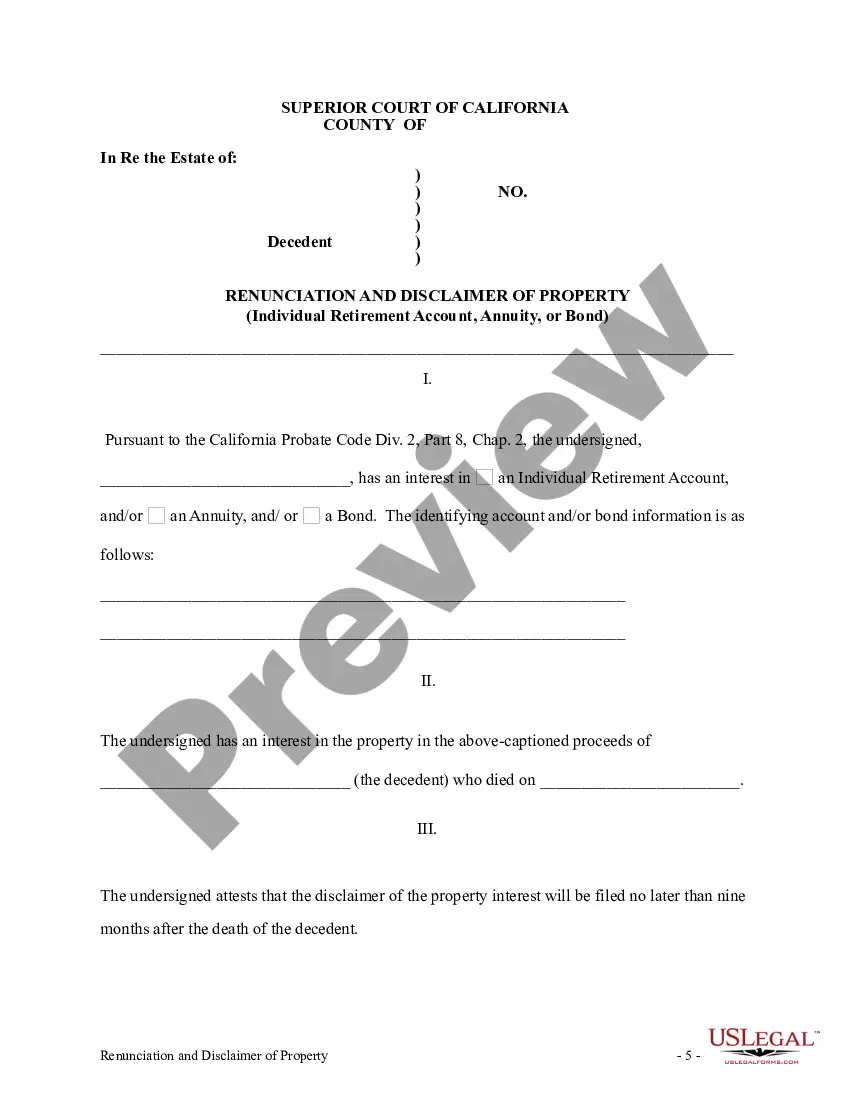

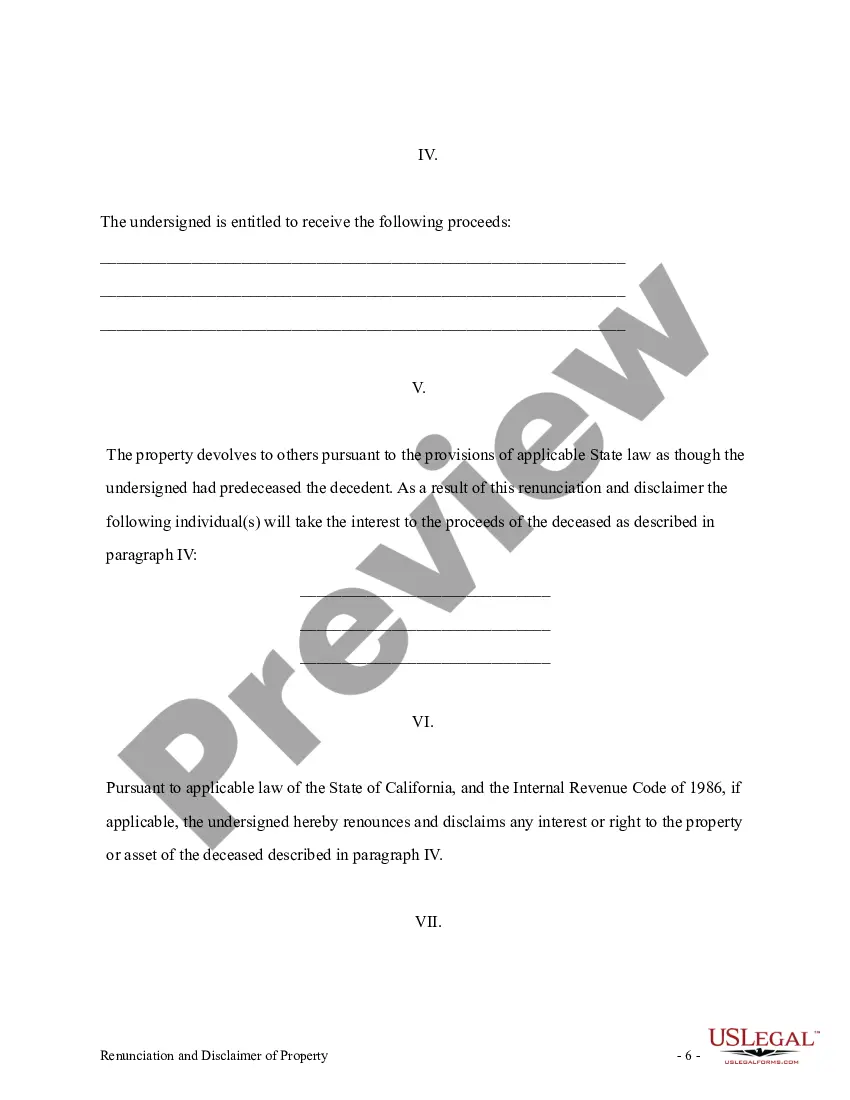

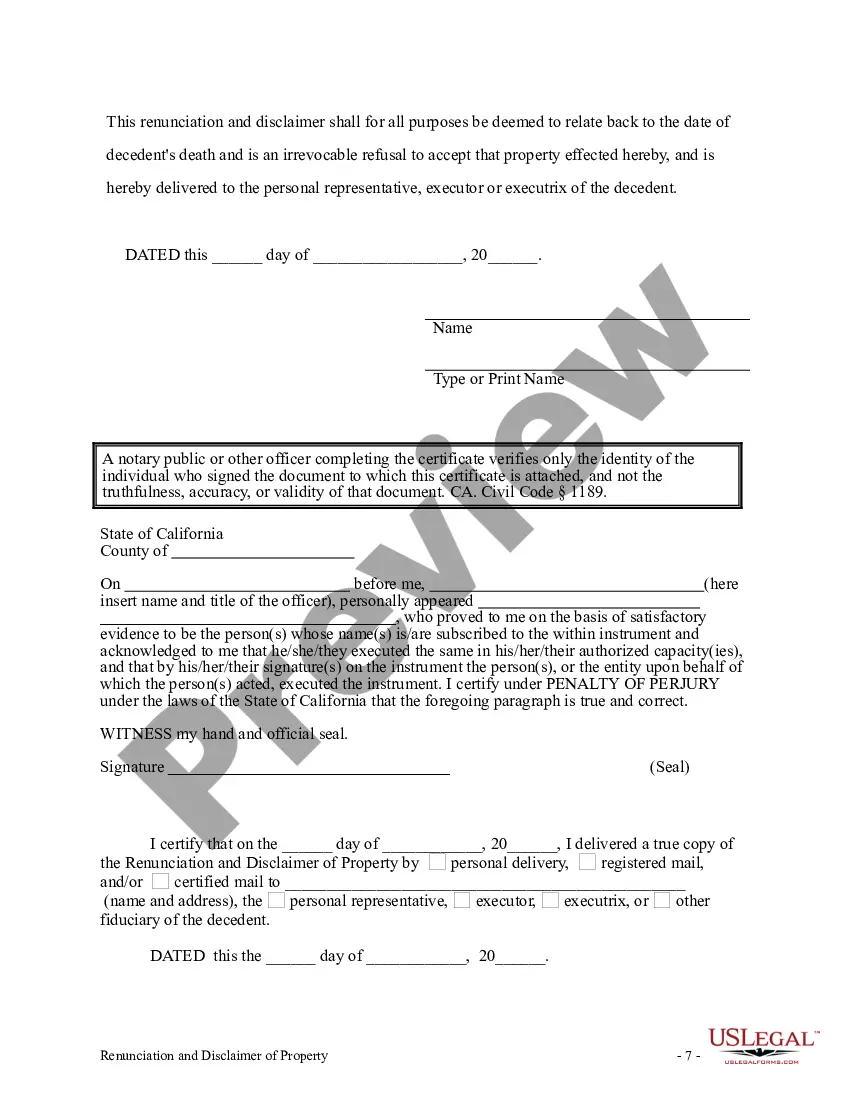

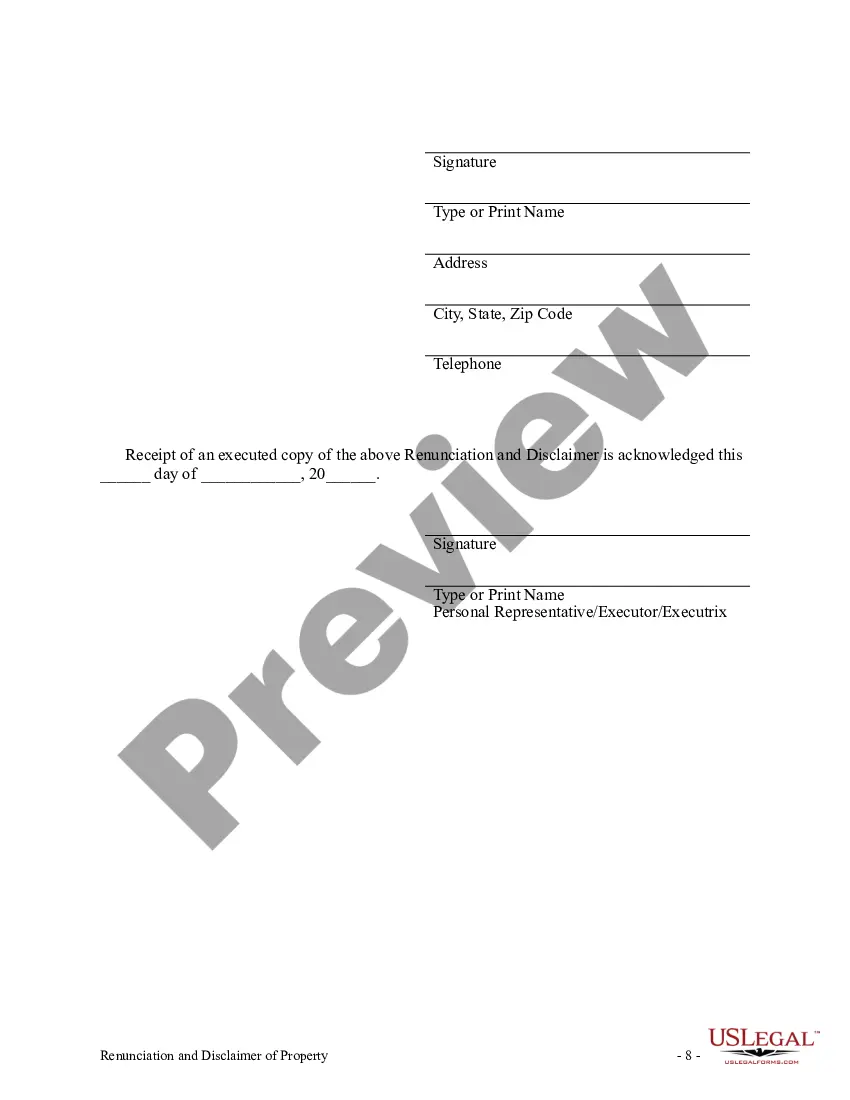

This form is a Renunciation and Disclaimer of an Individual Retirement Account, Annuity, or Bond. The beneficiary has acquired an interest in the proceeds of an individual retirement account, annuity, or bond. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has chosen to disclaim all rights to the proceeds. Under California law, the beneficiary must list within the disclaimer the individual(s) who will take the interest or the right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Santa Clarita California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond A renunciation and disclaimer of Individual Retirement Account (IRA), annuity, or bond is a legal process that individuals in Santa Clarita, California, may undertake to forgo their rights and interests in these financial assets. This renunciation allows individuals to disclaim any claim they may have on an IRA, annuity, or bond, ensuring that they will not be held responsible for any associated obligations or liabilities. It is important to understand the various types of renunciation and disclaimers in Santa Clarita when it comes to these types of assets. Let's delve into each category for a detailed understanding. 1. Renunciation of Individual Retirement Account (IRA) A renunciation of an IRA involves declaring that an individual does not wish to receive any benefits or inherited assets from an IRA account. This renunciation can occur when an individual inherits