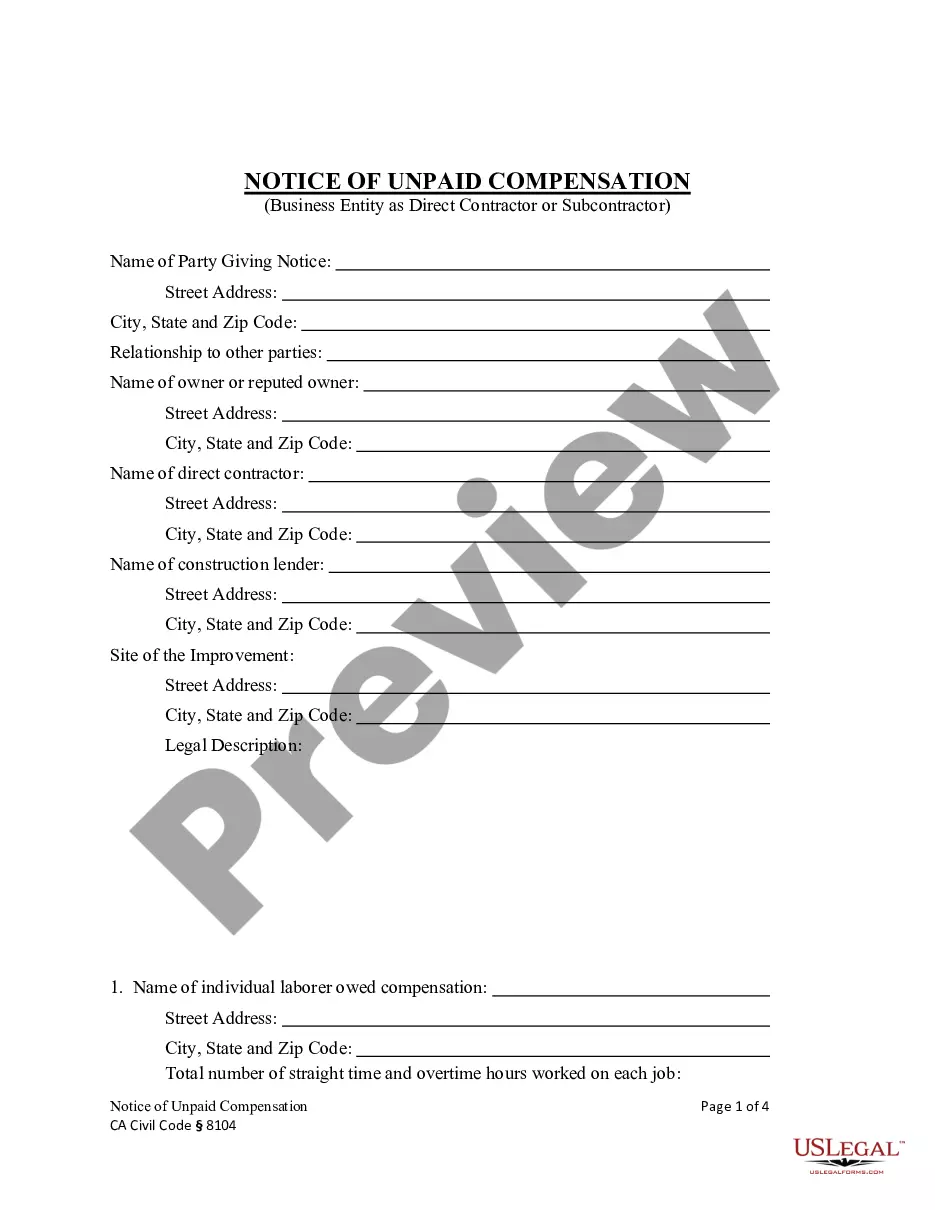

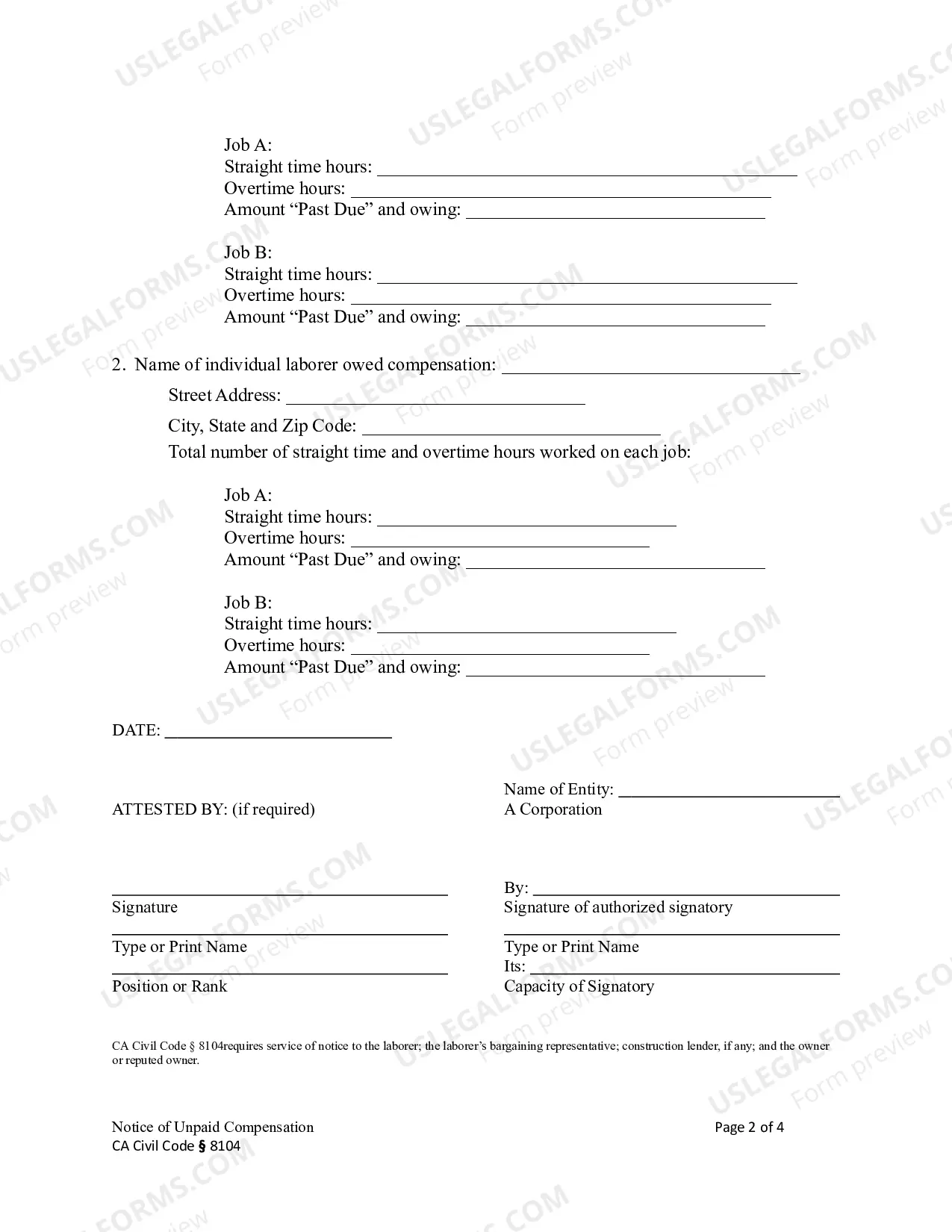

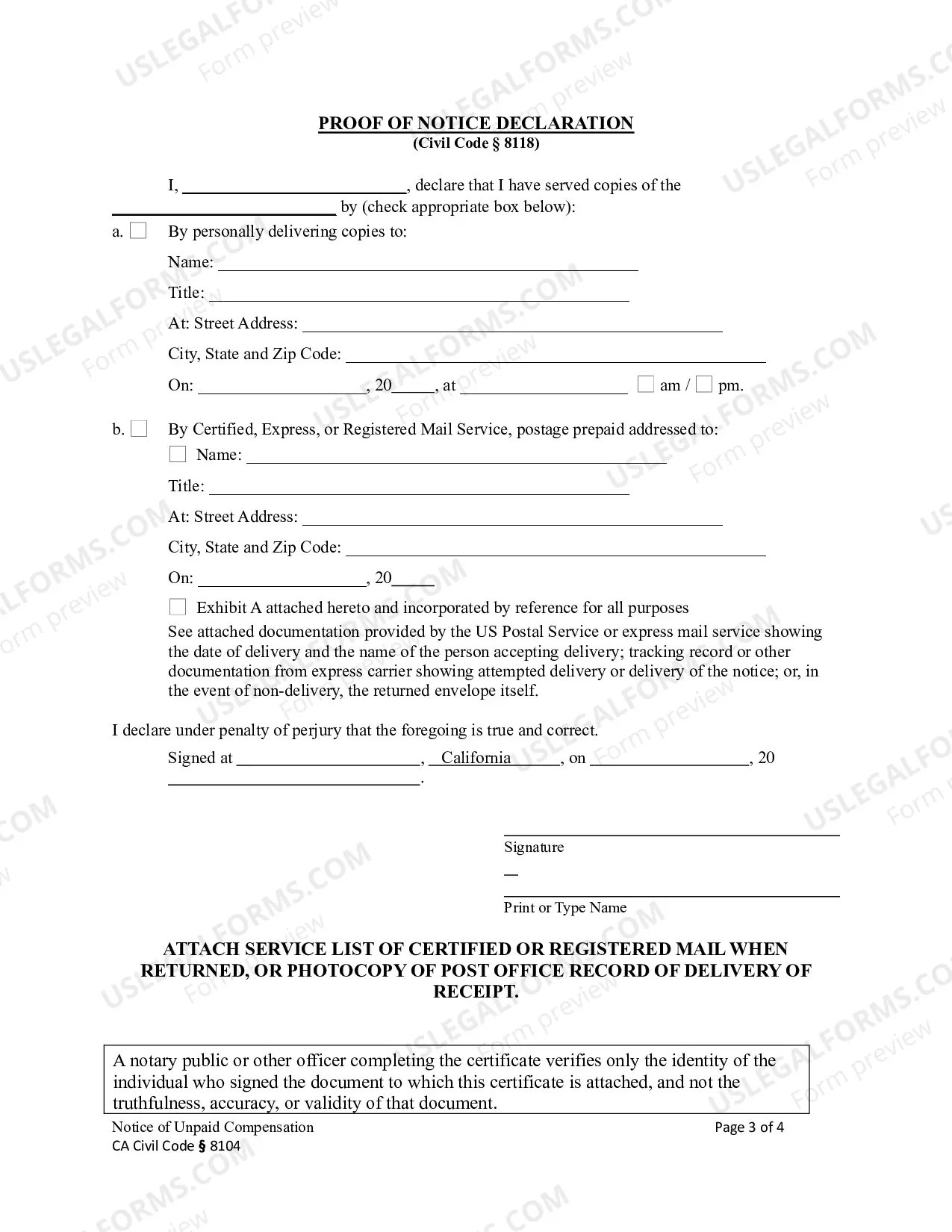

This form is used by the direct contractor or the subcontractor to give notice that a laborer employed on the project has not been paid. Notice must be given to the laborer; the laborer's bargaining representative, if any; the construction lender; and, the owner. Formatted for signature by a limited liability company or corporation.

