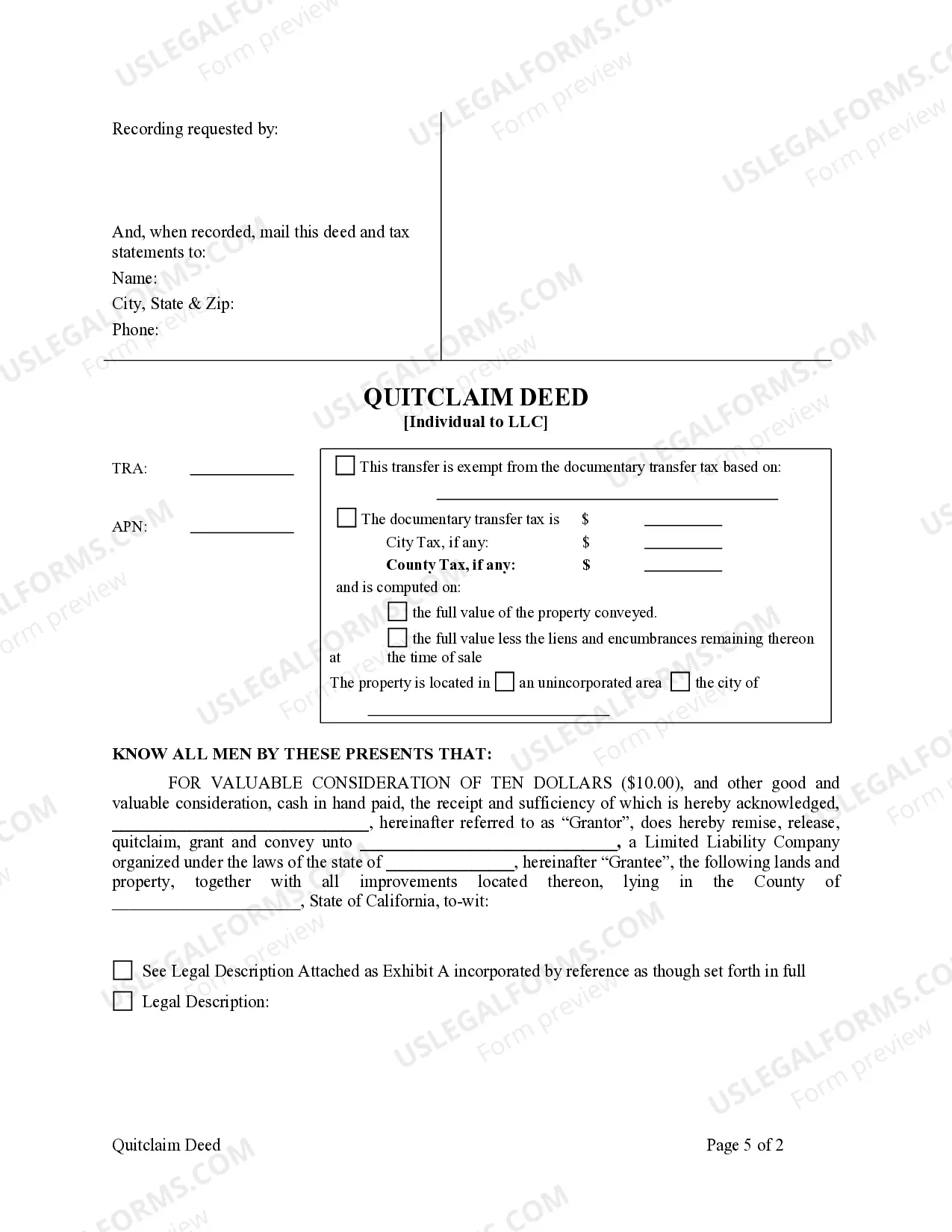

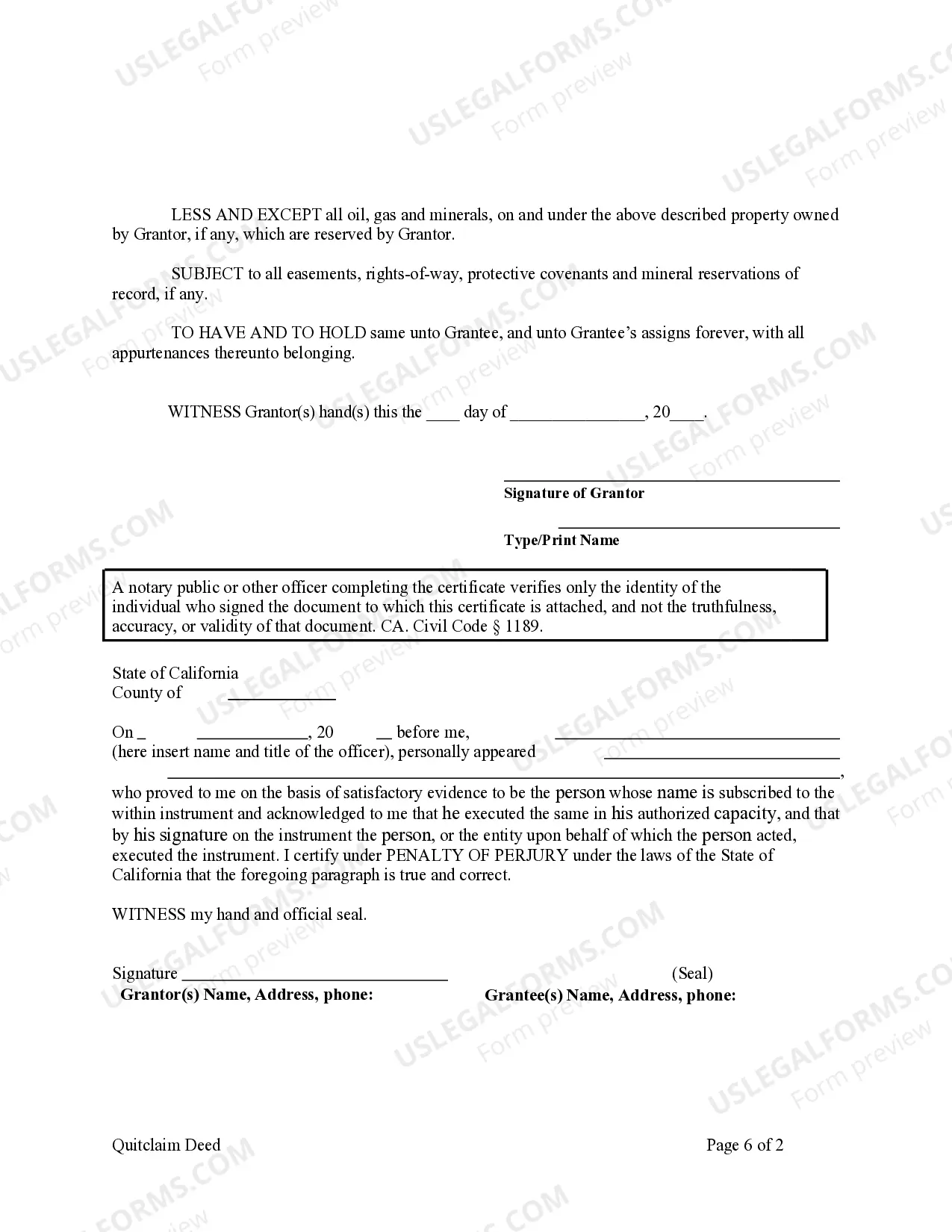

This Quitclaim Deed from Individual to LLC form is a Quitclaim Deed where the grantor is an individual and the grantee is a limited liability company. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

Elk Grove California Quitclaim Deed from Individual to LLC — A Detailed Description When transferring ownership of property from an individual to a Limited Liability Company (LLC) in Elk Grove, California, a quitclaim deed is commonly used. A quitclaim deed is a legal document that allows the individual, known as the granter, to release their interest or claim on a property to the LLC, known as the grantee. This transfer of ownership is typically executed when an individual wants to transfer personal property to their LLC for business or liability purposes. The Elk Grove California Quitclaim Deed from Individual to LLC serves as proof of the transfer and ensures all legal requirements are met. It includes essential information such as the names and addresses of both the granter and the grantee, the legal description of the property involved, and any pertinent details or conditions of the transfer. Keywords: — Elk Grove, California: Refers to the specific geographical location where the quitclaim deed is being executed. — Quitclaim Deed: The legal document used to transfer ownership and release the granter's interest in the property to the grantee. — Individual: The person currently owning the property and wishing to transfer it to the LLC. — LLC: The Limited Liability Company that will become the new owner of the property. — Transfer of ownership: The act of transferring property rights and responsibilities from the individual to the LLC. Granteror: The individual who