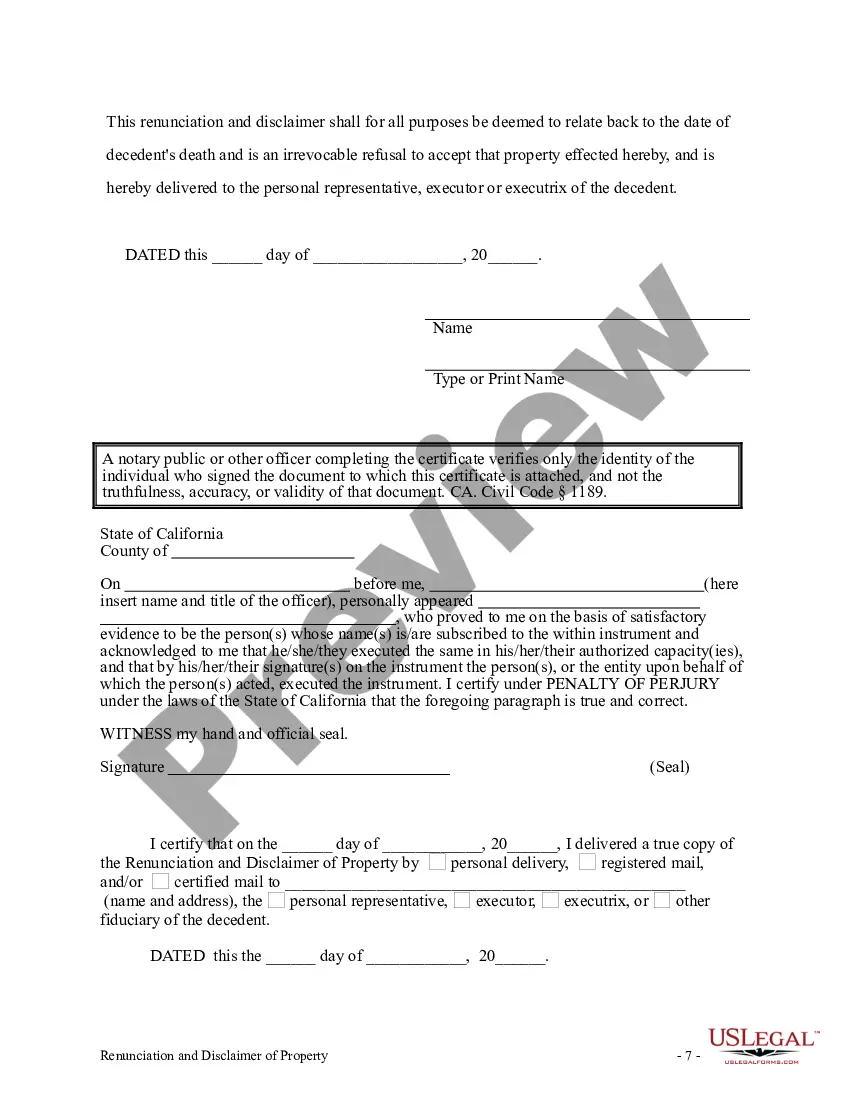

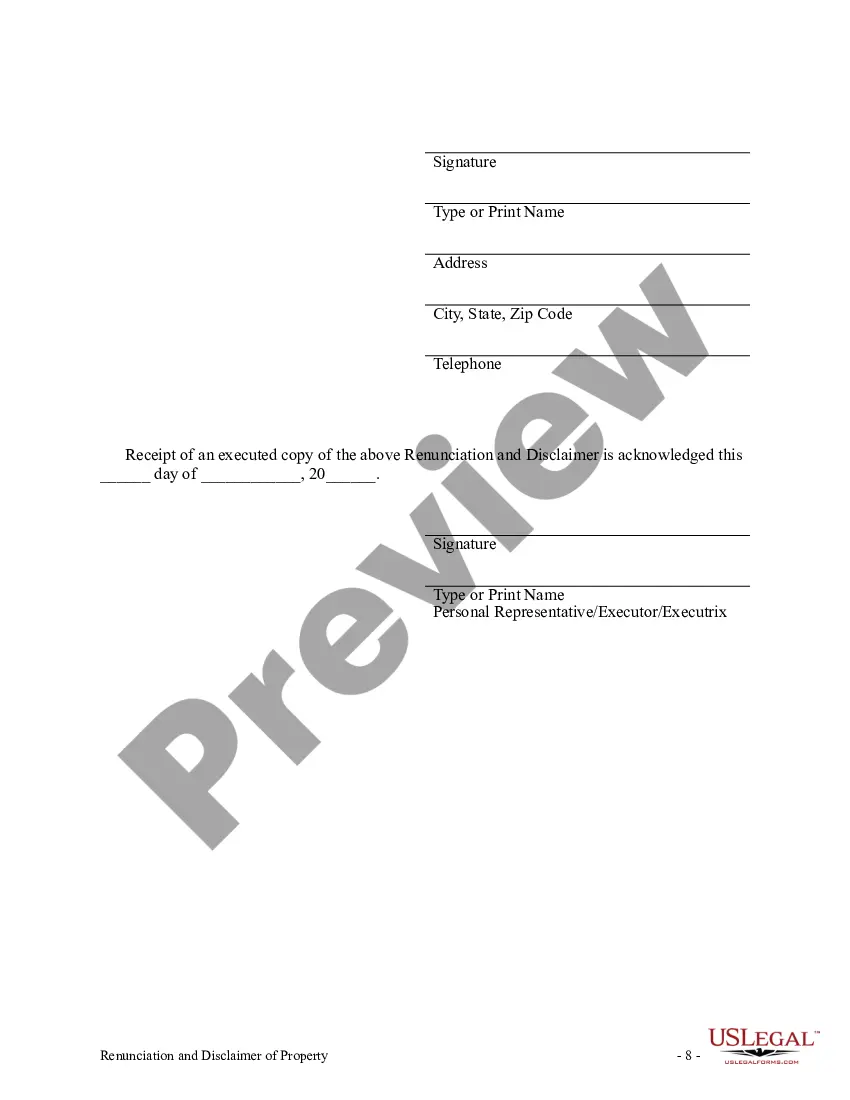

This form is a Renunciation and Disclaimer of an Individual Retirement Account, Annuity, or Bond. The beneficiary has acquired an interest in the proceeds of an individual retirement account, annuity, or bond. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has chosen to disclaim all rights to the proceeds. Under California law, the beneficiary must list within the disclaimer the individual(s) who will take the interest or the right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Temecula California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond is a legal process in which an individual voluntarily gives up their rights to, or disclaims, an Individual Retirement Account (IRA), annuity, or bond in the city of Temecula, California. This renunciation and disclaimer can be applied to various types of retirement accounts, investment annuities, or bond holdings. The Temecula California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond is typically initiated when an individual decides that they no longer wish to retain ownership or beneficiary rights over these financial assets. This formal process is carried out to legally transfer the ownership or rights to another designated individual or to the original granter. By renouncing or disclaiming these financial assets, individuals may be able to avoid unfavorable tax consequences, meet estate planning objectives, or simply release themselves from the responsibilities associated with managing or receiving benefits from these accounts. Some relevant keywords associated with Temecula California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond include: 1. Retirement Accounts: This refers to various types of accounts specifically created for retirement savings such as Traditional IRAs, Roth IRAs, Simplified Employee Pension (SEP) IRAs, or Savings Incentive Match Plan for Employees (SIMPLE) IRAs. 2. Annuities: These are financial products typically issued by insurance companies that provide a regular stream of income over a specific period or for the lifetime of an individual. Annuities can be immediate or deferred and can offer fixed, variable, or indexed interest rates. 3. Bonds: Bonds are fixed-income financial instruments where an investor loans money to an issuer such as the government or a corporation in exchange for periodic interest payments and the return of the principal amount at maturity. 4. Temecula, California: This city is located in Riverside County, California, known for its picturesque landscapes, vineyards, and hot air balloon festivals. The renunciation and disclaimer process specific to Temecula allows individuals in this area to handle their retirement accounts, annuities, or bonds according to California state laws and regulations. Different types of renunciations and disclaimers may be applicable based on the specific financial assets being relinquished. For example, an individual may choose to renounce their ownership of a Traditional IRA, while disclaiming their beneficiary rights over an annuity or bond. The specific type of renunciation or disclaimer used will depend on the individual's intentions and circumstances. It is important to