El Monte California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 El Monte, California, has specific regulations in place regarding construction liens and the recovery of unpaid compensation. Business entities such as corporations or limited liability companies (LCS) must comply with these regulations, as outlined in Civil Code Section 8104. This code section establishes the procedures involved in serving a notice of unpaid compensation to ensure fair payment for parties involved in construction projects. The El Monte California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC serves as a legal document and serves multiple purposes. Here are some types of notices that fall under this category: 1. Preliminary Notice: A preliminary notice is often the first step in the process of securing unpaid compensation as a business entity, corporation, or LLC involved in a construction project. This notice is typically sent to the property owner, general contractor, and other relevant parties involved in the project. It serves as a formal notice of the potential lien rights and notifies parties of the entity's involvement and intention to claim unpaid compensation. 2. Notice of Intent to Lien: If payment for services or materials provided still remains unpaid after the submission of a preliminary notice, a business entity may proceed with a Notice of Intent to Lien. This particular notice informs the property owner, general contractor, and interested parties of the entity's intention to file a formal construction lien if the unpaid compensation is not resolved promptly. 3. Construction Lien: The Construction Lien, also known as a mechanic's lien, is a legal claim filed by a business entity against a property's title when there is unpaid compensation for labor, materials, or services provided in the construction project. Once the lien is filed, it creates a cloud on the property's title, making it difficult to sell or refinance the property until the issue is resolved. The construction lien provides the business entity with a method of recovering their unpaid compensation through subsequent legal actions if necessary. It is crucial for corporations and LCS in El Monte, California, to familiarize themselves with Civil Code Section 8104 and understand the significance of the various notices related to unpaid compensation and construction liens. By following the proper procedures and timelines outlined in the code, business entities can protect their rights and increase the chances of receiving the compensation they are owed. Consulting with an experienced attorney or legal professional well-versed in construction lien laws can provide invaluable guidance and assistance throughout the process of dealing with unpaid compensation issues.El Monte California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 El Monte, California, has specific regulations in place regarding construction liens and the recovery of unpaid compensation. Business entities such as corporations or limited liability companies (LCS) must comply with these regulations, as outlined in Civil Code Section 8104. This code section establishes the procedures involved in serving a notice of unpaid compensation to ensure fair payment for parties involved in construction projects. The El Monte California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC serves as a legal document and serves multiple purposes. Here are some types of notices that fall under this category: 1. Preliminary Notice: A preliminary notice is often the first step in the process of securing unpaid compensation as a business entity, corporation, or LLC involved in a construction project. This notice is typically sent to the property owner, general contractor, and other relevant parties involved in the project. It serves as a formal notice of the potential lien rights and notifies parties of the entity's involvement and intention to claim unpaid compensation. 2. Notice of Intent to Lien: If payment for services or materials provided still remains unpaid after the submission of a preliminary notice, a business entity may proceed with a Notice of Intent to Lien. This particular notice informs the property owner, general contractor, and interested parties of the entity's intention to file a formal construction lien if the unpaid compensation is not resolved promptly. 3. Construction Lien: The Construction Lien, also known as a mechanic's lien, is a legal claim filed by a business entity against a property's title when there is unpaid compensation for labor, materials, or services provided in the construction project. Once the lien is filed, it creates a cloud on the property's title, making it difficult to sell or refinance the property until the issue is resolved. The construction lien provides the business entity with a method of recovering their unpaid compensation through subsequent legal actions if necessary. It is crucial for corporations and LCS in El Monte, California, to familiarize themselves with Civil Code Section 8104 and understand the significance of the various notices related to unpaid compensation and construction liens. By following the proper procedures and timelines outlined in the code, business entities can protect their rights and increase the chances of receiving the compensation they are owed. Consulting with an experienced attorney or legal professional well-versed in construction lien laws can provide invaluable guidance and assistance throughout the process of dealing with unpaid compensation issues.