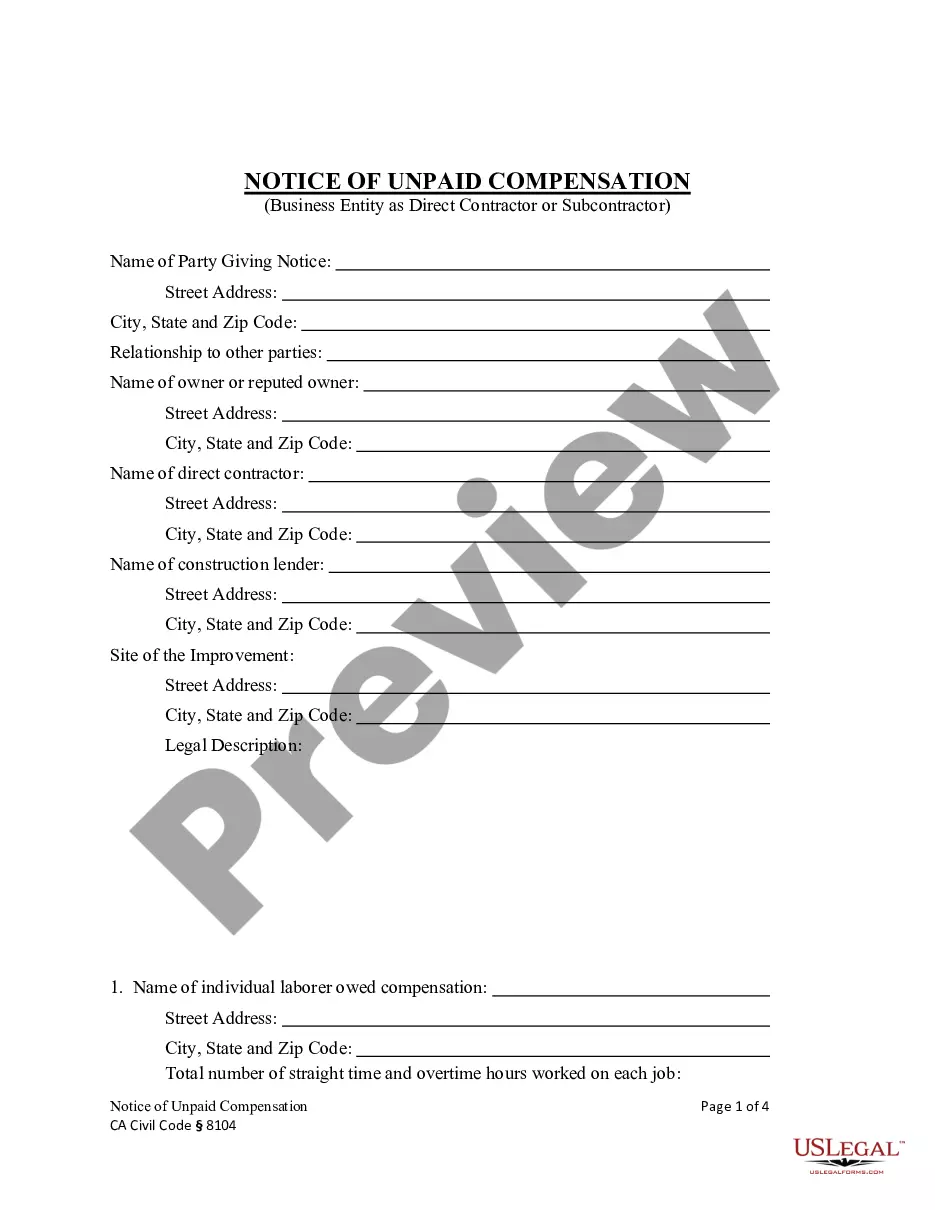

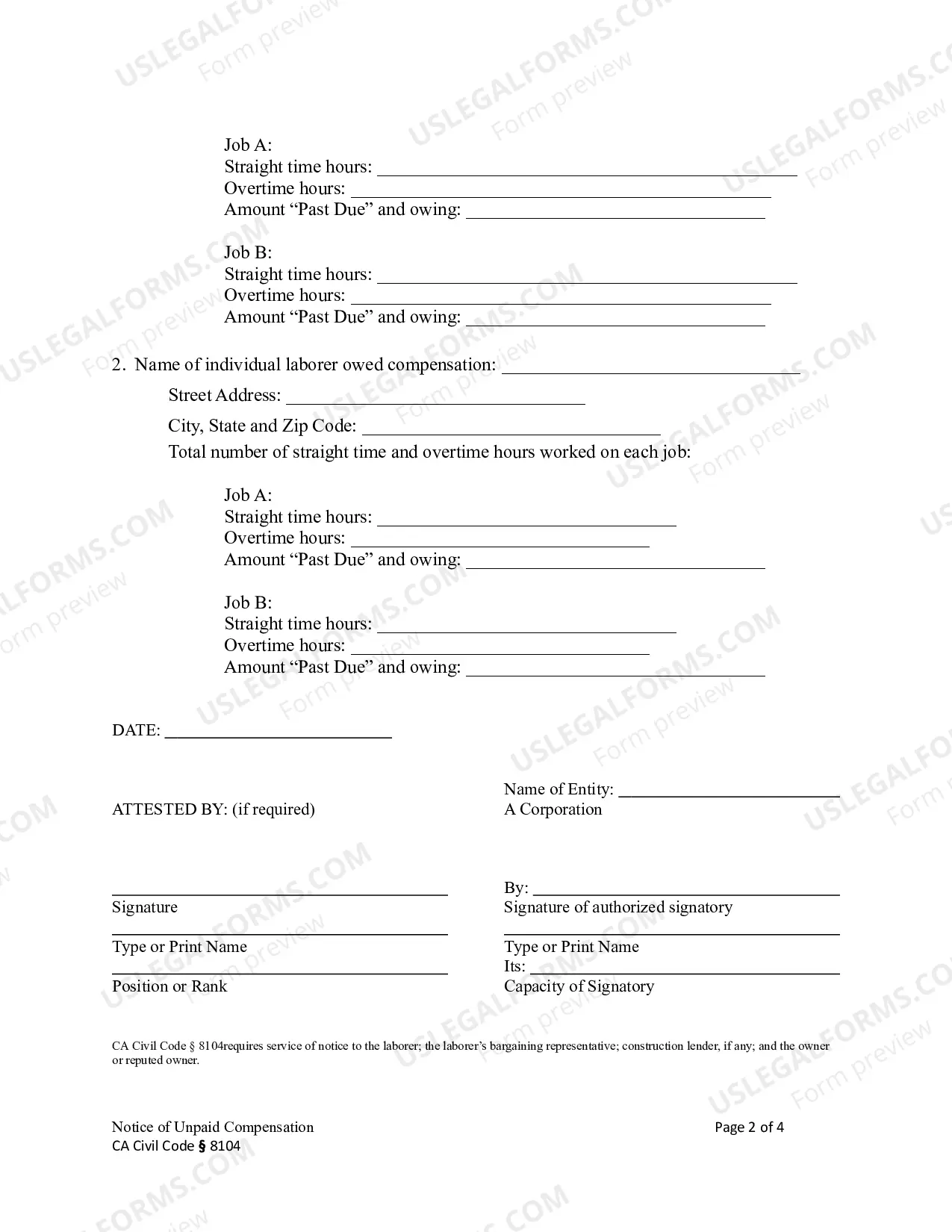

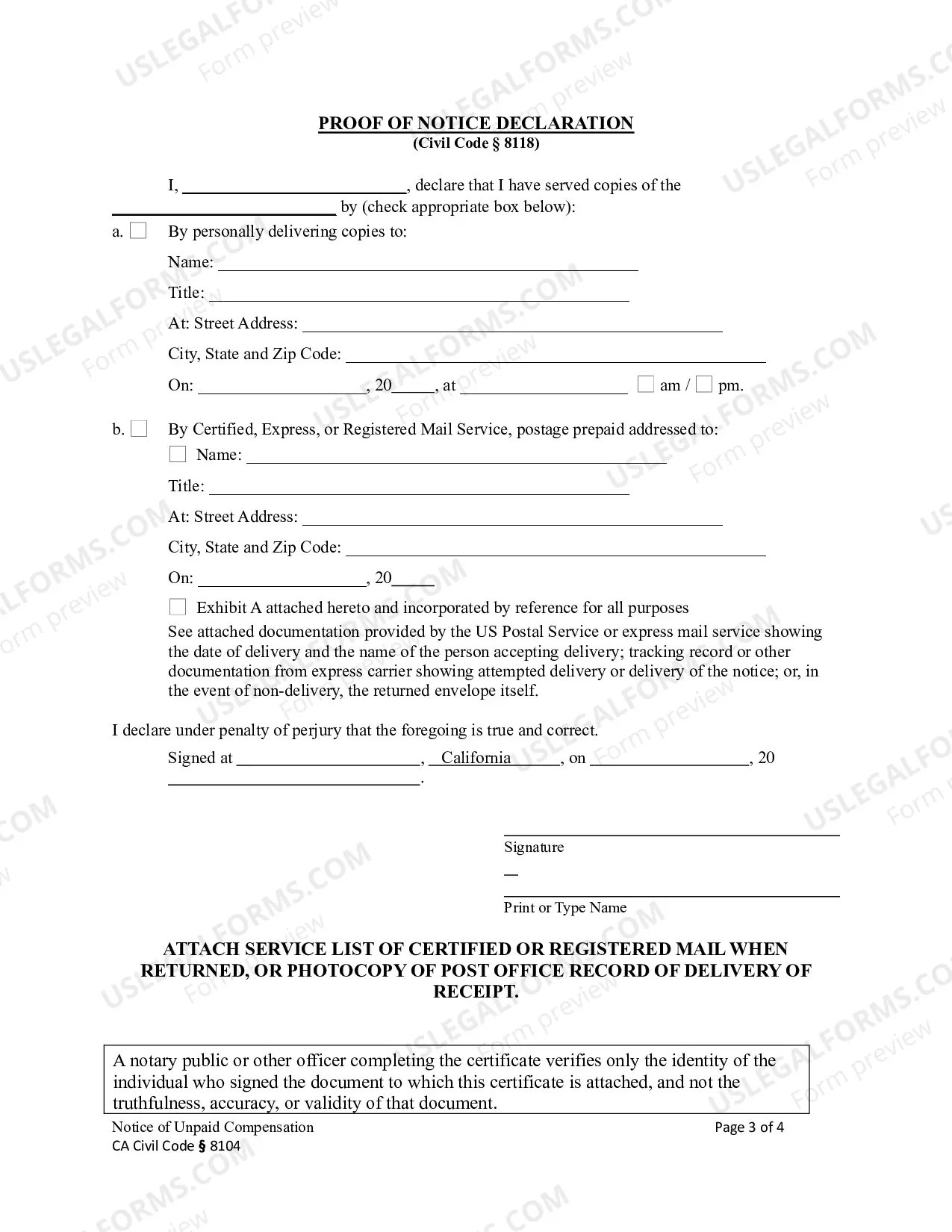

This form is used by the direct contractor or the subcontractor to give notice that a laborer employed on the project has not been paid. Notice must be given to the laborer; the laborer's bargaining representative, if any; the construction lender; and, the owner. Formatted for signature by a limited liability company or corporation.

The Santa Clara California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 is a legal document that serves as a means to protect contractors and suppliers who have provided labor, materials, or services for construction projects in Santa Clara, California. This notice is specifically designed for businesses that are registered as either a corporation or a limited liability company (LLC). Under Civil Code Section 8104, contractors and suppliers are entitled to file a construction lien against the property if they have not been fully compensated for their work or materials. The purpose of this notice is to inform the business entity, whether a corporation or LLC, that they have an outstanding payment obligation. There are different types of Santa Clara California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 notices, depending on the specific circumstances: 1. Preliminary Notice: This notice is typically sent at the beginning of a construction project to notify the business entity of potential future lien rights. It serves as a warning that if the contractor or supplier doesn't receive due compensation, they may proceed to file a construction lien. 2. Notice of Intent to File a Lien: If the business entity fails to make the necessary payments even after