consult with a qualified attorney or financial advisor familiar with Temecula California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond to ensure compliance with all legal requirements and to understand the potential implications of renouncing or disclaiming these financial assets.Temecula California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond is a legal process in which an individual voluntarily gives up their rights to, or disclaims, an Individual Retirement Account (IRA), annuity, or bond in the city of Temecula, California. This renunciation and disclaimer can be applied to various types of retirement accounts, investment annuities, or bond holdings. The Temecula California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond is typically initiated when an individual decides that they no longer wish to retain ownership or beneficiary rights over these financial assets. This formal process is carried out to legally transfer the ownership or rights to another designated individual or to the original granter. By renouncing or disclaiming these financial assets, individuals may be able to avoid unfavorable tax consequences, meet estate planning objectives, or simply release themselves from the responsibilities associated with managing or receiving benefits from these accounts. Some relevant keywords associated with Temecula California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond include: 1. Retirement Accounts: This refers to various types of accounts specifically created for retirement savings such as Traditional IRAs, Roth IRAs, Simplified Employee Pension (SEP) IRAs, or Savings Incentive Match Plan for Employees (SIMPLE) IRAs. 2. Annuities: These are financial products typically issued by insurance companies that provide a regular stream of income over a specific period or for the lifetime of an individual. Annuities can be immediate or deferred and can offer fixed, variable, or indexed interest rates. 3. Bonds: Bonds are fixed-income financial instruments where an investor loans money to an issuer such as the government or a corporation in exchange for periodic interest payments and the return of the principal amount at maturity. 4. Temecula, California: This city is located in Riverside County, California, known for its picturesque landscapes, vineyards, and hot air balloon festivals. The renunciation and disclaimer process specific to Temecula allows individuals in this area to handle their retirement accounts, annuities, or bonds according to California state laws and regulations. Different types of renunciations and disclaimers may be applicable based on the specific financial assets being relinquished. For example, an individual may choose to renounce their ownership of a Traditional IRA, while disclaiming their beneficiary rights over an annuity or bond. The specific type of renunciation or disclaimer used will depend on the individual's intentions and circumstances. It is important to consult with a qualified attorney or financial advisor familiar with Temecula California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond to ensure compliance with all legal requirements and to understand the potential implications of renouncing or disclaiming these financial assets.