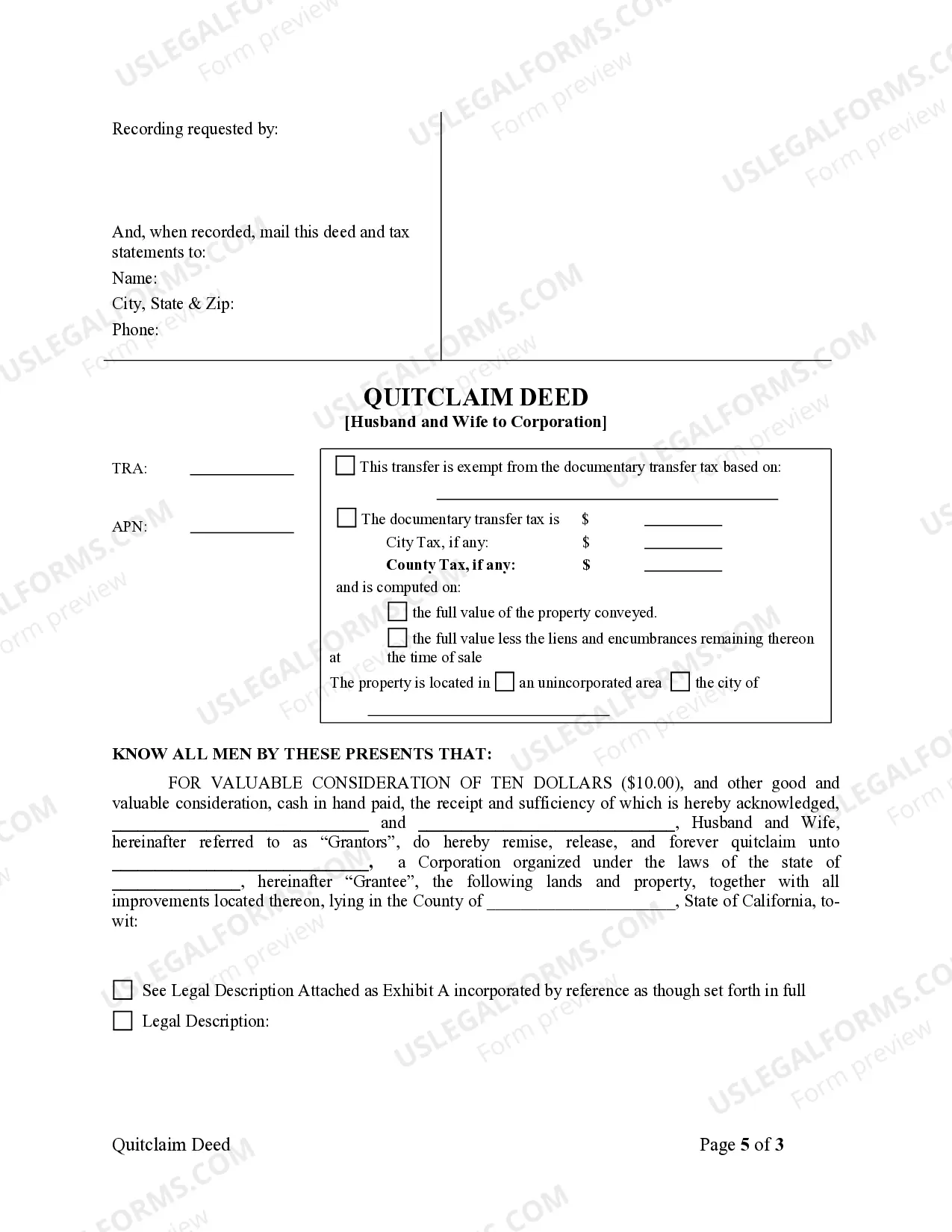

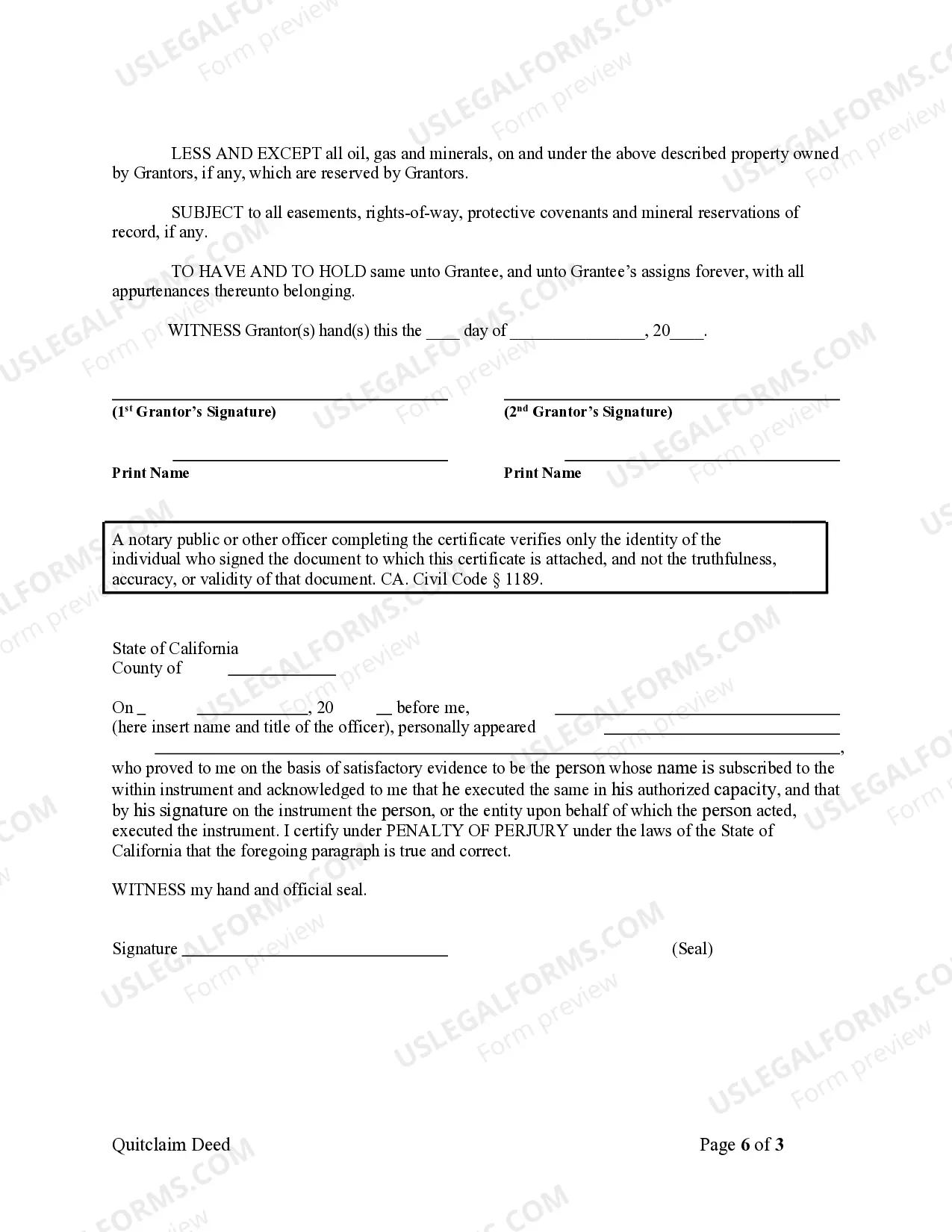

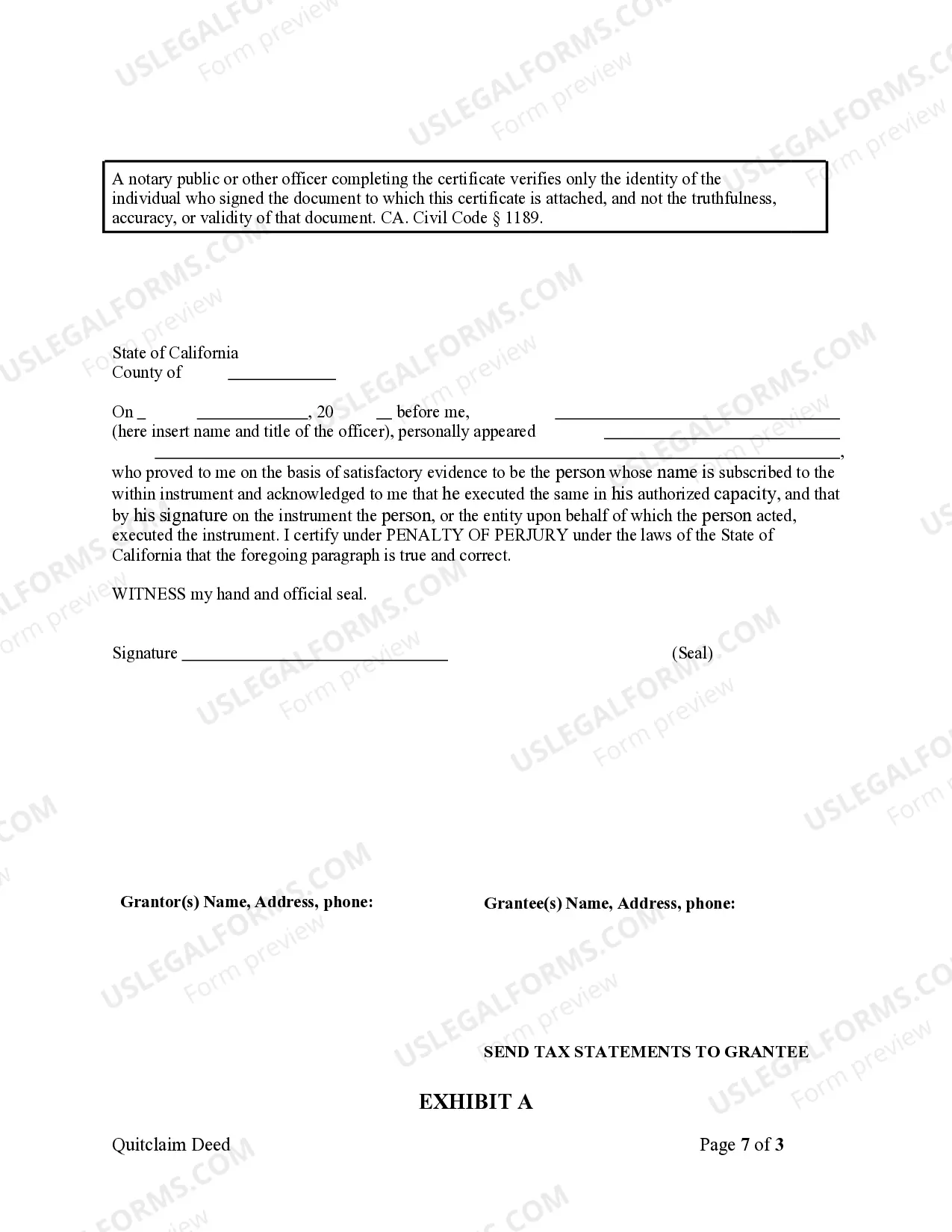

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

El Cajon California Quitclaim Deed from Husband and Wife to Corporation A Quitclaim Deed is a legal document used to transfer ownership of property from one party to another without making any warranties about the title or any other aspect of the property. In El Cajon, California, a Quitclaim Deed from Husband and Wife to Corporation serves as a means for a married couple to transfer their property rights to a corporation they own or are establishing. This type of deed is commonly used when there is a desire to restructure property ownership or protect assets within a corporate entity. The El Cajon California Quitclaim Deed from Husband and Wife to Corporation effectively transfers the interests and rights of the property from the married couple to the corporation. This transfer ensures that any future rights, profits, and liabilities associated with the property will be solely attributed to the corporation rather than the individuals. It is important to note that this type of deed does not guarantee or warrant the title or status of the property being transferred. There are several variations or circumstances which may require specific types of Quitclaim Deeds from Husband and Wife to Corporation in El Cajon, California. These variations include: 1. General Quitclaim Deed from Husband and Wife to Corporation: This type of deed is used when a married couple wants to transfer their property to a corporation without any specific conditions or limitations. 