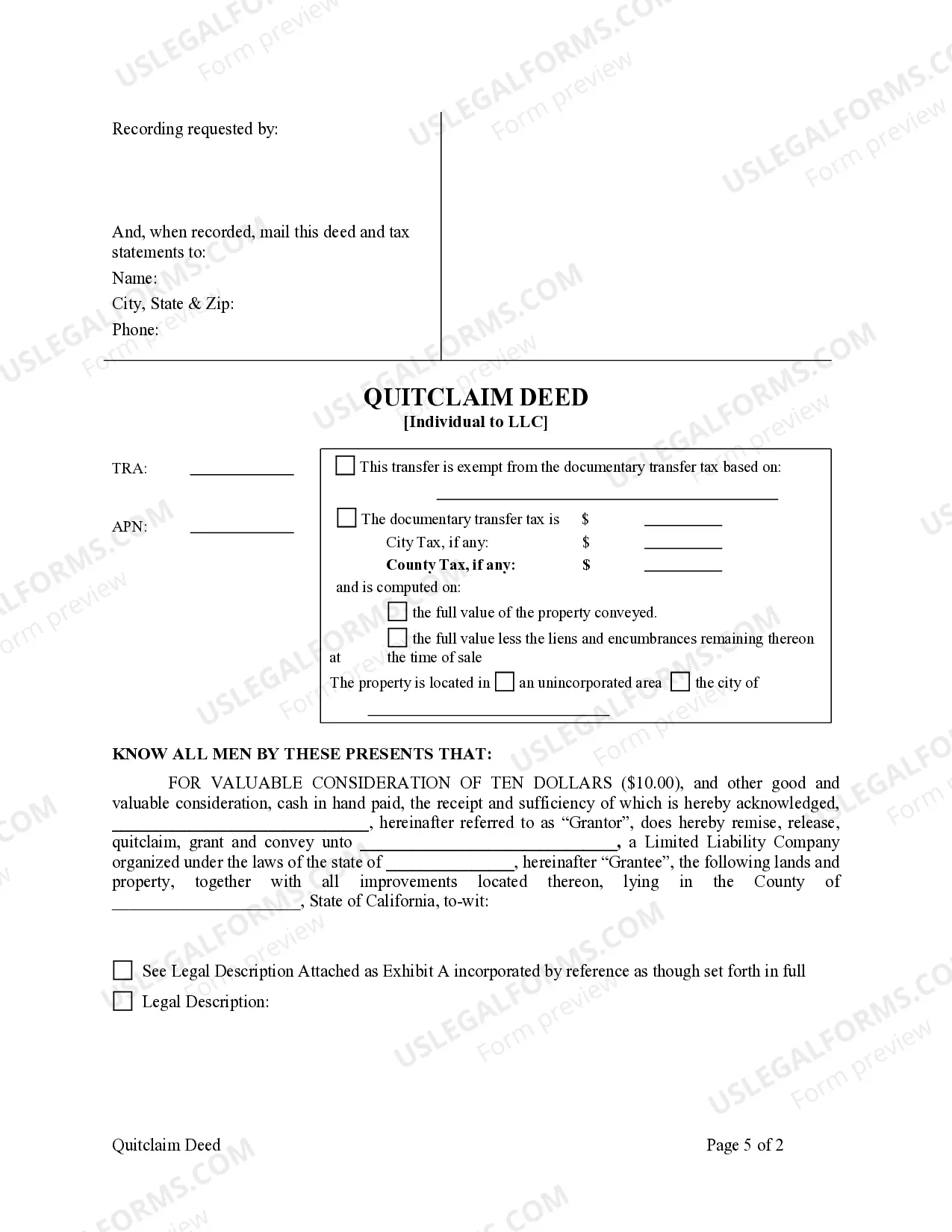

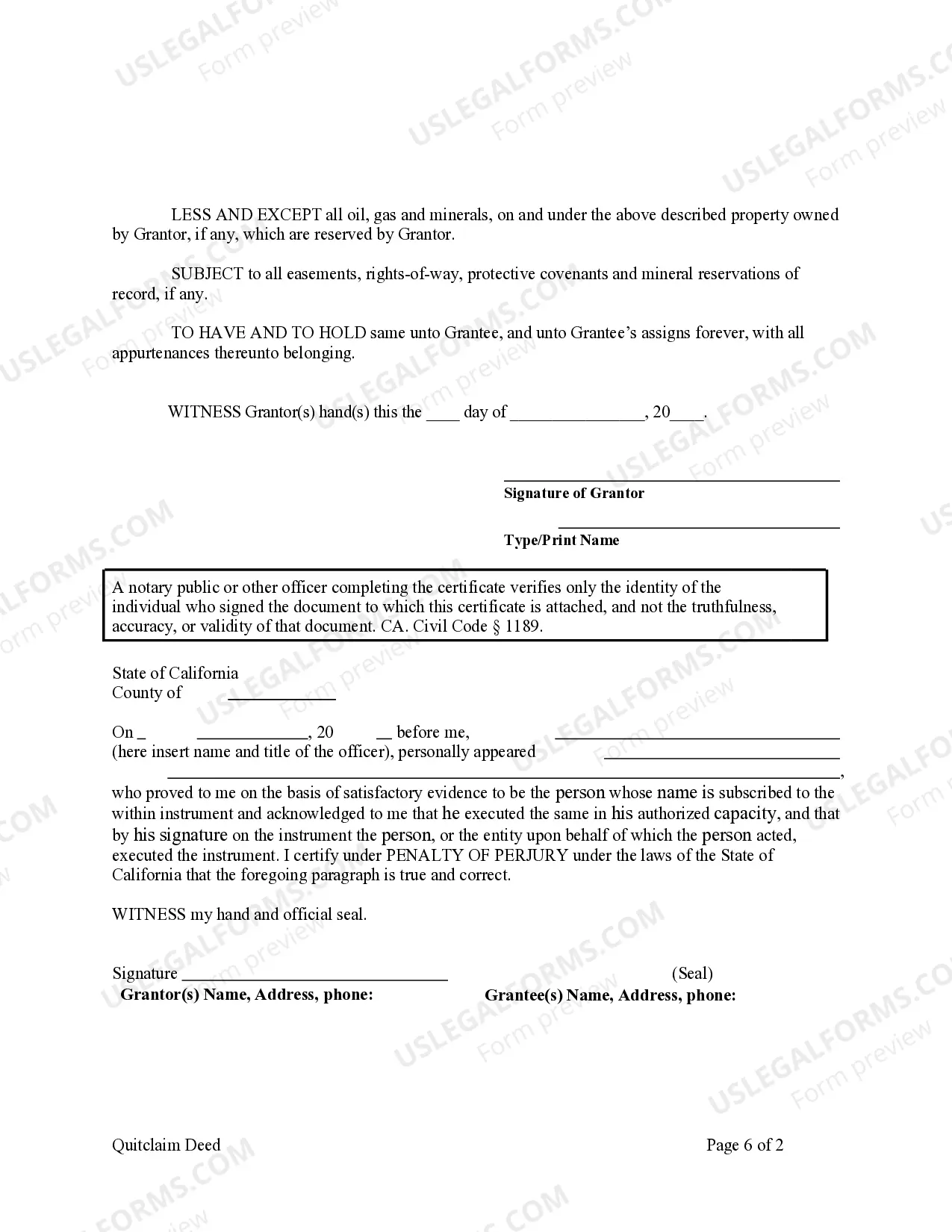

This Quitclaim Deed from Individual to LLC form is a Quitclaim Deed where the grantor is an individual and the grantee is a limited liability company. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

Title: Understanding Concord California Quitclaim Deed from Individual to LLC: Types and Process Introduction: A Concord California quitclaim deed from an individual to an LLC refers to a legal document that facilitates the transfer of ownership or interest in real estate from an individual property owner to a limited liability company (LLC). This article aims to provide a detailed description of the quitclaim deed process, its importance, and highlight any variations that may exist within this type of transfer. 1. Importance of Quitclaim Deeds: Quitclaim deeds play a vital role in facilitating the transfer of property ownership without guaranteeing the presence of a clear title. As such, they are commonly used in transactions between family members, business partners, or when transferring ownership to an LLC. 2. Process of a Concord California Quitclaim Deed from Individual to LLC: To complete a Concord California quitclaim deed from an individual to an LLC, the following steps are typically taken: a) Preparation: The individual (granter) must draft the quitclaim deed that clearly identifies both parties involved, provides a legal description of the property, and states the granter's intention to transfer ownership to the LLC. b) Execution: The granter must sign the document in the presence of a notary public, who then notarizes the deed to validate its authenticity. c) Recording: The executed quitclaim deed must be filed with the County Recorder's Office in Concord, California, to make the transfer legally binding and publicly recorded. 