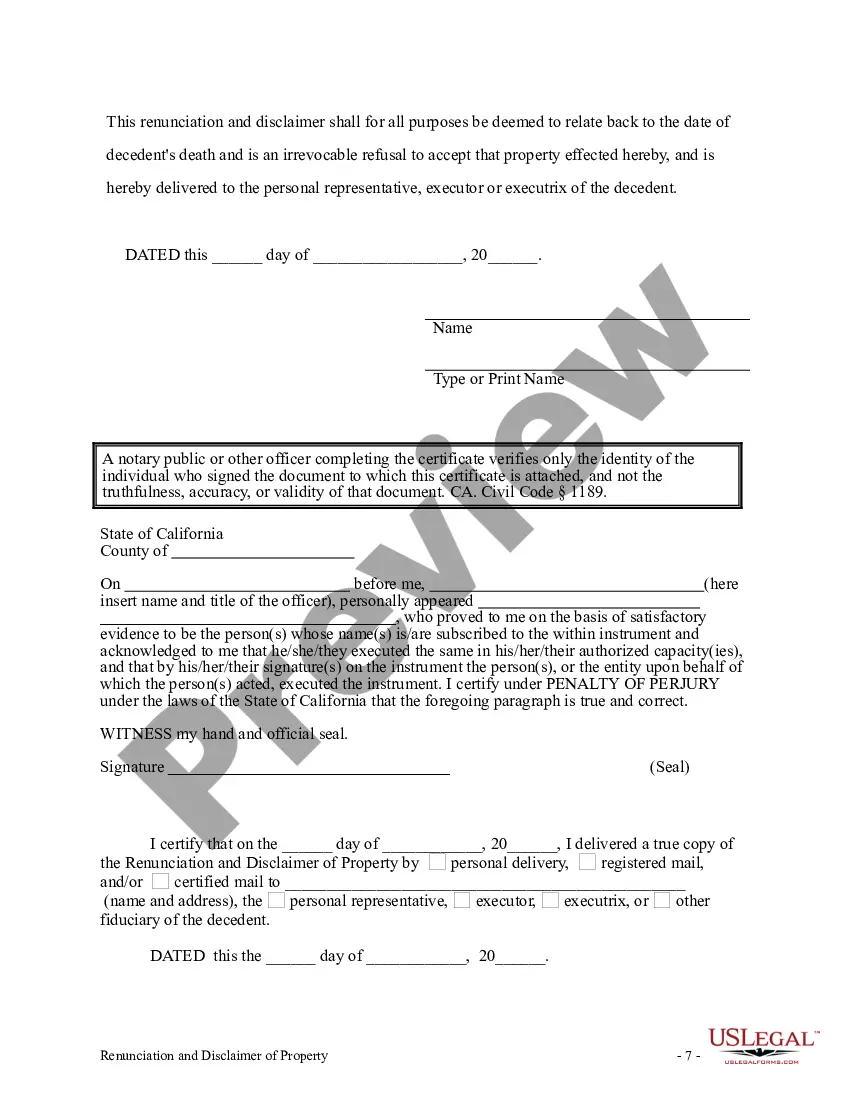

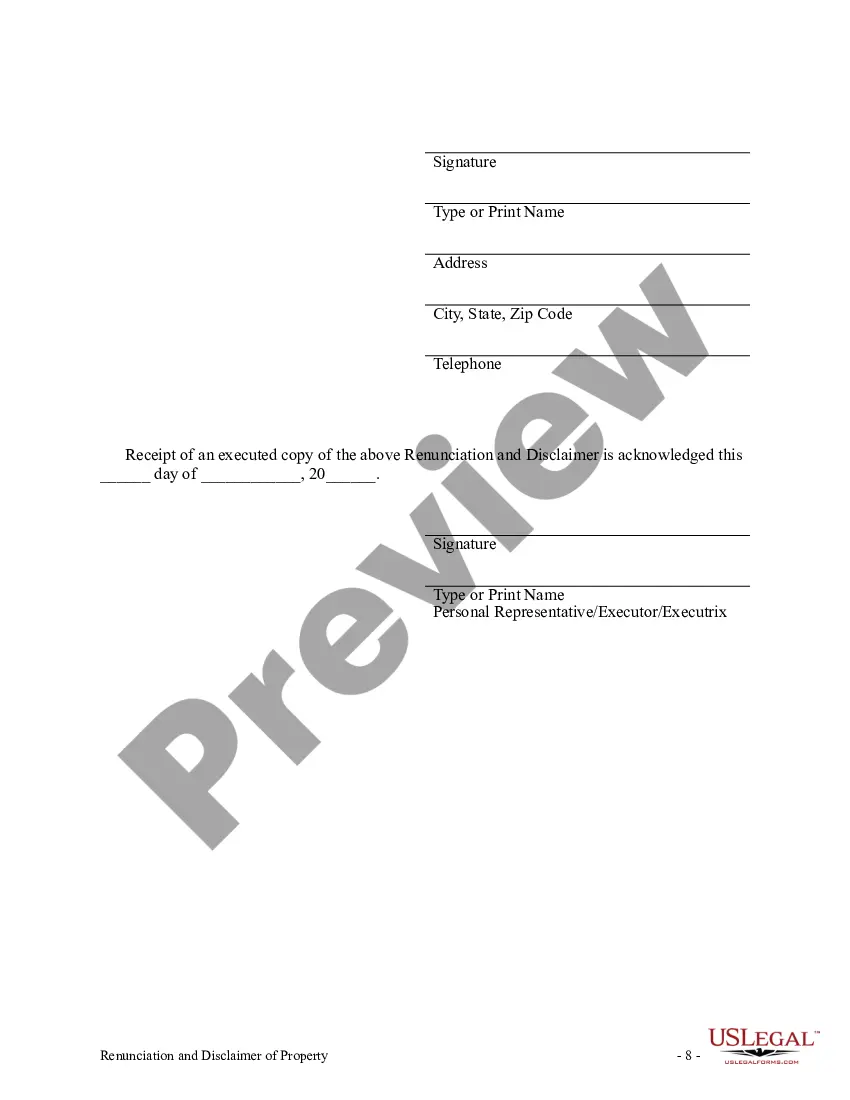

This form is a Renunciation and Disclaimer of an Individual Retirement Account, Annuity, or Bond. The beneficiary has acquired an interest in the proceeds of an individual retirement account, annuity, or bond. Pursuant to the California Probate Code Div. 2, Part 8, Chap. 2, the beneficiary has chosen to disclaim all rights to the proceeds. Under California law, the beneficiary must list within the disclaimer the individual(s) who will take the interest or the right to inherit. The form also contains a state specific acknowledgment and a certificate to verify delivery.

Title: Understanding West Covina California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond Introduction: In West Covina, California, individuals may encounter situations where they need to renounce or disclaim their Individual Retirement Account (IRA), annuity, or bond. Renunciation and disclaimer refer to the act of giving up one's legal right or claim over a specific asset. This written content will provide a detailed description of this process, covering its purpose, legal implications, and potential variations. 1. What is Renunciation and Disclaimer? Renunciation and disclaimer involve willingly relinquishing ownership or claim to an IRA, annuity, or bond. By doing so, an individual declines any entitlement or responsibility associated with these financial instruments. Renunciation typically occurs when an heir does not wish to receive an inheritance, while disclaimer is often utilized to avoid unfavorable tax consequences or when an individual is not the intended beneficiary. 2. Purpose of Renunciation and Disclaimer: — Inheritance: Individuals may renounce their right to inherit an IRA, annuity, or bond if they do not want or need the assets. This allows the assets to pass on to the next eligible beneficiary. — Tax Planning: Disclaiming an IRA, annuity, or bond can be a strategic move to minimize tax liabilities and preserve wealth. By disclaiming the assets, they can pass to a more tax-efficient beneficiary or charity. — Estate Planning: During estate planning, individuals may renounce or disclaim assets to ensure equitable distribution, help manage the size of the estate, or redirect assets to a trust or other designated beneficiaries. 