This Warranty Deed from Individual to LLC form is a Warranty Deed where the grantor is an individual and the grantee is a limited liability company. Grantor conveys and warrants the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

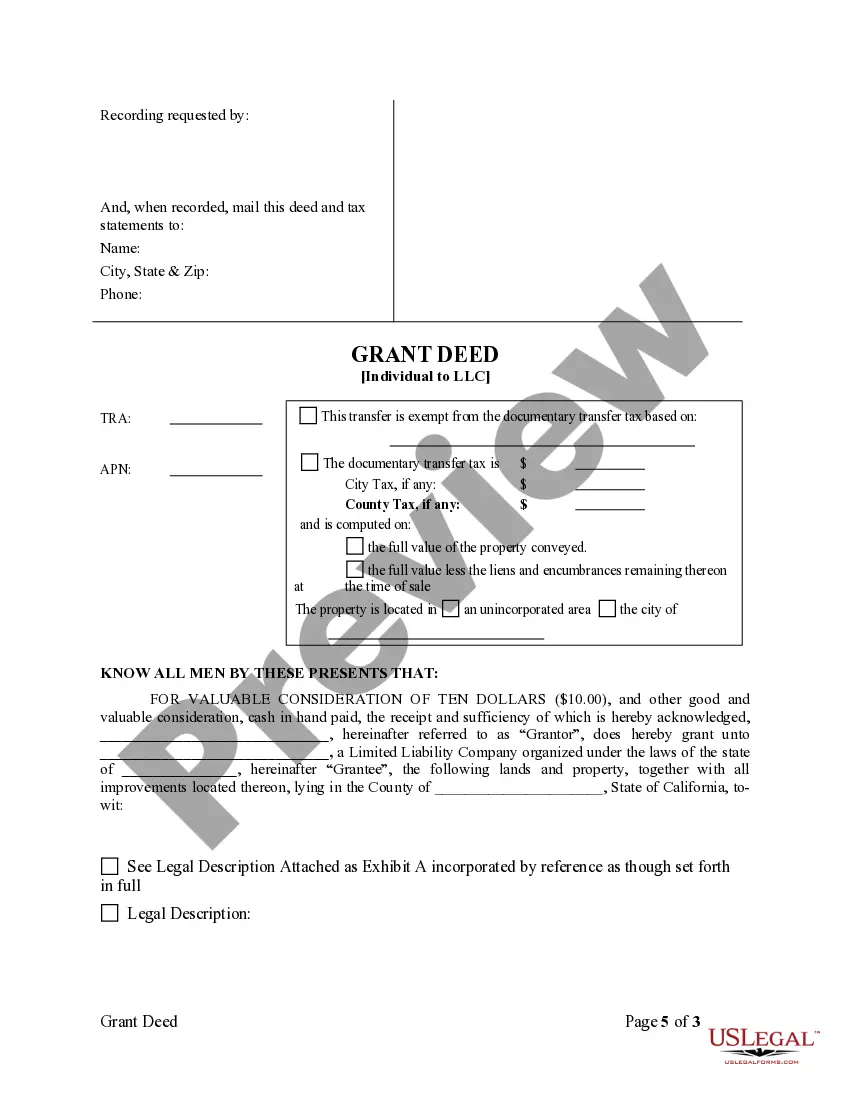

Sacramento California Grant Deed from Individual to LLC: A grant deed is a legal document used to transfer ownership of real property from one party to another. In the case of a Sacramento California Grant Deed from Individual to LLC, it involves the transfer of property ownership from an individual to a limited liability company (LLC) in the Sacramento area. This type of transfer is commonly used when an individual decides to transfer their personal property into an LLC they own or establish for various reasons, such as asset protection, tax benefits, or for business purposes. It allows the individual to retain control over the property while enjoying the advantages of conducting business or holding assets through an LLC. A Sacramento California Grant Deed from Individual to LLC typically includes specific keywords such as: 1. Sacramento County: Indicates that the property is located within the jurisdiction of Sacramento County, California. 2. Granter: The individual who currently holds ownership of the property and is transferring it to the LLC. 3. Grantee: The LLC that is receiving ownership of the property. 4. Legal description of the property: This includes detailed information about the property, such as its boundaries, lot number, and any encumbrances or restrictions on its use. 5. Assessor's Parcel Number (APN): A unique identifier assigned to the property by the County Assessor's Office. 6. Consideration: The amount of money or other valuable consideration exchanged between the parties as part of the transfer. Note that in some cases the transfer may be for nominal consideration or even without consideration. 7. Execution and acknowledgment information: The grant deed must be signed and notarized by the granter, then recorded with the County Recorder's Office to make the transfer legally binding. 8. Governing law and jurisdiction: Typically, the grant deed will contain provisions specifying that the transfer is governed by the laws of the State of California and that any disputes will be subject to the jurisdiction of the Sacramento County courts. It is worth mentioning that there are no specific types of Sacramento California Grant Deed from Individual to LLC, but variations may occur depending on the specific circumstances and purpose of the transfer. These variations may include alterations to the consideration, terms, or additional clauses to protect the interests of either party. In conclusion, a Sacramento California Grant Deed from Individual to LLC is a legal instrument used to transfer property ownership from an individual to a limited liability company in the Sacramento area. This document ensures a smooth and legally binding transfer of property rights while providing the individual with the benefits associated with conducting business or holding assets through an LLC.