3. Variations of Concord California Quitclaim Deeds from Individual to LLC: While the basic process remains the same, there might be variations in certain circumstances. Some common types of Concord California quitclaim deeds include: a) Transfer to an Existing LLC: In this scenario, the granter transfers the property ownership to an already established LLC, indicating a change in ownership structure but not creating a new entity. b) Transfer to a Single-Member LLC: When an individual transfers property solely to an LLC with a single member, the process remains the same, but the transferor and transferee are one and the same. c) Transfer to a Newly Formed LLC: When an individual creates a new LLC to hold the property, the quitclaim deed facilitates the initial transfer of ownership to the newly established entity. d) Transfer with Multiple Individuals: If multiple individuals jointly own the property and intend to transfer their ownership interests to an LLC, additional legal steps and agreements may be required. Conclusion: Concord California quitclaim deeds from individuals to LCS provide a seamless method for transferring property ownership. Understanding the process and any potential variations allows parties involved to navigate the legalities involved and ensure the smooth transition of assets from an individual owner to an LLC. It is crucial to consult with a qualified attorney or legal professional to ensure compliance with all applicable laws and regulations during this transaction.Title: Understanding Concord California Quitclaim Deed from Individual to LLC: Types and Process Introduction: A Concord California quitclaim deed from an individual to an LLC refers to a legal document that facilitates the transfer of ownership or interest in real estate from an individual property owner to a limited liability company (LLC). This article aims to provide a detailed description of the quitclaim deed process, its importance, and highlight any variations that may exist within this type of transfer. 1. Importance of Quitclaim Deeds: Quitclaim deeds play a vital role in facilitating the transfer of property ownership without guaranteeing the presence of a clear title. As such, they are commonly used in transactions between family members, business partners, or when transferring ownership to an LLC. 2. Process of a Concord California Quitclaim Deed from Individual to LLC: To complete a Concord California