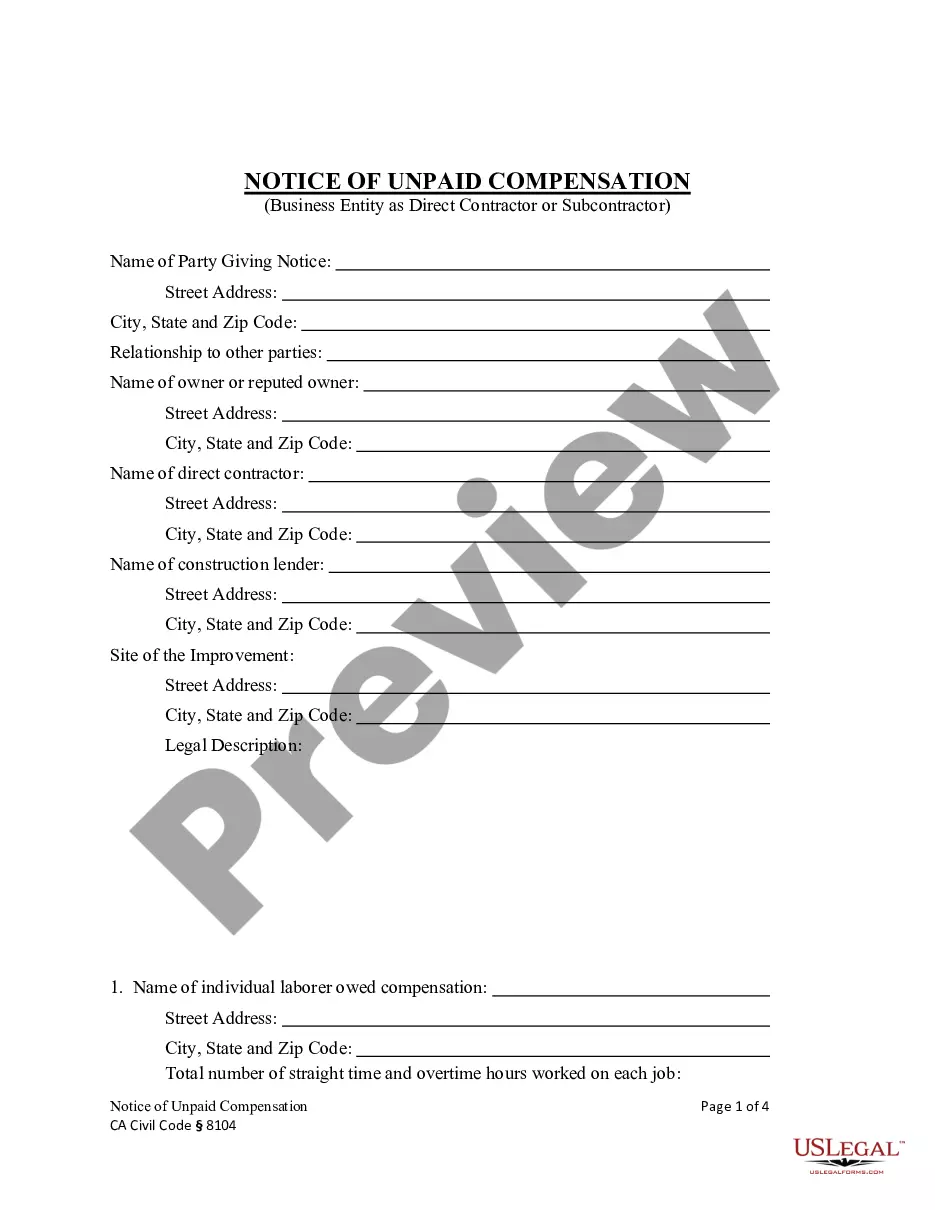

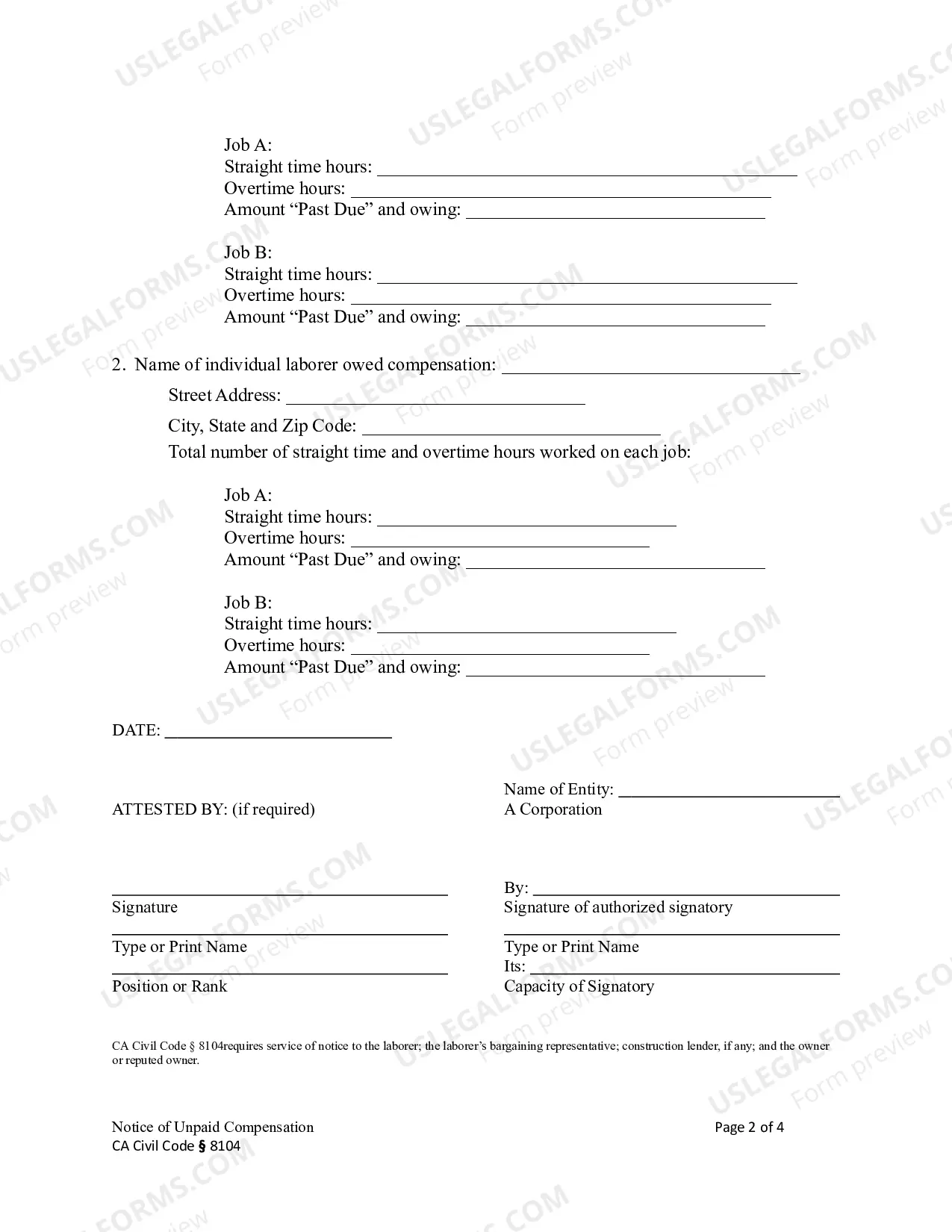

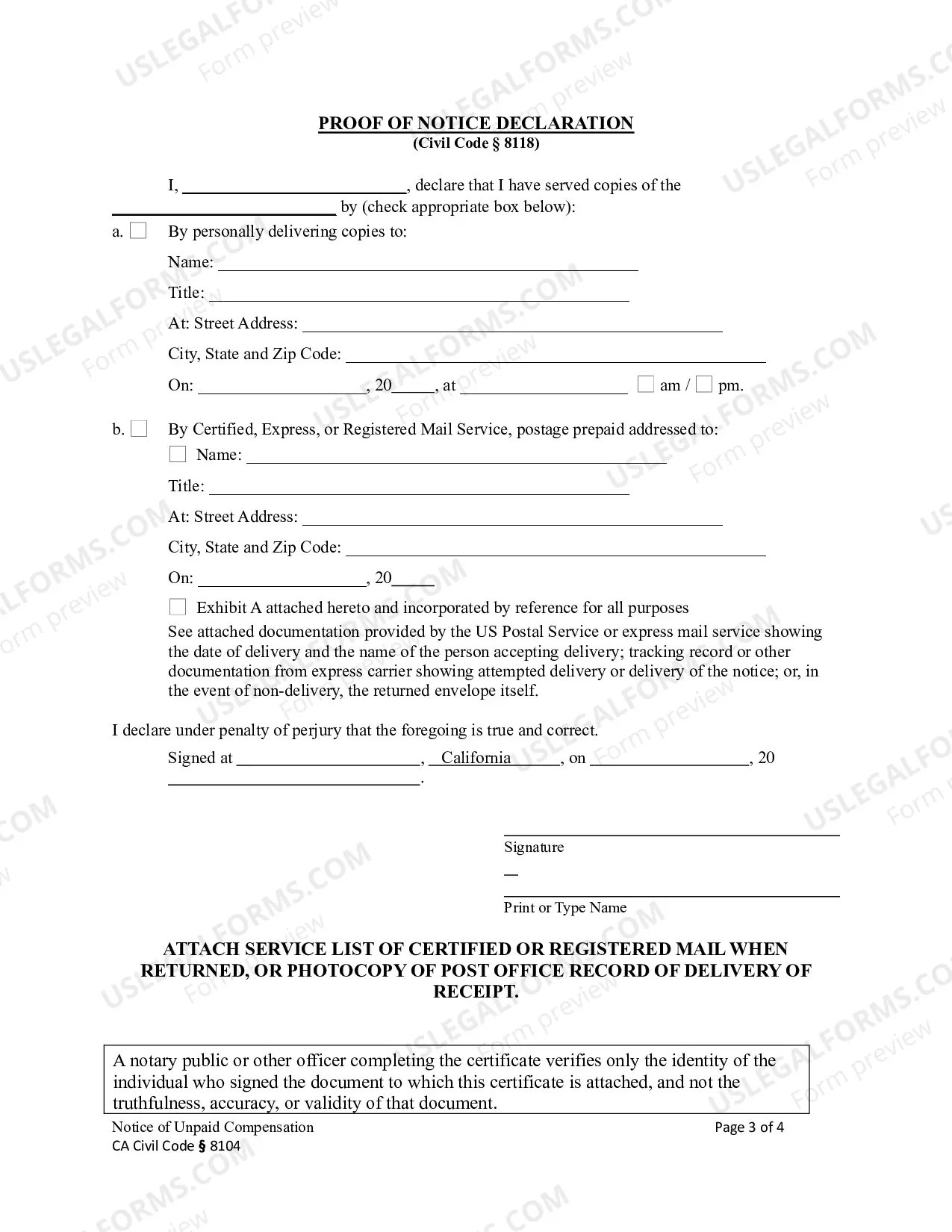

This form is used by the direct contractor or the subcontractor to give notice that a laborer employed on the project has not been paid. Notice must be given to the laborer; the laborer's bargaining representative, if any; the construction lender; and, the owner. Formatted for signature by a limited liability company or corporation.

The El Cajon California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 serves as a crucial legal document in situations where a construction entity such as a corporation or LLC has unpaid compensation owed to contractors, suppliers, or laborers. This notice is designed to inform all relevant parties and create a lien against the property until the outstanding payment is resolved. In California, several types of El Cajon California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 notices can be distinguished based on the specific circumstances and parties involved. Here are a few examples: 1. General Unpaid Compensation Notice: This notice is typically used when a construction corporation or LLC encounters a situation where it has not paid the contractors, laborers, or suppliers for their services or materials. The purpose of this notice is to officially inform all parties involved, including the property owner, that the business entity has outstanding payment obligations. 2. Preliminary Notice of Unpaid Compensation: This type of notice is issued by a corporation or LLC at the beginning of a construction project to provide an early warning to potential claimants, including contractors, material suppliers, and laborers. It is crucial in ensuring that all parties are aware of the business entity's involvement and potential compensation obligations. 