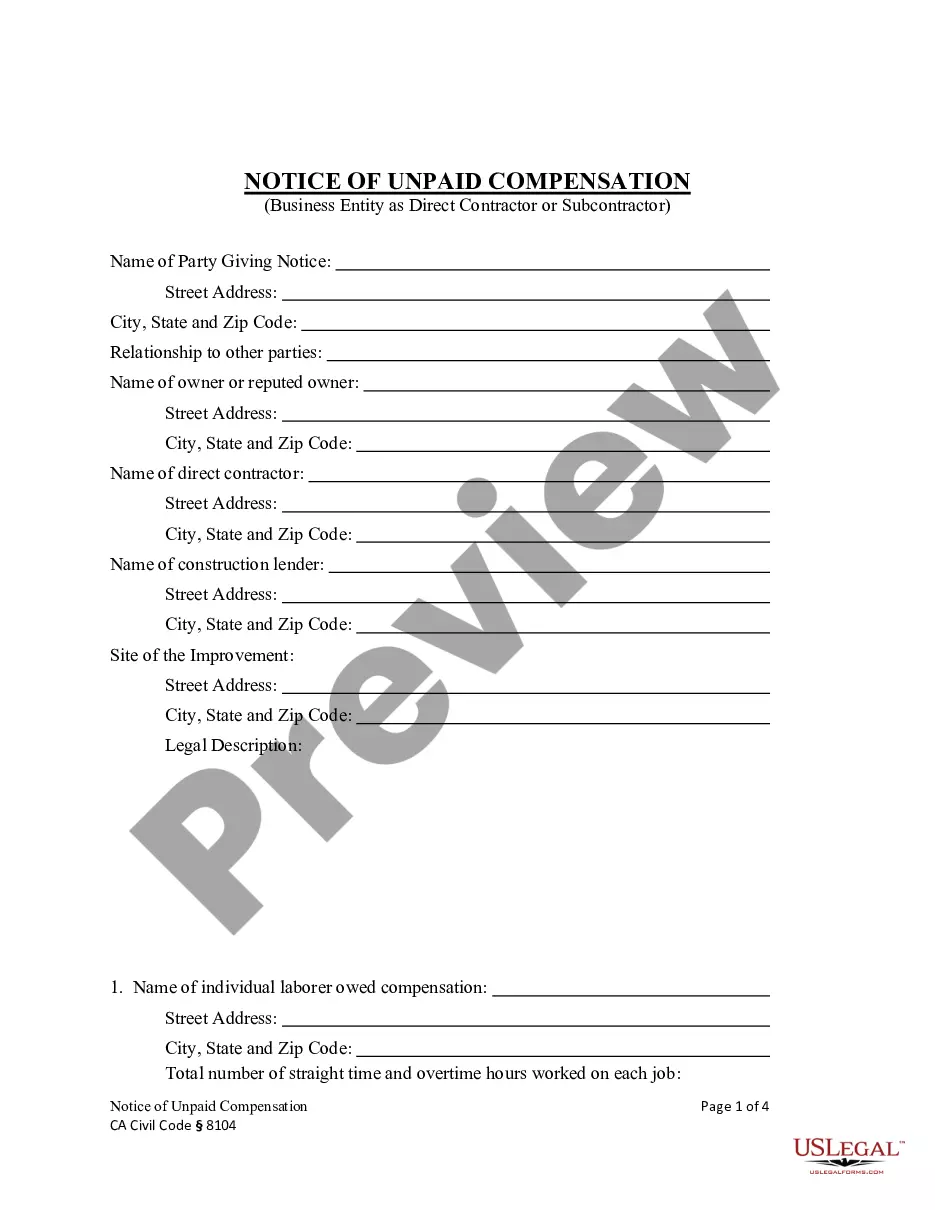

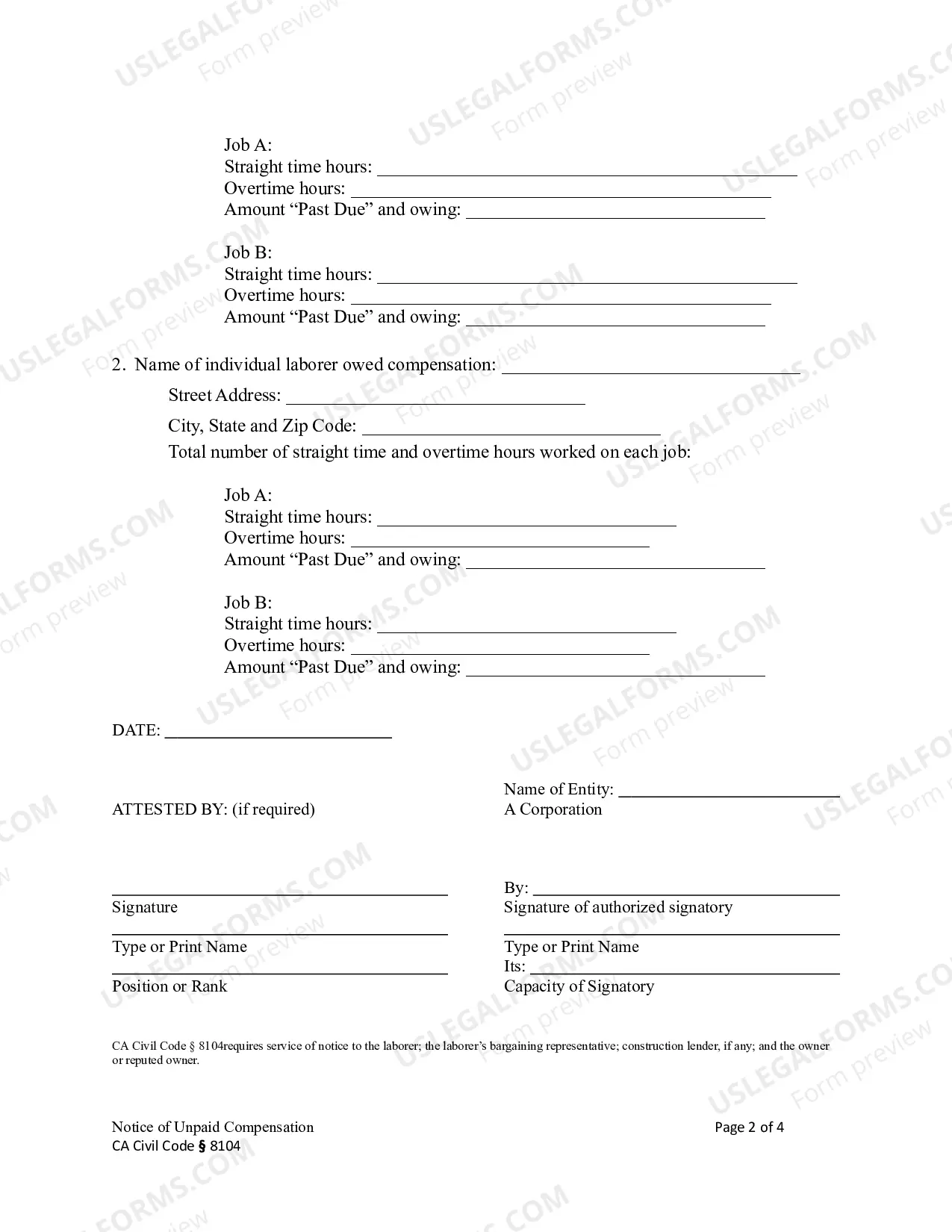

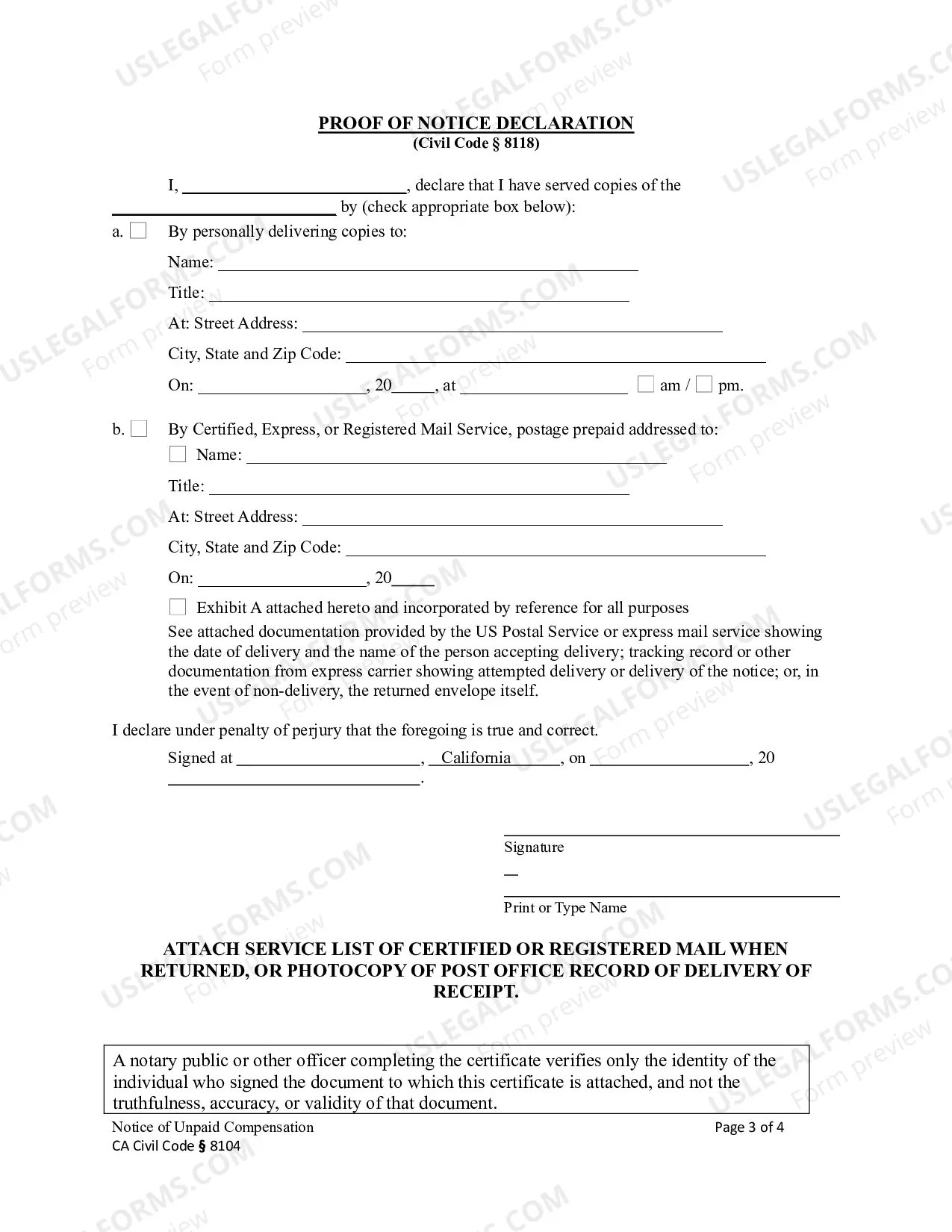

This form is used by the direct contractor or the subcontractor to give notice that a laborer employed on the project has not been paid. Notice must be given to the laborer; the laborer's bargaining representative, if any; the construction lender; and, the owner. Formatted for signature by a limited liability company or corporation.