quitclaim deed from an individual to an LLC, the following steps are typically taken: a) Preparation: The individual (granter) must draft the quitclaim deed that clearly identifies both parties involved, provides a legal description of the property, and states the granter's intention to transfer ownership to the LLC. b) Execution: The granter must sign the document in the presence of a notary public, who then notarizes the deed to validate its authenticity. c) Recording: The executed quitclaim deed must be filed with the County Recorder's Office in Concord, California, to make the transfer legally binding and publicly recorded. 3. Variations of Concord California Quitclaim Deeds from Individual to LLC: While the basic process remains the same, there might be variations in certain circumstances. Some common types of Concord California quitclaim deeds include: a) Transfer to an Existing LLC: In this scenario, the granter transfers the property ownership to an already established LLC, indicating a change in ownership structure but not creating a new entity. b) Transfer to a Single-Member LLC: When an individual transfers property solely to an LLC with a single member, the process remains the same, but the transferor and transferee are one and the same. c) Transfer to a Newly Formed LLC: When an individual creates a new LLC to hold the property, the quitclaim deed facilitates the initial transfer of ownership to the newly established entity. d) Transfer with Multiple Individuals: If multiple individuals jointly own the property and intend to transfer their ownership interests to an LLC, additional legal steps and agreements may be required. Conclusion: Concord California quitclaim deeds from individuals to LCS provide a seamless method for transferring property ownership. Understanding the process and any potential variations allows parties involved to navigate the legalities involved and ensure the smooth transition of assets from an individual owner to an LLC. It is crucial to consult with a qualified attorney or legal professional to ensure compliance with all applicable laws and regulations during this transaction.