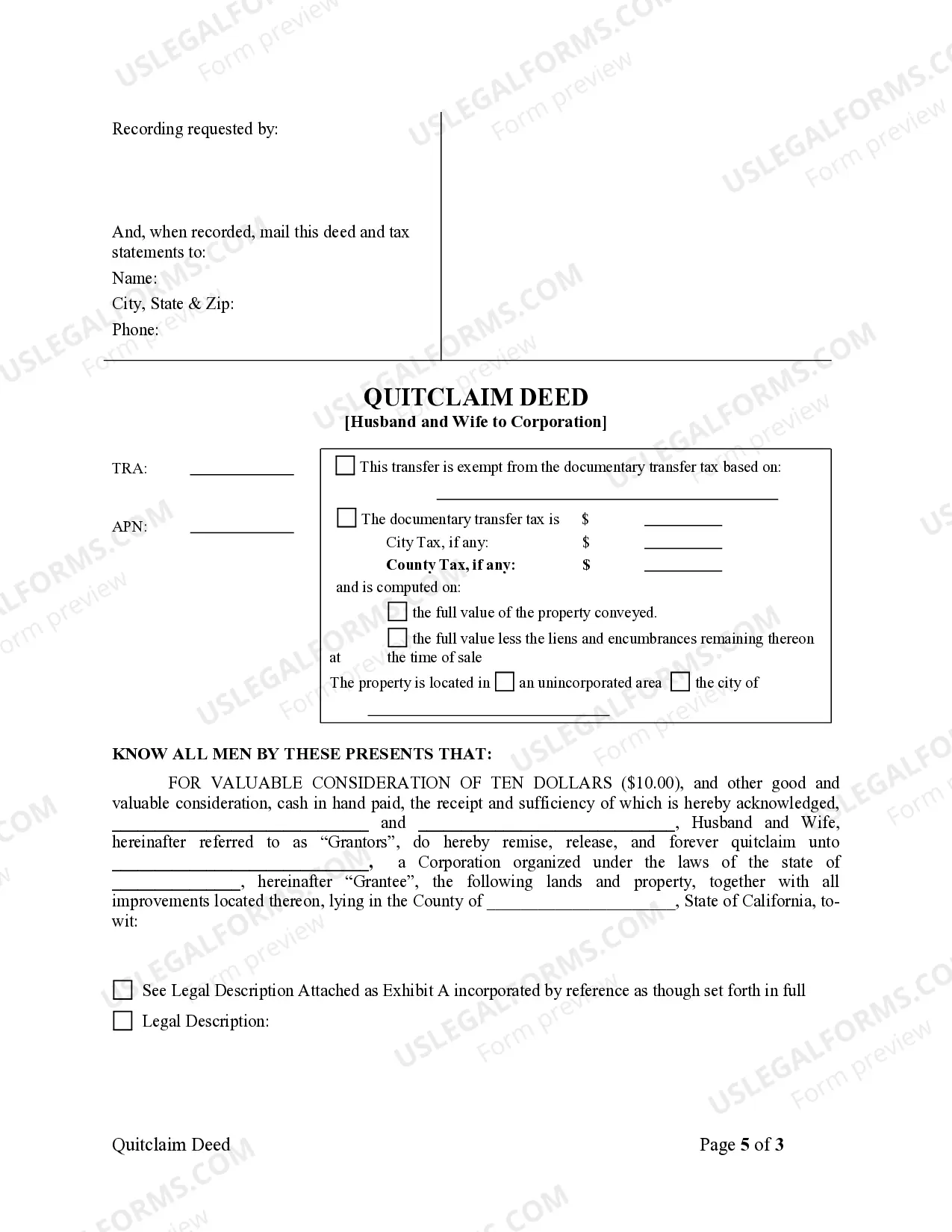

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

The Alameda California Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer property ownership from a married couple to a corporation. This type of transfer is commonly used when a married couple wants to establish a business entity and transfer ownership of their property to that corporation. A quitclaim deed is a legal instrument that allows individuals to transfer their interest in a property to another party, without making any warranties regarding the title. This means that the granter (the husband and wife in this case) simply transfers their interest in the property to the grantee (the corporation), and does not guarantee that they have clear title to the property. The Alameda California Quitclaim Deed from Husband and Wife to Corporation ensures that the property is transferred solely to the corporation, removing the couple's individual ownership rights and instead vesting it in the entity. This type of transfer is commonly seen when individuals wish to protect their personal assets by transferring them to a corporate entity. There are various types of Alameda California Quitclaim Deed from Husband and Wife to Corporation, depending on the specific circumstances of the transfer. Some common variations include: 1. General quitclaim deed: This is the standard form of quitclaim deed used to transfer property from a husband and wife to a corporation. It typically includes basic information such as the names of the granter and grantee, a legal description of the property, and any special conditions or considerations. 2. Quitclaim deed with consideration: This type of deed includes additional provisions regarding any financial consideration exchanged between the parties during the transfer. For example, if the corporation pays the husband and wife for the property, the terms of this payment would be detailed in the document. 3. Quitclaim deed subject to a mortgage: When the property being transferred is encumbered by a mortgage, this type of deed acknowledges the existing mortgage and ensures that the corporation assumes liability for the mortgage going forward. 4. Quitclaim deed with survivorship rights: In cases where the husband and wife also want to establish survivorship rights within the corporation, this type of deed outlines the terms of such an arrangement. Survivorship rights mean that if one spouse passes away, the surviving spouse automatically takes full ownership of the property. It is crucial to consult with a qualified attorney or a real estate professional when preparing an Alameda California Quitclaim Deed from Husband and Wife to Corporation, as the specific requirements and regulations may vary depending on the jurisdiction and individual circumstances.The Alameda California Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer property ownership from a married couple to a corporation. This type of transfer is commonly used when a married couple wants to establish a business entity and transfer ownership of their property to that corporation. A quitclaim deed is a legal instrument that allows individuals to transfer their interest in a property to another party, without making any warranties regarding the title. This means that the granter (the husband and wife in this case) simply transfers their interest in the property to the grantee (the corporation), and does not guarantee that they have clear title to the property. The Alameda California Quitclaim Deed from Husband and Wife to Corporation ensures that the property is transferred solely to the corporation, removing the couple's individual ownership rights and instead vesting it in the entity. This type of transfer is commonly seen when individuals wish to protect their personal assets by transferring them to a corporate entity. There are various types of Alameda California Quitclaim Deed from Husband and Wife to Corporation, depending on the specific circumstances of the transfer. Some common variations include: 1. General quitclaim deed: This is the standard form of quitclaim deed used to transfer property from a husband and wife to a corporation. It typically includes basic information such as the names of the granter and grantee, a legal description of the property, and any special conditions or considerations. 2. Quitclaim deed with consideration: This type of deed includes additional provisions regarding any financial consideration exchanged between the parties during the transfer. For example, if the corporation pays the husband and wife for the property, the terms of this payment would be detailed in the document. 3. Quitclaim deed subject to a mortgage: When the property being transferred is encumbered by a mortgage, this type of deed acknowledges the existing mortgage and ensures that the corporation assumes liability for the mortgage going forward. 4. Quitclaim deed with survivorship rights: In cases where the husband and wife also want to establish survivorship rights within the corporation, this type of deed outlines the terms of such an arrangement. Survivorship rights mean that if one spouse passes away, the surviving spouse automatically takes full ownership of the property. It is crucial to consult with a qualified attorney or a real estate professional when preparing an Alameda California Quitclaim Deed from Husband and Wife to Corporation, as the specific requirements and regulations may vary depending on the jurisdiction and individual circumstances.