Thousand Oaks California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 In Thousand Oaks, California, the Notice of Unpaid Compensation serves as an important legal document when it comes to addressing unpaid compensation issues related to construction projects. This notice is specifically relevant to business entities operating as corporations or limited liability companies (LCS) under Civil Code Section 8104. Under the provisions of Civil Code Section 8104, contractors, subcontractors, suppliers, and other parties involved in construction projects have the right to file a construction lien against a property owner or business entity if they haven't received proper payment for their work or materials provided. When a business entity operating as a corporation or LLC fails to compensate contractors, subcontractors, or suppliers for their services or materials, those unpaid parties can serve a Notice of Unpaid Compensation upon the entity. This notice acts as a formal warning and initiates the lien process. It informs the business entity that legal action may be taken against them to secure payment if the outstanding compensation is not promptly addressed. The Notice of Unpaid Compensation contains crucial information including: 1. Identification of the business entity: The full legal name and address of the corporation or LLC are stated clearly in the notice. This ensures that the entity is correctly identified as the party responsible for the unpaid compensation. 2. Description of services or materials provided: The notice outlines the specific work, services, or materials provided by the unpaid party. This description helps to establish a clear understanding of the debt owed. 3. Dollar amount owed: The notice includes the total amount of compensation that remains unpaid by the business entity. 4. Deadline for payment or response: Typically, a specific deadline is provided in the notice, allowing the business entity a reasonable amount of time to respond and address the outstanding compensation issue. It's important to note that there may be different types of Thousand Oaks California Notices of Unpaid Compensation — Construction LienBusinessmenNENTnthank youty - Corporation or LL— - Civil Code Section 8104. These variations may exist based on the type of construction project, the scope of work, or the specific services or materials provided. However, the general purpose of these notices remains consistent — to notify the business entity of the unpaid compensation and initiate the lien process to protect the rights of the unpaid party. Properly addressing the unpaid compensation issue is crucial for both the business entity and the unpaid party. Failure to respond or settle the outstanding compensation may result in legal action, which can lead to potential damages, additional costs, and damage to the entity's reputation. In summary, the Thousand Oaks California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 is an essential legal document that ensures unpaid parties are protected and provided with a means to seek appropriate compensation for their work or materials. By complying with the relevant legal requirements, businesses can prevent potential legal disputes, maintain positive business relationships, and uphold their reputation in the construction industry.Thousand Oaks California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 In Thousand Oaks, California, the Notice of Unpaid Compensation serves as an important legal document when it comes to addressing unpaid compensation issues related to construction projects. This notice is specifically relevant to business entities operating as corporations or limited liability companies (LCS) under Civil Code Section 8104. Under the provisions of Civil Code Section 8104, contractors, subcontractors, suppliers, and other parties involved in construction projects have the right to file a construction lien against a property owner or business entity if they haven't received proper payment for their work or materials provided. When a business entity operating as a corporation or LLC fails to compensate contractors, subcontractors, or suppliers for their services or materials, those unpaid parties can serve a Notice of Unpaid Compensation upon the entity. This notice acts as a formal warning and initiates the lien process. It informs the business entity that legal action may be taken against them to secure payment if the outstanding compensation is not promptly addressed. The Notice of Unpaid Compensation contains crucial information including: 1. Identification of the business entity: The full legal name and address of the corporation or LLC are stated clearly in the notice. This ensures that the entity is correctly identified as the party responsible for the unpaid compensation. 2. Description of services or materials provided: The notice outlines the specific work, services, or materials provided by the unpaid party. This description helps to establish a clear understanding of the debt owed. 3. Dollar amount owed: The notice includes the total amount of compensation that remains unpaid by the business entity. 4. Deadline for payment or response: Typically, a specific deadline is provided in the notice, allowing the business entity a reasonable amount of time to respond and address the outstanding compensation issue. It's important to note that there may be different types of Thousand Oaks California Notices of Unpaid Compensation — Construction LienBusinessmenNENTnthank youty - Corporation or LL— - Civil Code Section 8104. These variations may exist based on the type of construction project, the scope of work, or the specific services or materials provided. However, the general purpose of these notices remains consistent — to notify the business entity of the unpaid compensation and initiate the lien process to protect the rights of the unpaid party. Properly addressing the unpaid compensation issue is crucial for both the business entity and the unpaid party. Failure to respond or settle the outstanding compensation may result in legal action, which can lead to potential damages, additional costs, and damage to the entity's reputation. In summary, the Thousand Oaks California Notice of Unpaid Compensation — Construction Lien— - Business Entity - Corporation or LLC — Civil Code Section 8104 is an essential legal document that ensures unpaid parties are protected and provided with a means to seek appropriate compensation for their work or materials. By complying with the relevant legal requirements, businesses can prevent potential legal disputes, maintain positive business relationships, and uphold their reputation in the construction industry.