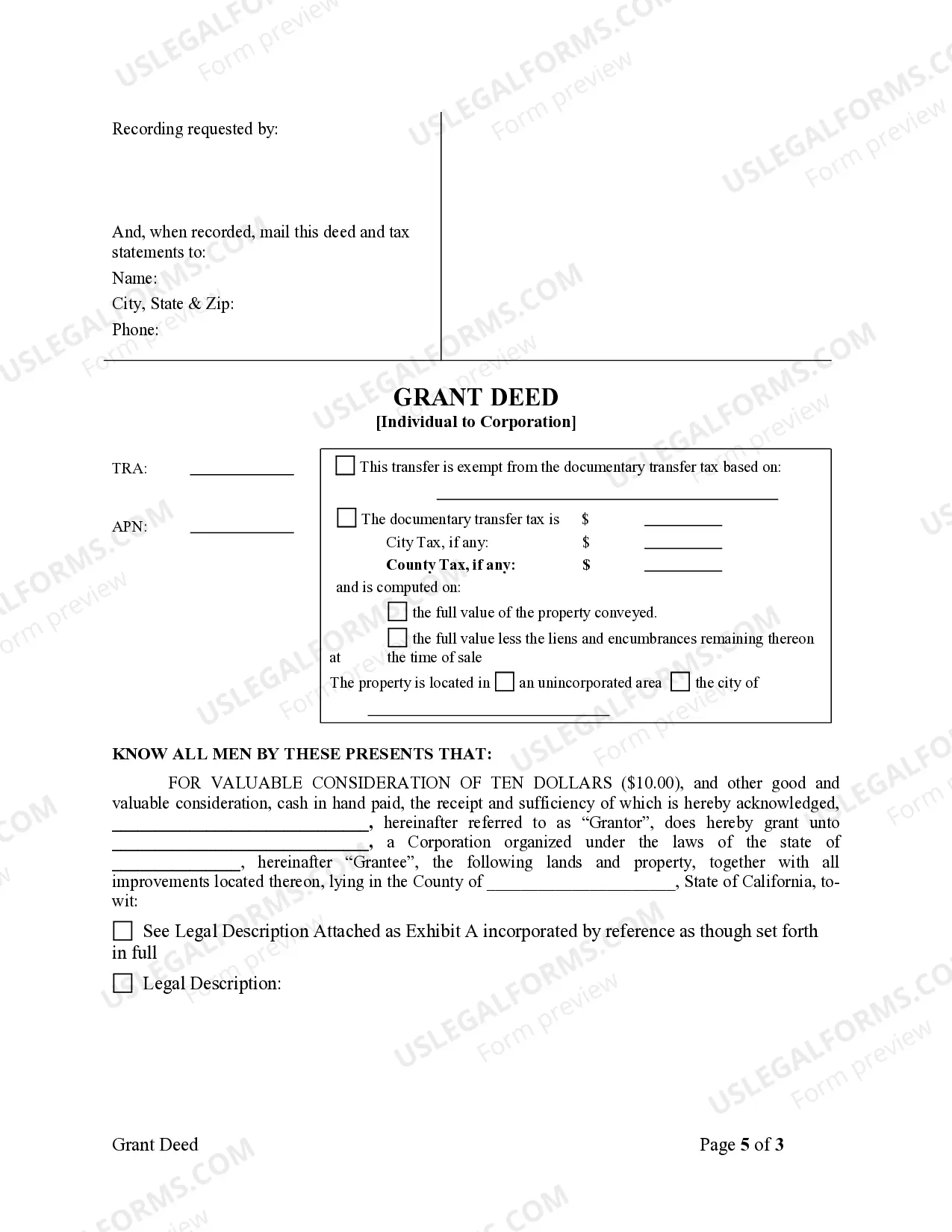

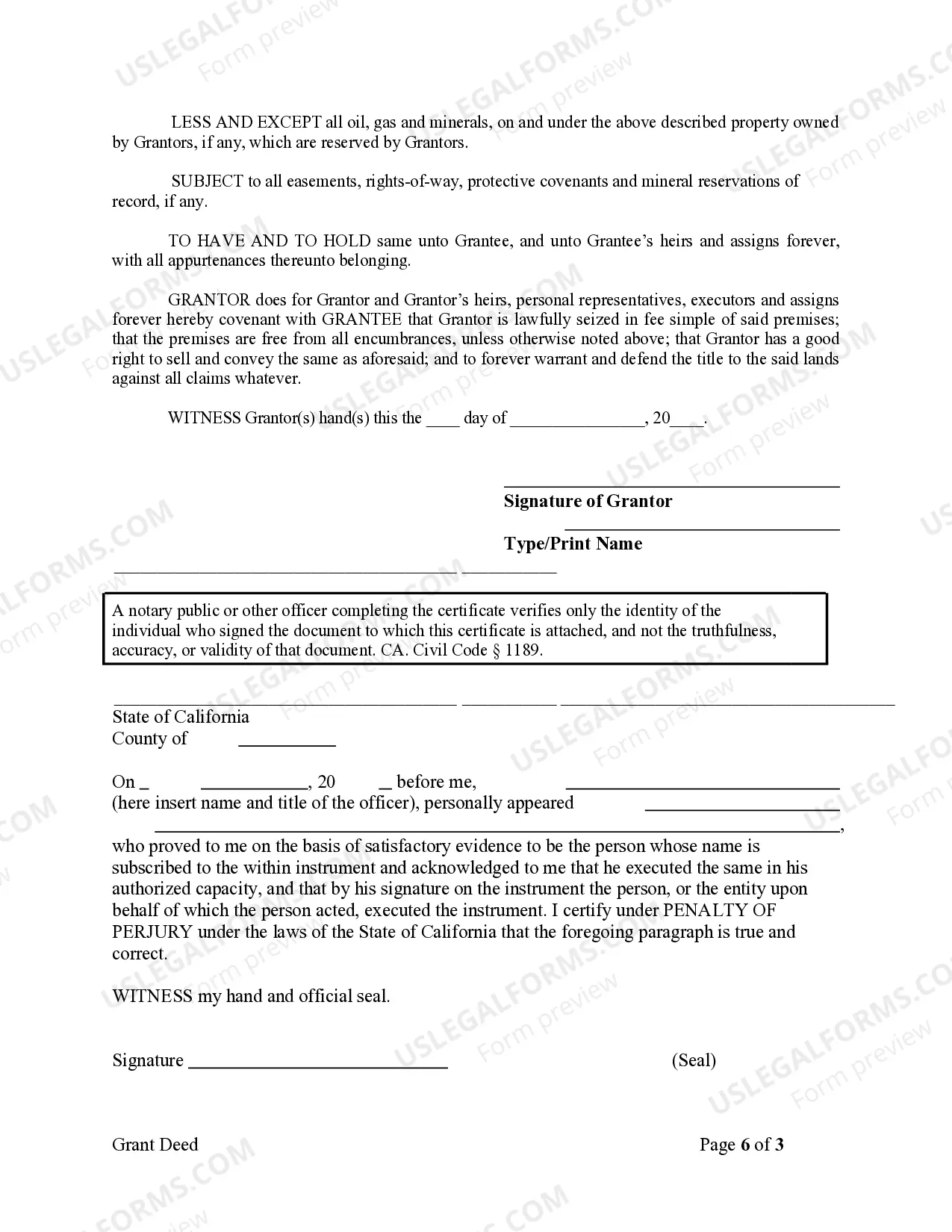

This Warranty Deed from Individual to Corporation form is a Warranty Deed where the grantor is an individual and the grantee is a corporation. Grantor conveys and warrants the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

El Cajon California Grant Deed from Individual to Corporation is a legal document that facilitates the transfer of property ownership rights from an individual to a corporation located in El Cajon, California. This type of deed is commonly used when an individual wishes to transfer their property to a corporation for various reasons, such as asset protection, estate planning, or business restructuring. The El Cajon California Grant Deed from Individual to Corporation includes specific details about the property being transferred, such as the legal description, boundaries, and any existing encumbrances or liens. It also states the consideration for the transfer, which could be monetary compensation, shares in the corporation, or other valuable assets. As for different types of El Cajon California Grant Deed from Individual to Corporation, there aren't specific variations. However, depending on the circumstances, there may be additional documents or agreements that supplement the grant deed. These may include: 1. Bill of Sale: If the property being transferred includes tangible assets like equipment, vehicles, or fixtures, a bill of sale may be necessary to properly transfer ownership of these items to the corporation. 2. Stock Purchase Agreement: If the consideration for the transfer includes shares in the corporation, a stock purchase agreement may be required. This agreement outlines the terms and conditions of the stock issuance, including purchase price, number of shares, and any applicable restrictions or conditions. 3. Asset or Business Transfer Agreement: In cases where the individual transfers not just the property but an entire business or assets associated with it, an asset or business transfer agreement may be needed. This agreement outlines the terms and conditions of the transfer, including any liabilities or obligations the corporation assumes. 4. Certificate of Corporate Resolution: Before the transfer can occur, the corporation's board of directors or shareholders may need to pass a corporate resolution authorizing the transaction. This resolution is typically documented in a Certificate of Corporate Resolution, stating the approval and authorization of the transfer. It is crucial for both parties involved in the El Cajon California Grant Deed from Individual to Corporation to consult