2. Trust-based Quitclaim Deed from Husband and Wife to Corporation: If the property is held in a trust by the married couple, they may need to execute a trust-based Quitclaim Deed to transfer the property from the trust to the corporation. 3. Partition Quitclaim Deed from Husband and Wife to Corporation: In the event of divorce or separation, where the couple jointly owns the property and wants to transfer their individual interests to the corporation, a partition Quitclaim Deed can be used. 4. Joint Tenancy to Tenants in Common Quitclaim Deed from Husband and Wife to Corporation: If the couple initially held the property as joint tenants, they may want to modify their ownership to tenants in common before transferring the property to the corporation. This type of deed helps redefine the owners' rights and interests. 5. Non-Intermediary Transfer Quitclaim Deed from Husband and Wife to Corporation: This variation is used when an intermediary, such as a trustee or executor, is not involved in the transfer process. It simplifies the transfer process by directly transferring ownership from the husband and wife to the corporation. When executing an El Cajon California Quitclaim Deed from Husband and Wife to Corporation, it is recommended to consult with a qualified real estate attorney to ensure compliance with legal requirements, properly draft the deed, and conduct a title search to identify any potential issues or encumbrances associated with the property being transferred. This deed is an essential tool for establishing clear ownership within a corporate entity and maintaining the integrity of property transfers in El Cajon, California.El Cajon California Quitclaim Deed from Husband and Wife to Corporation A Quitclaim Deed is a legal document used to transfer ownership of property from one party to another without making any warranties about the title or any other aspect of the property. In El Cajon, California, a Quitclaim Deed from Husband and Wife to Corporation serves as a means for a married couple to transfer their property rights to a corporation they own or are establishing. This type of deed is commonly used when there is a desire to restructure property ownership or protect assets within a corporate entity. The El Cajon California Quitclaim Deed from Husband and Wife to Corporation effectively transfers the interests and rights of the property from the married couple to the corporation. This transfer ensures that any future rights, profits, and liabilities associated with the property will be solely attributed to the corporation rather than the individuals. It is important to note that this type of deed does not guarantee or warrant the title or status of the property being transferred. There are several variations or circumstances which may require specific types of Quitclaim Deeds from Husband and Wife to Corporation in El Cajon, California. These variations include: 1. General Quitclaim Deed from Husband and Wife to Corporation: This type of deed is used when a married couple wants to transfer their property to a corporation without any specific conditions or limitations. 