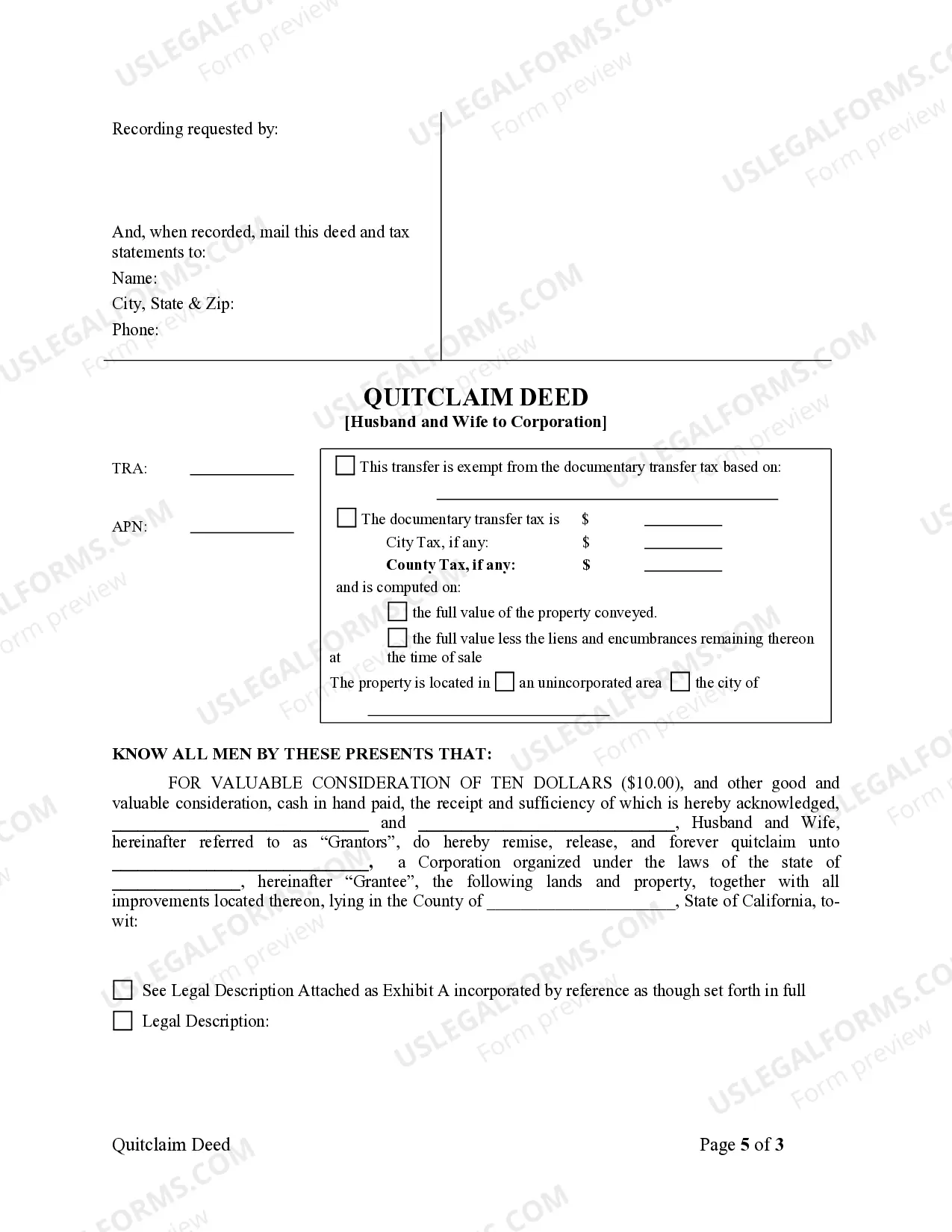

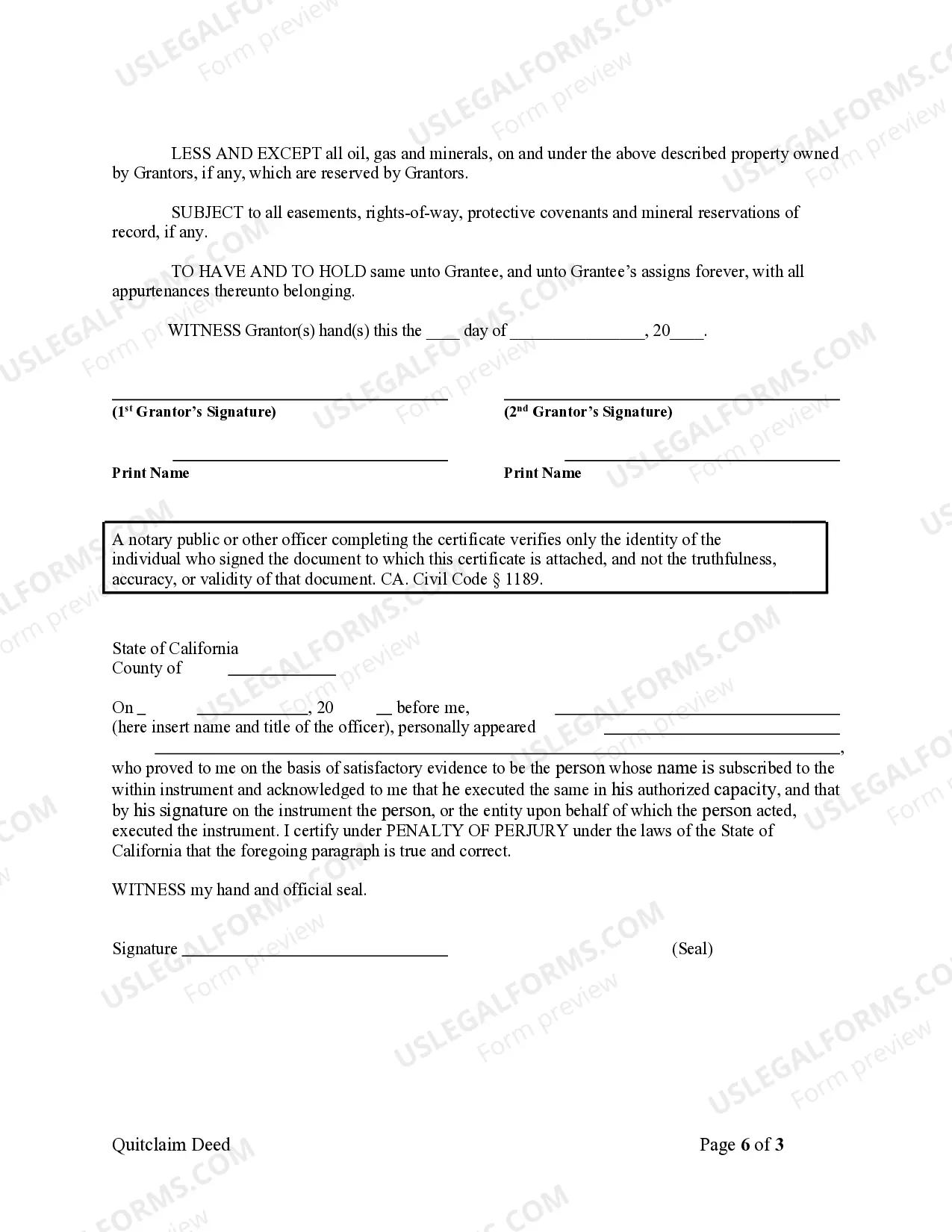

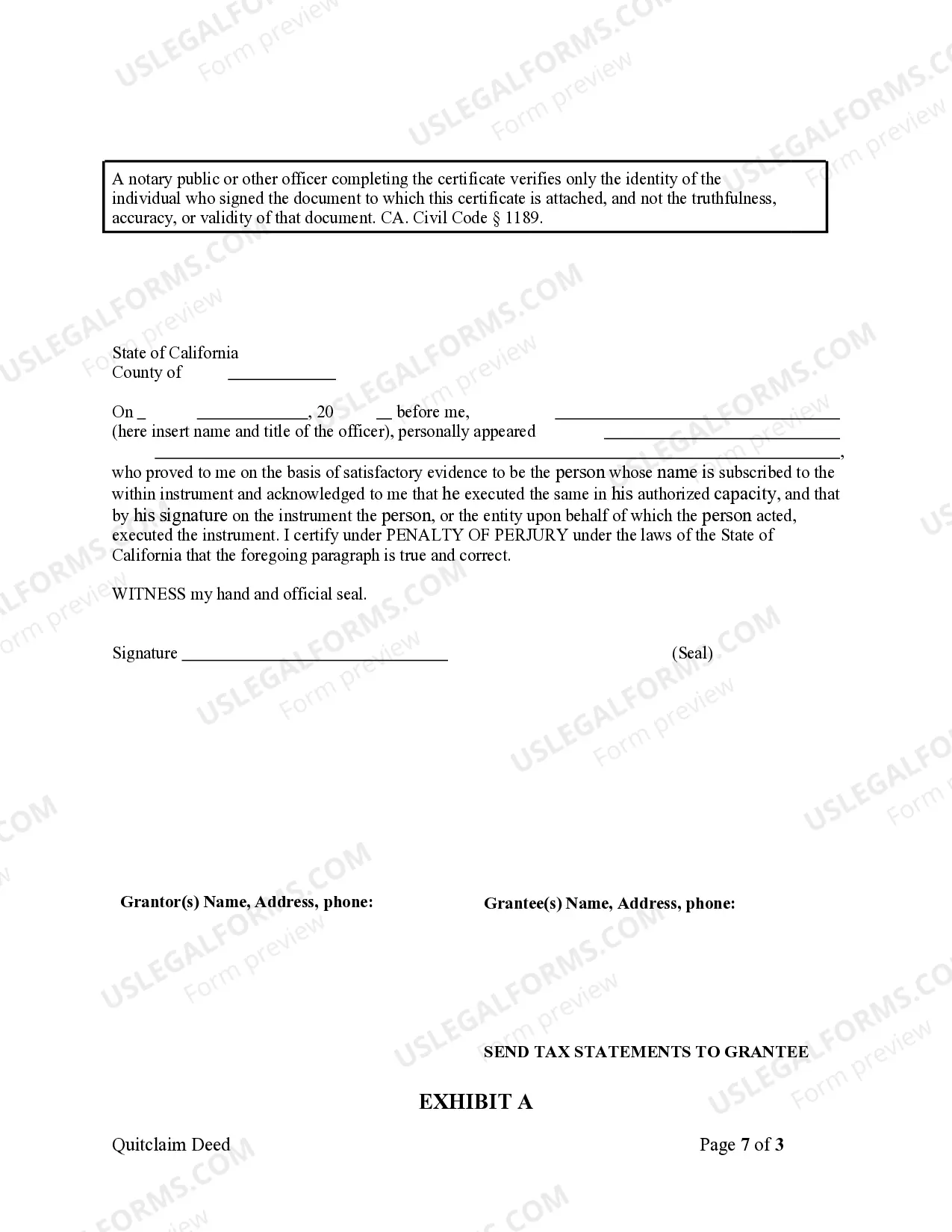

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Downey California Quitclaim Deed from Husband and Wife to Corporation is a legal document that allows a married couple to transfer ownership of a property to a corporation using a quitclaim deed. This type of deed is common when a married couple wants to transfer their property to a corporation for various reasons, such as asset protection, tax advantages, or business purposes. The purpose of a quitclaim deed is to transfer the property "as-is," with no guarantee of a clear title or responsibilities for any existing liens or encumbrances. It merely conveys whatever interest the couple has in the property to the corporation. It is essential for both parties involved to understand that a quitclaim deed does not provide any warranties or guarantees regarding the property's title. There can be different types of Downey California Quitclaim Deeds from Husband and Wife to Corporation, depending on specific circumstances and objectives. Here are some notable variations: 1. Absolute quitclaim deed: This type of quitclaim deed transfers all ownership rights and interest from the husband and wife to the corporation, with no conditions attached. It signifies a complete transfer of property ownership. 