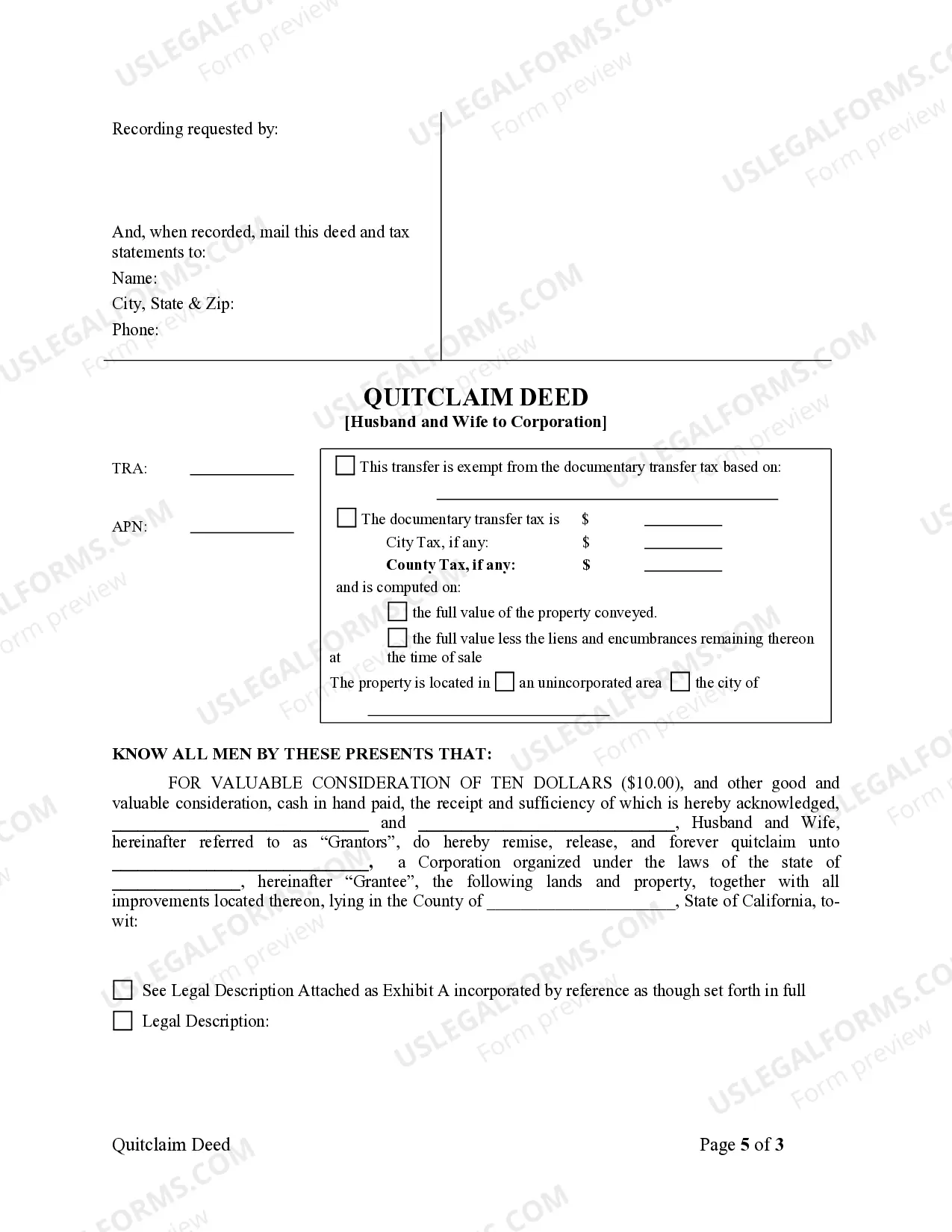

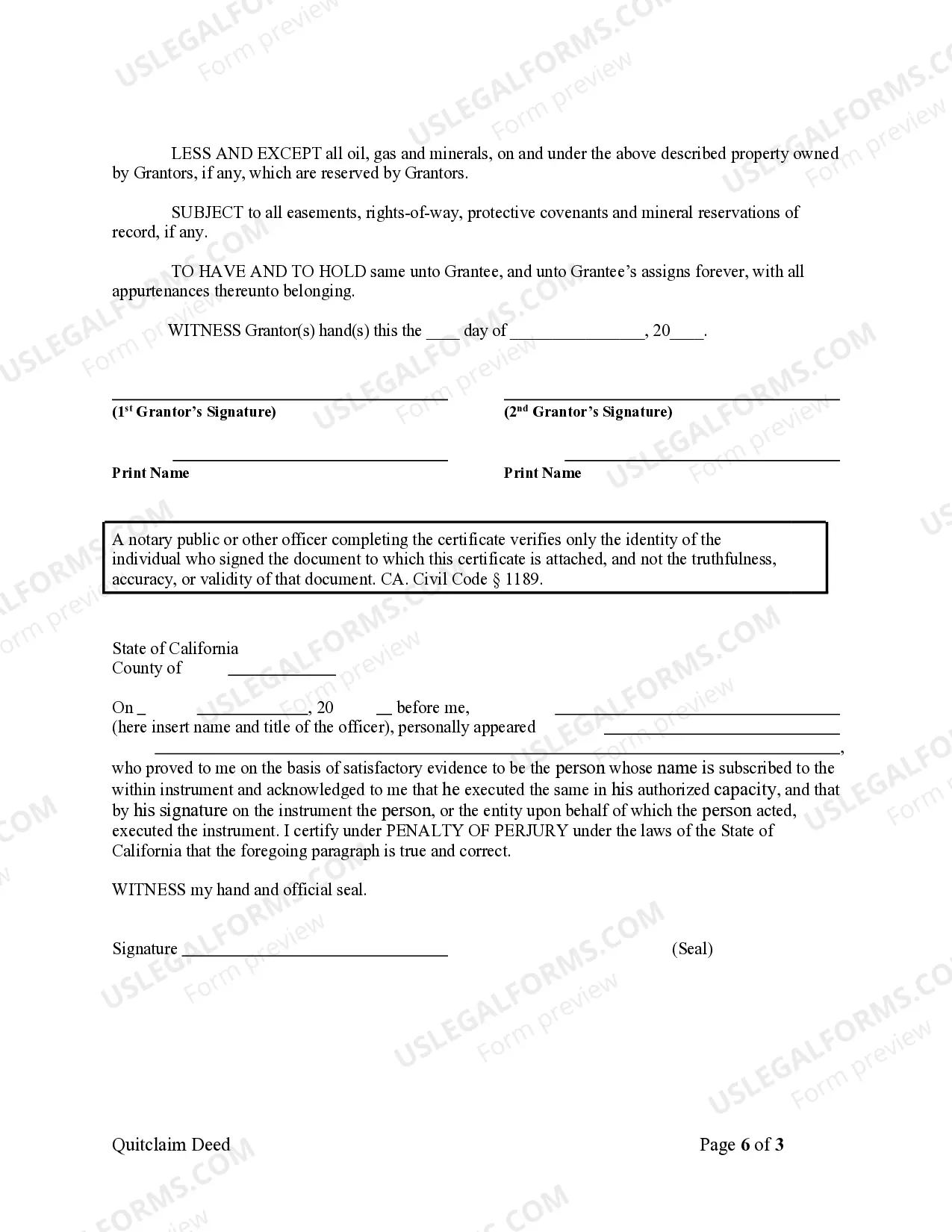

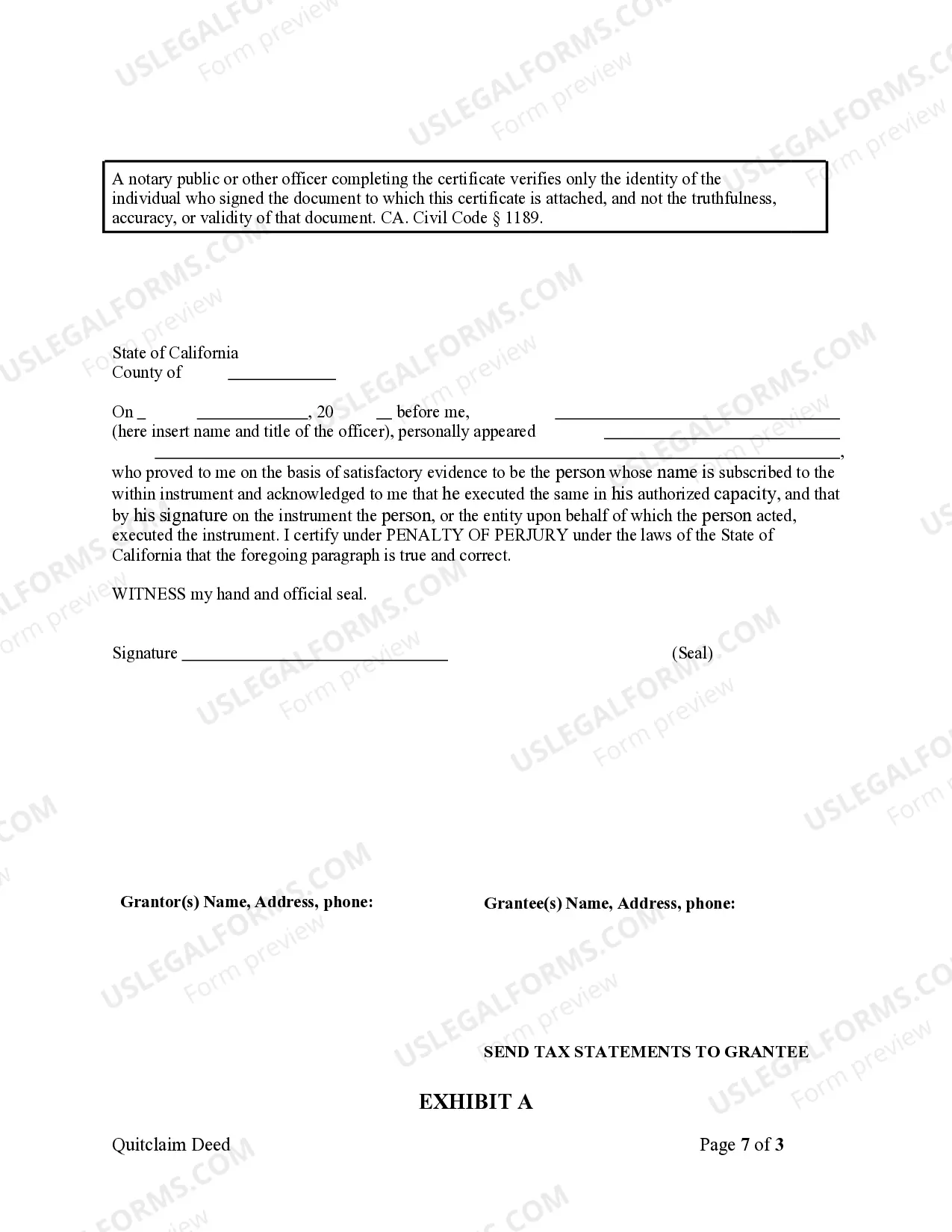

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Burbank California Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer ownership rights from a married couple to a corporation. This type of transaction is typically carried out when a couple wishes to transfer real estate or property assets to a corporation entity. The Burbank California Quitclaim Deed ensures a smooth and legal transfer of property ownership between the parties involved. The process begins with the husband and wife, known as granters, executing the Quitclaim Deed in favor of the corporation, referred to as the grantee. The deed contains essential information such as the names of the granters and the corporation, a complete description of the property being transferred, and a statement confirming the intention to transfer all rights and interest held by the couple to the corporation. It is essential to note that the Burbank California Quitclaim Deed from Husband and Wife to Corporation is specific to Burbank, a city located in Los Angeles County, California. Thus, it complies with the state and local laws and regulations governing property transfers in that particular jurisdiction. Different variations of Burbank California Quitclaim Deeds from Husband and Wife to Corporation may exist based on specific circumstances and requirements. Some notable examples include: 1. Commercial Property Transfer: This type of Quitclaim Deed is used when a husband and wife wish to transfer a commercial property they jointly own to a corporation. It could involve retail spaces, office buildings, or other commercial real estate assets. 2. Residential Property Transfer: This Quitclaim Deed variant is employed when the couple intends to transfer residential properties such as houses, apartments, or condominiums to a corporation. 