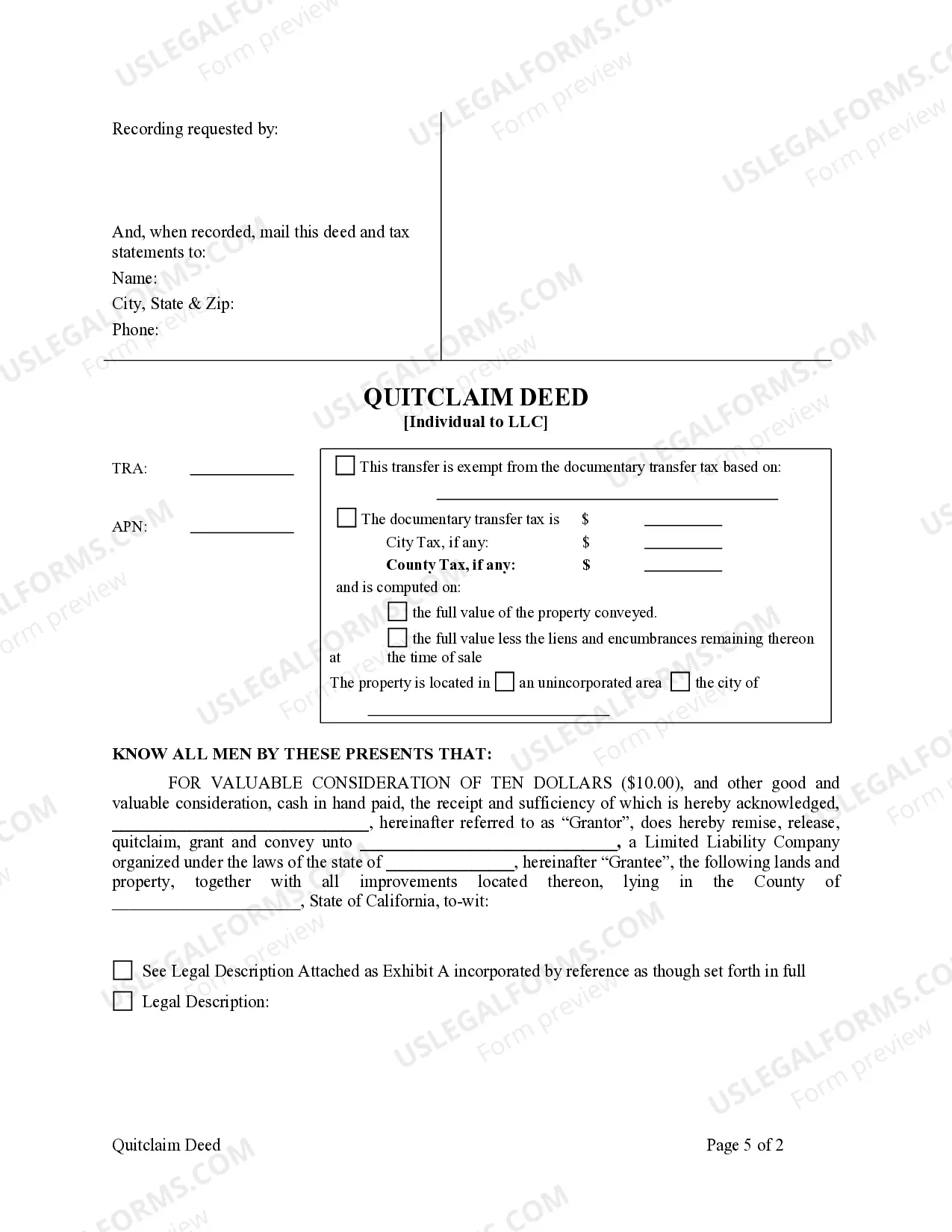

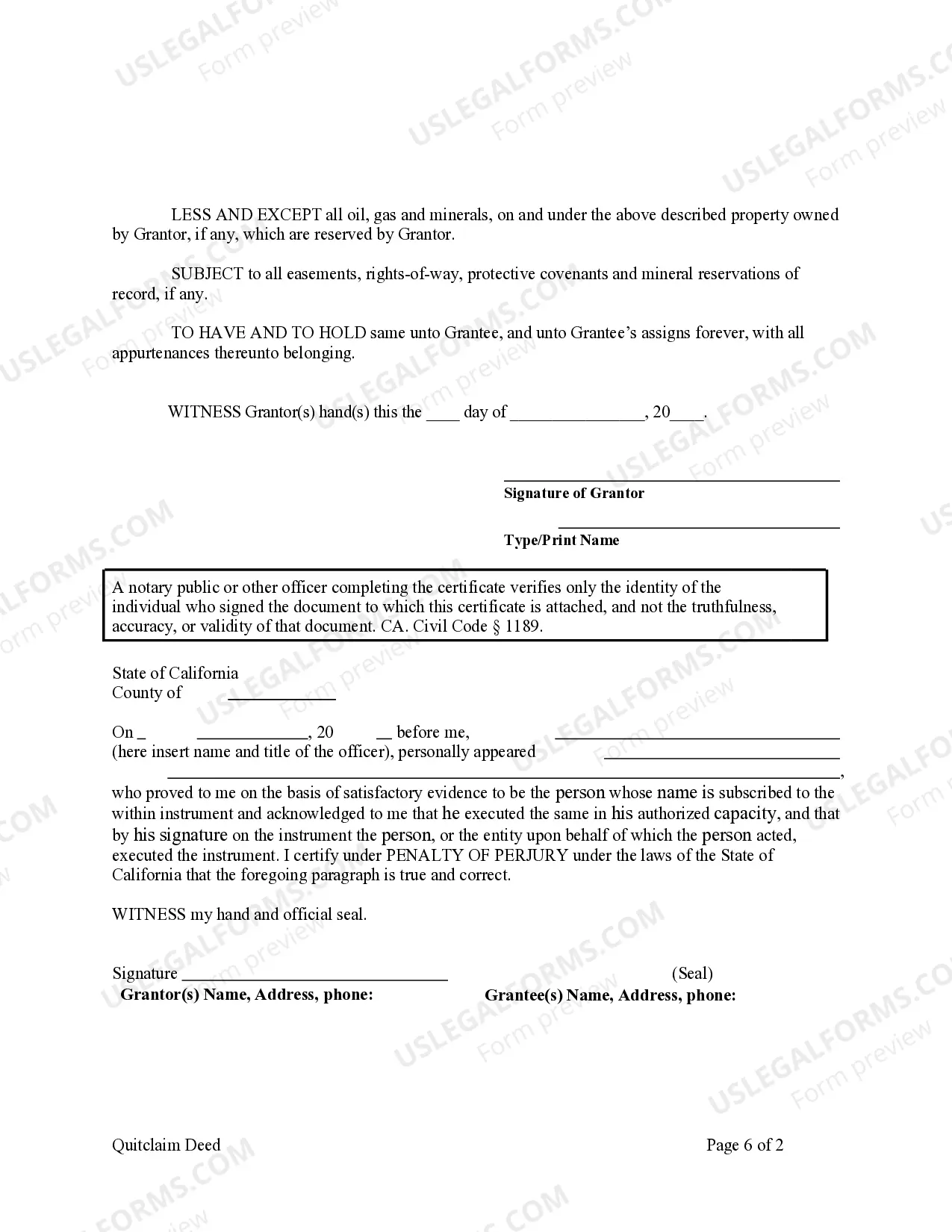

This Quitclaim Deed from Individual to LLC form is a Quitclaim Deed where the grantor is an individual and the grantee is a limited liability company. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

A Jurupa Valley California Quitclaim Deed from Individual to LLC is a legal document used to transfer ownership of real estate from an individual to a limited liability company (LLC). This type of deed is commonly utilized when an individual, referred to as the granter, wants to transfer their property rights to an LLC that they own or intend to establish. Keywords: Jurupa Valley California, Quitclaim Deed, Individual, LLC, ownership transfer, real estate, granter, property rights. There are different variations of Jurupa Valley California Quitclaim Deeds from Individual to LLC, depending on the specific circumstances and requirements of the parties involved. Some of the most common types include: 1. General Jurupa Valley California Quitclaim Deed from Individual to LLC: This is the standard form used when an individual wishes to transfer their ownership interest in real estate to an LLC. It includes basic information about the granter, the LLC, and the property being transferred. 2. Jurupa Valley California Quitclaim Deed from Individual to LLC with Consideration: This type of deed is used when there is a monetary exchange involved in the transfer of property. It includes details about the financial consideration or payment made from the LLC to the individual. 3. Jurupa Valley California Quitclaim Deed from Individual to LLC with Restrictive Covenants: In certain cases, the granter may want to impose specific restrictions or conditions on the use of the property by the LLC. This type of deed includes additional clauses outlining these restrictions and covenants. 4. Jurupa Valley California Quitclaim Deed from Individual to LLC with Partial Interest: If the individual only wants to transfer a portion of their ownership interest to the LLC, a deed with a partial interest clause is used. This allows for the division of ownership between the individual and the LLC. 5. Jurupa Valley California Quitclaim Deed from Individual to LLC for Tax Purposes: Sometimes, individuals choose to establish an LLC for tax planning purposes. This type of deed focuses on the appropriate language to reflect the transfer for tax planning or asset protection reasons. It is crucial to consult with a qualified attorney or legal professional