receiving the preliminary notice, the contractor or supplier may send a Notice of Intent to File a Lien. This notice informs the business entity of the contractor's or supplier's intention to file a construction lien unless the unpaid amount is settled within a specific time frame. 3. Notice of Unpaid Compensation: In the event that the business entity still fails to make the required payments after receiving the Notice of Intent to File a Lien, the contractor or supplier can send a Notice of Unpaid Compensation. This notice explicitly states that the contractor or supplier intends to file a construction lien against the property if the outstanding payment is not received within a specified period. It is important for contractors and suppliers to follow the proper procedures and timelines while sending these notices, as non-compliance may negatively impact their ability to successfully pursue a construction lien claim. Seeking legal advice or consulting the Santa Clara County's specific rules and regulations is recommended to ensure compliance and protect the contractor's or supplier's rights.The Santa Clara California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 is a legal document that serves as a means to protect contractors and suppliers who have provided labor, materials, or services for construction projects in Santa Clara, California. This notice is specifically designed for businesses that are registered as either a corporation or a limited liability company (LLC). Under Civil Code Section 8104, contractors and suppliers are entitled to file a construction lien against the property if they have not been fully compensated for their work or materials. The purpose of this notice is to inform the business entity, whether a corporation or LLC, that they have an outstanding payment obligation. There are different types of Santa Clara California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 notices, depending on the specific circumstances: 1. Preliminary Notice: This notice is typically sent at the beginning of a construction project to notify the business entity of potential future lien rights. It serves as a warning that if the contractor or supplier doesn't receive due compensation, they may proceed to file a construction lien. 2. Notice of Intent to File a Lien: If the business entity fails to make the necessary payments even after receiving the preliminary notice, the contractor or supplier may send a Notice of Intent to File a Lien. This notice informs the business entity of the contractor's or supplier's intention to file a construction lien unless the unpaid amount is settled within a specific time frame. 3. Notice of Unpaid Compensation: In the event that the business entity still fails to make the required payments after receiving the Notice of Intent to File a Lien, the contractor or supplier can send a Notice of Unpaid Compensation. This notice explicitly states that the contractor or supplier intends to file a construction lien against the property if the outstanding payment is not received within a specified period. It is important for contractors and suppliers to follow the proper procedures and timelines while sending these notices, as non-compliance may negatively impact their ability to successfully pursue a construction lien claim. Seeking legal advice or consulting the Santa Clara County's specific rules and regulations is recommended to ensure compliance and protect the contractor's or supplier's rights.