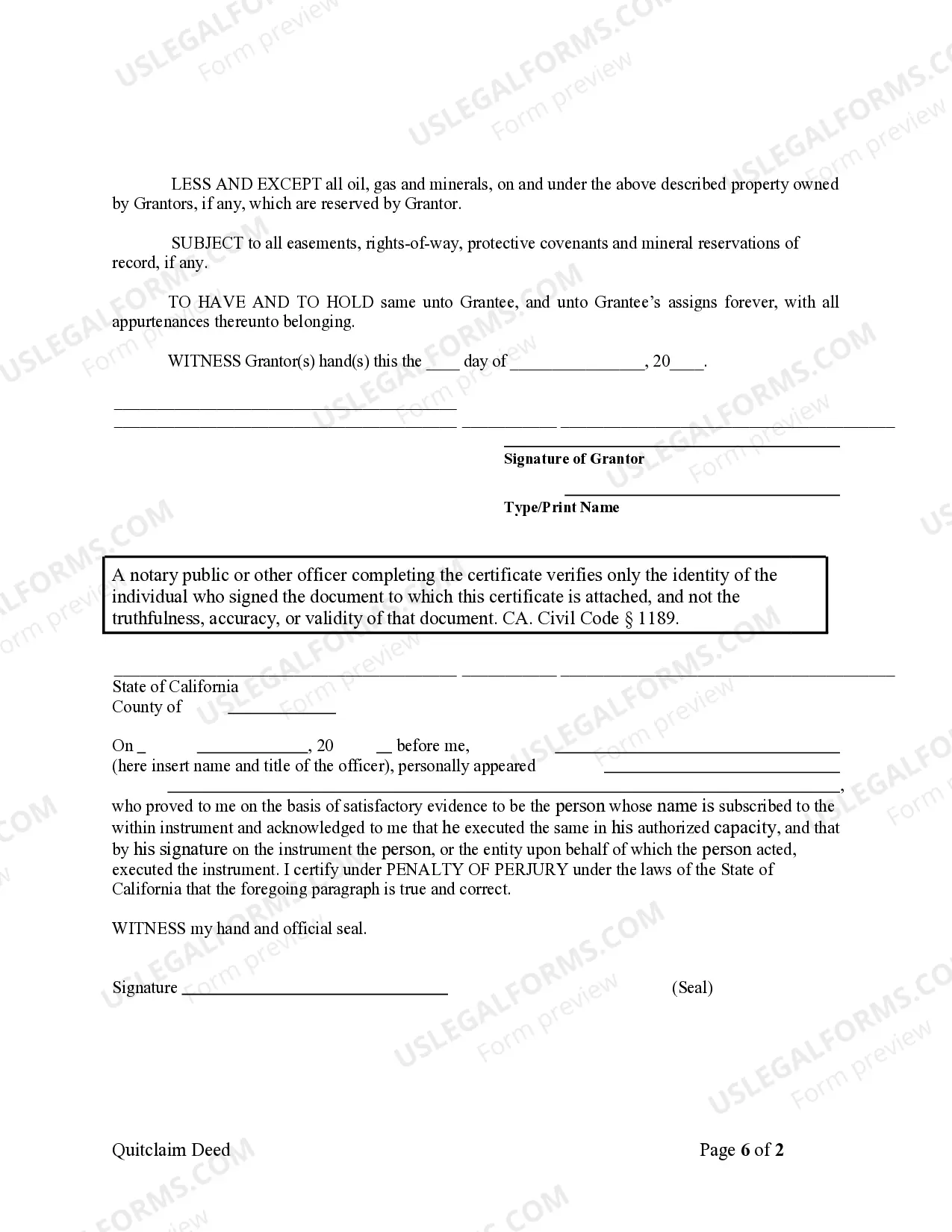

This Quitclaim Deed From an Individual To a Corporation form is a Quitclaim Deed where the grantor is an individual and the grantee is a corporation. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

A Stockton California Quitclaim Deed from Individual to Corporation is a legal document that transfers ownership of a property from an individual to a corporation. This type of deed is commonly used when an individual wants to convey their interest in real estate to a corporation, either for business purposes or to protect personal assets. The process begins with the preparation of the quitclaim deed, which includes important details such as the names of the individual granter and the corporation grantee, a description of the property being transferred, and any relevant legal descriptions or identifying numbers. The deed must also be signed and notarized to be legally valid. There are a few different types of Stockton California Quitclaim Deed from Individual to Corporation, each serving a specific purpose. These include: 1. General Quitclaim Deed: This is the most common type of quitclaim deed, used when the individual is transferring the property to the corporation without any specific conditions or restrictions. 2. Special Quitclaim Deed: In some cases, the quitclaim deed may have special conditions or restrictions attached to the transfer. These could include limitations on the use of the property or certain obligations the corporation must fulfill. 3. Tax-Free Quitclaim Deed: This type of quitclaim deed is often used in situations where the transfer of property between an individual and a corporation is done without incurring any tax consequences. It is important to consult with a tax professional or attorney to ensure compliance with applicable tax laws. 4. Bargain and Sale Quitclaim Deed: This type of deed is used when the transfer of property is made for a nominal consideration, such as one dollar. It conveys the property from the individual to the corporation without any warranties or guarantees of title. It is crucial to consult with a qualified attorney or real estate professional when drafting and executing a Stockton California Quitclaim Deed from Individual to Corporation. They can provide guidance on the specific requirements and legal aspects involved in this type of transaction, ensuring that all parties involved are protected and the transfer is conducted in accordance with California laws.