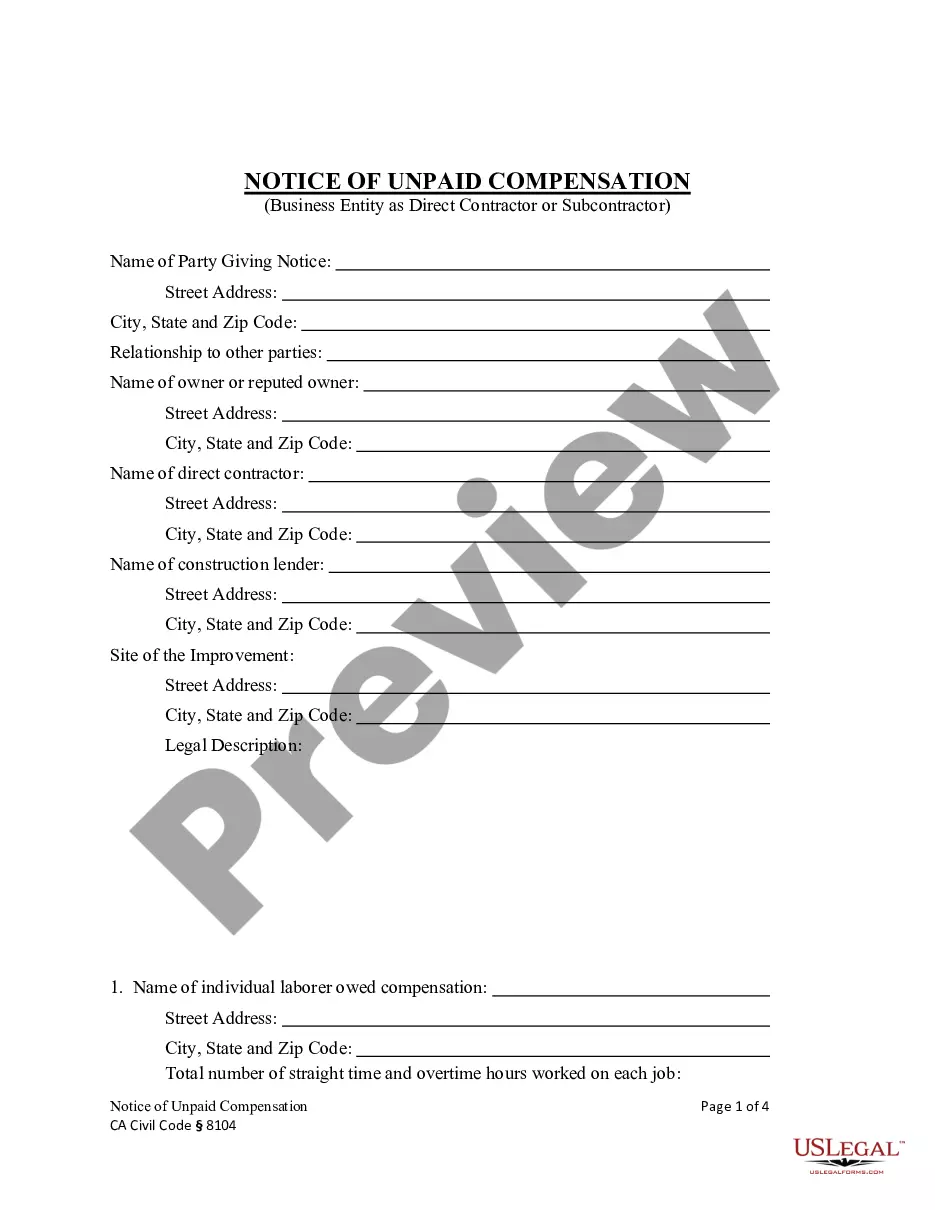

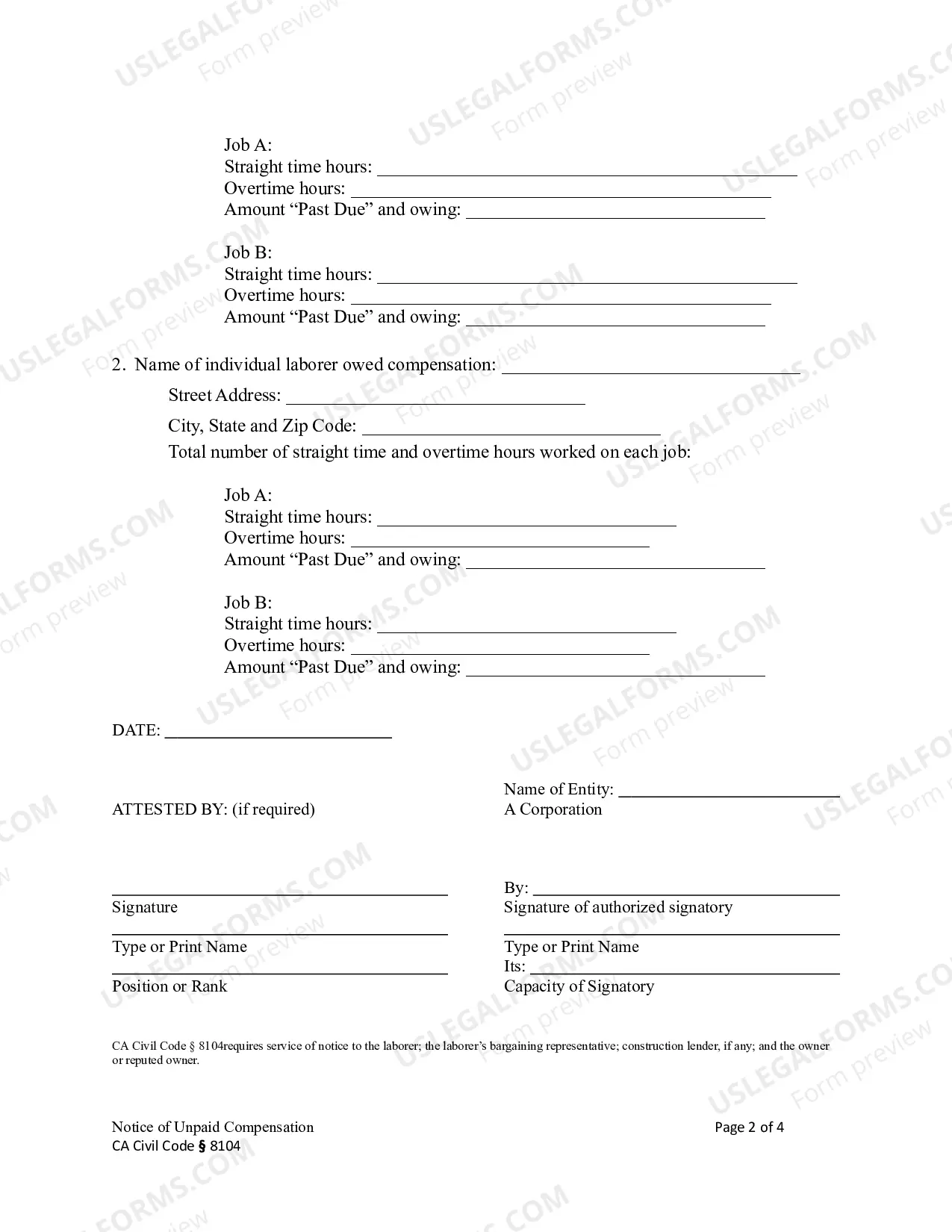

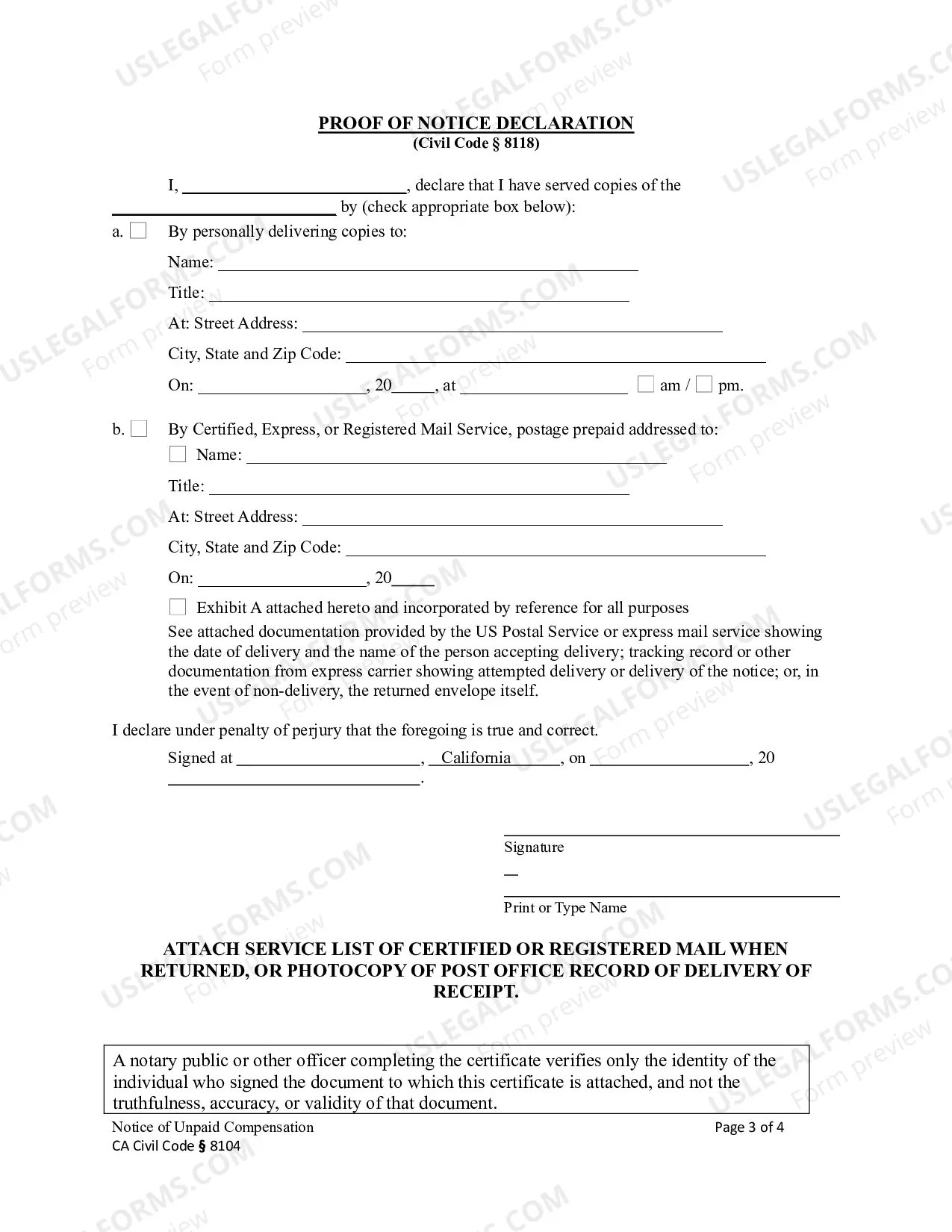

This form is used by the direct contractor or the subcontractor to give notice that a laborer employed on the project has not been paid. Notice must be given to the laborer; the laborer's bargaining representative, if any; the construction lender; and, the owner. Formatted for signature by a limited liability company or corporation.

