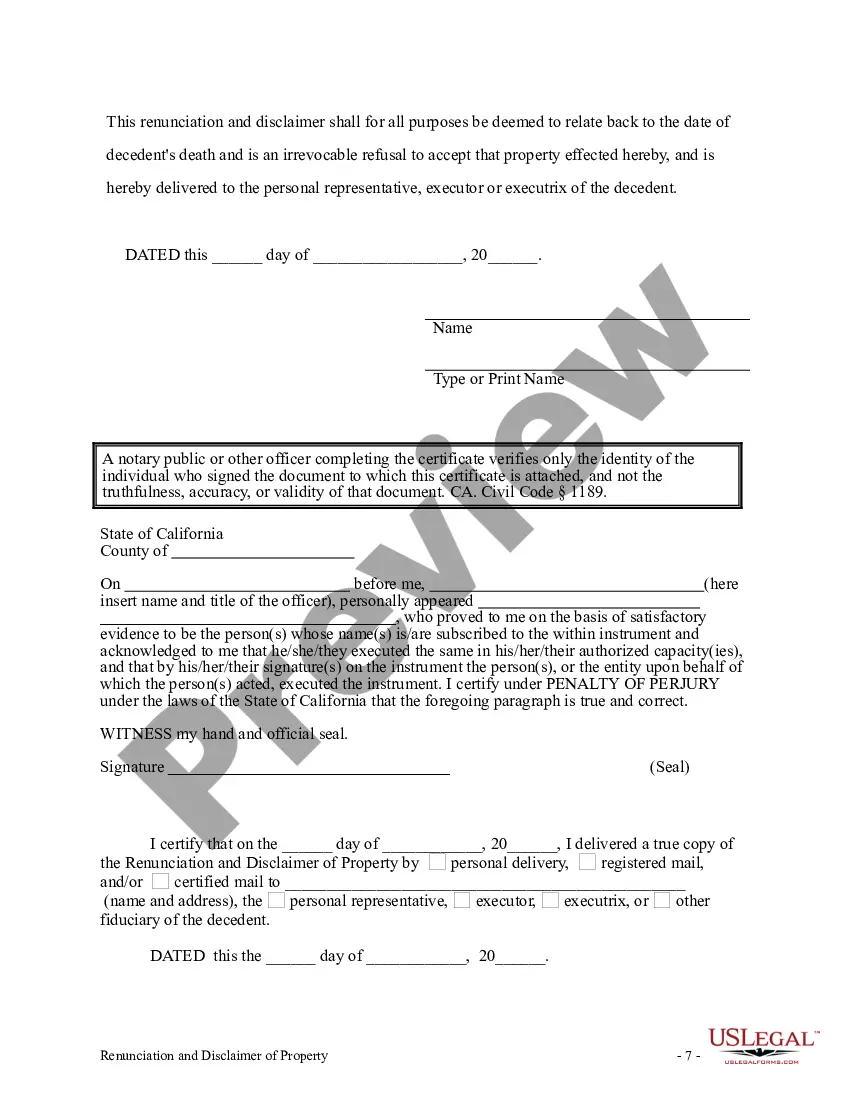

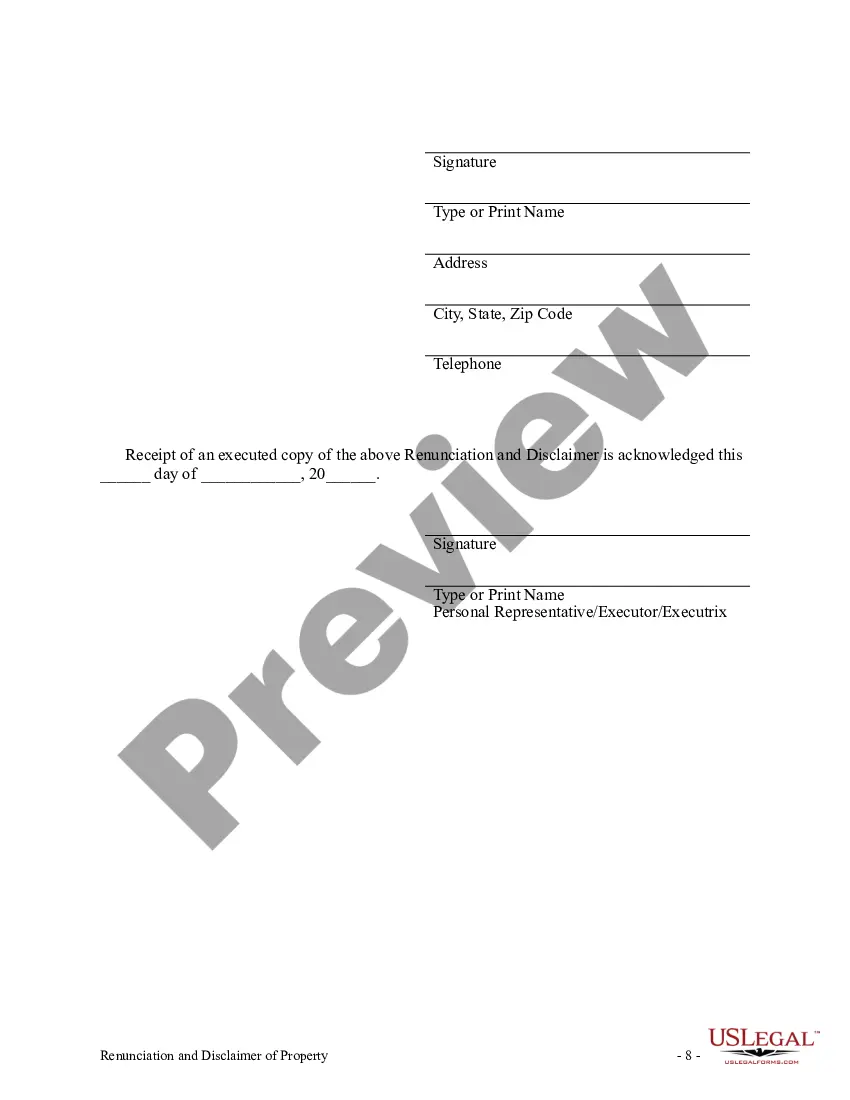

This form is a Renunciation and Disclaimer of an Individual Retirement Account, Annuity, or Bond. The beneficiary has acquired an interest in the proceeds of an individual retirement account, annuity, or bond. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has chosen to disclaim all rights to the proceeds. Under California law, the beneficiary must list within the disclaimer the individual(s) who will take the interest or the right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

El Monte California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond: Understanding the Process The El Monte California Renunciation and Disclaimer of Individual Retirement Account (IRA), Annuity, or Bond is a legal procedure that allows an individual to relinquish their rights or interest in a specific type of financial asset. This process is essential for individuals who have been named as beneficiaries of retirement accounts, annuities, or bonds but wish to decline their inheritance or entitlement. There are different types of El Monte California renunciations and disclaimers that can apply to individual retirement accounts, annuities, or bonds. Let's explore each of them in detail: 1. Renunciation of Individual Retirement Account (IRA): — This type of renunciation applies to an individual who has been named as a beneficiary of an IRA but chooses not to accept it. — By renouncing their interest in the IRA, they effectively refuse any rights or claims to the funds held within the account. — The renunciation must be formalized through the appropriate legal channels to ensure its validity. 2. Renunciation of Annuity: — An individual who has been designated as a beneficiary of an annuity may utilize this type of renunciation if they prefer not to accept it. — An annuity is a financial product that provides a series of periodic payments over a specified period or for the individual's lifetime. — By renouncing the annuity, the beneficiary waives their entitlement to receive the payments or any associated benefits. 3. Renunciation of Bond: — This renunciation applies when an individual has been named as a beneficiary of a bond but wishes to disclaim their inheritance. — Bonds are debt securities issued by governments or corporations, entitling the bondholder to receive periodic interest payments and the return of principal upon maturity. — By renouncing the bond, the beneficiary declines their right to any future interest payments and the repayment of principal. The El Monte California Renunciation and Disclaimer process requires careful consideration and adherence to legal formalities. It typically involves submitting a written document to the relevant financial institution or entity responsible for administering the retirement account, annuity, or bond, stating the intent to renounce or disclaim the asset. Professional legal advice or guidance is recommended to ensure compliance and proper execution. In summary, the El Monte California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond is a legal procedure that allows beneficiaries to