3. Investment Property Transfer: In cases where the husband and wife want to convert their investment properties, such as rental properties or vacation homes, into corporate assets, a specific Quitclaim Deed is used. 4. Tax Planning and Estate Planning: This variation focuses on transferring property ownership to a corporation for tax planning purposes or estate planning strategies. It might involve minimizing tax burdens, protecting assets, or implementing specific estate planning goals. Executing a Burbank California Quitclaim Deed from Husband and Wife to Corporation requires the involvement of legal professionals who are well-versed in property law and local regulations. It is essential for both the granters and the grantee to fully understand the implications and consequences associated with the transfer of property ownership. Therefore, seeking professional advice and guidance throughout the process is highly recommended ensuring a legally sound and effective transfer of property rights.A Burbank California Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer ownership rights from a married couple to a corporation. This type of transaction is typically carried out when a couple wishes to transfer real estate or property assets to a corporation entity. The Burbank California Quitclaim Deed ensures a smooth and legal transfer of property ownership between the parties involved. The process begins with the husband and wife, known as granters, executing the Quitclaim Deed in favor of the corporation, referred to as the grantee. The deed contains essential information such as the names of the granters and the corporation, a complete description of the property being transferred, and a statement confirming the intention to transfer all rights and interest held by the couple to the corporation. It is essential to note that the Burbank