an IRA but decides to decline the associated privileges due to various reasons such as tax implications or financial constraints. By renouncing the IRA, individuals ensure that they will not be held liable for any taxes, required minimum distributions (Rods), or account management responsibilities. 2. Renunciation of Annuity The renunciation of an annuity involves the rejection of rights and claims to an annuity contract. An annuity is a financial instrument that provides regular income payments over a specified period or for the individual's lifetime. When an individual renounces an annuity, they forfeit their rights to receive future payments or any further benefits associated with the annuity contract. This renunciation can occur due to personal financial considerations, changing investment goals, or preferences for alternative investment strategies. 3. Renunciation of Bond In the context of Santa Clarita, California, the renunciation of a bond refers to an individual's refusal to accept any benefits or obligations related to a specific bond. Bonds are debt instruments issued by companies or governments, typically serving as an investment vehicle. By renouncing a bond, individuals disclaim any rights to receive interest payments, principal repayments, or any other advantages connected to the bond. This might occur if the individual believes that the bond's investment potential is unfavorable or no longer aligned with their financial objectives. It is worth noting that each type of renunciation and disclaimer mentioned above should be filed formally with the relevant financial institutions, typically through a legal process. Individuals in Santa Clarita, California, considering renouncing or disclaiming an IRA, annuity, or bond should consult with a qualified attorney or financial advisor to understand the legal implications, potential tax consequences, and required procedures to execute such actions properly.Santa Clarita California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond A renunciation and disclaimer of Individual Retirement Account (IRA), annuity, or bond is a legal process that individuals in Santa Clarita, California, may undertake to forgo their rights and interests in these financial assets. This renunciation allows individuals to disclaim any claim they may have on an IRA, annuity, or bond, ensuring that they will not be held responsible for any associated obligations or liabilities. It is important to understand the various types of renunciation and disclaimers in Santa Clarita when it comes to these types of assets. Let's delve into each category for a detailed understanding. 1. Renunciation of Individual Retirement Account (IRA) A renunciation of an IRA involves declaring that an individual does not wish to receive any benefits or inherited assets from an IRA account. This renunciation can occur when an individual inherits an IRA but decides to decline the associated privileges due to various reasons such as tax implications or financial constraints. By renouncing the IRA, individuals ensure that they will not be held liable for any taxes, required minimum distributions (Rods), or account management responsibilities. 2. Renunciation of Annuity The renunciation of an annuity involves the rejection of rights and claims to an annuity contract. An annuity is a financial instrument that provides regular income payments over a specified period or for the individual's lifetime. When an individual renounces an annuity, they forfeit their rights to receive future payments or any further benefits associated with the annuity contract. This renunciation can occur due to personal financial considerations, changing investment goals, or preferences for alternative investment strategies. 3. Renunciation of Bond In the context of Santa Clarita, California, the renunciation of a bond refers to an individual's refusal to accept any benefits or obligations related to a specific bond. Bonds are debt instruments issued by companies or governments, typically serving as an investment vehicle. By renouncing a bond, individuals disclaim any rights to receive interest payments, principal repayments, or any other advantages connected to the bond. This might occur if the individual believes that the bond's investment potential is unfavorable or no longer aligned with their financial objectives. It is worth noting that each type of renunciation and disclaimer mentioned above should be filed formally with the relevant financial institutions, typically through a legal process. Individuals in Santa Clarita, California, considering renouncing or disclaiming an IRA, annuity, or bond should consult with a qualified attorney or financial advisor to understand the legal implications, potential tax consequences, and required procedures to execute such actions properly.