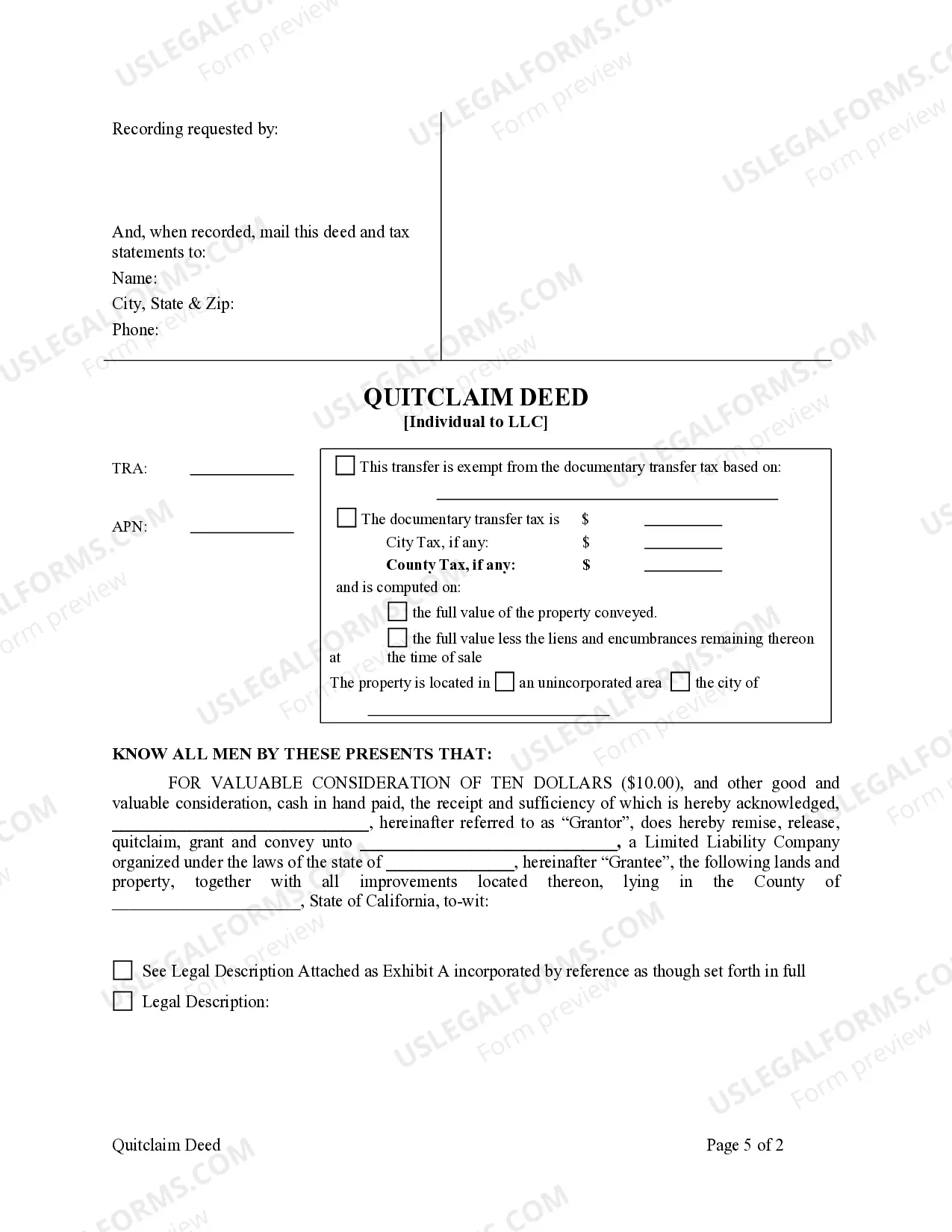

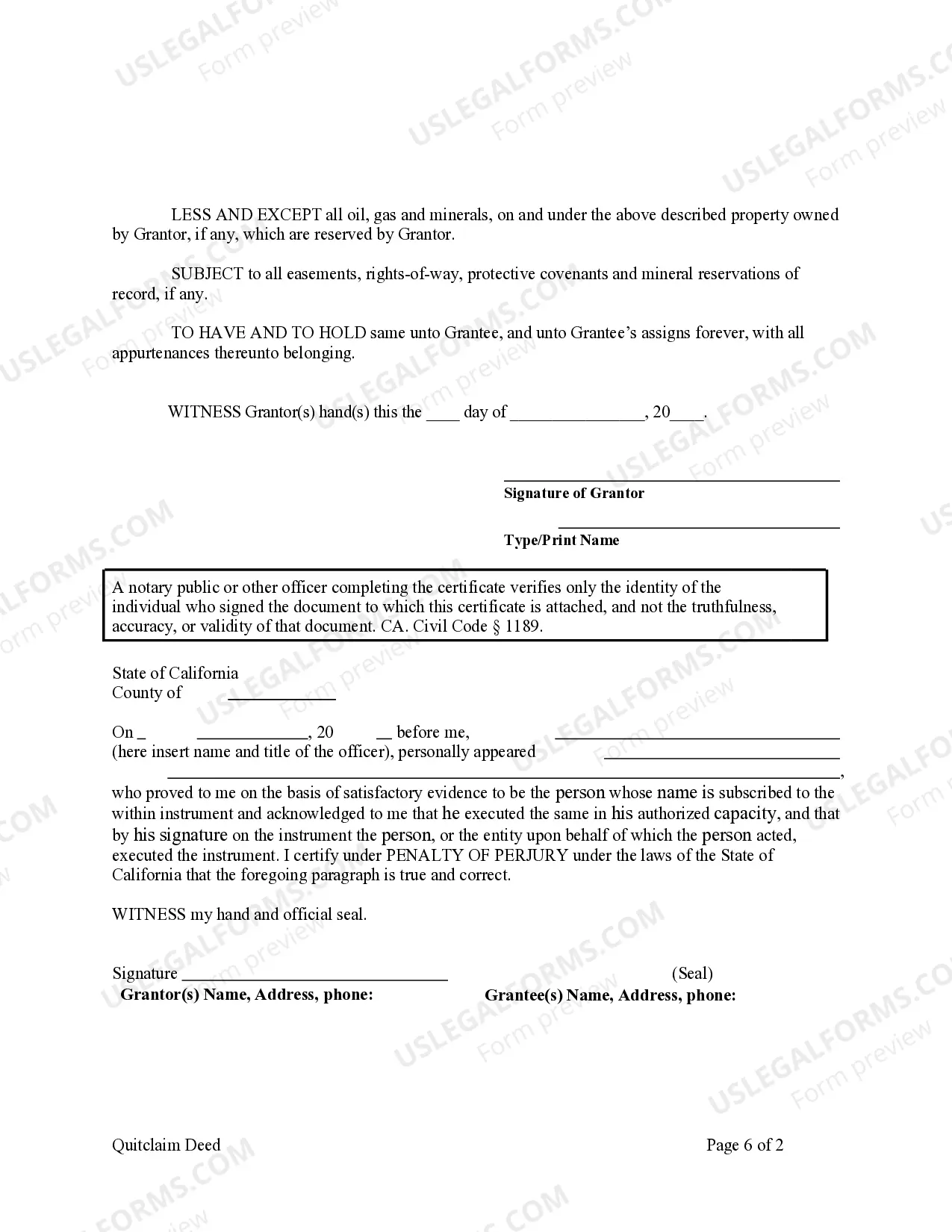

This Quitclaim Deed from Individual to LLC form is a Quitclaim Deed where the grantor is an individual and the grantee is a limited liability company. Grantor conveys and quitclaims the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantor, if any, which are reserved by Grantor.