A Rancho Cucamonga California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 is an important legal document that pertains to unpaid compensation within the construction industry for corporations or limited liability companies (LCS). This notice serves as a way for contractors, subcontractors, and suppliers to assert their rights and seek payment for work done or materials provided. Under Civil Code Section 8104, there are different types of notices that can be filed depending on the circumstances. These include: 1. Preliminary Notice: Before commencing any construction work, contractors, subcontractors, or suppliers should file a preliminary notice to inform the property owner, business entity (corporation or LLC), and other parties involved that they are providing services or materials to the project. This helps protect their rights to file a lien later on if they are not compensated properly. 2. Notice of Unpaid Compensation: If compensation remains unpaid for work done or materials provided, the contractor, subcontractor, or supplier has the right to file a notice of unpaid compensation. This notice specifies the amount owed and provides a legal warning to the corporation or LLC. 3. Notice of Intention to File a Lien: In case the unpaid compensation still goes unresolved after the notice of unpaid compensation, the contractor, subcontractor, or supplier can file a notice of intention to file a lien. This notice notifies all interested parties, including the corporation or LLC, that a lien will be filed if payment is not made within the statutory period. 4. Lien: If payment is not received within the specified timeframe after filing the notice of intention to file a lien, the aggrieved party can proceed to file a construction lien. A construction lien is a legal claim against the property's title, ensuring that the unpaid debt is secured by the property until adequate compensation is provided. Rancho Cucamonga, California, follows the specific provisions of Civil Code Section 8104, ensuring that all parties involved in construction projects are protected and have legal remedies available to receive the compensation they are entitled to. It is important for corporations and LCS involved in construction projects to be aware of their obligations and rights under the civil code to avoid potential legal disputes and financial repercussions. Properly handling notices and addressing any unpaid compensation can help maintain positive relationships between all parties involved in construction projects.A Rancho Cucamonga California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 is an important legal document that pertains to unpaid compensation within the construction industry for corporations or limited liability companies (LCS). This notice serves as a way for contractors, subcontractors, and suppliers to assert their rights and seek payment for work done or materials provided. Under Civil Code Section 8104, there are different types of notices that can be filed depending on the circumstances. These include: 1. Preliminary Notice: Before commencing any construction work, contractors, subcontractors, or suppliers should file a preliminary notice to inform the property owner, business entity (corporation or LLC), and other parties involved that they are providing services or materials to the project. This helps protect their rights to file a lien later on if they are not compensated properly. 2. Notice of Unpaid Compensation: If compensation remains unpaid for work done or materials provided, the contractor, subcontractor, or supplier has the right to file a notice of unpaid compensation. This notice specifies the amount owed and provides a legal warning to the corporation or LLC. 3. Notice of Intention to File a Lien: In case the unpaid compensation still goes unresolved after the notice of unpaid compensation, the contractor, subcontractor, or supplier can file a notice of intention to file a lien. This notice notifies all interested parties, including the corporation or LLC, that a lien will be filed if payment is not made within the statutory period. 4. Lien: If payment is not received within the specified timeframe after filing the notice of intention to file a lien, the aggrieved party can proceed to file a construction lien. A construction lien is a legal claim against the property's title, ensuring that the unpaid debt is secured by the property until adequate compensation is provided. Rancho Cucamonga, California, follows the specific provisions of Civil Code Section 8104, ensuring that all parties involved in construction projects are protected and have legal remedies available to receive the compensation they are entitled to. It is important for corporations and LCS involved in construction projects to be aware of their obligations and rights under the civil code to avoid potential legal disputes and financial repercussions. Properly handling notices and addressing any unpaid compensation can help maintain positive relationships between all parties involved in construction projects.