with attorneys or legal professionals specializing in real estate and business law to ensure that all necessary documents are prepared and executed correctly.El Cajon California Grant Deed from Individual to Corporation is a legal document that facilitates the transfer of property ownership rights from an individual to a corporation located in El Cajon, California. This type of deed is commonly used when an individual wishes to transfer their property to a corporation for various reasons, such as asset protection, estate planning, or business restructuring. The El Cajon California Grant Deed from Individual to Corporation includes specific details about the property being transferred, such as the legal description, boundaries, and any existing encumbrances or liens. It also states the consideration for the transfer, which could be monetary compensation, shares in the corporation, or other valuable assets. As for different types of El Cajon California Grant Deed from Individual to Corporation, there aren't specific variations. However, depending on the circumstances, there may be additional documents or agreements that supplement the grant deed. These may include: 1. Bill of Sale: If the property being transferred includes tangible assets like equipment, vehicles, or fixtures, a bill of sale may be necessary to properly transfer ownership of these items to the corporation. 2. Stock Purchase Agreement: If the consideration for the transfer includes shares in the corporation, a stock purchase agreement may be required. This agreement outlines the terms and conditions of the stock issuance, including purchase price, number of shares, and any applicable restrictions or conditions. 3. Asset or Business Transfer Agreement: In cases where the individual transfers not just the property but an entire business or assets associated with it, an asset or business transfer agreement may be needed. This agreement outlines the terms and conditions of the transfer, including any liabilities or obligations the corporation assumes. 4. Certificate of Corporate Resolution: Before the transfer can occur, the corporation's board of directors or shareholders may need to pass a corporate resolution authorizing the transaction. This resolution is typically documented in a Certificate of Corporate Resolution, stating the approval and authorization of the transfer. It is crucial for both parties involved in the El Cajon California Grant Deed from Individual to Corporation to consult with attorneys or legal professionals specializing in real estate and business law to ensure that all necessary documents are prepared and executed correctly.