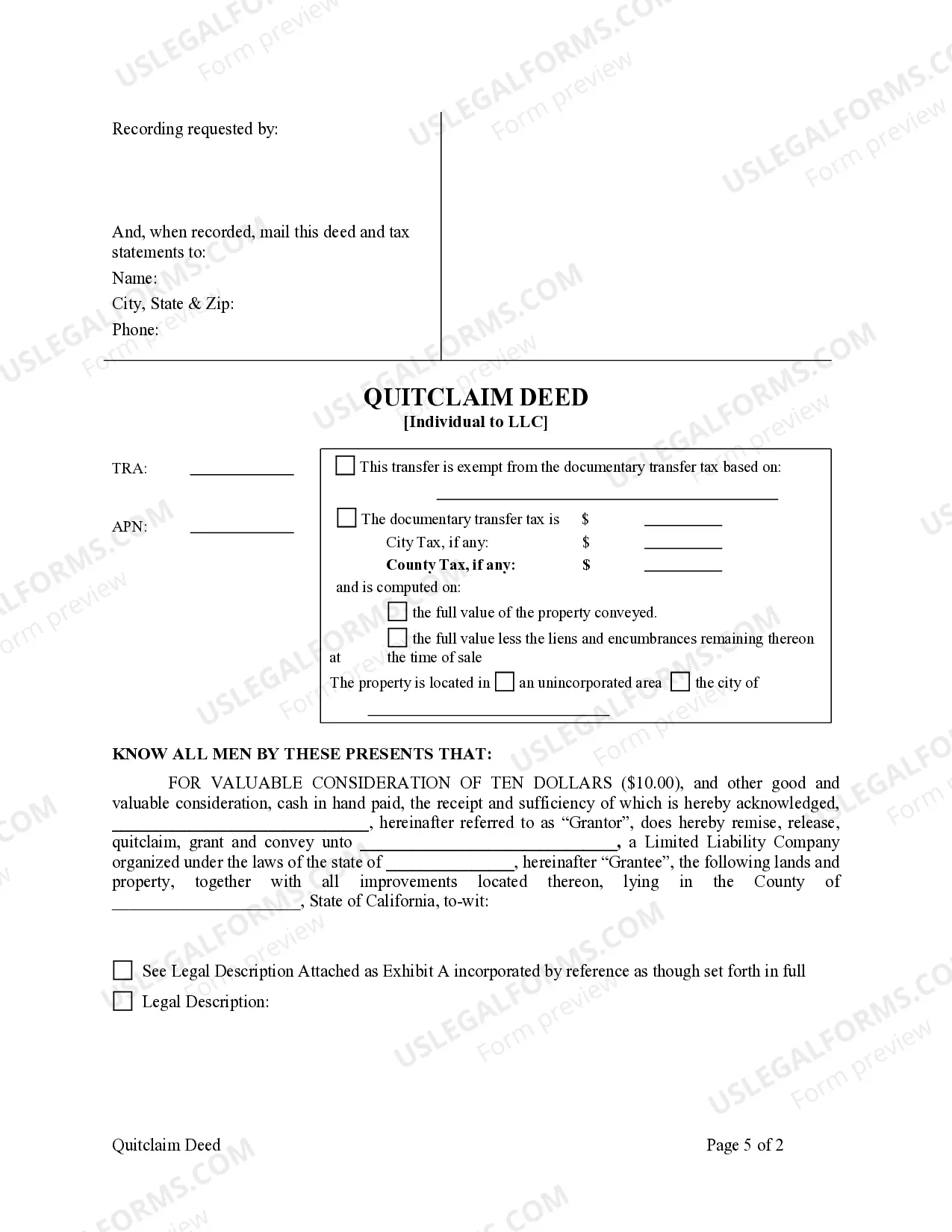

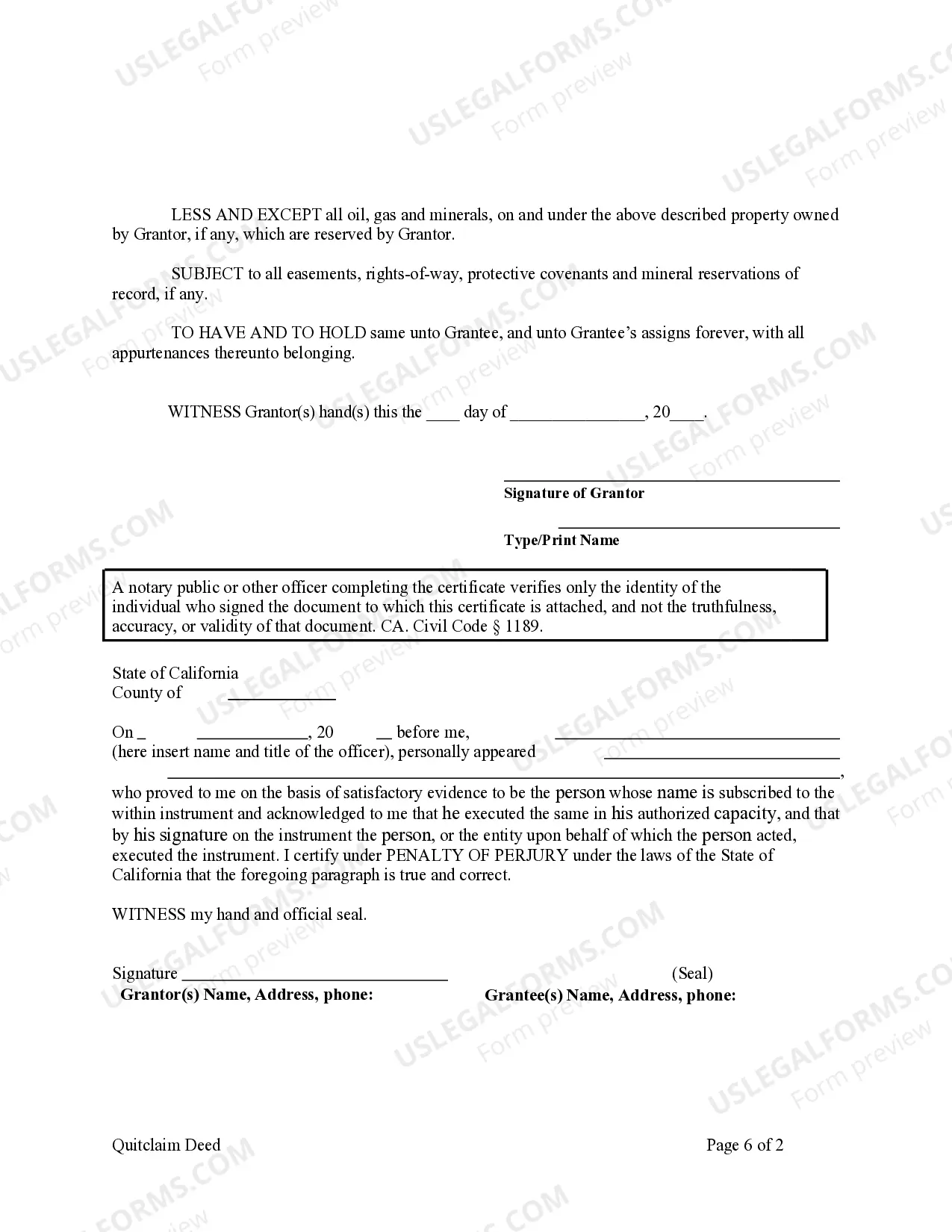

This Quitclaim Deed from Individual to LLC form is a Quitclaim Deed where the grantor is an individual and the grantee is a limited liability company. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

A Salinas California quitclaim deed from an individual to an LLC is a legal document used to transfer ownership of a property from an individual to a limited liability company (LLC). This type of deed is commonly used when a property owner wants to transfer their real estate holdings to an LLC they own or plan to establish. The quitclaim deed serves as a legal guarantee that the individual, known as the granter, is relinquishing all rights, interests, and claims they may have in the property to the LLC, called the grantee. It essentially allows the grantee to assume full ownership and control over the property. It is important to note that a quitclaim deed only transfers the granter's interest in the property at the time of the transfer. Unlike a warranty deed, it does not provide any warranties or guarantees regarding the property's title. Therefore, it is crucial for both parties involved to conduct a thorough property title search and due diligence before completing the transfer. In Salinas, California, there are no specific variations or types of quitclaim deeds from an individual to an LLC. However, it is highly recommended consulting with a real estate attorney or professional before proceeding with the transfer. They can provide guidance on the legal implications, tax considerations, and any specific requirements in Salinas or California that may affect the process. Some relevant keywords for this topic: — Salinas, California quitclaiDeeee— - Individual to LLC property transfer — Property ownership transfer in Salinas — Quitclaim deed process and requirements — Legal implications of transferring property to an LLC — Real estate transfer to a limited liability company — Importance of due diligence in property transfers — Title search and