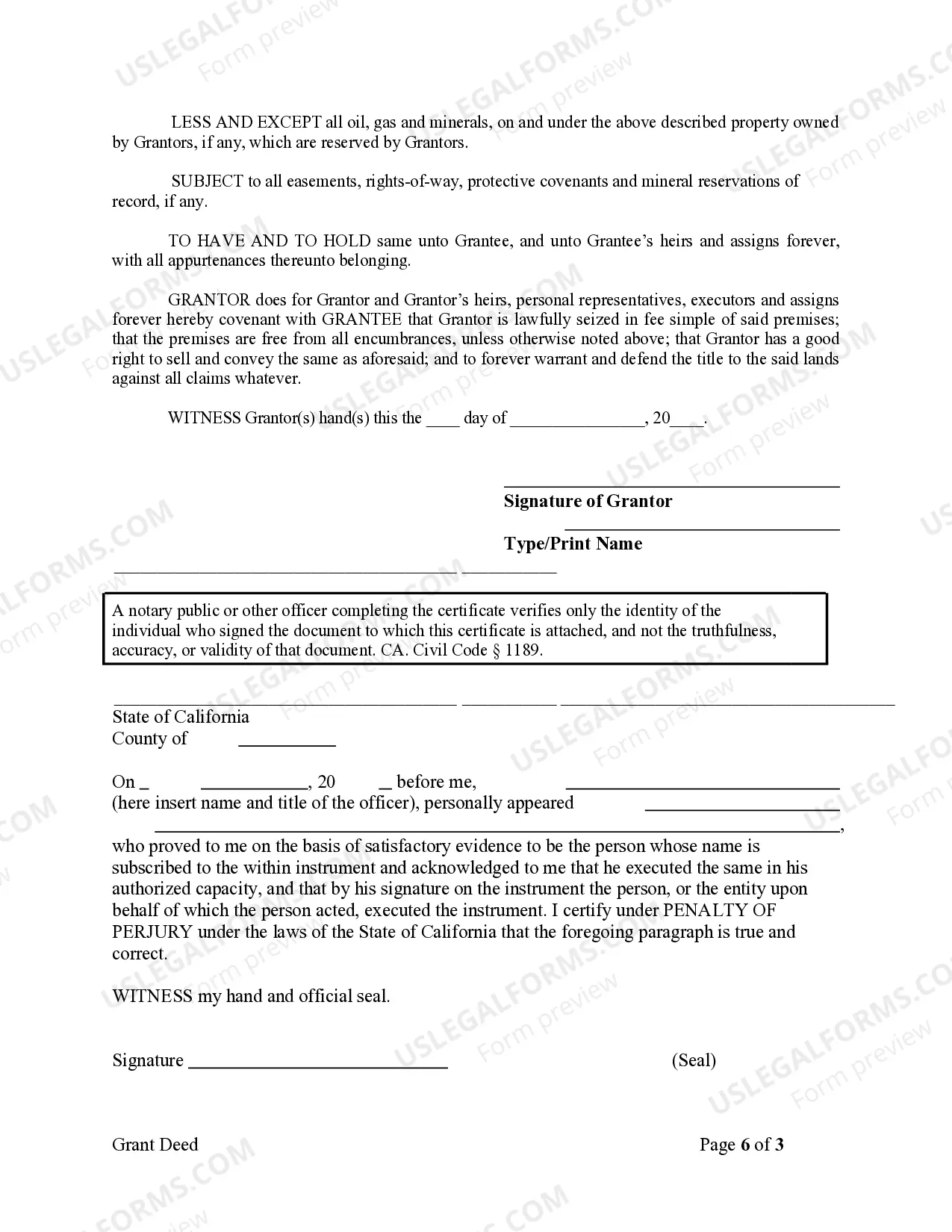

This Warranty Deed from Individual to Corporation form is a Warranty Deed where the grantor is an individual and the grantee is a corporation. Grantor conveys and warrants the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

