This Warranty Deed from Individual to LLC form is a Warranty Deed where the grantor is an individual and the grantee is a limited liability company. Grantor conveys and warrants the described property to grantee less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

Vallejo California Grant Deed from Individual to LLC

Description

How to fill out California Grant Deed From Individual To LLC?

We consistently endeavor to reduce or evade legal repercussions when addressing intricate law-related or fiscal matters.

To achieve this, we engage in legal services which are typically quite costly.

However, not every legal challenge is similarly complicated; many of them can be managed independently.

US Legal Forms is an online directory of current DIY legal documents encompassing a range of items from wills and powers of attorney to articles of incorporation and petitions for dissolution.

Just Log In to your account and click the Get button beside it. Should you misplace the form, you can effortlessly download it again in the My documents section. The procedure is equally simple if you are a newcomer to the site! You can establish your account in a few minutes. Ensure that the Vallejo California Grant Deed from Individual to LLC adheres to the laws and regulations of your state and locality. Additionally, it’s vital to review the form’s structure (if provided), and if you observe any inconsistencies with what you initially sought, look for an alternative template. Once you’ve confirmed that the Vallejo California Grant Deed from Individual to LLC meets your needs, you can choose a subscription plan and process the payment. You can then download the form in any appropriate file format. For more than 24 years in the industry, we’ve assisted millions of individuals by providing ready-to-use and current legal documents. Take advantage of US Legal Forms today to conserve time and resources!

- Our repository empowers you to handle your affairs independently without seeking legal advice.

- We facilitate access to legal form templates that may not always be publicly accessible.

- Our templates cater to specific states and regions, greatly easing the search process.

- Leverage US Legal Forms whenever you need to obtain and download the Vallejo California Grant Deed from Individual to LLC or any other form swiftly and securely.

Form popularity

FAQ

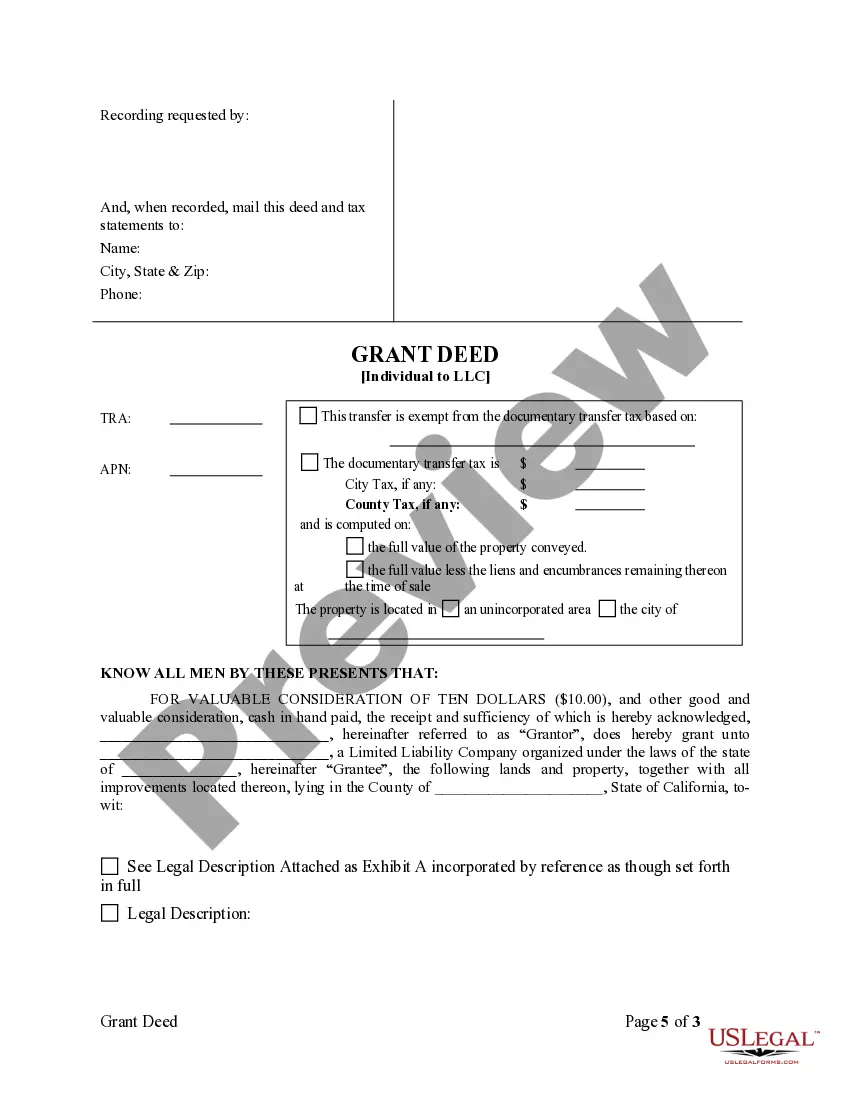

To notarize a grant deed in California, you must first sign the deed in front of a notary public. The notary will then verify your identity and witness the signature, adding their signature and seal to the document. This step is crucial for validating your Vallejo California Grant Deed from Individual to LLC, so ensure you complete it properly for legal protection.

Filling out a grant deed California template involves entering the names of the grantor and grantee, followed by the property's legal description. You can find a user-friendly template on USLegalForms that guides you through the process step-by-step. This ensures that your Vallejo California Grant Deed from Individual to LLC is completed accurately and legally.

To write a simple deed, start by stating the names of the parties involved in the transaction. Next, include a clear description of the property, followed by a statement of the transfer. Make sure to sign the deed and consider using a template from USLegalForms for a Vallejo California Grant Deed from Individual to LLC to ensure compliance with local laws.

A valid grant deed in California must clearly identify the grantor and grantee. It should contain a legal description of the property, as well as the grantor's intention to transfer ownership. Additionally, the deed must be signed by the grantor and should be notarized, ensuring that it meets the legal requirements for a Vallejo California Grant Deed from Individual to LLC.

To transfer a title from an individual to an LLC in Vallejo, California, you need to prepare a Vallejo California Grant Deed from Individual to LLC. First, ensure that the LLC is properly registered with the state. Next, complete the grant deed form, detailing the ownership transfer, and have it signed by the individual transferring the title. Finally, record the deed at your local county recorder's office to make the transfer official.

Transferring property to an LLC in California involves filing the appropriate deed and potentially notifying lenders if there is a mortgage involved. Proper documentation, such as a Vallejo California Grant Deed from Individual to LLC, is crucial to ensure the transaction meets legal standards. Seeking guidance can simplify this process.

To transfer a deed from an individual to an LLC, you need to complete a deed document and comply with state requirements. This includes completing the Vallejo California Grant Deed from Individual to LLC, which formalizes the change of ownership. Consulting a legal expert can ensure that every step is executed accurately.

Transferring assets from personal ownership to a business requires clear documentation to establish ownership transition. Begin by identifying the assets and drafting the necessary paperwork, like a Vallejo California Grant Deed from Individual to LLC. This process protects both your personal and business interests.

To transfer personal assets to an LLC, you generally need to draft a formal deed or agreement showing the asset transfer. This includes real estate, vehicles, or any tangible assets you own. When handling the specifics, such as a Vallejo California Grant Deed from Individual to LLC, it's beneficial to consult professionals to ensure compliance with local laws.

Transferring personal funds to your LLC is possible and often necessary for its operation. These funds can provide capital for business expenses and growth. Make sure to document this transfer properly to maintain clear financial records, especially when dealing with a Vallejo California Grant Deed from Individual to LLC.