property ownership verification — Role of a real estate attorney in the transfer process — Tax considerations for property transfers in Salinas.A Salinas California quitclaim deed from an individual to an LLC is a legal document used to transfer ownership of a property from an individual to a limited liability company (LLC). This type of deed is commonly used when a property owner wants to transfer their real estate holdings to an LLC they own or plan to establish. The quitclaim deed serves as a legal guarantee that the individual, known as the granter, is relinquishing all rights, interests, and claims they may have in the property to the LLC, called the grantee. It essentially allows the grantee to assume full ownership and control over the property. It is important to note that a quitclaim deed only transfers the granter's interest in the property at the time of the transfer. Unlike a warranty deed, it does not provide any warranties or guarantees regarding the property's title. Therefore, it is crucial for both parties involved to conduct a thorough property title search and due diligence before completing the transfer. In Salinas, California, there are no specific variations or types of quitclaim deeds from an individual to an LLC. However, it is highly recommended consulting with a real estate attorney or professional before proceeding with the transfer. They can provide guidance on the legal implications, tax considerations, and any specific requirements in Salinas or California that may affect the process. Some relevant keywords for this topic: — Salinas, California quitclaiDeeee— - Individual to LLC property transfer — Property ownership transfer in Salinas — Quitclaim deed process and requirements — Legal implications of transferring property to an LLC — Real estate transfer to a limited liability company — Importance of due diligence in property transfers — Title search and property ownership verification — Role of a real estate attorney in the transfer process — Tax considerations for property transfers in Salinas.