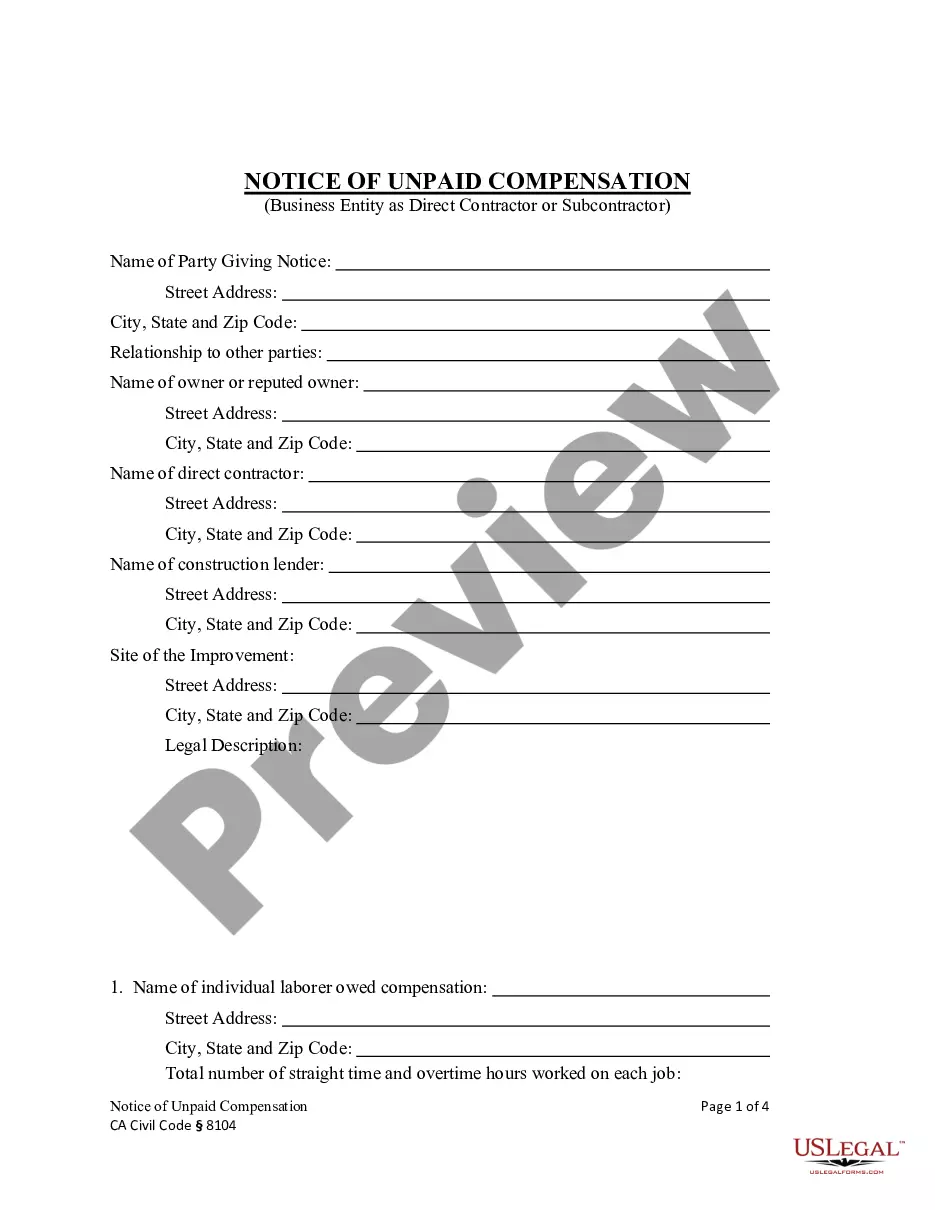

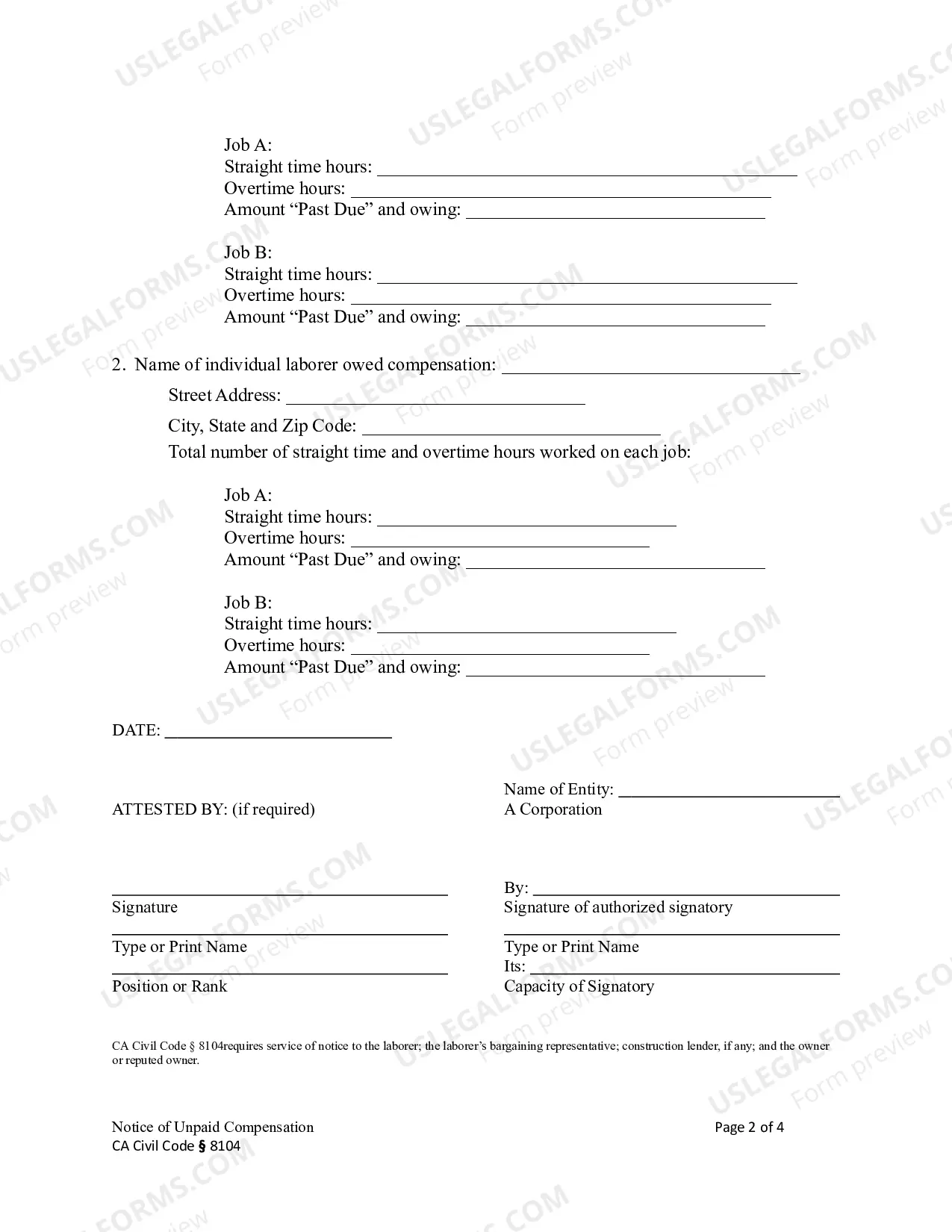

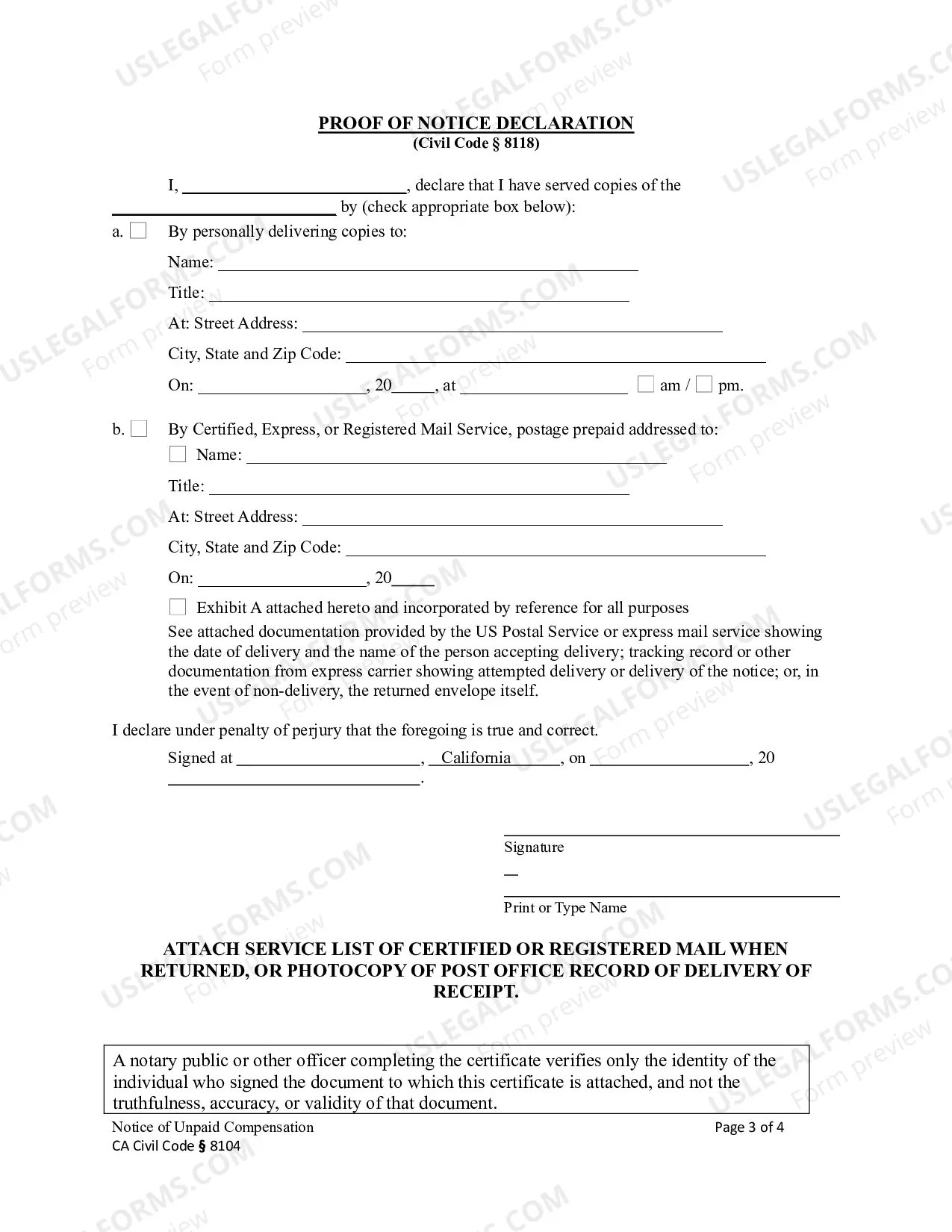

This form is used by the direct contractor or the subcontractor to give notice that a laborer employed on the project has not been paid. Notice must be given to the laborer; the laborer's bargaining representative, if any; the construction lender; and, the owner. Formatted for signature by a limited liability company or corporation.

A Riverside California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 is a legal document that protects construction workers and contractors in Riverside, California who have not been compensated appropriately for their services rendered on a construction project. This notice is specifically designed for business entities, including corporations and limited liability companies (LCS), who have failed to pay their contractors or subcontractors for the work performed. Under Civil Code Section 8104 in California, contractors and subcontractors have the right to file a construction lien against the property owner and the business entity responsible for payment if they have not received full compensation for their work. This notice serves as a formal communication to inform the business entity that they are in violation of their legal obligation to pay for the services provided. The Riverside California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC is divided into different types based on the specific circumstances and parties involved. Some possible variations include: 1. Preliminary Notice: This is the initial notice sent by the contractor or subcontractor to the business entity, providing them with information about the project, the services provided, and the amount owed. It serves as a warning that the contractor or subcontractor may file a construction lien if payment is not received promptly. 