currently owns the property and is relinquishing their interest in it. — Grantee: The LLC that will receive ownership of the property through the quitclaim deed. — Legal Description: A detailed description of the property, including information such as lot and block numbers, dimensions, and sometimes the property's history. — Business: This describes the motive for transferring ownership to the LLC, typically for business purposes such as asset protection or liability limitation. — Liability: Refers to the legal responsibilities and obligations associated with owning a property, which an individual may want to separate from their personal assets by transferring to an LLC. Different Types of Elk Grove California Quitclaim Deeds from Individual to LLC: 1. Standard Quitclaim Deed: The most common type of quitclaim deed used, where the individual transfers their property to the LLC without any specific conditions or restrictions. 2. Special Purpose Quitclaim Deed: This type of quitclaim deed may include specific conditions or restrictions on the transfer, such as maintaining certain land use or zoning restrictions. 3. Tax-Deferred Exchange Quitclaim Deed: This type of quitclaim deed is used when the transfer is part of a tax-deferred exchange, allowing the individual to defer capital gains taxes on the property. 4. Joint Tenancy to LLC Quitclaim Deed: If the property is currently co-owned by multiple individuals in a joint tenancy arrangement, this type of quitclaim deed facilitates the transfer of their interests to the LLC. These various types of Elk Grove California Quitclaim Deeds cater to different circumstances and intentions, ensuring the specific requirements of the transfer are met while providing legal clarity and protection for all involved parties.