3. Legal Implications: — Renunciation: When an individual renounces their right to an IRA, annuity, or bond, they should provide a written renunciation document to the entity or party responsible for administering these assets. Legal procedures, such as notarization, may be required to ensure its validity. — Disclaimer: Disclaiming an asset generally requires adhering to specific legal guidelines. The disclaimer must usually be made within a specific period, often nine months, following the original owner's death or the creation of the instrument. The disclaimer should be in writing and delivered to the appropriate party or institution, such as the IRA custodian or annuity issuer. 4. Potential Variations in West Covina California: While the general concept of renunciation and disclaimer applies throughout California, specific variations or forms may be required in West Covina. These variations might include: — West Covina California IRA Renunciation and Disclaimer Form — West Covina California Annuity Renunciation and Disclaimer Form — West Covina California Bond Renunciation and Disclaimer Form Conclusion: Understanding West Covina California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond is essential for individuals involved in inheritance, tax planning, or estate planning. By renouncing or disclaiming these assets properly, individuals can ensure the smooth transfer of wealth and minimize potential legal or tax complications. If you find yourself in a situation requiring renunciation or disclaimer, consulting with legal professionals or financial advisors in West Covina can provide you with specialized guidance tailored to your circumstances.Title: Understanding West Covina California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond Introduction: In West Covina, California, individuals may encounter situations where they need to renounce or disclaim their Individual Retirement Account (IRA), annuity, or bond. Renunciation and disclaimer refer to the act of giving up one's legal right or claim over a specific asset. This written content will provide a detailed description of this process, covering its purpose, legal implications, and potential variations. 1. What is Renunciation and Disclaimer? Renunciation and disclaimer involve willingly relinquishing ownership or claim to an IRA, annuity, or bond. By doing so, an individual declines any entitlement or responsibility associated with these financial instruments. Renunciation typically occurs when an heir does not wish to receive an inheritance, while disclaimer is often utilized to avoid unfavorable tax consequences or when an individual is not the intended beneficiary. 