2. Notice of Intent to Lien: If the business entity fails to resolve the payment dispute after receiving the preliminary notice, the contractor or subcontractor may send a Notice of Intent to Lien. This notice informs the business entity of their intention to file a construction lien if the outstanding payment is not settled within a specified time frame. 3. Construction Lien: If the business entity still refuses to pay or negotiate a resolution, the contractor or subcontractor may proceed to file a construction lien against the property owned by the business entity. This legal claim prevents the property from being sold or transferred until the outstanding debt is paid. It is important to note that the Riverside California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC should be drafted in accordance with the specific requirements outlined in Civil Code Section 8104. Compliance with these regulations ensures that the notice is valid and enforceable in any potential legal proceedings.A Riverside California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 is a legal document that protects construction workers and contractors in Riverside, California who have not been compensated appropriately for their services rendered on a construction project. This notice is specifically designed for business entities, including corporations and limited liability companies (LCS), who have failed to pay their contractors or subcontractors for the work performed. Under Civil Code Section 8104 in California, contractors and subcontractors have the right to file a construction lien against the property owner and the business entity responsible for payment if they have not received full compensation for their work. This notice serves as a formal communication to inform the business entity that they are in violation of their legal obligation to pay for the services provided. The Riverside California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC is divided into different types based on the specific circumstances and parties involved. Some possible variations include: 1. Preliminary Notice: This is the initial notice sent by the contractor or subcontractor to the business entity, providing them with information about the project, the services provided, and the amount owed. It serves as a warning that the contractor or subcontractor may file a construction lien if payment is not received promptly. 2. Notice of Intent to Lien: If the business entity fails to resolve the payment dispute after receiving the preliminary notice, the contractor or subcontractor may send a Notice of Intent to Lien. This notice informs the business entity of their intention to file a construction lien if the outstanding payment is not settled within a specified time frame. 3. Construction Lien: If the business entity still refuses to pay or negotiate a resolution, the contractor or subcontractor may proceed to file a construction lien against the property owned by the business entity. This legal claim prevents the property from being sold or transferred until the outstanding debt is paid. It is important to note that the Riverside California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC should be drafted in accordance with the specific requirements outlined in Civil Code Section 8104. Compliance with these regulations ensures that the notice is valid and enforceable in any potential legal proceedings.