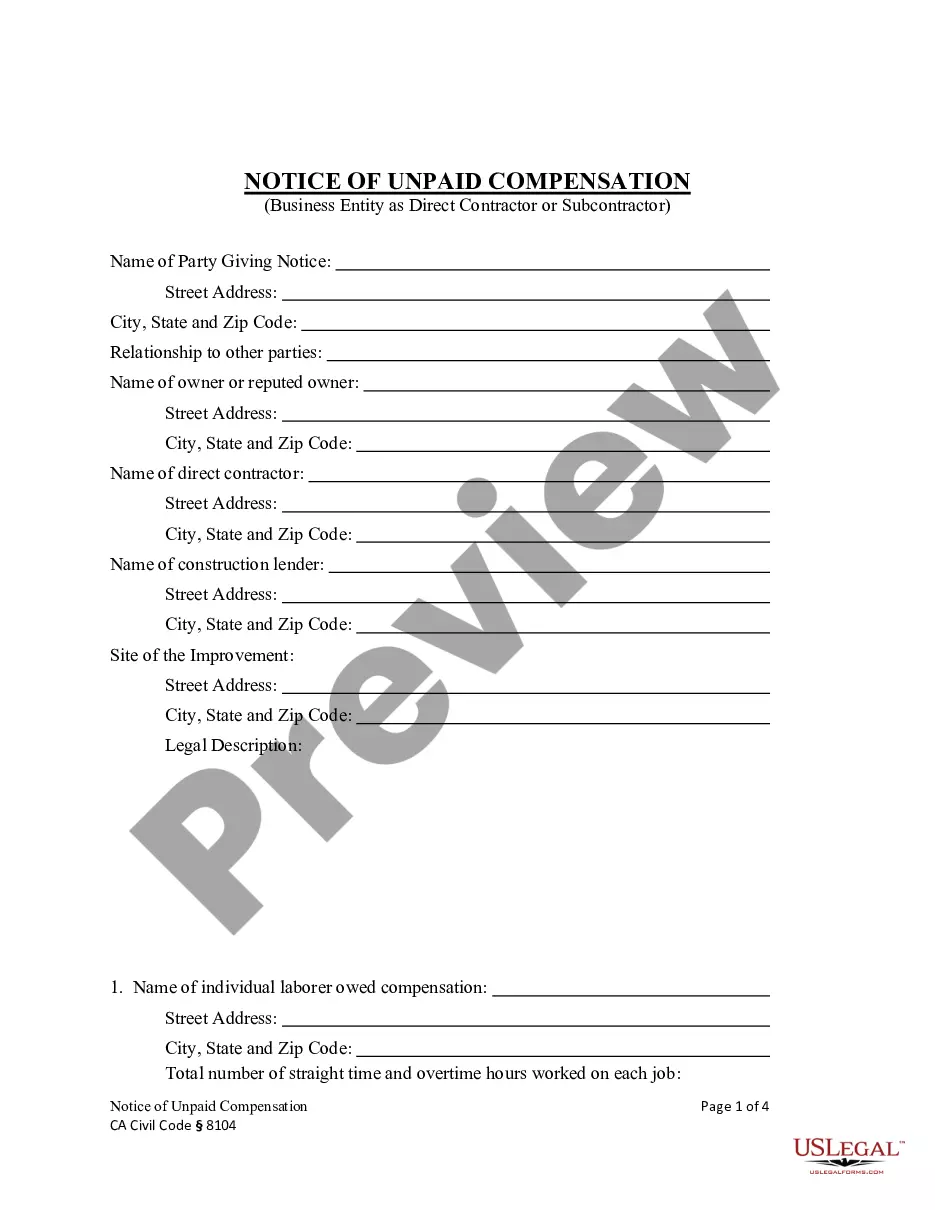

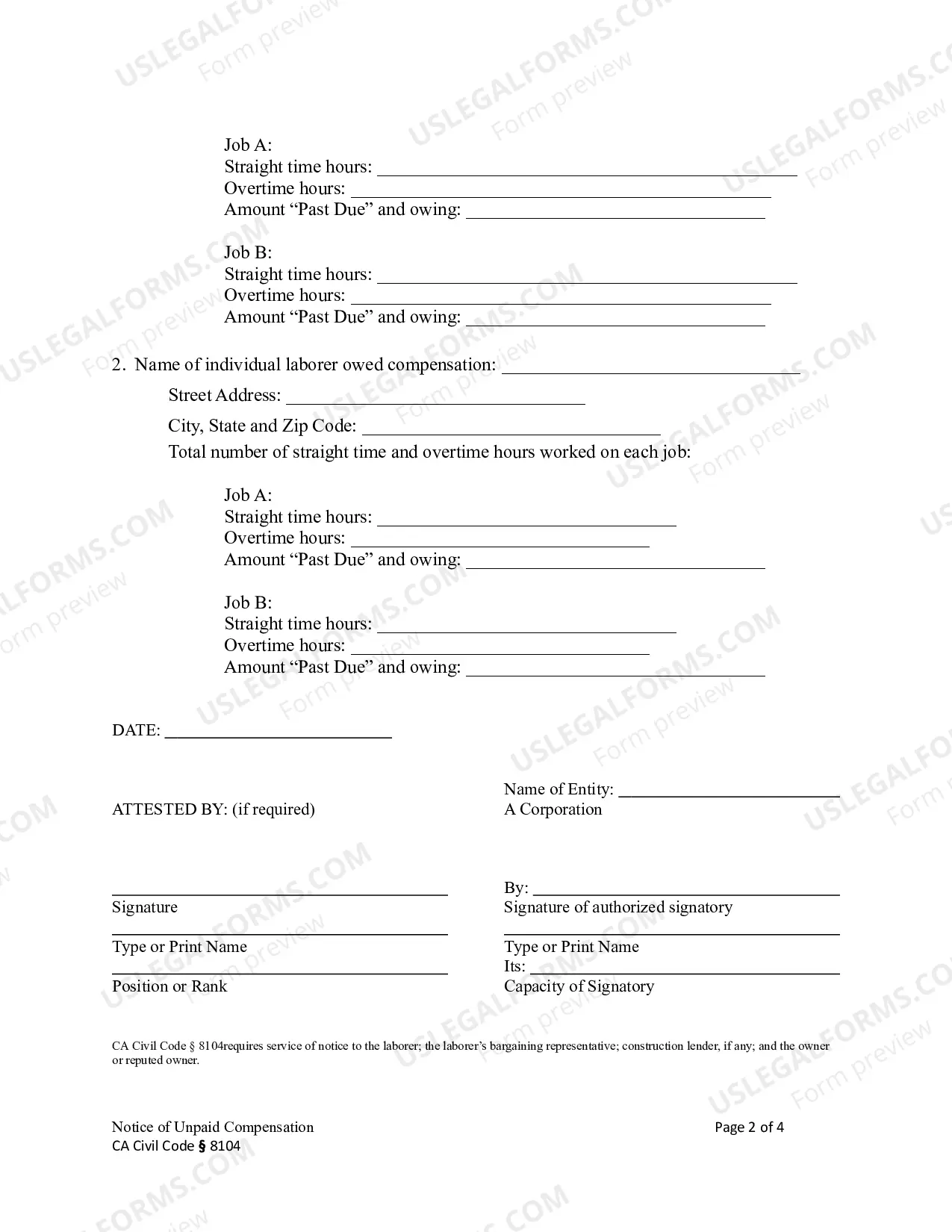

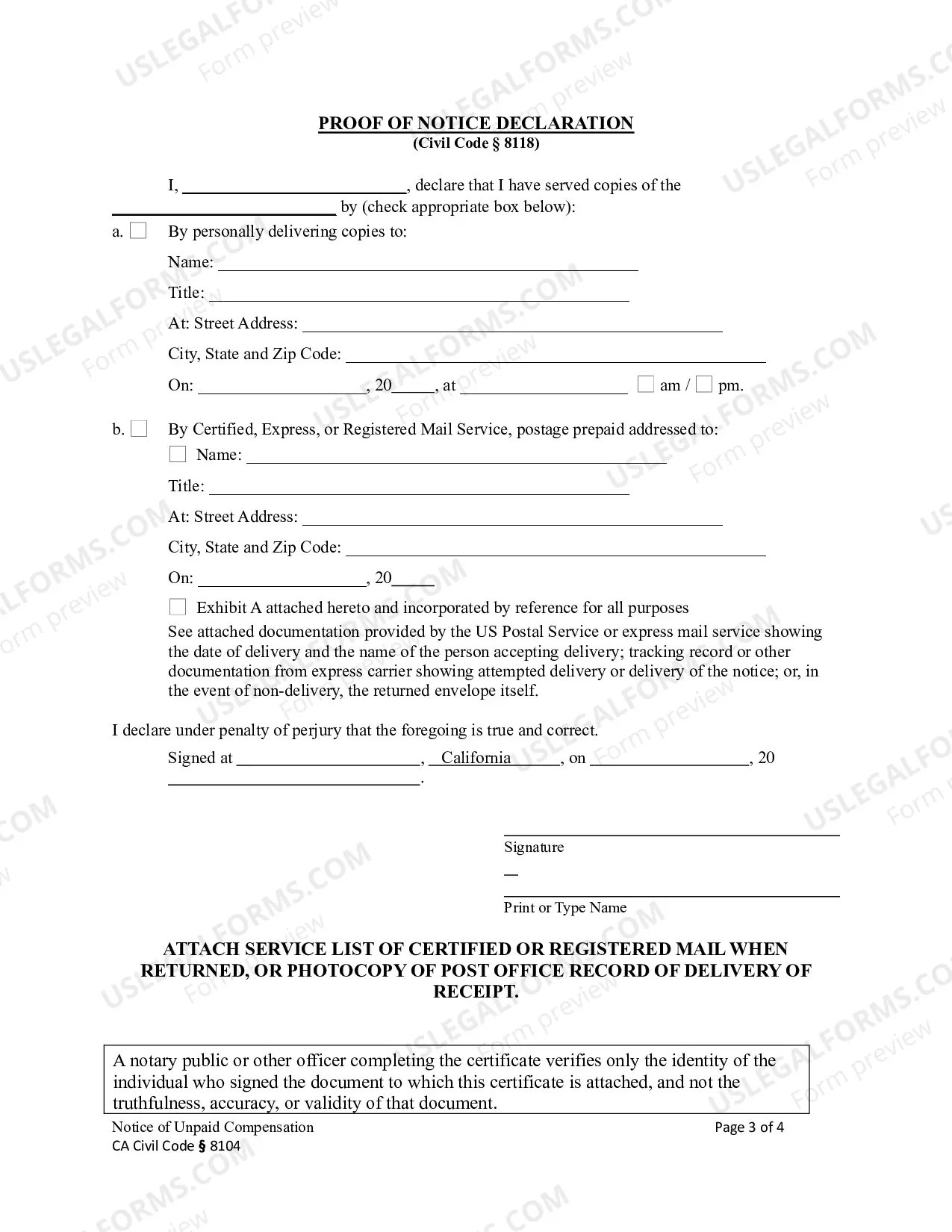

This form is used by the direct contractor or the subcontractor to give notice that a laborer employed on the project has not been paid. Notice must be given to the laborer; the laborer's bargaining representative, if any; the construction lender; and, the owner. Formatted for signature by a limited liability company or corporation.