to determine the most suitable type of Jurupa Valley California Quitclaim Deed from Individual to LLC based on your specific circumstances.A Jurupa Valley California Quitclaim Deed from Individual to LLC is a legal document used to transfer ownership of real estate from an individual to a limited liability company (LLC). This type of deed is commonly utilized when an individual, referred to as the granter, wants to transfer their property rights to an LLC that they own or intend to establish. Keywords: Jurupa Valley California, Quitclaim Deed, Individual, LLC, ownership transfer, real estate, granter, property rights. There are different variations of Jurupa Valley California Quitclaim Deeds from Individual to LLC, depending on the specific circumstances and requirements of the parties involved. Some of the most common types include: 1. General Jurupa Valley California Quitclaim Deed from Individual to LLC: This is the standard form used when an individual wishes to transfer their ownership interest in real estate to an LLC. It includes basic information about the granter, the LLC, and the property being transferred. 2. Jurupa Valley California Quitclaim Deed from Individual to LLC with Consideration: This type of deed is used when there is a monetary exchange involved in the transfer of property. It includes details about the financial consideration or payment made from the LLC to the individual. 3. Jurupa Valley California Quitclaim Deed from Individual to LLC with Restrictive Covenants: In certain cases, the granter may want to impose specific restrictions or conditions on the use of the property by the LLC. This type of deed includes additional clauses outlining these restrictions and covenants. 4. Jurupa Valley California Quitclaim Deed from Individual to LLC with Partial Interest: If the individual only wants to transfer a portion of their ownership interest to the LLC, a deed with a partial interest clause is used. This allows for the division of ownership between the individual and the LLC. 5. Jurupa Valley California Quitclaim Deed from Individual to LLC for Tax Purposes: Sometimes, individuals choose to establish an LLC for tax planning purposes. This type of deed focuses on the appropriate language to reflect the transfer for tax planning or asset protection reasons. It is crucial to consult with a qualified attorney or legal professional to determine the most suitable type of Jurupa Valley California Quitclaim Deed from Individual to LLC based on your specific circumstances.