2. Trust-based Quitclaim Deed from Husband and Wife to Corporation: If the property is held in a trust by the married couple, they may need to execute a trust-based Quitclaim Deed to transfer the property from the trust to the corporation. 3. Partition Quitclaim Deed from Husband and Wife to Corporation: In the event of divorce or separation, where the couple jointly owns the property and wants to transfer their individual interests to the corporation, a partition Quitclaim Deed can be used. 4. Joint Tenancy to Tenants in Common Quitclaim Deed from Husband and Wife to Corporation: If the couple initially held the property as joint tenants, they may want to modify their ownership to tenants in common before transferring the property to the corporation. This type of deed helps redefine the owners' rights and interests. 5. Non-Intermediary Transfer Quitclaim Deed from Husband and Wife to Corporation: This variation is used when an intermediary, such as a trustee or executor, is not involved in the transfer process. It simplifies the transfer process by directly transferring ownership from the husband and wife to the corporation. When executing an El Cajon California Quitclaim Deed from Husband and Wife to Corporation, it is recommended to consult with a qualified real estate attorney to ensure compliance with legal requirements, properly draft the deed, and conduct a title search to identify any potential issues or encumbrances associated with the property being transferred. This deed is an essential tool for establishing clear ownership within a corporate entity and maintaining the integrity of property transfers in El Cajon, California.