A Temecula California quitclaim deed from an individual to an LLC is a legal document that transfers ownership of a property from an individual to a limited liability company (LLC) located in Temecula, California. This type of deed is commonly used when an individual wants to transfer their personal property into a business entity for various reasons, such as asset protection or business structuring purposes. In a Temecula California quitclaim deed from individual to LLC, the individual, referred to as the granter, relinquishes all rights and claims to the property and transfers it to the LLC, referred to as the grantee. It is important to note that a quitclaim deed does not guarantee ownership or provide any warranties on the property title, unlike a warranty deed. Instead, it simply conveys the granter's interest, if any, to the grantee. There may be different types or variations of Temecula California quitclaim deeds from individual to an LLC, depending on specific circumstances and intentions. Some examples of these distinctions may include: 1. Personal Asset Transfer: This type of quitclaim deed is used when an individual wants to transfer their personal property, such as a primary residence, vacation home, or rental property, into an LLC. This is commonly done for asset protection purposes, separating personal and business assets, and managing liability risks. 2. Business Asset Transfer: In certain cases, individuals may transfer a property they own as an individual into an LLC in order to incorporate it into their existing business. This may occur when the property is a valuable asset related to the company's operations, such as a warehouse, office space, or storefront. 3. Investment Property Transfer: Investors who possess properties solely for investment purposes could choose to transfer them to an LLC to streamline management, protect personal assets, and potentially gain tax advantages specific to business entities. 4. Inheritance or Estate Planning: Quitclaim deeds from individuals to LCS can also be utilized in estate planning, where property owners may transfer their assets to an LLC to simplify the distribution process and ensure proper management and protection of the inherited property. It is important to consult with a legal professional or a qualified real estate attorney to understand the specific requirements, implications, and potential tax consequences associated with the different types of Temecula California quitclaim deeds from individual to LCS. A thorough understanding of the intended purpose and relevant laws is crucial when considering such a property transfer.A Temecula California quitclaim deed from an individual to an LLC is a legal document that transfers ownership of a property from an individual to a limited liability company (LLC) located in Temecula, California. This type of deed is commonly used when an individual wants to transfer their personal property into a business entity for various reasons, such as asset protection or business structuring purposes. In a Temecula California quitclaim deed from individual to LLC, the individual, referred to as the granter, relinquishes all rights and claims to the property and transfers it to the LLC, referred to as the grantee. It is important to note that a quitclaim deed does not guarantee ownership or provide any warranties on the property title, unlike a warranty deed. Instead, it simply conveys the granter's interest, if any, to the grantee. There may be different types or variations of Temecula California quitclaim deeds from individual to an LLC, depending on specific circumstances and intentions. Some examples of these distinctions may include: 1. Personal Asset Transfer: This type of quitclaim deed is used when an individual wants to transfer their personal property, such as a primary residence, vacation home, or rental property, into an LLC. This is commonly done for asset protection purposes, separating personal and business assets, and managing liability risks. 2. Business Asset Transfer: In certain cases, individuals may transfer a property they own as an individual into an LLC in order to incorporate it into their existing business. This may occur when the property is a valuable asset related to the company's operations, such as a warehouse, office space, or storefront. 3. Investment Property Transfer: Investors who possess properties solely for investment purposes could choose to transfer them to an LLC to streamline management, protect personal assets, and potentially gain tax advantages specific to business entities. 4. Inheritance or Estate Planning: Quitclaim deeds from individuals to LCS can also be utilized in estate planning, where property owners may transfer their assets to an LLC to simplify the distribution process and ensure proper management and protection of the inherited property. It is important to consult with a legal professional or a qualified real estate attorney to understand the specific requirements, implications, and potential tax consequences associated with the different types of Temecula California quitclaim deeds from individual to LCS. A thorough understanding of the intended purpose and relevant laws is crucial when considering such a property transfer.