The Temecula California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 is a legal document that serves as a notice to a business entity, specifically a corporation or limited liability company (LLC), regarding unpaid compensation related to construction projects. It is important for business owners and contractors in Temecula, California to understand this notice and its implications to protect their rights and handle potential disputes in a timely and lawful manner. Construction projects often involve various parties, such as contractors, subcontractors, suppliers, and property owners. Occasionally, issues may arise where a business entity fails to compensate another party for their services or materials provided during the project. When this occurs, the unpaid entity has the right to file a construction lien under Civil Code Section 8104 and issue a Notice of Unpaid Compensation to the responsible business entity. The Notice of Unpaid Compensation is a crucial step in the lien process, as it formally notifies the business entity in question of the outstanding debt. It provides detailed information about the project, the services or materials provided, and the amount of compensation owed. By serving this notice, the unpaid entity establishes a legal claim against the property where the construction took place, ensuring that they have a lawful right to seek payment. Different types of Temecula California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 may include: 1. General Notice of Unpaid Compensation: This type of notice is typically issued when the business entity responsible for the unpaid compensation is a corporation or LLC. It outlines the relevant details of the construction project and the amount owed, urging the recipient to address the matter promptly. 2. Preliminary Notice of Unpaid Compensation: Before officially filing a construction lien, the unpaid entity may choose to send a preliminary notice. This serves as a preemptive step to inform the business entity of potential future action if the compensation remains unpaid within a designated timeframe. 3. Notice of Intent to Lien: If the initial Notice of Unpaid Compensation fails to yield satisfactory results, the unpaid entity may proceed with issuing a Notice of Intent to Lien. This notice notifies the business entity that the unpaid entity is prepared to initiate a formal construction lien if the overdue compensation is not resolved in a specified period. Understanding the legal implications of the Temecula California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 is essential, both for businesses seeking to protect themselves from unwarranted liens and for those seeking rightful compensation. It is strongly advisable to consult with an attorney experienced in construction law to ensure compliance with all relevant legal procedures and to navigate any potential disputes effectively.The Temecula California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 is a legal document that serves as a notice to a business entity, specifically a corporation or limited liability company (LLC), regarding unpaid compensation related to construction projects. It is important for business owners and contractors in Temecula, California to understand this notice and its implications to protect their rights and handle potential disputes in a timely and lawful manner. Construction projects often involve various parties, such as contractors, subcontractors, suppliers, and property owners. Occasionally, issues may arise where a business entity fails to compensate another party for their services or materials provided during the project. When this occurs, the unpaid entity has the right to file a construction lien under Civil Code Section 8104 and issue a Notice of Unpaid Compensation to the responsible business entity. The Notice of Unpaid Compensation is a crucial step in the lien process, as it formally notifies the business entity in question of the outstanding debt. It provides detailed information about the project, the services or materials provided, and the amount of compensation owed. By serving this notice, the unpaid entity establishes a legal claim against the property where the construction took place, ensuring that they have a lawful right to seek payment. Different types of Temecula California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 may include: 1. General Notice of Unpaid Compensation: This type of notice is typically issued when the business entity responsible for the unpaid compensation is a corporation or LLC. It outlines the relevant details of the construction project and the amount owed, urging the recipient to address the matter promptly. 2. Preliminary Notice of Unpaid Compensation: Before officially filing a construction lien, the unpaid entity may choose to send a preliminary notice. This serves as a preemptive step to inform the business entity of potential future action if the compensation remains unpaid within a designated timeframe. 3. Notice of Intent to Lien: If the initial Notice of Unpaid Compensation fails to yield satisfactory results, the unpaid entity may proceed with issuing a Notice of Intent to Lien. This notice notifies the business entity that the unpaid entity is prepared to initiate a formal construction lien if the overdue compensation is not resolved in a specified period. Understanding the legal implications of the Temecula California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 is essential, both for businesses seeking to protect themselves from unwarranted liens and for those seeking rightful compensation. It is strongly advisable to consult with an attorney experienced in construction law to ensure compliance with all relevant legal procedures and to navigate any potential disputes effectively.