This Warranty Deed from Individual to LLC form is a Warranty Deed where the grantor is an individual and the grantee is a limited liability company. Grantor conveys and warrants the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

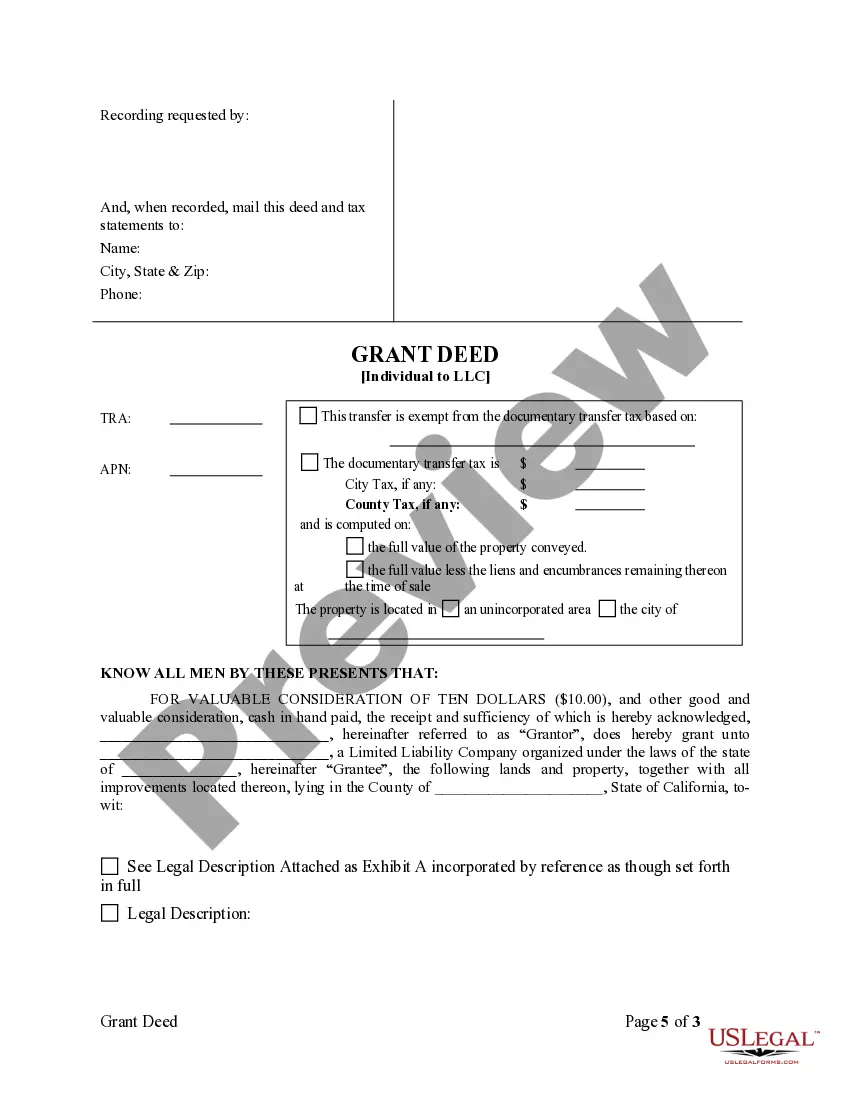

A Murrieta California Grant Deed from Individual to LLC is a legal document that facilitates the transfer of ownership of real property from an individual to a limited liability company (LLC) in the city of Murrieta, California. This transaction is commonly used when an individual wishes to transfer property owned in their personal capacity to an LLC that they own or are affiliated with. A Grant Deed is a legally binding instrument that conveys the ownership of real property from one party to another. In this case, the individual (granter) transfers their interest in the property to the LLC (grantee). The granter, by executing the deed, guarantees that they have the legal right to transfer the property and that no other claims or liens exist against it, except those mentioned in the deed. This type of transfer can have several significant benefits. One key advantage is the protection it offers to the individual's personal assets. By transferring the property to an LLC, the individual effectively separates their personal liability from the LLC's liability, shielding their personal assets from potential legal claims or debts related to the property. Additionally, transferring property to an LLC can also provide tax benefits and simplify the management of the property, especially if multiple individuals are involved in its ownership or if it is being used for business purposes. Murrieta California Grant Deed from Individual to LLC can come in various forms, depending on the specific circumstances and requirements of the parties involved. Some common variations include: 1. General Grant Deed: This type of deed transfers the property ownership to the LLC without any specific warranties or guarantees, except that the granter has not conveyed the property to anyone else. 2. Special Warranty Deed: This deed provides limited warranties from the granter, assuring that they have not done anything that would negatively impact the title and ownership of the property, except as mentioned in the deed. 3. Quitclaim Deed: This type of deed transfers the granter's interest in the property without any warranties or guarantees. It is often used when the granter's ownership interest may be uncertain or when the property is being transferred between family members or affiliated entities. In conclusion, a Murrieta California Grant Deed from Individual to LLC is a legal document that facilitates the transfer of property ownership from an individual to an LLC in Murrieta, California. This type of transfer offers asset protection, tax benefits, and simplified management for the property. Different variations of the grant deed, such as general grant deed, special warranty deed, and quitclaim deed, may be used depending on the specific circumstances of the transfer.