2. Purpose of Renunciation and Disclaimer: — Inheritance: Individuals may renounce their right to inherit an IRA, annuity, or bond if they do not want or need the assets. This allows the assets to pass on to the next eligible beneficiary. — Tax Planning: Disclaiming an IRA, annuity, or bond can be a strategic move to minimize tax liabilities and preserve wealth. By disclaiming the assets, they can pass to a more tax-efficient beneficiary or charity. — Estate Planning: During estate planning, individuals may renounce or disclaim assets to ensure equitable distribution, help manage the size of the estate, or redirect assets to a trust or other designated beneficiaries. 3. Legal Implications: — Renunciation: When an individual renounces their right to an IRA, annuity, or bond, they should provide a written renunciation document to the entity or party responsible for administering these assets. Legal procedures, such as notarization, may be required to ensure its validity. — Disclaimer: Disclaiming an asset generally requires adhering to specific legal guidelines. The disclaimer must usually be made within a specific period, often nine months, following the original owner's death or the creation of the instrument. The disclaimer should be in writing and delivered to the appropriate party or institution, such as the IRA custodian or annuity issuer. 4. Potential Variations in West Covina California: While the general concept of renunciation and disclaimer applies throughout California, specific variations or forms may be required in West Covina. These variations might include: — West Covina California IRA Renunciation and Disclaimer Form — West Covina California Annuity Renunciation and Disclaimer Form — West Covina California Bond Renunciation and Disclaimer Form Conclusion: Understanding West Covina California Renunciation and Disclaimer of Individual Retirement Account, Annuity, or Bond is essential for individuals involved in inheritance, tax planning, or estate planning. By renouncing or disclaiming these assets properly, individuals can ensure the smooth transfer of wealth and minimize potential legal or tax complications. If you find yourself in a situation requiring renunciation or disclaimer, consulting with legal professionals or financial advisors in West Covina can provide you with specialized guidance tailored to your circumstances.