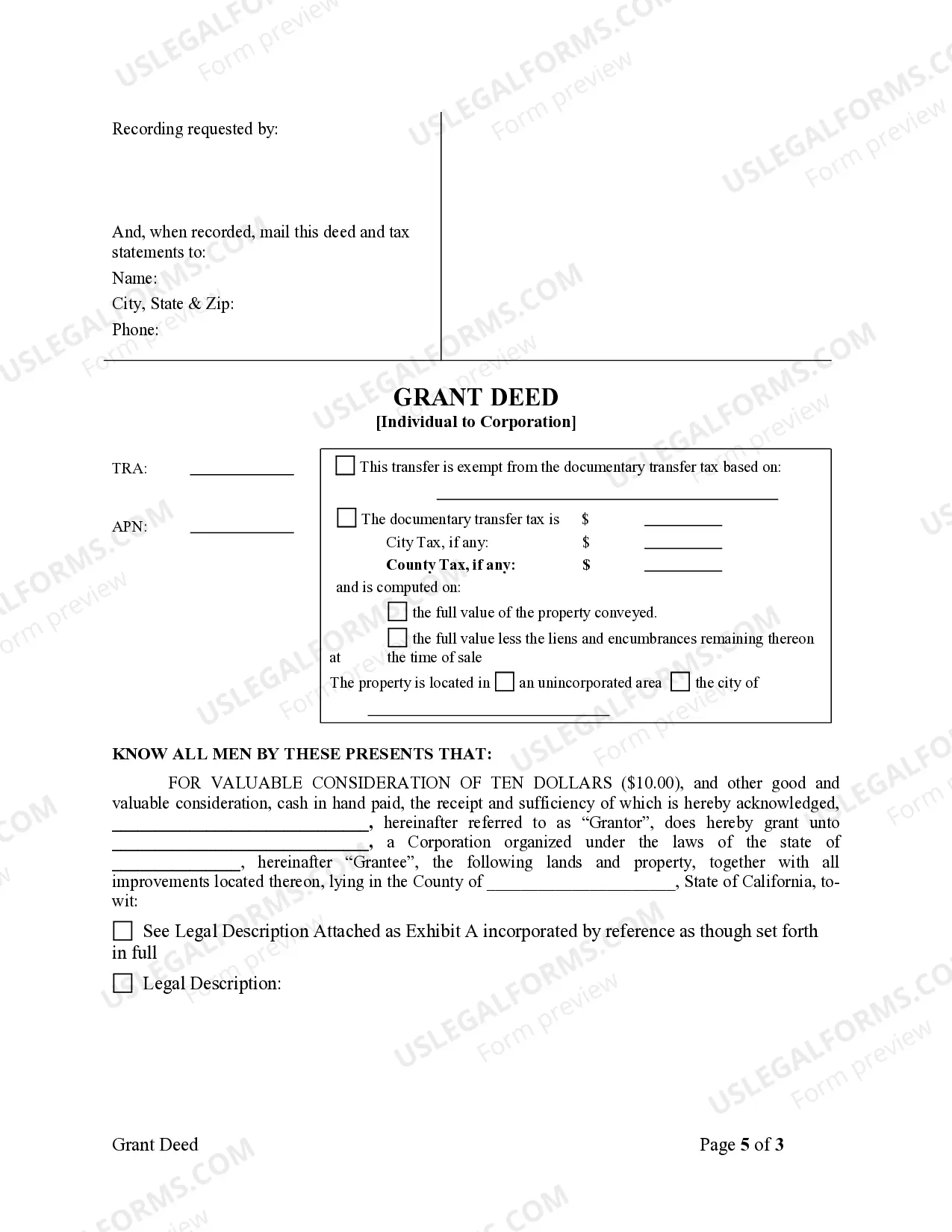

San Jose California Grant Deed from Individual to Corporation

Description

How to fill out California Grant Deed From Individual To Corporation?

Utilize the US Legal Forms to gain immediate access to any form template you need.

Our beneficial website, featuring thousands of document samples, enables you to locate and acquire nearly any form you seek.

You can download, fill out, and verify the San Jose California Grant Deed from Individual to Corporation in mere minutes instead of spending hours on the Internet searching for the right template.

Leveraging our collection is a smart method to enhance the security of your document submissions.

If you have not yet set up an account, follow these instructions.

- Our skilled attorneys frequently review all documents to ensure that the forms are applicable to specific jurisdictions and conform to updated laws and regulations.

- How can you acquire the San Jose California Grant Deed from Individual to Corporation.

- If you already possess a subscription, simply Log In to your account.

- The Download button will be activated on all the samples you examine.

- Additionally, you can access all previously saved documents in the My documents section.

Form popularity

FAQ

The California TOD deed form allows property to be automatically transferred to a new owner when the current owner dies, without the need to go through probate. It also gives the current owner retained control over the property, including the right to change his or her mind about the transfer.

Calculating real property transfer tax is straightforward. Currently, most counties charge $1.10 per $1000 value of transferred real property in California. For example, on real property valued at $20,000, the county documentary tax would be $22.00.

How to transfer property ownership Identify the donee or recipient. Discuss terms and conditions with that person. Complete a change of ownership form. Change the title on the deed. Hire a real estate attorney to prepare the deed. Notarize and file the deed.

California uses two types of deeds to change ownership of real property: grant deeds and quitclaim deeds. Further names such as warranty deed, interspousal deed, or trust transfer deed are simply special identification given to grant deeds or quitclaim deeds based on specific circumstances.

Today, Californians most often transfer title to real property by a simple written instrument, the grant deed. The word ?grant? is expressly designated by statute as a word of conveyance. (Civil Code Section 1092) A second form of deed is the quitclaim deed.

Step 1: Locate the Current Deed for the Property.Step 2: Determine What Type of Deed to Fill Out for Your Situation.Step 3: Determine How New Owners Will Take Title. Step 4: Fill Out the New Deed (Do Not Sign)Step 5: Grantor(s) Sign in Front of a Notary.Step 6: Fill Out the Preliminary Change of Ownership Report (PCOR)

To do this in California, you will need a copy of the current deed ? for San Francisco property, visit the assessor-recorder's office in city hall ? as well as a preliminary change of ownership report form and a new grant deed form. You can find the forms online at a court or county law library website.

Both types of legal documents serve the same function of transferring ownership of real property. The fundamental difference between quitclaim deeds and grant deeds is the level of protection and warranty provided to the grantee.

While California does not require grant deeds to be recorded, almost all of them are in order to protect the grantee from any later transfer of the same property. As long as the grant deed is recorded, any potential purchaser would be on notice of the earlier sale to a new owner.