decline their entitlements to specific financial assets. Whether it be an IRA, annuity, or bond, each type has its own renunciation process, requiring proper documentation and adherence to legal protocols. Always consult with a legal professional to navigate this complex process effectively.El Monte California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond: Understanding the Process The El Monte California Renunciation and Disclaimer of Individual Retirement Account (IRA), Annuity, or Bond is a legal procedure that allows an individual to relinquish their rights or interest in a specific type of financial asset. This process is essential for individuals who have been named as beneficiaries of retirement accounts, annuities, or bonds but wish to decline their inheritance or entitlement. There are different types of El Monte California renunciations and disclaimers that can apply to individual retirement accounts, annuities, or bonds. Let's explore each of them in detail: 1. Renunciation of Individual Retirement Account (IRA): — This type of renunciation applies to an individual who has been named as a beneficiary of an IRA but chooses not to accept it. — By renouncing their interest in the IRA, they effectively refuse any rights or claims to the funds held within the account. — The renunciation must be formalized through the appropriate legal channels to ensure its validity. 2. Renunciation of Annuity: — An individual who has been designated as a beneficiary of an annuity may utilize this type of renunciation if they prefer not to accept it. — An annuity is a financial product that provides a series of periodic payments over a specified period or for the individual's lifetime. — By renouncing the annuity, the beneficiary waives their entitlement to receive the payments or any associated benefits. 3. Renunciation of Bond: — This renunciation applies when an individual has been named as a beneficiary of a bond but wishes to disclaim their inheritance. — Bonds are debt securities issued by governments or corporations, entitling the bondholder to receive periodic interest payments and the return of principal upon maturity. — By renouncing the bond, the beneficiary declines their right to any future interest payments and the repayment of principal. The El Monte California Renunciation and Disclaimer process requires careful consideration and adherence to legal formalities. It typically involves submitting a written document to the relevant financial institution or entity responsible for administering the retirement account, annuity, or bond, stating the intent to renounce or disclaim the asset. Professional legal advice or guidance is recommended to ensure compliance and proper execution. In summary, the El Monte California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond is a legal procedure that allows beneficiaries to decline their entitlements to specific financial assets. Whether it be an IRA, annuity, or bond, each type has its own renunciation process, requiring proper documentation and adherence to legal protocols. Always consult with a legal professional to navigate this complex process effectively.