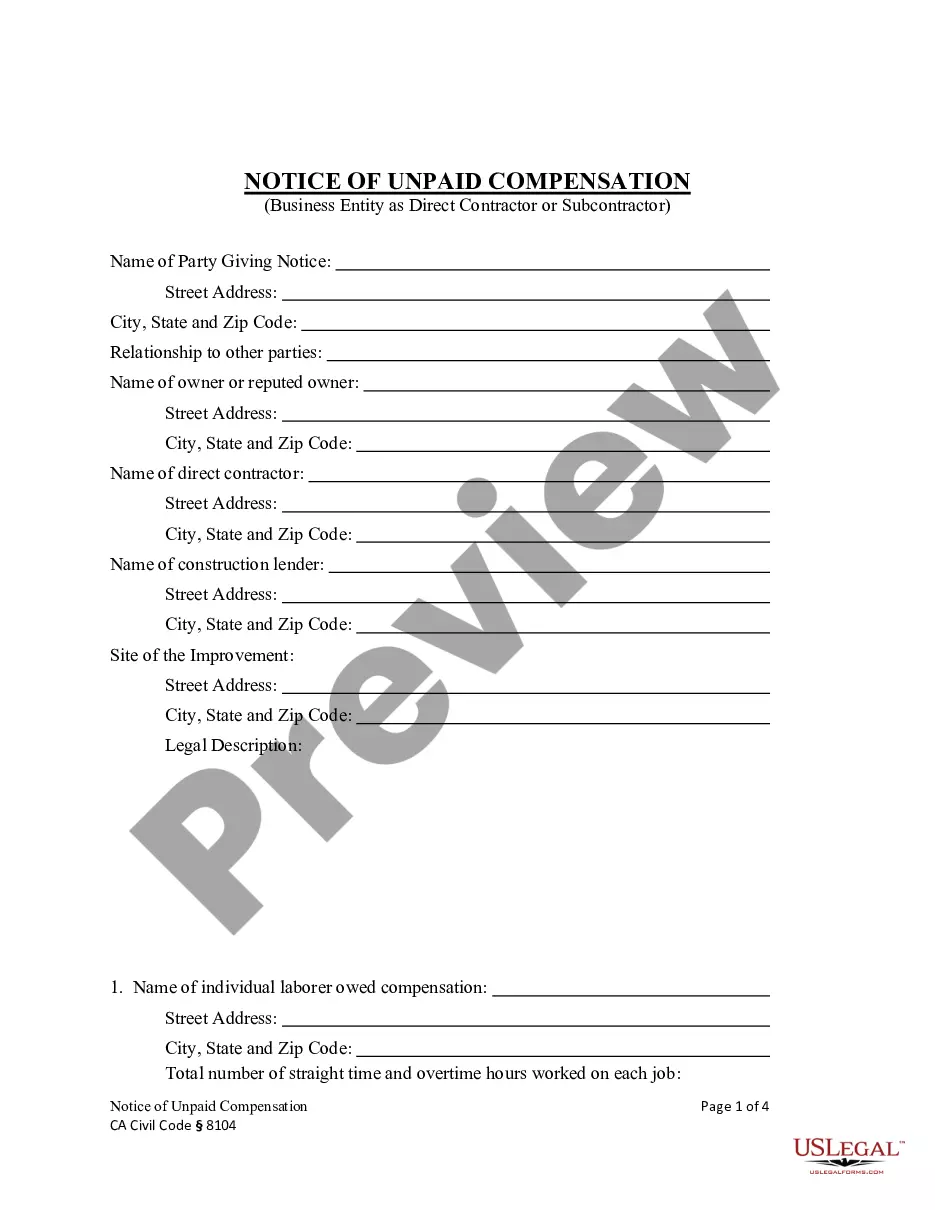

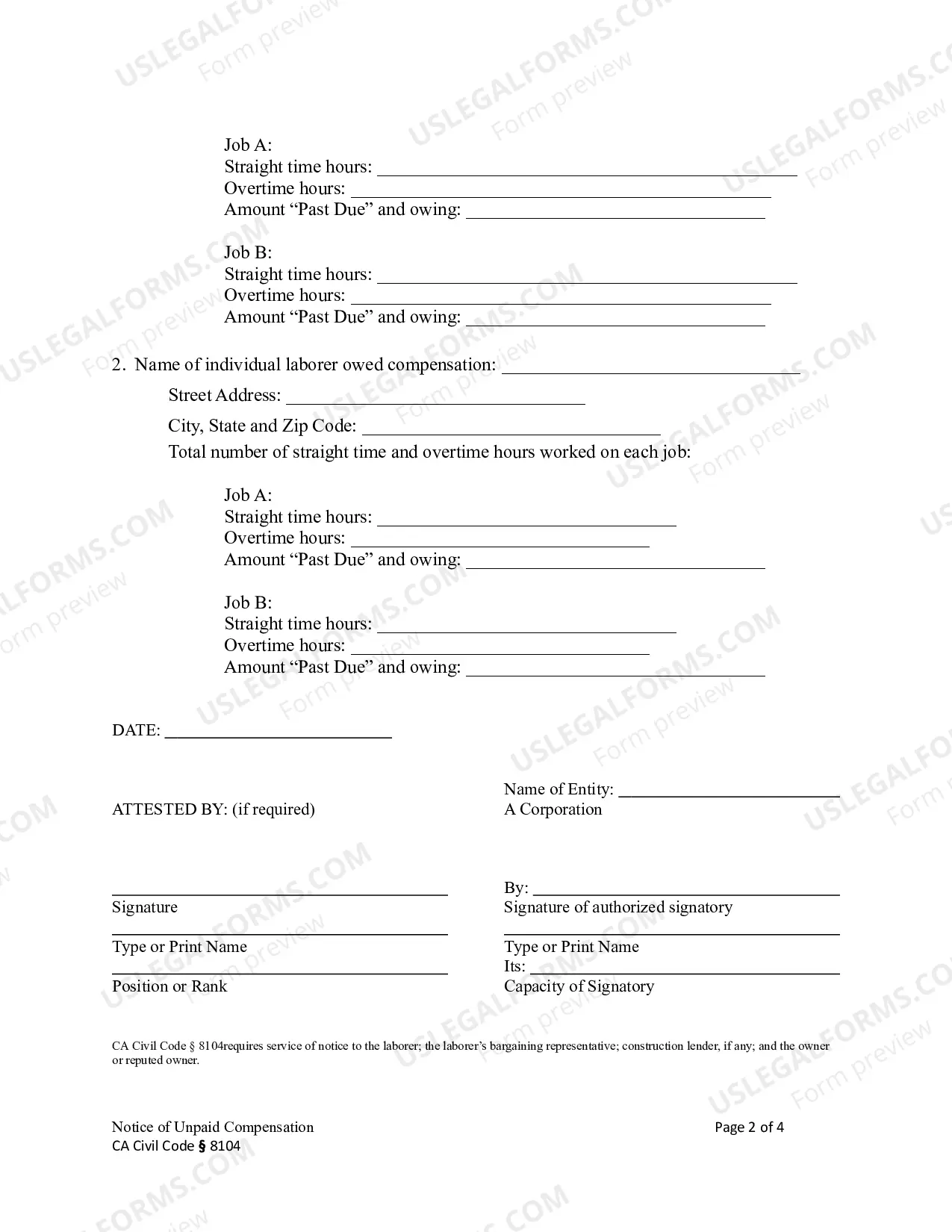

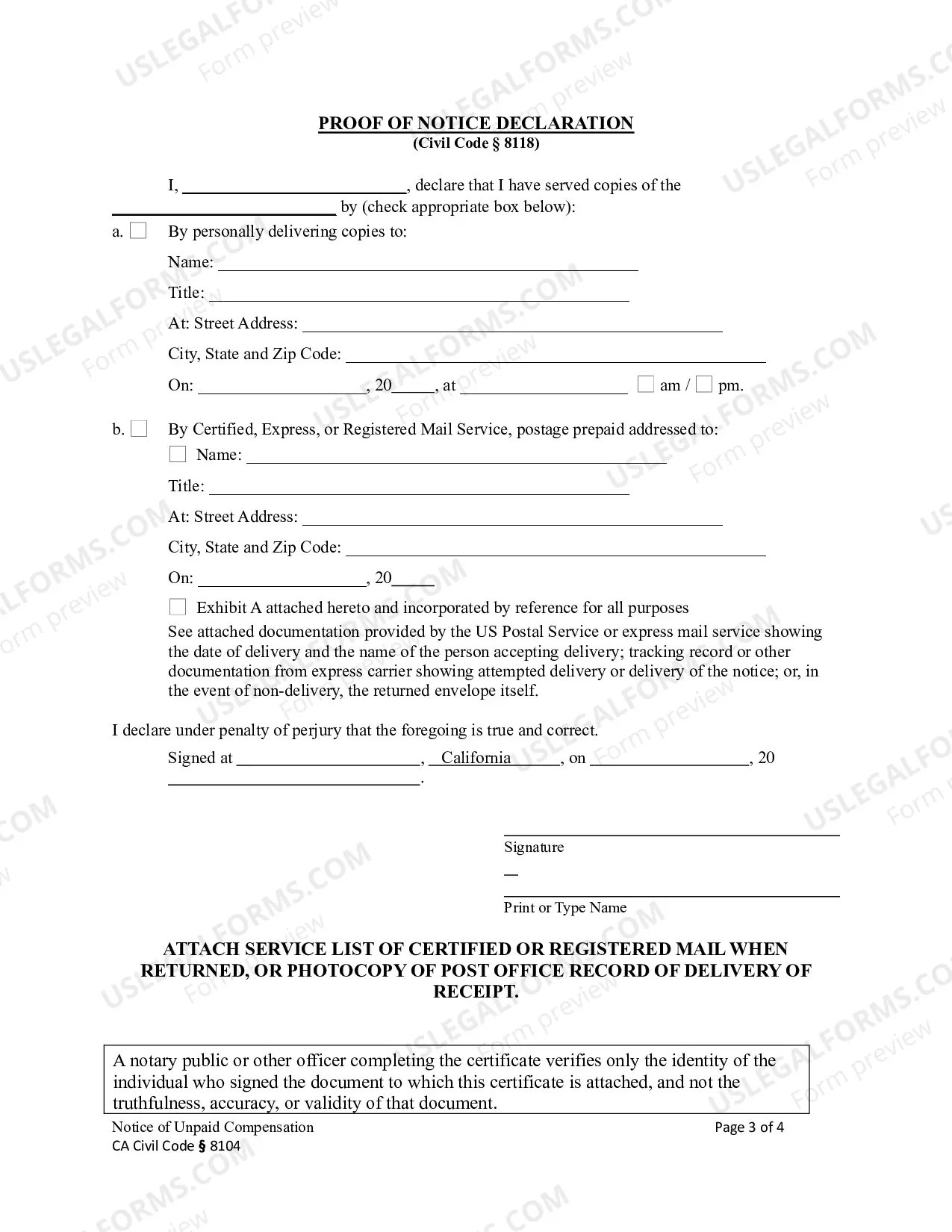

This form is used by the direct contractor or the subcontractor to give notice that a laborer employed on the project has not been paid. Notice must be given to the laborer; the laborer's bargaining representative, if any; the construction lender; and, the owner. Formatted for signature by a limited liability company or corporation.

Corona California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 is a legal document that serves as a formal notice to alert corporations or limited liability companies (LCS) in the construction industry in Corona, California about unpaid compensation. This notice is governed by Civil Code Section 8104, which outlines the specific requirements and procedures for filing such liens. The purpose of the Corona California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 is to protect the rights of contractors, subcontractors, suppliers, and other parties involved in construction projects by providing a mechanism to claim unpaid compensation. There are a few different types of Corona California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 that can be filed, depending on the nature of the claim: 1. General Contractor's Notice of Unpaid Compensation: This type of notice is filed by a general contractor who has not been fully compensated for their services on a construction project. It informs the business entity, whether a corporation or LLC, that they have a lien against the property and may pursue legal action to recover their unpaid compensation. 2. Subcontractor's Notice of Unpaid Compensation: Subcontractors who have not received full payment for their work on a construction project can file this notice against the business entity. It asserts their right to a lien on the property and warns the corporation or LLC about potential legal consequences if the compensation is not settled. 