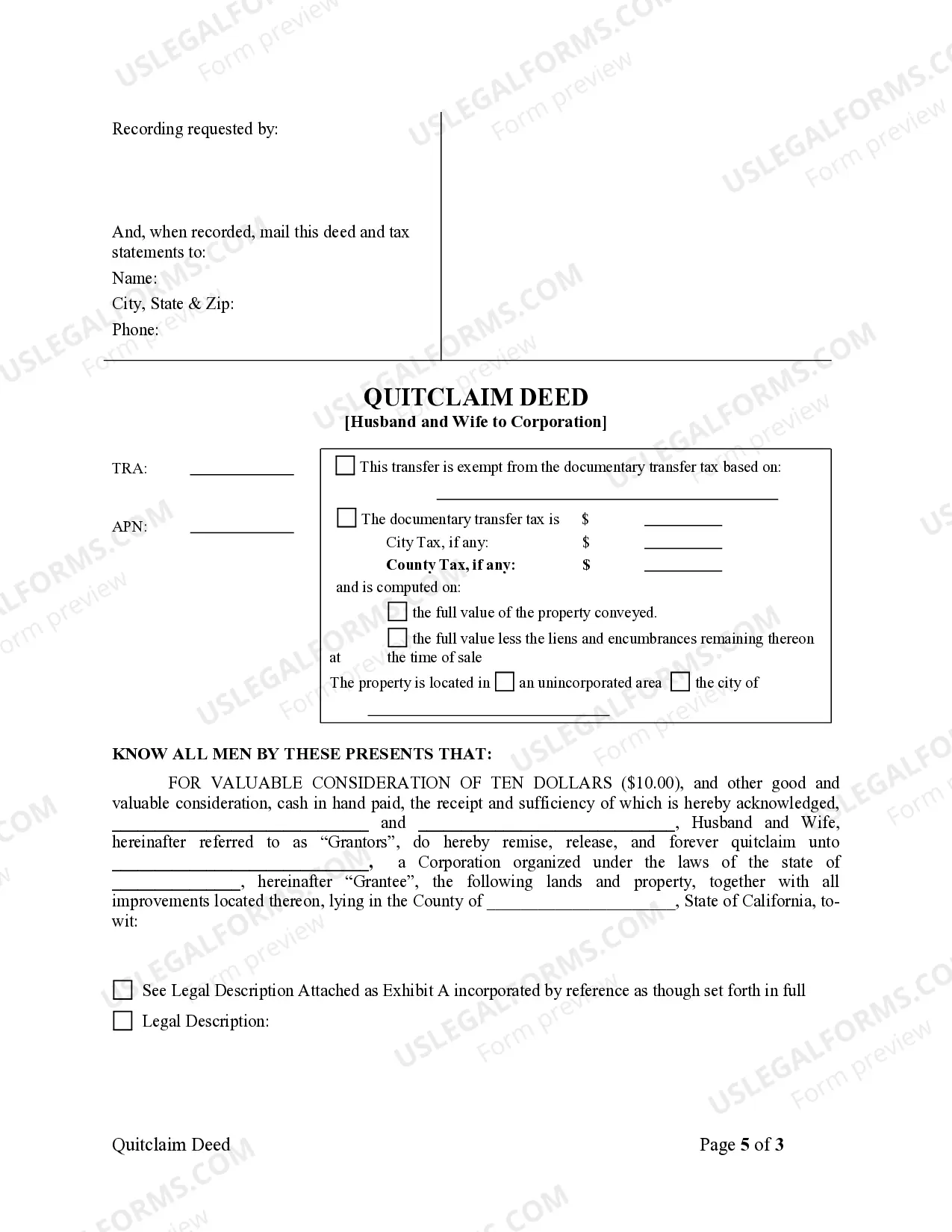

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Corona California Quitclaim Deed from Husband and Wife to Corporation is a legal document that allows a married couple to transfer their ownership interests in a property to a corporation using a quitclaim deed. This type of deed is commonly used when a couple wants to transfer ownership of their property to a corporation they own or establish for various business purposes. The husband and wife who are the granter(s) of the deed relinquish all their rights, title, and interest in the property being transferred to the corporation, which becomes the grantee. It is important to note that in a quitclaim deed, the granter(s) do not guarantee that they have clear and marketable title to the property, but rather transfer whatever interest they may have at the time of the transfer. Keywords: Corona California, Quitclaim Deed, Husband and Wife, Corporation, legal document, transfer, ownership interests, property, quitclaim, granter, grantee, title, marketable, business purposes. Different types of Corona California Quitclaim Deed from Husband and Wife to Corporation can include: 1. General Corona California Quitclaim Deed: This is the most common type of quitclaim deed where the husband and wife transfer their full ownership interests in a property to a corporation. 2. Partial Interest Corona California Quitclaim Deed: In some cases, the husband and wife may want to transfer only a portion of their ownership interests to the corporation. This deed specifies the exact share or percentage being transferred to the corporation. 3. Quitclaim Deed with Restrictions: This type of deed may include specific restrictions or limitations on the use or transfer of the property by the corporation. It ensures that the corporation uses the property as agreed upon by the husband and wife. 4. Corporate Resolution Corona California Quitclaim Deed: This deed may be required when the corporation's board of directors passes a resolution authorizing the transfer of the property from the husband and wife to the corporation. The resolution is drafted in the quitclaim deed itself. 5. Transfer for Consideration Corona California Quitclaim Deed: In certain cases, the transfer of property from a husband and wife to a corporation may involve monetary consideration, such as the corporation paying a specific amount to the individuals. This type of deed reflects the exchange of consideration. Remember, it is important to consult with a qualified attorney or legal professional when preparing and executing any legal documents, including a Corona California Quitclaim Deed from Husband and Wife to Corporation, to ensure compliance with local laws and requirements.