California Quitclaim Deed from Husband and Wife to Corporation is specific to Burbank, a city located in Los Angeles County, California. Thus, it complies with the state and local laws and regulations governing property transfers in that particular jurisdiction. Different variations of Burbank California Quitclaim Deeds from Husband and Wife to Corporation may exist based on specific circumstances and requirements. Some notable examples include: 1. Commercial Property Transfer: This type of Quitclaim Deed is used when a husband and wife wish to transfer a commercial property they jointly own to a corporation. It could involve retail spaces, office buildings, or other commercial real estate assets. 2. Residential Property Transfer: This Quitclaim Deed variant is employed when the couple intends to transfer residential properties such as houses, apartments, or condominiums to a corporation. 3. Investment Property Transfer: In cases where the husband and wife want to convert their investment properties, such as rental properties or vacation homes, into corporate assets, a specific Quitclaim Deed is used. 4. Tax Planning and Estate Planning: This variation focuses on transferring property ownership to a corporation for tax planning purposes or estate planning strategies. It might involve minimizing tax burdens, protecting assets, or implementing specific estate planning goals. Executing a Burbank California Quitclaim Deed from Husband and Wife to Corporation requires the involvement of legal professionals who are well-versed in property law and local regulations. It is essential for both the granters and the grantee to fully understand the implications and consequences associated with the transfer of property ownership. Therefore, seeking professional advice and guidance throughout the process is highly recommended ensuring a legally sound and effective transfer of property rights.