3. Supplier's Notice of Unpaid Compensation: This notice is filed by suppliers who have not been paid for providing materials or equipment for a construction project. It alerts the business entity that the supplier has a right to claim a lien on the property and may take legal action to collect their unpaid compensation. Regardless of the specific type, every Corona California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 must include essential information. This includes details about the construction project, a description of the work or materials provided, the amount of unpaid compensation, and a statement requesting payment within a given timeframe. It is crucial for business entities to respond promptly upon receiving this notice, as failing to address the claims can result in further legal action, including potentially costly lawsuits. Both contractors and business entities should consult legal professionals to ensure compliance with the requirements and to protect their rights and interests in such matters.Corona California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 is a legal document that serves as a formal notice to alert corporations or limited liability companies (LCS) in the construction industry in Corona, California about unpaid compensation. This notice is governed by Civil Code Section 8104, which outlines the specific requirements and procedures for filing such liens. The purpose of the Corona California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 is to protect the rights of contractors, subcontractors, suppliers, and other parties involved in construction projects by providing a mechanism to claim unpaid compensation. There are a few different types of Corona California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 that can be filed, depending on the nature of the claim: 1. General Contractor's Notice of Unpaid Compensation: This type of notice is filed by a general contractor who has not been fully compensated for their services on a construction project. It informs the business entity, whether a corporation or LLC, that they have a lien against the property and may pursue legal action to recover their unpaid compensation. 2. Subcontractor's Notice of Unpaid Compensation: Subcontractors who have not received full payment for their work on a construction project can file this notice against the business entity. It asserts their right to a lien on the property and warns the corporation or LLC about potential legal consequences if the compensation is not settled. 3. Supplier's Notice of Unpaid Compensation: This notice is filed by suppliers who have not been paid for providing materials or equipment for a construction project. It alerts the business entity that the supplier has a right to claim a lien on the property and may take legal action to collect their unpaid compensation. Regardless of the specific type, every Corona California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 must include essential information. This includes details about the construction project, a description of the work or materials provided, the amount of unpaid compensation, and a statement requesting payment within a given timeframe. It is crucial for business entities to respond promptly upon receiving this notice, as failing to address the claims can result in further legal action, including potentially costly lawsuits. Both contractors and business entities should consult legal professionals to ensure compliance with the requirements and to protect their rights and interests in such matters.