3. Release of Lien Notice: Once the construction entity has settled its unpaid compensation, it may issue a Release of Lien Notice. This document serves as evidence that the outstanding debts have been fully paid, absolving the property from any liens related to the unpaid compensation. Additionally, it is essential to note that the El Cajon California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 is guided by California's Civil Code Section 8104, which outlines the specific legal requirements and obligations for such notices. Compliance with this code is crucial to ensure the effectiveness and validity of the notices. Overall, the El Cajon California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 plays a vital role in protecting the rights of contractors, laborers, and suppliers involved in construction projects, while also ensuring businesses meet their financial obligations.The El Cajon California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 serves as a crucial legal document in situations where a construction entity such as a corporation or LLC has unpaid compensation owed to contractors, suppliers, or laborers. This notice is designed to inform all relevant parties and create a lien against the property until the outstanding payment is resolved. In California, several types of El Cajon California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 notices can be distinguished based on the specific circumstances and parties involved. Here are a few examples: 1. General Unpaid Compensation Notice: This notice is typically used when a construction corporation or LLC encounters a situation where it has not paid the contractors, laborers, or suppliers for their services or materials. The purpose of this notice is to officially inform all parties involved, including the property owner, that the business entity has outstanding payment obligations. 2. Preliminary Notice of Unpaid Compensation: This type of notice is issued by a corporation or LLC at the beginning of a construction project to provide an early warning to potential claimants, including contractors, material suppliers, and laborers. It is crucial in ensuring that all parties are aware of the business entity's involvement and potential compensation obligations. 3. Release of Lien Notice: Once the construction entity has settled its unpaid compensation, it may issue a Release of Lien Notice. This document serves as evidence that the outstanding debts have been fully paid, absolving the property from any liens related to the unpaid compensation. Additionally, it is essential to note that the El Cajon California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 is guided by California's Civil Code Section 8104, which outlines the specific legal requirements and obligations for such notices. Compliance with this code is crucial to ensure the effectiveness and validity of the notices. Overall, the El Cajon California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 plays a vital role in protecting the rights of contractors, laborers, and suppliers involved in construction projects, while also ensuring businesses meet their financial obligations.