2. Partial quitclaim deed: In some cases, a couple may choose to transfer only a portion of their interest in the property to the corporation using a partial quitclaim deed. This allows them to retain partial ownership while also involving the corporation in property matters. 3. Conditional quitclaim deed: This type of quitclaim deed may include specific conditions or agreements between the husband, wife, and corporation. These conditions could dictate certain actions or responsibilities that must be fulfilled before the transfer is considered complete. 4. Transfer for business purposes: Occasionally, a husband and wife may wish to transfer their property to a corporation solely for business purposes, such as expanding their business operations or separating personal and business assets. In these instances, a Downey California Quitclaim Deed from Husband and Wife to Corporation can facilitate the transfer seamlessly. 5. Transfer for tax advantages: Another common scenario includes transferring the property to a corporation to gain tax advantages or minimize taxation liability. This strategy is frequently employed by couples with substantial assets seeking strategic estate planning. When utilizing a Downey California Quitclaim Deed from Husband and Wife to Corporation, it is essential to consult with legal professionals and seek guidance from experts familiar with California real estate laws. Proper legal advice ensures all parties involved fully comprehend the implications of the deed, protecting their rights and interests.A Downey California Quitclaim Deed from Husband and Wife to Corporation is a legal document that allows a married couple to transfer ownership of a property to a corporation using a quitclaim deed. This type of deed is common when a married couple wants to transfer their property to a corporation for various reasons, such as asset protection, tax advantages, or business purposes. The purpose of a quitclaim deed is to transfer the property "as-is," with no guarantee of a clear title or responsibilities for any existing liens or encumbrances. It merely conveys whatever interest the couple has in the property to the corporation. It is essential for both parties involved to understand that a quitclaim deed does not provide any warranties or guarantees regarding the property's title. There can be different types of Downey California Quitclaim Deeds from Husband and Wife to Corporation, depending on specific circumstances and objectives. Here are some notable variations: 1. Absolute quitclaim deed: This type of quitclaim deed transfers all ownership rights and interest from the husband and wife to the corporation, with no conditions attached. It signifies a complete transfer of property ownership. 2. Partial quitclaim deed: In some cases, a couple may choose to transfer only a portion of their interest in the property to the corporation using a partial quitclaim deed. This allows them to retain partial ownership while also involving the corporation in property matters. 3. Conditional quitclaim deed: This type of quitclaim deed may include specific conditions or agreements between the husband, wife, and corporation. These conditions could dictate certain actions or responsibilities that must be fulfilled before the transfer is considered complete. 4. Transfer for business purposes: Occasionally, a husband and wife may wish to transfer their property to a corporation solely for business purposes, such as expanding their business operations or separating personal and business assets. In these instances, a Downey California Quitclaim Deed from Husband and Wife to Corporation can facilitate the transfer seamlessly. 5. Transfer for tax advantages: Another common scenario includes transferring the property to a corporation to gain tax advantages or minimize taxation liability. This strategy is frequently employed by couples with substantial assets seeking strategic estate planning. When utilizing a Downey California Quitclaim Deed from Husband and Wife to Corporation, it is essential to consult with legal professionals and seek guidance from experts familiar with California real estate laws. Proper legal advice ensures all parties involved fully comprehend the implications of the deed, protecting their rights and interests.